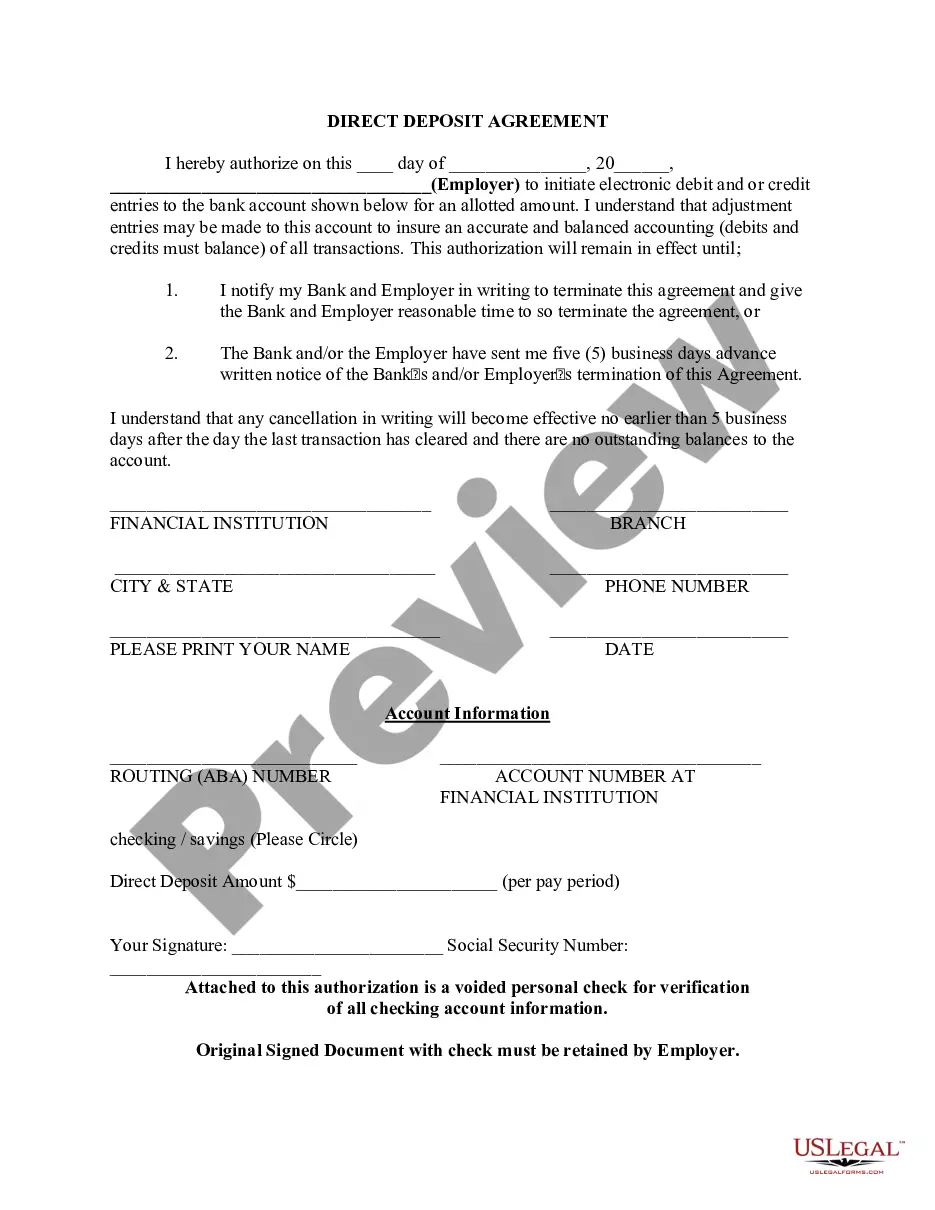

Minnesota Direct Deposit Form for Chase

Description

How to fill out Direct Deposit Form For Chase?

If you need to compile, obtain, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's simple and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you download is your property forever.

You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

- Use US Legal Forms to acquire the Minnesota Direct Deposit Form for Chase within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Minnesota Direct Deposit Form for Chase.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for your correct area/state.

- Step 2. Use the Review option to examine the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms in the legal form template.

- Step 4. Once you locate the form you need, click the Download now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to make the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Minnesota Direct Deposit Form for Chase.

Form popularity

FAQ

Setting up a Minnesota Direct Deposit Form for Chase involves several straightforward steps. First, fill out the direct deposit form, ensuring you include your bank details accurately. After completing the form, submit it to your employer, who will process it through their payroll system. Once approved, your future paychecks will be automatically deposited into your Chase account, offering you convenience and peace of mind.

You can easily obtain a Minnesota Direct Deposit Form for Chase without stepping foot in a bank by visiting the uSlegalforms platform. This website provides downloadable templates that you can fill out at your convenience. You can also find forms specific to your needs, ensuring you have exactly what you require. Once completed, simply follow your employer's submission process.

You should send your Minnesota Direct Deposit Form for Chase directly to your employer’s payroll department. Each company may have a specific procedure, so it's wise to confirm with them beforehand. Sometimes, companies require you to hand in the form in person or through specific online platforms. Ensuring you follow your employer's guidelines helps expedite the process.

To submit your Minnesota Direct Deposit Form for Chase, begin by filling out the necessary details. After you complete the form, you can submit it directly to your employer. Alternatively, if your employer accepts electronic submissions, you might send the completed form via secure email. Always double-check that you have provided accurate information to avoid delays.

When using Chase Mobile for check deposit, include your account information and the amount on the back of the check. You don't need a Minnesota Direct Deposit Form for Chase in this case; the app will guide you through taking a photo of the front and back of the check. Review your submission for accuracy before confirming the deposit. This method is quick and efficient, allowing you to deposit checks anytime, anywhere.

Filling out deposit information requires using the Minnesota Direct Deposit Form for Chase. Start with your account number, then provide your personal details and the deposit amount. Ensure the information is clear and accurate to avoid any confusion. When completed, submit this information to your bank or through designated channels for direct deposit.

When filling out your direct deposit authorization form, start by using the Minnesota Direct Deposit Form for Chase. Input your name, address, and account number accurately. Provide your employer's information and the amount to be deposited. Once the form is completed, send it to your employer or the financial institution managing your deposit to ensure a smooth setup.

Filling out a deposit at Chase involves using the Minnesota Direct Deposit Form for Chase. Start by entering your account number and the amount of the deposit in the appropriate fields. Ensure all your personal information is accurate, and double-check the amount for any errors before submitting. Once completed, turn in the form to a teller or utilize the Chase app for a quicker process.

To get your Minnesota Direct Deposit Form for Chase online, simply log into your Chase online banking account. Once logged in, look for the section dedicated to direct deposit options, where you can easily download the form. This process is quick and allows you to obtain your form in minutes without visiting a branch.

Getting a direct deposit form is a straightforward process. You can usually download the Minnesota Direct Deposit Form for Chase from the bank’s official website, or request a paper copy at your bank. If you're unsure where to start, ask your employer or payroll office for guidance.