The Minnesota Direct Deposit Form for Bank America is a document that allows customers to set up direct deposit for their Bank of America accounts in the state of Minnesota. Direct deposit is a convenient and secure way to receive recurring payments, such as salaries, government benefits, or pension payments, directly into a bank account. The Minnesota Direct Deposit Form for Bank America typically includes several sections that need to be filled out by the account holder. These sections may require information such as the account holder's name, address, social security number, bank account number, and the bank's routing number. Additionally, the form may ask for the type of payment being received, the amount or percentage of the payment to be deposited, and the frequency of the direct deposit (e.g., weekly, bi-weekly, monthly). Bank of America may offer different types or variations of the Minnesota Direct Deposit Form to cater to the specific needs of its customers. Some potential variations may include forms for different types of accounts, such as savings accounts, checking accounts, or money market accounts. Other variations may be specific to certain types of payments, such as employer payroll direct deposit forms, government benefits direct deposit forms, or pension direct deposit forms. It is essential for bank customers in Minnesota to accurately complete the Direct Deposit Form to ensure the smooth processing of their recurring payments. Providing correct information, including the bank account number and routing number, is crucial to avoid any payment delays or complications. Once the Minnesota Direct Deposit Form for Bank America is filled out, customers typically need to submit it to the appropriate entity or organization responsible for making the recurring payments. This may include the employer's human resources department for payroll deposits, a government agency responsible for disbursing benefits, or a pension fund administrator. In summary, the Minnesota Direct Deposit Form for Bank America is a valuable tool that enables bank customers to establish direct deposit for their accounts. By providing the necessary information on the form, customers can receive their recurring payments directly into their bank accounts, ensuring convenience, security, and timely access to their funds.

Minnesota Direct Deposit Form for Bank America

Description

How to fill out Direct Deposit Form For Bank America?

If you need to total, download, or print out authorized document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the website's simple and convenient search function to find the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

- Utilize US Legal Forms to find the Minnesota Direct Deposit Form for Bank America in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Acquire button to download the Minnesota Direct Deposit Form for Bank America.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

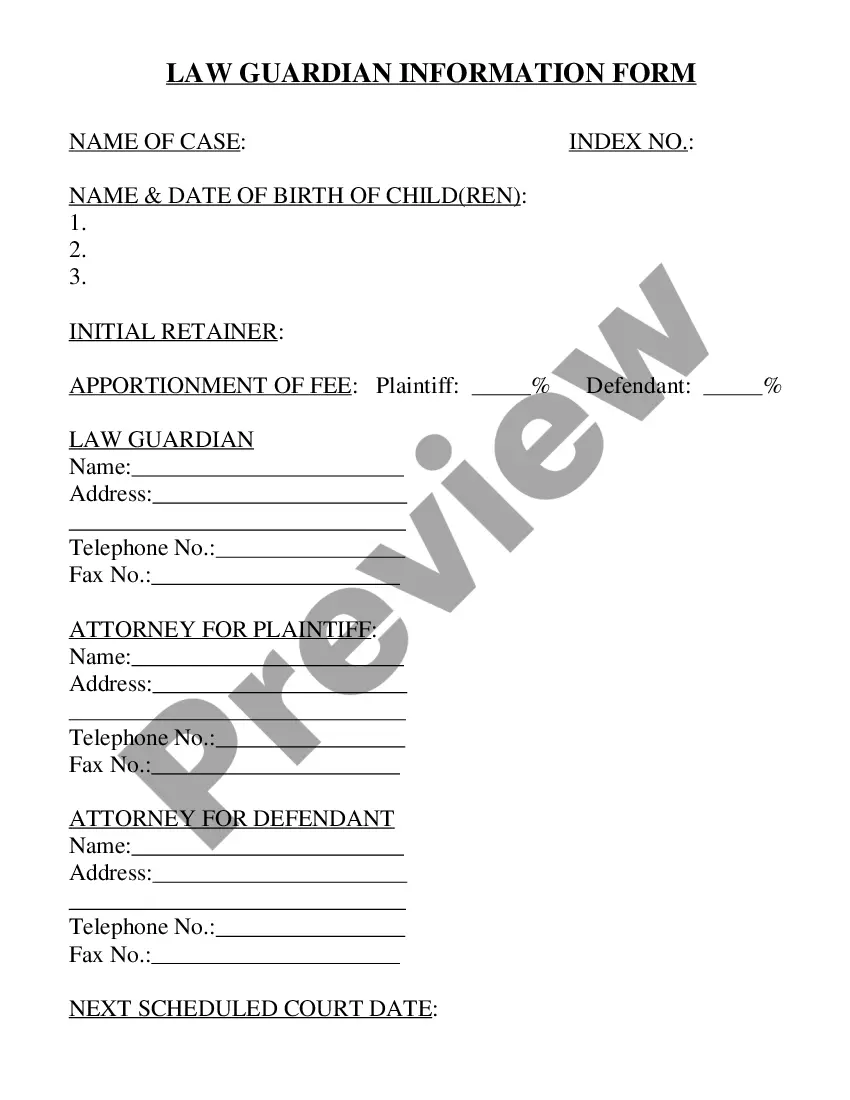

- Step 2. Use the Preview option to review the form's content. Don't forget to read the details.

Form popularity

FAQ

Yes, you can easily obtain a Minnesota Direct Deposit Form for Bank America online. Many banks provide these forms through their websites, allowing you to download and print them. Additionally, platforms like US Legal Forms offer various direct deposit templates, ensuring you have the right documents at your fingertips. This convenience allows you to set up your direct deposit smoothly and efficiently.

To receive a deposit statement, you can log into your Bank America account and access the statements section. Look for the option to view or print your deposit statements, including your Minnesota Direct Deposit Form for Bank America. Additionally, you can set up paperless statements for convenience and quicker access.

Getting a bank direct deposit form is simple. You can either visit the Bank America website and download the Minnesota Direct Deposit Form for Bank America directly from their forms section or request one at your local branch. If you prefer assistance, the Bank America customer service team is ready to guide you through the process.

To obtain your Minnesota Direct Deposit Form for Bank America, start by logging into your Bank America online account. Navigate to the account services section, where you can request the direct deposit form. Alternatively, you can contact customer service directly for assistance in acquiring the necessary form.

Enter your bank’s complete address on the direct deposit form, which includes the bank name, street address, city, state, and ZIP code. Using the correct address is vital for ensuring that your funds are accurately deposited without any issues. Check resources like the Minnesota Direct Deposit Form for Bank America or consult directly with your bank if you have any uncertainties.

For direct deposit, you should provide the address of your bank’s main office or the branch where you hold your account. This address can usually be found online or on your account services documents. Make sure the address matches what your bank has on file to guarantee the swift processing of your Minnesota Direct Deposit Form for Bank America.

When filling out a bank address, include the name of your bank, its street address, city, state, and ZIP code. It’s crucial to get this information right, as it ensures your Minnesota Direct Deposit Form for Bank America is processed smoothly. Always double-check the details against your recent account documents or the bank’s website.

To locate your bank address for direct debit, you typically need to check your bank’s official website or your account statements. Often, the address is printed on checks you have, or it can be found in the customer service section of your bank’s website. If you are using the Minnesota Direct Deposit Form for Bank America, ensure you have the correct address to avoid any delays in processing.

To submit your Minnesota Direct Deposit Form for Bank America, first ensure that you have completed all necessary fields accurately. You may choose to email or physically deliver the form to your employer, depending on their preferences. It’s also possible for some employers to allow submissions through a secure online portal. Verify with your employer to confirm the preferred submission method.

After completing your Minnesota Direct Deposit Form for Bank America, you typically send it to your employer’s payroll department. It’s also essential to double-check your employer’s specific submission guidelines, as they might have a different process. If submitting electronically, follow the instructions for uploading the form provided by your employer. Be sure to keep a copy for your records.