Minnesota Affidavit of Domicile

Description

How to fill out Affidavit Of Domicile?

Have you found yourself in a scenario where you need documentation for either business or personal reasons almost every day.

There are numerous legitimate document templates accessible online, but locating ones you can trust is not simple.

US Legal Forms provides thousands of form templates, such as the Minnesota Affidavit of Domicile, which are designed to meet state and federal requirements.

Once you locate the appropriate form, click Purchase now.

Choose the pricing plan you want, complete the required details to create your account, and process your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Minnesota Affidavit of Domicile template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

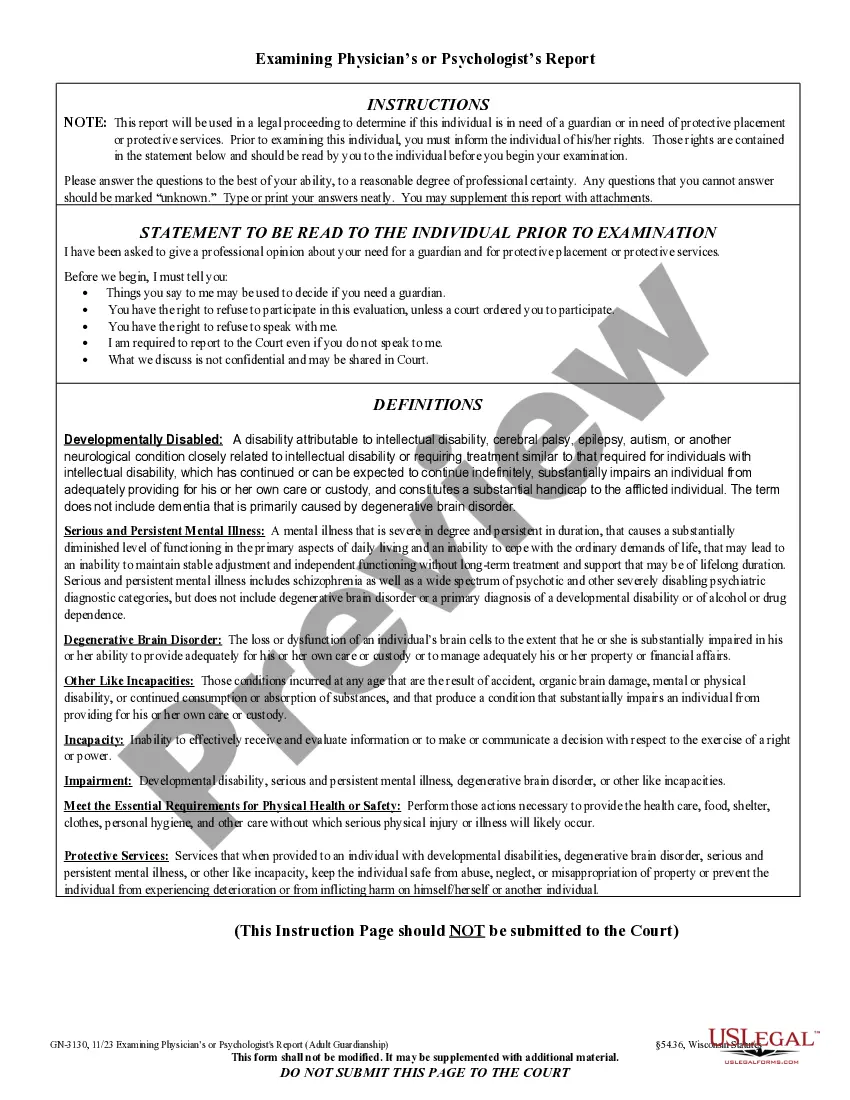

- Utilize the Preview feature to review the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you’re looking for, use the Lookup section to find the form that meets your needs.

Form popularity

FAQ

To obtain a residence affidavit, you can start by drafting the document with the necessary details about your residency. The Minnesota Affidavit of Domicile can be easily created using online resources, such as the US Legal Forms platform, which offers templates tailored to your needs. After preparing the affidavit, you will need to sign it in front of a notary public to make it legally binding. Once completed, you can use the affidavit for various legal and administrative purposes.

An affidavit of domicile is a legal document that confirms an individual's permanent residence. Specifically, the Minnesota Affidavit of Domicile serves to establish a person's primary address for various legal purposes, such as estate planning or property transactions. This document typically includes information like the individual's name, address, and the date of the affidavit's execution. By providing this information, you can ensure clarity in legal matters regarding your residency.

When filling out a Minnesota Affidavit of Domicile example, start by examining the template for required fields. Enter your personal details, including your name and address at the top. Follow with a statement affirming your residency and any specific information requested in the example. Finally, ensure the document is signed and dated before a notary public to validate it.

Writing a Minnesota Affidavit of Domicile begins with a clear introduction stating your intent to affirm your residency. Include your full name, address, and any relevant dates. Then, provide a concise explanation of your residency circumstances, ensuring that all facts are truthful. Conclude with your signature and the date, and have the document notarized to make it official.

To fill out a Minnesota Affidavit of Domicile correctly, ensure that you provide all necessary information clearly and accurately. Use legible handwriting or a typewriter to avoid any misinterpretations. Additionally, review the document for completeness, and make sure to follow any specific instructions provided by the authority requesting the affidavit. Finally, have it notarized to confirm its authenticity.

Filling out a Minnesota Affidavit of Domicile involves several straightforward steps. Begin by accurately listing your name and current address. Next, include a statement affirming that you reside at that address, along with any supporting details required by the state. Don’t forget to sign the document in the presence of a notary to ensure its validity.

Typically, any adult who can understand and attest to the facts can complete a Minnesota Affidavit of Domicile. This means you should be over 18 years old and capable of providing accurate information about your residency. If you are unable to complete the affidavit yourself, you may have an authorized representative assist you, but they will need your consent.

To fill out a Minnesota Affidavit of Domicile, start by entering your personal information, such as your name and address. Next, clearly state the purpose of the affidavit, indicating that it serves to verify your residence. Make sure to provide any additional information required by local authorities, and finally, sign and date the document in front of a notary public.