Minnesota Sample Letter for Claim Settlement Against Decedent's Estate

Description

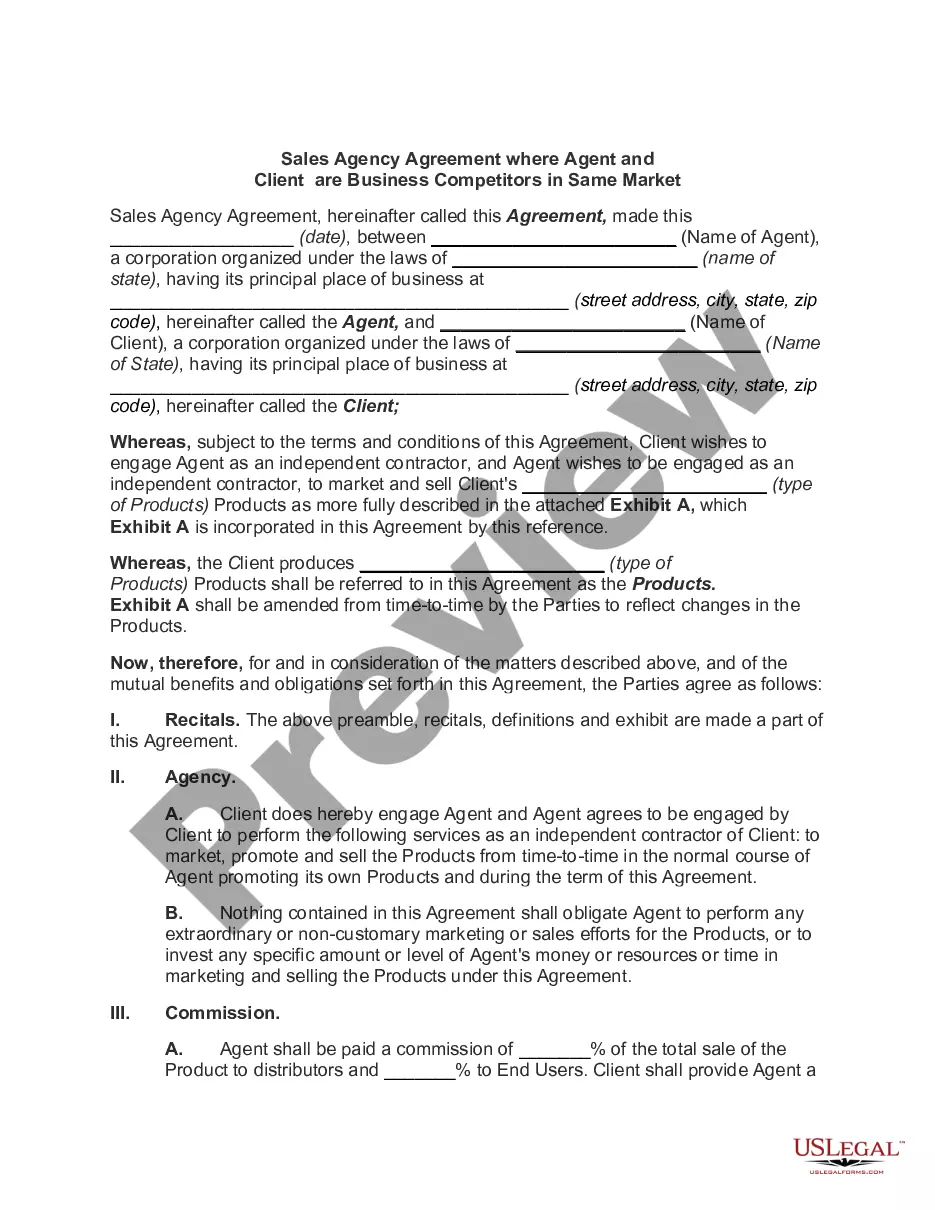

How to fill out Sample Letter For Claim Settlement Against Decedent's Estate?

You might spend time online trying to locate the valid document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of valid forms that are reviewed by specialists.

You can easily obtain or print the Minnesota Sample Letter for Claim Settlement Against Decedent's Estate from my service.

If available, take advantage of the Preview button to review the document template as well. If you wish to get another version of the form, use the Search field to find the template that meets your needs and specifications. After locating the template you need, click Acquire now to proceed. Choose the pricing plan you want, enter your details, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make changes to your document if necessary. You can complete, modify, sign, and print the Minnesota Sample Letter for Claim Settlement Against Decedent's Estate. Access and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Minnesota Sample Letter for Claim Settlement Against Decedent's Estate.

- Each legal document template you purchase is yours permanently.

- To get another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/region you choose.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

Minnesota small estate affidavit is a legal form used in estates valued and under $75,000. Minnesota statute 524.3-1201 tells us that this dollar amount is the threshold level by which an estate in Minnesota does or does not need to be probated.

To start a probate case, a petition or application must be filed with the court and a personal representative must be appointed by a court order. The personal representative is responsible for the following: Collection, inventory, and appraisal of assets of the person who has died. Protection of the estate's assets.

If all inheritors do not agree then the property cannot be sold. Chill! If majority of the inheritors are willing to sell the property they need to go through a probate court. The inheritors can file a 'partition action' lawsuit in the probate court.

Steps in estate settlement Locating the will or trust document. ... Consult an attorney. ... Secure copies of the death certificate. ... Inventory assets. ... Payment of claims and bills. ... Life insurance. ... Tax implications. ... Convert assets to cash.

Trusts. One of the most popular ways to avoid probate is by having a revocable living trust as part of your estate plan.

Organize Important Information The first step (and one of the most important ones) in the process of settling an estate is getting organized. You'll want to keep track of both your expenses and all the time you spend working on settling the estate, as you're entitled to be compensated. You should look for a Will.

There's no easy way to say how long Minnesota probate should take, but one year is a good rule of thumb. An estate that includes a clear will and beneficiaries who can get along may take less than a year whereas one that involves taxes, challenges, multiple attorneys, or other complications can drag on much longer.

If your personal property exceeds $75,000 or you own real estate in your name alone, your estate must be probated.