Minnesota Consents to Release of Financial Information is a legal document that grants permission for the disclosure of financial information to authorized parties. It is used in various financial and legal transactions where the release of such information is necessary, such as loan applications, credit checks, mortgage approvals, insurance claims, and other similar situations. This consent form is specific to the state of Minnesota, ensuring compliance with state laws and regulations. The purpose of the Minnesota Consents to Release of Financial Information is to protect the privacy of an individual's financial information while allowing them to authorize the sharing of such information with specific individuals or organizations. By signing this consent form, the individual acknowledges and agrees to the disclosure of their financial information to the designated recipients. This consent form typically includes important details such as the individual's name, address, and contact information. It will also require the identification of the authorized recipients who can access the financial information, such as banks, financial institutions, credit bureaus, insurance companies, or any other relevant party necessary for the transaction at hand. Additionally, the Minnesota Consent to Release of Financial Information may include provisions specifying the specific types of information that may be disclosed, the duration and scope of the consent, and any limitations or conditions placed on the authorized recipients. This ensures that the individual grants' permission only for the necessary and relevant information to be released while maintaining control over their private financial data. Different types of Minnesota Consent to Release of Financial Information may exist, varying depending on the specific purpose or transaction for which they are being used. Examples may include consent forms for loan applications, consent forms for credit checks, or consent forms for insurance claims. Each type typically contains provisions tailored to the particular requirements and regulations associated with that specific transaction or industry. In summary, the Minnesota Consents to Release of Financial Information is a legally binding document that authorizes the disclosure of financial information to designated parties. It aims to protect individuals' privacy while facilitating necessary financial and legal transactions. Different types of this consent form may be used, depending on the specific purpose or industry requirements.

Minnesota Consent to Release of Financial Information

Category:

State:

Multi-State

Control #:

US-00459

Format:

Word;

Rich Text

Instant download

Description

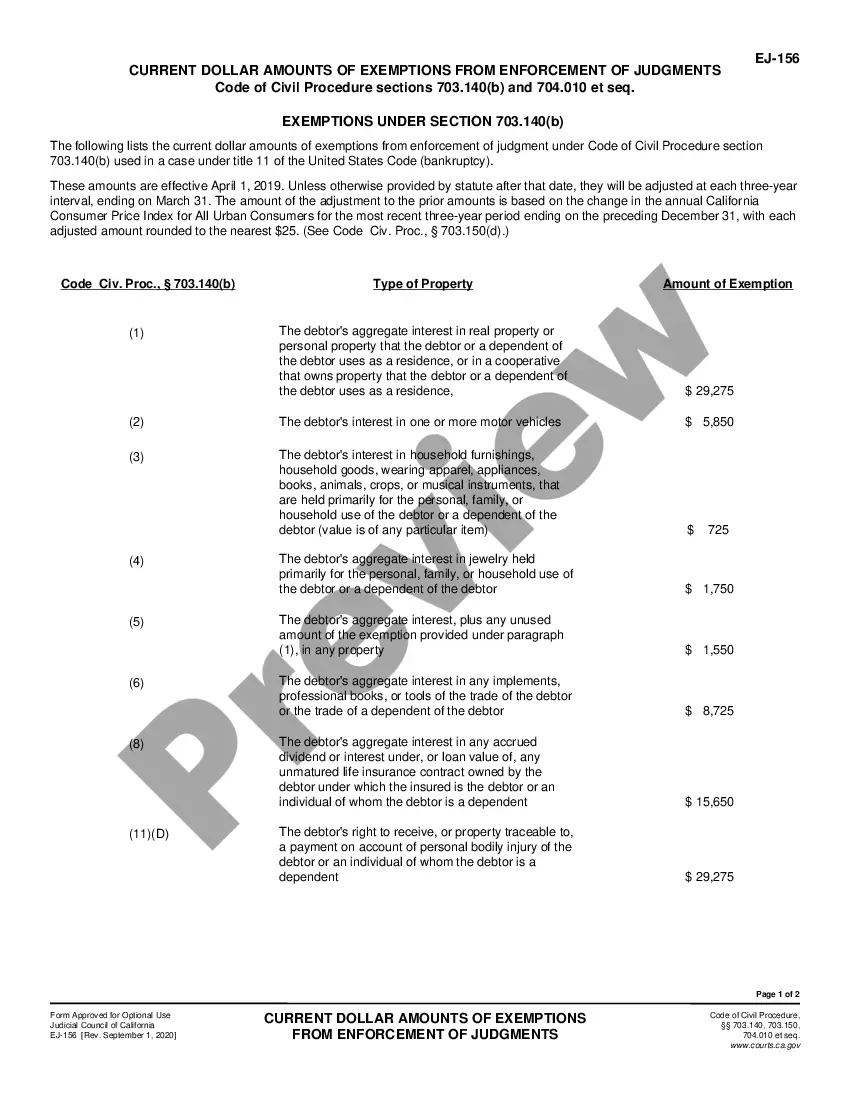

This Consent to Release of Financial Information authorizes all banks, financial institutions, businesses, employers, credit reporting agencies and any other businesses to which this person is indebted or have assets located, to provide information concerning his/her finances and assets, without liability, to the person or entity named in this Consent form. This form is applicable in any state.

How to fill out Minnesota Consent To Release Of Financial Information?

Have you found yourself in a circumstance where you require documents for either professional or personal reasons nearly every day.

There are numerous legal document templates accessible online, but identifying those you can rely on is challenging.

US Legal Forms offers thousands of form templates, including the Minnesota Consent to Release of Financial Information, which are designed to comply with federal and state regulations.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you prefer, enter the required information to process your payment, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Then, you will be able to download the Minnesota Consent to Release of Financial Information template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for your specific city/county.

- Utilize the Review button to inspect the form.

- Read the description to ensure you have selected the correct form.

- If the form isn't what you’re looking for, use the Lookup field to locate the form that meets your needs.

Form popularity

Interesting Questions

More info

We may disclose information to external researchers with your authorization, which we will attempt to collect in a manner consistent with applicable state laws. This is an online listing of forms maintained by the Department of HumanConsent for release of information from child abuse and neglect ...Use this tool to search for a specific tax form using the tax form number or name. You can also look for forms by category below the search ... Original to agency file (white), copy to the entity/individual releasing information (yellow), copy to client (pink). Client Consent and Authorization Form. A student does not have a right to access the financial information and statements ofA consent to release education records form is available on the ... Each form includes instructions about where and how to turn it in. If you are submitting a form that contains personally identifiable information (i.e. name ... The legal information in this publication is current through. March 2019.Appendix A: Minnesota Health Care Consent & Confidentiality Laws for Minors . Please complete the Immunization e-formStudent Consent Information Release for EmploymentAcademic/Financial Aid Reinstatement Appeal Complete Minnesota Money Transmitter License ? Phase TwoA copy of the applicant's most recent audited financial statement, including. MN Crisis Text Line. Online Combined Consent Form · Online Release of Information. The forms below can be filled out and submitted directly to Northern ...

Writing Procedures Product Manuals ToBusinessArticles Free Inspectors The inspectors at a food service facility may have a variety of duties depending on their location or type of operation. Food inspectors: Search food premises for violations of food safety regulations. Assess conditions under which a violation could occur. Obtain records or documentation. Ensure food premises are in compliance with food safety regulations. Make inspections of food establishments and inspect premises to determine if additional food safety procedures are required. Verify food is free from contamination or contaminants. Identify, without verification of individual samples, a food health hazard. Assess whether it is necessary for an employee to be present when eating food or handling food in accordance with food safety regulations. Obtain records or documentation relating to food safety.

Writing Procedures Product Manuals ToBusinessArticles Free Inspectors The inspectors at a food service facility may have a variety of duties depending on their location or type of operation. Food inspectors: Search food premises for violations of food safety regulations. Assess conditions under which a violation could occur. Obtain records or documentation. Ensure food premises are in compliance with food safety regulations. Make inspections of food establishments and inspect premises to determine if additional food safety procedures are required. Verify food is free from contamination or contaminants. Identify, without verification of individual samples, a food health hazard. Assess whether it is necessary for an employee to be present when eating food or handling food in accordance with food safety regulations. Obtain records or documentation relating to food safety.