A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

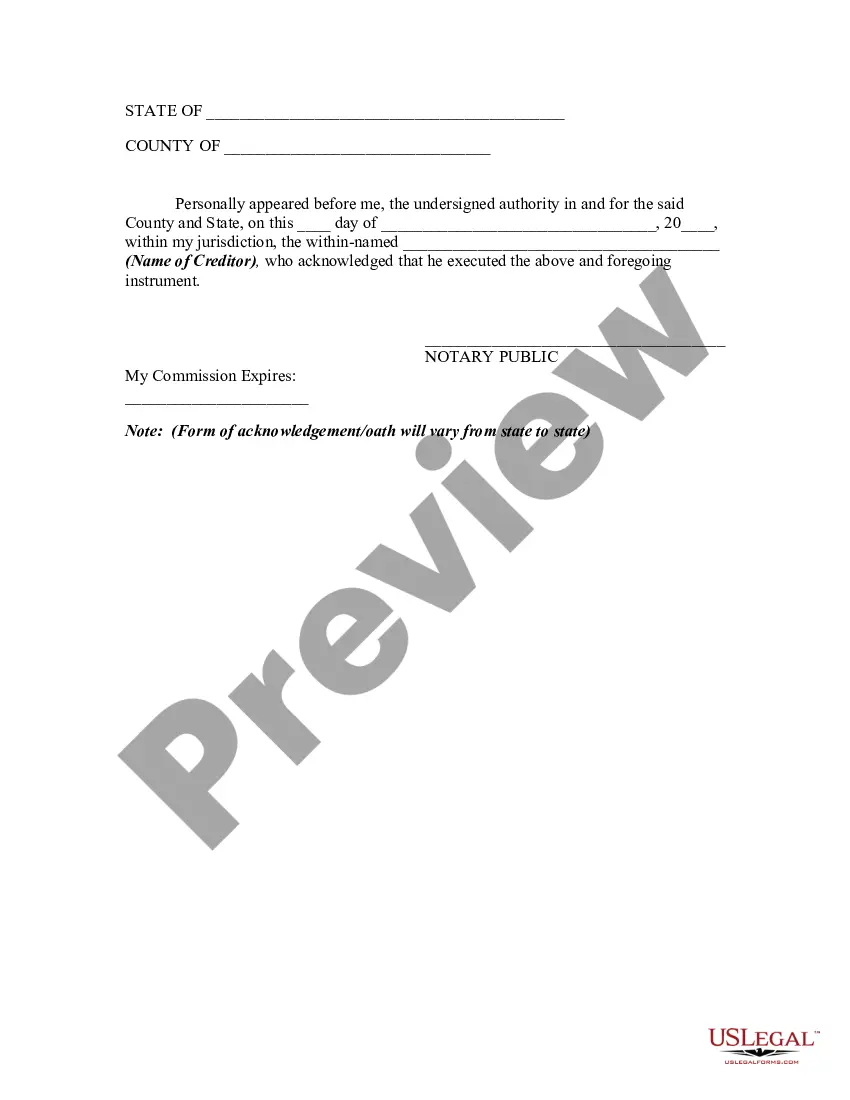

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Minnesota Release of Claims Against an Estate By Creditor: A Comprehensive Guide Introduction: In the state of Minnesota, when a creditor seeks to release their claims against an estate, they can do so by utilizing a specific legal document known as the "Minnesota Release of Claims Against an Estate By Creditor." This document acts as a formal agreement between the creditor and the estate, ensuring a lawful resolution to any outstanding debts. Keywords: Minnesota, release of claims, estate, creditor, legal document, debts I. Understanding the Minnesota Release of Claims Against an Estate By Creditor: 1. Definition and Purpose: The Minnesota Release of Claims Against an Estate By Creditor is a legal instrument used to release and discharge a creditor's claims against the assets of an estate, effectively acknowledging that any debts owed have been satisfied or compromised. 2. Applicable Laws and Regulations: This document must adhere to the relevant laws, such as the Minnesota Probate Code, as well as any court rules governing estate administration. 3. Types of Claims: a. Unsecured debts: Debts that are not backed by collateral, such as credit card debts, personal loans, or medical bills. b. Secured debts: Debts secured by collateral, such as mortgages or car loans, require special attention and may require additional legal proceedings. 4. Individuals Involved: a. Creditor: The individual or entity to whom the money is owed. b. Estate Representative: The person legally responsible for administering the estate, typically the executor or personal representative. II. Components of a Minnesota Release of Claims Against an Estate By Creditor: 1. Identification of Parties: a. Creditor: Full legal name, address, and contact details. b. Estate Representative: Full legal name, address, and contact details. 2. Description of Debt: Clear and detailed information about the debt being released, including the amount, nature, and any relevant account numbers. 3. Consideration: Any agreed-upon payment or compensation, including a lump-sum payment, partial payment, or alternative arrangement, offered to the creditor for releasing their claims. 4. Creditor's Acknowledgment: An explicit acknowledgment by the creditor, affirming that they have received the agreed-upon payment or satisfaction. 5. Termination of Liability: A statement expressly releasing and discharging the creditor's claims against the estate, absolving the estate from any future legal actions relating to the discharged debt. III. Additional Considerations: 1. Legal Assistance: Given the complex nature of releasing claims against an estate, it is advisable to seek legal counsel to ensure compliance with state laws, regulations, and specific circumstances. 2. Probate Court Approval: Depending on the particular circumstances, court approval may be required, especially for secured debts or when there are disputes among creditors. 3. Documentation and Filing: Proper documentation and filing processes should be followed to ensure the release document is legally binding and enforceable. Conclusion: The Minnesota Release of Claims Against an Estate By Creditor serves as a crucial legal document that allows the release and discharge of a creditor's claims against an estate. Understanding the components and requirements of this document is essential for both creditors and estate representatives to ensure a fair and lawful resolution to outstanding debts. Keywords: Minnesota, release of claims, estate, creditor, legal document, debts, secured debts, unsecured debts, estate representative, probate court approval, legal assistance