The Minnesota Pledge of Stock for Loan is a legal document used in the state of Minnesota to secure a loan by pledging stock as collateral. This pledge agreement allows the lender to hold the pledged stock until the borrower repays the loan in full. By pledging the stock, the borrower gives the lender a security interest in the stock, which means that the lender has the right to take ownership of the stock if the borrower fails to repay the loan. The Minnesota Pledge of Stock for Loan provides a sense of security to lenders, as they can rely on the value of the stock to recoup their investment in case of default. This type of loan arrangement is commonly used by businesses or individuals seeking funding for various purposes, such as expansion, investment, or consolidation of debts. There are several types of Minnesota Pledge of Stock for Loan, depending on the specifics of the loan agreement. These may include: 1. General Pledge of Stock for Loan: This is the most common type of pledge agreement in Minnesota. It allows the borrower to pledge any type of stock owned by them as collateral for the loan. 2. Restricted Pledge of Stock for Loan: In certain cases, lenders may require specific restrictions on the pledged stock. For example, they may limit the borrower's ability to sell or transfer the stock without prior consent. 3. Specific Pledge of Stock for Loan: This type of pledge agreement is used when the lender requires the borrower to pledge a specific stock or a certain number of shares as collateral. It could be a particular company's stock or a predetermined portfolio of stocks. 4. Floating Pledge of Stock for Loan: In some cases, the borrower may have multiple stocks that can be pledged as collateral. With a floating pledge, the borrower can select which stock(s) to pledge from this pool of eligible stocks, providing flexibility in collateral options. The Minnesota Pledge of Stock for Loan is an essential legal instrument that offers protection to lenders and provides a secure loan arrangement for borrowers. It enables individuals and businesses to access financing while leveraging the value of their stock holdings.

Minnesota Pledge of Stock for Loan

Description

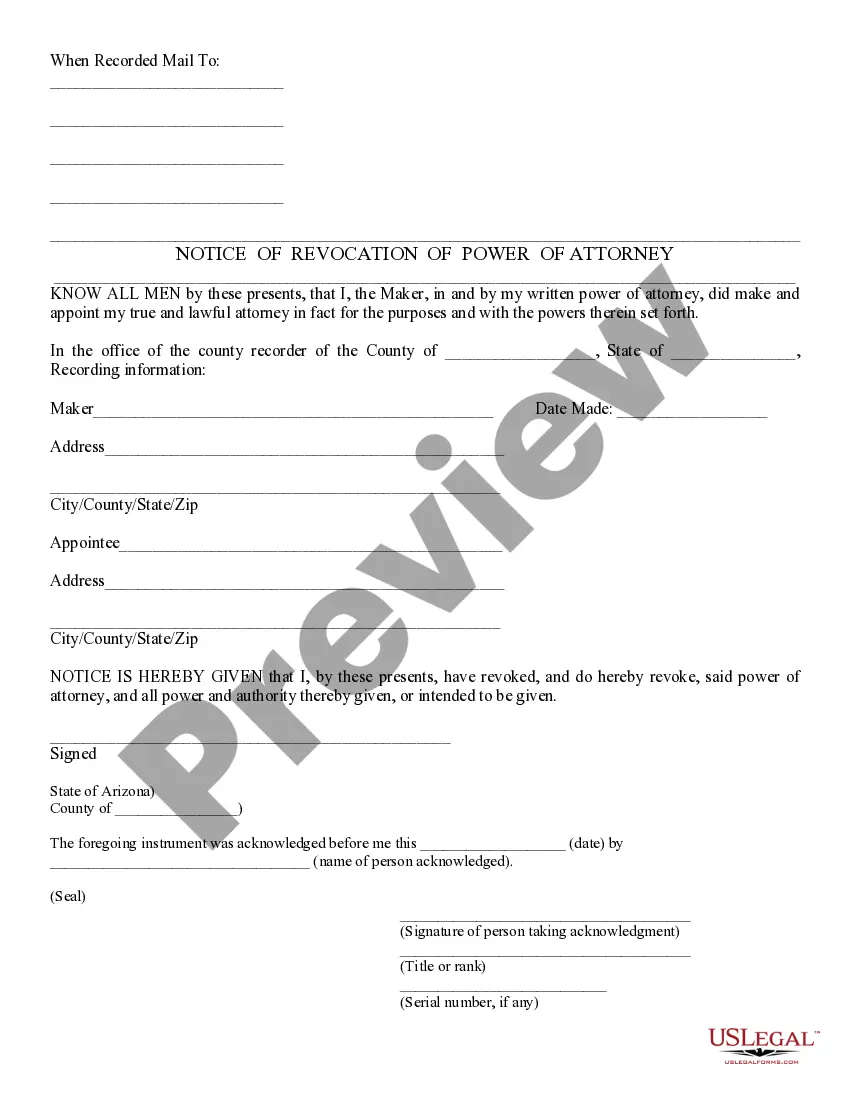

How to fill out Pledge Of Stock For Loan?

You may commit hrs on the web trying to find the legal papers format that fits the state and federal needs you will need. US Legal Forms offers a huge number of legal forms which can be evaluated by experts. You can easily down load or print out the Minnesota Pledge of Stock for Loan from our services.

If you already have a US Legal Forms profile, you are able to log in and click on the Download option. Next, you are able to total, modify, print out, or sign the Minnesota Pledge of Stock for Loan. Each legal papers format you buy is the one you have forever. To get an additional copy of any bought type, visit the My Forms tab and click on the related option.

If you are using the US Legal Forms internet site the very first time, stick to the basic instructions listed below:

- Initial, make sure that you have selected the proper papers format for that state/metropolis that you pick. Look at the type description to make sure you have picked the appropriate type. If readily available, utilize the Review option to appear throughout the papers format too.

- If you wish to locate an additional edition of your type, utilize the Search discipline to get the format that suits you and needs.

- Once you have discovered the format you need, just click Buy now to proceed.

- Choose the prices prepare you need, type your credentials, and register for a free account on US Legal Forms.

- Full the transaction. You should use your bank card or PayPal profile to cover the legal type.

- Choose the formatting of your papers and down load it to the gadget.

- Make alterations to the papers if required. You may total, modify and sign and print out Minnesota Pledge of Stock for Loan.

Download and print out a huge number of papers layouts utilizing the US Legal Forms website, which provides the most important assortment of legal forms. Use expert and status-specific layouts to tackle your business or personal requirements.

Form popularity

FAQ

In case of a Pledge, the lender holds on to certain goods or items such as gold, stock or certificates till the time the borrower makes the complete payment of the loan amount.

A government entity may not enter into a transaction with a broker until the broker has provided this written agreement to the government entity. (d) The state auditor shall prepare uniform notification forms which shall be used by the government entities and the brokers to meet the requirements of this subdivision.

Subd. (c) Tear gas, a tear gas compound, or an electronic incapacitation device shall legally constitute a weapon when it is used in the commission of a crime. (d) No person shall use tear gas or a tear gas compound in an immobilizing concentration against another person, except as otherwise permitted by subdivision 2.

169.17 EMERGENCY VEHICLE. Drivers of all emergency vehicles shall sound an audible signal by siren and display at least one lighted red light to the front, except that law enforcement vehicles shall sound an audible signal by siren or display at least one lighted red light to the front.

So in simple terms Loan Against shares or LAS is a loan availed against your shares. Instead of selling your shares, you can simply pledge them as collateral and avail instant funds for your unplanned expenses or for any of your personal needs.

State law requires that the amount of collateral pledged equal 110% of the uninsured amount on deposit. and above the deposit insurance amount, the financial institution needs to pledge collateral with a market value of $1,100 to protect the deposit.

A financial institution may withdraw excess collateral or substitute other collateral after giving written notice to the government entity and receiving confirmation. The authority to return any delivered and assigned collateral rests with the government entity.