A Minnesota Promissory Note — Satisfaction and Release is a legal document used in the state of Minnesota to confirm that a promissory note has been fully satisfied and released by the borrower. This document serves to provide evidence and protection for both the lender and the borrower when a loan has been paid off. Keywords: Minnesota, Promissory Note, Satisfaction, Release, legal document, borrower, lender, loan In Minnesota, there are different variations of the Promissory Note — Satisfaction and Release that can be used, depending on the specific circumstances and requirements. Some common types include: 1. Simple Promissory Note — Satisfaction and Release: This type of document is used when a simple promissory note has been fully paid off by the borrower and the lender wishes to release any further claims or rights to the loan. 2. Secured Promissory Note — Satisfaction and Release: In cases where the promissory note was secured by collateral, such as real estate or a vehicle, this type of document is used to confirm the satisfaction of the loan and to release the lien or security interest on the collateral. 3. Installment Promissory Note — Satisfaction and Release: When a promissory note has been structured as an installment loan with specific payment terms, this type of document is used to acknowledge the full repayment of the loan over time and release both parties from any future obligations. 4. Commercial Promissory Note — Satisfaction and Release: This document is utilized when a promissory note is associated with a commercial loan, such as for a business or investment purposes. It ensures that the loan has been satisfied according to the terms of the agreement and releases the borrower from any further liability. Regardless of the specific type used, a Minnesota Promissory Note — Satisfaction and Release should include essential information such as the names and contact details of the borrower and lender, the original loan amount, the date of the promissory note, the date of full repayment, and a statement confirming the satisfaction and release of the promissory note. It is crucial for both parties involved to sign and date the document in the presence of a notary public to ensure its validity and enforceability in a legal context. Overall, a Minnesota Promissory Note — Satisfaction and Release is a vital legal instrument that protects the rights and interests of both borrowers and lenders when a promissory note has been fully satisfied. It provides a clear record of the loan repayment, releases any security interests or liens, and brings a sense of closure to the lending relationship.

Minnesota Promissory Note - Satisfaction and Release

Description

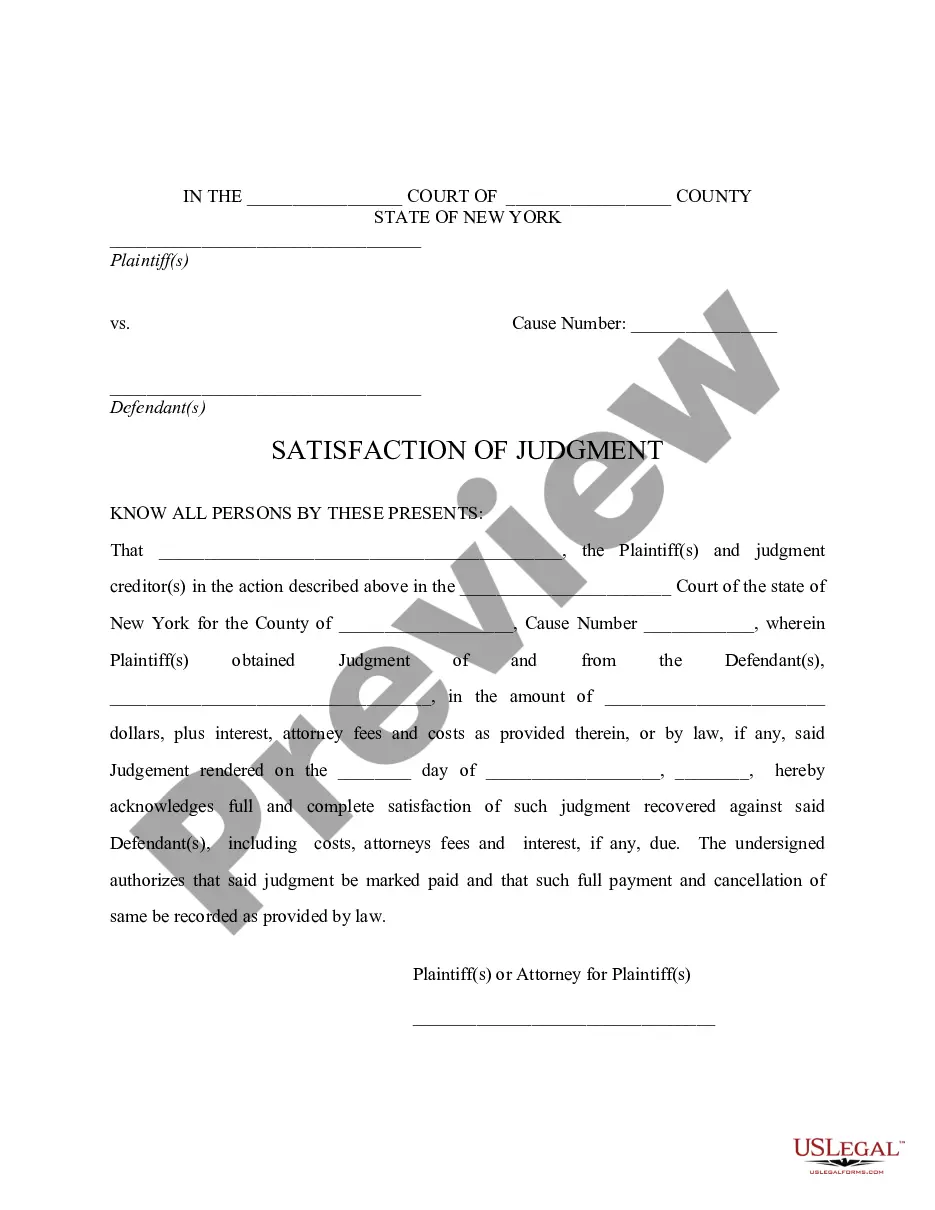

How to fill out Minnesota Promissory Note - Satisfaction And Release?

Are you currently in a circumstance where you require documentation for either business or personal purposes nearly every day.

There are many legal document templates accessible online, but finding ones you can rely on isn't simple.

US Legal Forms offers thousands of form templates, such as the Minnesota Promissory Note - Satisfaction and Release, which are designed to meet federal and state regulations.

Once you find the right form, click Acquire now.

Choose the payment plan you want, fill in the required information to create your account, and complete the purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Minnesota Promissory Note - Satisfaction and Release template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Select the template you need and confirm it is for the correct area/county.

- Use the Review button to inspect the form.

- Check the details to ensure you have selected the correct template.

- If the form isn't what you're looking for, use the Search field to find the document that meets your needs.

Form popularity

FAQ

The rules for a promissory note in Minnesota include the necessity for clear terms outlining the amount, repayment period, and interest rate. The document must be signed by the borrower, and it's advisable to have witnesses or notarization. Additionally, ensure compliance with state laws to maintain enforceability. Understanding these rules helps you create a robust Minnesota Promissory Note - Satisfaction and Release.

In Minnesota, notarization of a promissory note is not mandatory. However, having a notary witness the signing can enhance the credibility and enforceability of the note. If disputes arise later, a notarized document may offer stronger evidence. Therefore, consider this step to protect your interests with a Minnesota Promissory Note - Satisfaction and Release.

In Minnesota, a living will does not need to be notarized to be valid. However, having it notarized can provide additional legal assurance. While it is not a requirement, those with a living will may find it beneficial to have documentation witnessed. This way, you can ensure your wishes are respected, similar to how a Minnesota Promissory Note - Satisfaction and Release protects your financial agreements.

After a person's death, a promissory note typically becomes part of their estate. The estate executor or administrator is responsible for settling any outstanding debts, including the Minnesota Promissory Note - Satisfaction and Release. If the note remains unpaid, the lender can seek repayment from the estate’s assets. It is important to understand your rights and obligations regarding promissory notes in estate situations.

The eminent domain statute in Minnesota is largely found in Minnesota Statutes, Chapter 117. This law outlines the process and rules governing how the government can acquire private property for public use. Key provisions include the requirement for a public purpose and the stipulation that property owners must be compensated fairly. Familiarizing yourself with this statute can help you understand your rights and responsibilities, especially if you are impacted by a government project.

The statute of limitations on a promissory note in Minnesota is typically six years. This period starts from the date of the last payment or the due date of the note. After this time frame, lenders may lose their right to enforce the note in court. Knowing this time limitation can help both borrowers and lenders manage their rights effectively.

The eminent domain law in Minnesota allows the government to take private property for public use, while requiring fair compensation for the owner. This law is aimed at balancing individual property rights with the needs of the community. In Minnesota, this process follows regulated procedures to ensure transparency and fairness. By understanding your rights under this law, you can navigate potential eminent domain actions more confidently.

In Minnesota, the three requirements for eminent domain include a public purpose, just compensation, and the taking of private property. The law mandates that the taking must serve a defined public need, such as infrastructure development. Furthermore, property owners must receive fair payment for their property, assuring equity in the process. If you are facing an eminent domain situation, being informed about these requirements can empower you in negotiations.

Yes, a promissory note requires signatures from both the borrower and the lender for it to be valid. This mutual agreement ensures that both parties understand their rights and obligations. In Minnesota, a signed note strengthens its enforceability in case of disputes. Using platforms like US Legal Forms can help you design professional notes that meet legal requirements.