Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

Are you currently in the location where you need documents for either professional or personal purposes almost every day.

There are many legal document templates available online, but finding ones you can rely on is challenging.

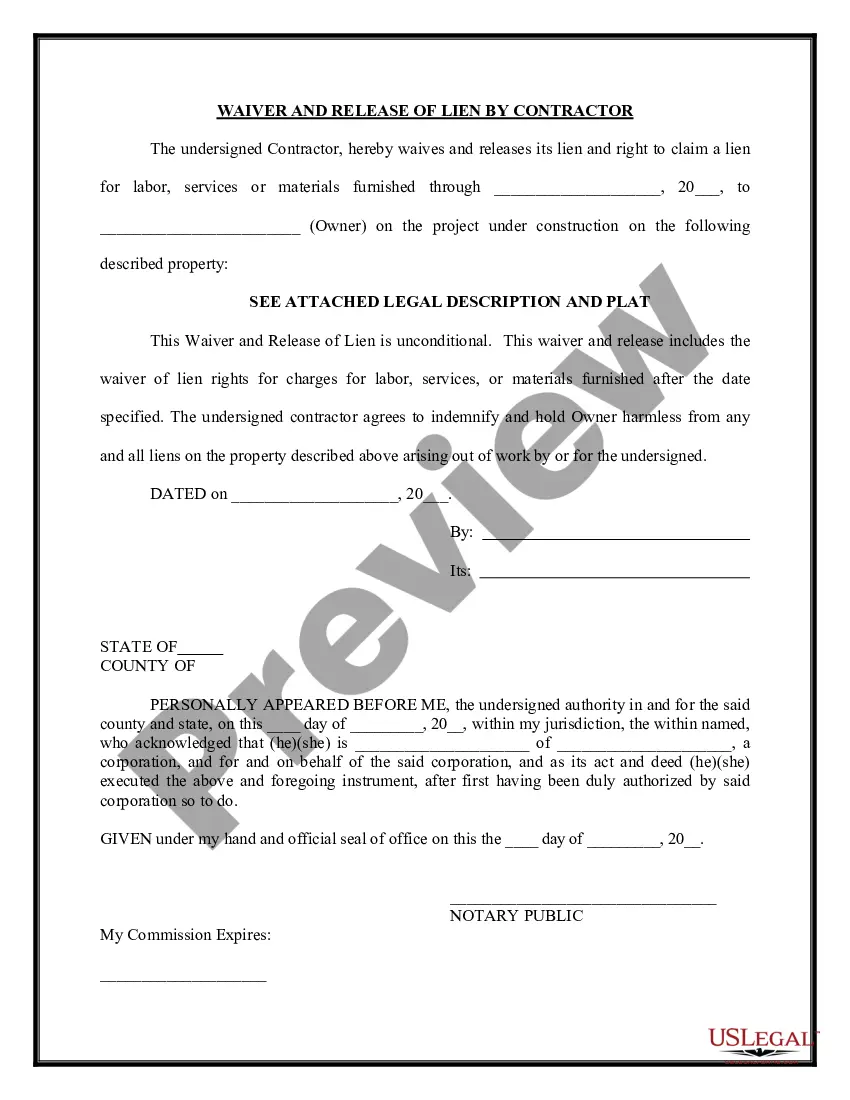

US Legal Forms provides thousands of form templates, such as the Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises, designed to comply with federal and state standards.

Once you have the appropriate form, click Buy now.

Choose the pricing plan you need, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card. Select a convenient file format and download your copy. Find all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises whenever needed. Just click the required form to download or print the format. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers well-crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your daily routine a bit easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for the correct city/area.

- Use the Preview button to inspect the form.

- Review the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search area to find the form that meets your criteria.

Form popularity

FAQ

In a sole proprietorship, you cannot officially have a partner since the structure is designed for one owner. However, a sole proprietor can enter into a partnership or collaborate with others, which then changes the business structure. If you decide to expand your business, reviewing the Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises is crucial to ensure all agreements are legally sound and beneficial.

A sole proprietor may seek a partner for various reasons, including shared financial responsibilities and diversified skill sets. A partner can bring additional resources and expertise, which may enhance business growth and stability. When drafting a Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises, it is vital to outline the roles and contributions of each partner to avoid future conflicts.

Yes, a sole proprietor can have a silent partner who invests in the business but does not participate in its daily operations. This arrangement allows for financial support without the complexities of shared decision-making. If you’re considering a partnership, consulting a legal resource for the Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises can ensure compliance and protection of interests.

A sole trader typically operates independently, but they can form a partnership with one or more individuals. However, it is important to note that in a partnership, the structure changes, and the individual may lose the sole proprietorship status. When creating a Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises, careful consideration of such changes is essential to maintain clarity and legality.

Generally, a sole proprietorship in Malaysia does not require an audit unless it meets certain criteria regarding revenue. This often makes it easier for small business owners to manage their finances. However, if you are considering an asset sale, such as detailed in the Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises, having clear financial records may still be beneficial.

The sole proprietorship law in Malaysia requires business registration with the Companies Commission of Malaysia. This law establishes that the sole proprietor is responsible for all aspects of the business, including debts. It’s wise to review relevant regulations, especially if drafting documents like the Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

Yes, you can sue a sole proprietorship in Malaysia. Since the business and the owner are legally indistinguishable, any legal claim against the business will involve the owner personally. Understanding the implications of such legal actions is crucial, particularly if the Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises is part of a prior transaction.

In Canada, a self-employed individual can operate under various business structures, while a sole proprietor specifically refers to an individual who owns and operates a business alone. Though both manage their operations independently, understanding the legal documents required, such as the Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises, is beneficial for smooth transitions.

Selling a sole proprietorship involves transferring assets and liabilities. The seller typically prepares a comprehensive sale agreement that outlines the terms, including the Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises. This ensures both parties understand the sale process and their rights.

Yes, a foreigner can establish a sole proprietorship in Malaysia, but there are certain conditions. The individual must comply with local regulations and may need to partner with a Malaysian citizen. If you are looking to understand how this connects to the Minnesota Agreement for Sale of Business by Sole Proprietorship with Leased Premises, it is important to ensure legal compliance at all levels.