Minnesota Trust Agreement — Family Special Needs A Minnesota Trust Agreement — Family Special Needs is a legally binding document that offers a comprehensive solution for families seeking to provide long-term care, support, and financial security for their loved ones with special needs in the state of Minnesota. This trust agreement specifically caters to the unique needs and requirements of individuals with disabilities, ensuring their quality of life is not compromised. Key Elements of a Minnesota Trust Agreement — Family Special Needs: 1. Trustee Appointment: The trust agreement identifies and appoints a trustee who will manage and distribute the trust's assets on behalf of the beneficiary, i.e., the individual with special needs. The trustee can be a family member, a close friend, or a professional trustee selected for their financial expertise and understanding of the beneficiary's needs. 2. Asset Protection: The primary objective of a family special needs trust is to protect the beneficiary's eligibility for government benefits such as Supplemental Security Income (SSI), Medicaid, and other assistance programs. Through proper structuring and management of assets, the trust ensures that the beneficiary remains eligible for such crucial benefits. 3. Supplemental Care: The trust agreement outlines the specific requirements and preferences for the beneficiary's care, including medical, educational, housing, transportation, and recreational needs. It allows the trustee to use trust funds to enhance the beneficiary's quality of life beyond what government benefits cover. 4. Income Distribution: The trust agreement includes instructions on how income from the trust's assets will be distributed to the beneficiary. It may specify regular payments, periodic lump sums, or allow for discretionary distributions based on the beneficiary's evolving needs. 5. Trust Termination: Depending on the circumstances, the trust agreement can outline conditions under which the trust will terminate. For example, it may specify that the trust will dissolve once the beneficiary no longer requires government assistance or upon the beneficiary's passing. Types of Minnesota Trust Agreement — Family Special Needs: 1. Supplemental Care Trust: This trust is designed to supplement government benefits and provide additional funds for the beneficiary's unique needs, such as therapies, assistive devices, or vacations. It ensures that the beneficiary enjoys an enhanced lifestyle without jeopardizing their eligibility for assistance programs. 2. Pooled Trust: A pooled trust combines assets from multiple families with special needs individuals into a single investment fund, creating economies of scale. It is managed by a nonprofit organization, which can provide professional asset management, trust administration, and advocacy for the beneficiary. 3. Third-Party Special Needs Trust: This type of trust is established by a family member or another person for the benefit of an individual with special needs. It allows the family to leave an inheritance or make substantial gifts to the trust without affecting the beneficiary's eligibility for government benefits. In conclusion, a Minnesota Trust Agreement — Family Special Needs is a crucial legal instrument for families seeking to ensure their loved ones with special needs receive proper care and financial support while preserving their eligibility for government assistance. By tailoring the trust agreement to specific requirements and utilizing one of the various types available, families can secure the well-being and future of their special needs family member in Minnesota.

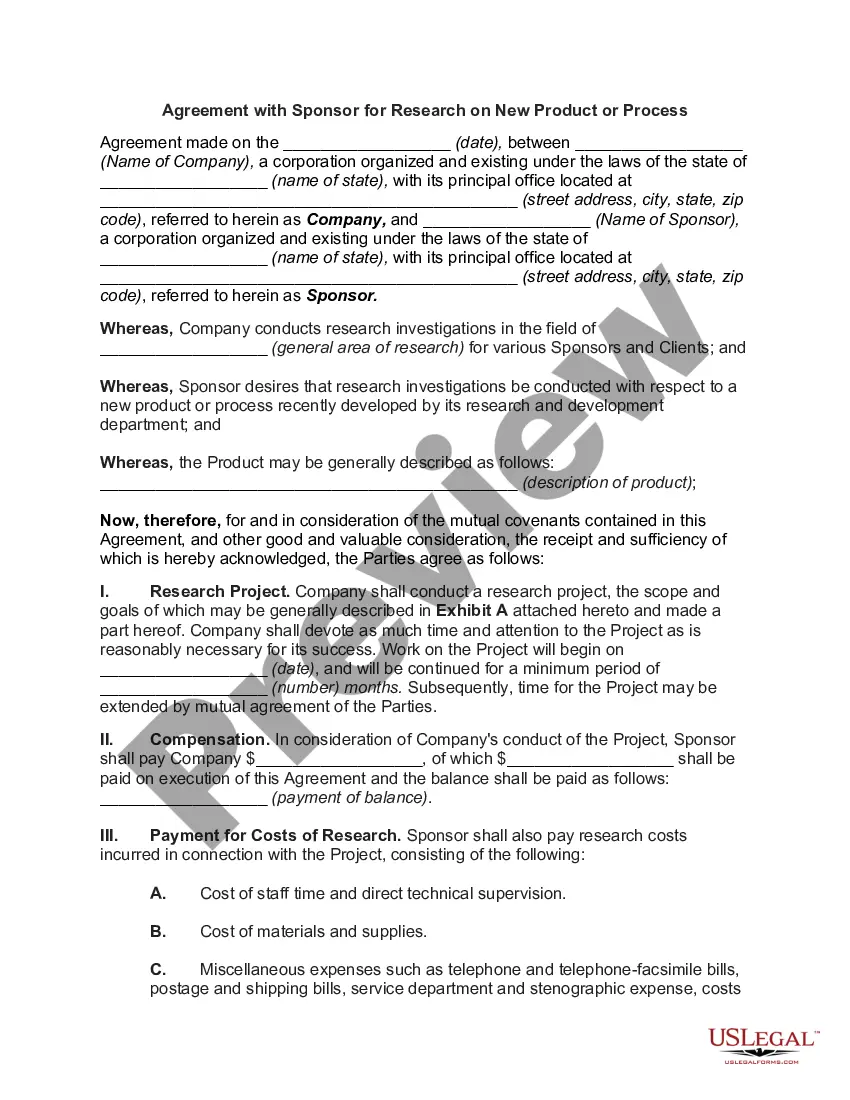

Minnesota Trust Agreement - Family Special Needs

Description

How to fill out Minnesota Trust Agreement - Family Special Needs?

It is possible to commit several hours online looking for the authorized papers design that suits the state and federal specifications you need. US Legal Forms provides 1000s of authorized types that are examined by pros. It is simple to acquire or print the Minnesota Trust Agreement - Family Special Needs from our assistance.

If you have a US Legal Forms account, you are able to log in and click on the Acquire key. Next, you are able to complete, change, print, or signal the Minnesota Trust Agreement - Family Special Needs. Every single authorized papers design you acquire is your own property for a long time. To acquire yet another copy for any bought type, check out the My Forms tab and click on the related key.

If you use the US Legal Forms website for the first time, adhere to the easy instructions under:

- Initial, make sure that you have selected the right papers design for the region/area that you pick. See the type description to ensure you have selected the proper type. If offered, use the Review key to check from the papers design at the same time.

- If you would like discover yet another variation of your type, use the Look for discipline to obtain the design that meets your needs and specifications.

- After you have identified the design you need, click on Buy now to carry on.

- Select the rates plan you need, key in your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You may use your Visa or Mastercard or PayPal account to cover the authorized type.

- Select the formatting of your papers and acquire it to the gadget.

- Make changes to the papers if possible. It is possible to complete, change and signal and print Minnesota Trust Agreement - Family Special Needs.

Acquire and print 1000s of papers layouts making use of the US Legal Forms web site, that provides the greatest assortment of authorized types. Use specialist and state-specific layouts to handle your business or specific requirements.