Title: Understanding Minnesota Trust Agreement — Irrevocable: Types, Features, and Benefits Introduction: A Minnesota Trust Agreement — Irrevocable is a legal document that establishes a trust, in which the granter transfers their assets to be managed and protected by a trustee. This type of trust cannot be modified, amended, or revoked without the permission of all beneficiaries involved. This article will provide a detailed description of what a Minnesota Trust Agreement — Irrevocable entails, exploring its types, key features, and highlighting the benefits it offers. Types of Minnesota Trust Agreement — Irrevocable: 1. Charitable Remainder Trust: Used to support charitable causes by designating a predetermined portion or percentage of assets to be donated to a charity or non-profit organization while providing income to beneficiaries during their lifetimes. 2. Generation-Skipping Trust: This trust allows individuals to bypass a generation and distribute assets directly to grandchildren or future generations, minimizing estate taxes and providing long-term financial protection. 3. Special Needs Trust: Created to financially support individuals with disabilities or special needs, this trust ensures that the beneficiary's eligibility for government benefits remains intact, while offering additional assets for care, education, and quality of life improvements. 4. Life Insurance Trust: Often utilized by individuals with large life insurance policies, this trust helps exclude the policy proceeds from the taxable estate, ensuring that beneficiaries receive the insurance benefits without estate tax burdens. Key Features of Minnesota Trust Agreement — Irrevocable: 1. Asset Protection: One of the primary reasons to establish an irrevocable trust is to safeguard assets from potential creditors, lawsuits, or other legal claims, providing increased protection and preserving wealth for future generations. 2. Estate Tax Planning: Irrevocable trusts allow granters to minimize estate taxes by removing assets from their taxable estate, potentially reducing the tax liability their beneficiaries may face later on. 3. Charitable Giving: Charitable trusts within the Minnesota Trust Agreement — Irrevocable offer individuals an efficient way to support charitable causes while potentially receiving income tax deductions. 4. Medicaid Planning: For individuals looking to plan for potential long-term care needs while still preserving assets, irrevocable trusts can assist in meeting Medicaid eligibility requirements. Benefits of Minnesota Trust Agreement — Irrevocable: 1. Long-term Wealth Preservation: By placing assets in an irrevocable trust, individuals can ensure their wealth is protected and distributed according to their wishes, promoting financial stability and legacy preservation. 2. Tax Efficiency: Minimizing estate taxes through various irrevocable trust structures can benefit both the granter and beneficiaries, allowing for more efficient wealth transfer. 3. Charitable Legacy: Irrevocable trusts can establish a lasting charitable legacy by supporting causes that match the granter's values, securing a long-lasting impact for generations to come. Conclusion: A Minnesota Trust Agreement — Irrevocable provides individuals with the means to protect their assets, reduce tax burdens, and establish a lasting legacy. With various trust types available, including the Charitable Remainder Trust, Generation-Skipping Trust, Special Needs Trust, and Life Insurance Trust, individuals can tailor their trust to their unique goals and circumstances. By consulting with legal and financial professionals, individuals can understand and utilize the benefits of an irrevocable trust to effectively plan for their financial future.

Minnesota Trust Agreement - Irrevocable

Description

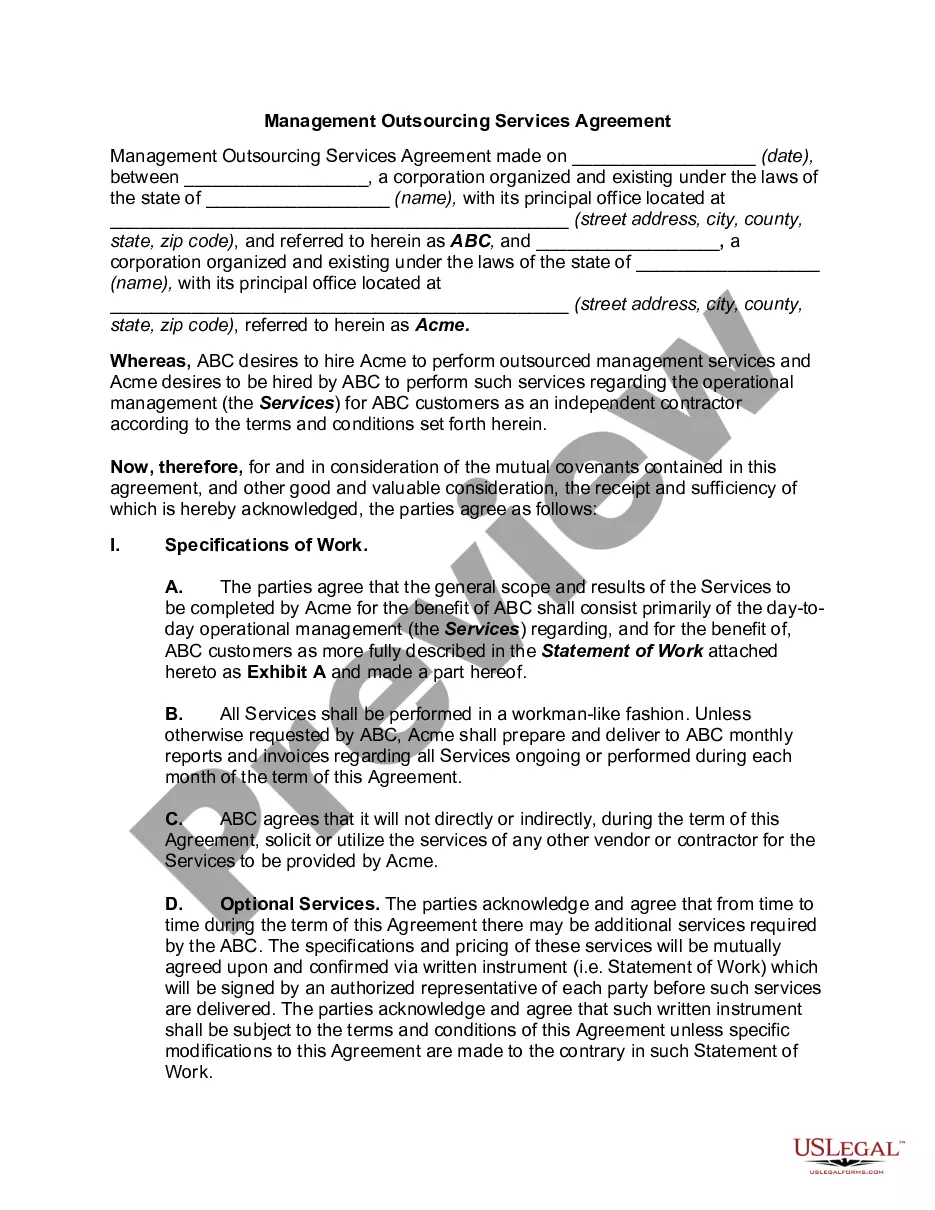

How to fill out Minnesota Trust Agreement - Irrevocable?

If you want to comprehensive, download, or print authorized document templates, use US Legal Forms, the biggest assortment of authorized kinds, which can be found on-line. Use the site`s basic and practical research to find the papers you require. Numerous templates for enterprise and individual purposes are sorted by categories and states, or key phrases. Use US Legal Forms to find the Minnesota Trust Agreement - Irrevocable in a number of click throughs.

Should you be already a US Legal Forms client, log in to your accounts and click the Acquire button to get the Minnesota Trust Agreement - Irrevocable. You can also gain access to kinds you previously saved within the My Forms tab of your accounts.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape to the correct city/country.

- Step 2. Take advantage of the Review method to examine the form`s content material. Do not overlook to learn the explanation.

- Step 3. Should you be unsatisfied with the kind, take advantage of the Research discipline near the top of the display to get other types of the authorized kind template.

- Step 4. Upon having identified the shape you require, select the Acquire now button. Choose the costs prepare you like and add your qualifications to sign up for the accounts.

- Step 5. Process the purchase. You can use your charge card or PayPal accounts to complete the purchase.

- Step 6. Choose the formatting of the authorized kind and download it in your product.

- Step 7. Comprehensive, change and print or signal the Minnesota Trust Agreement - Irrevocable.

Each authorized document template you buy is your own permanently. You might have acces to each and every kind you saved with your acccount. Select the My Forms segment and select a kind to print or download once more.

Be competitive and download, and print the Minnesota Trust Agreement - Irrevocable with US Legal Forms. There are millions of specialist and condition-particular kinds you may use for your enterprise or individual needs.