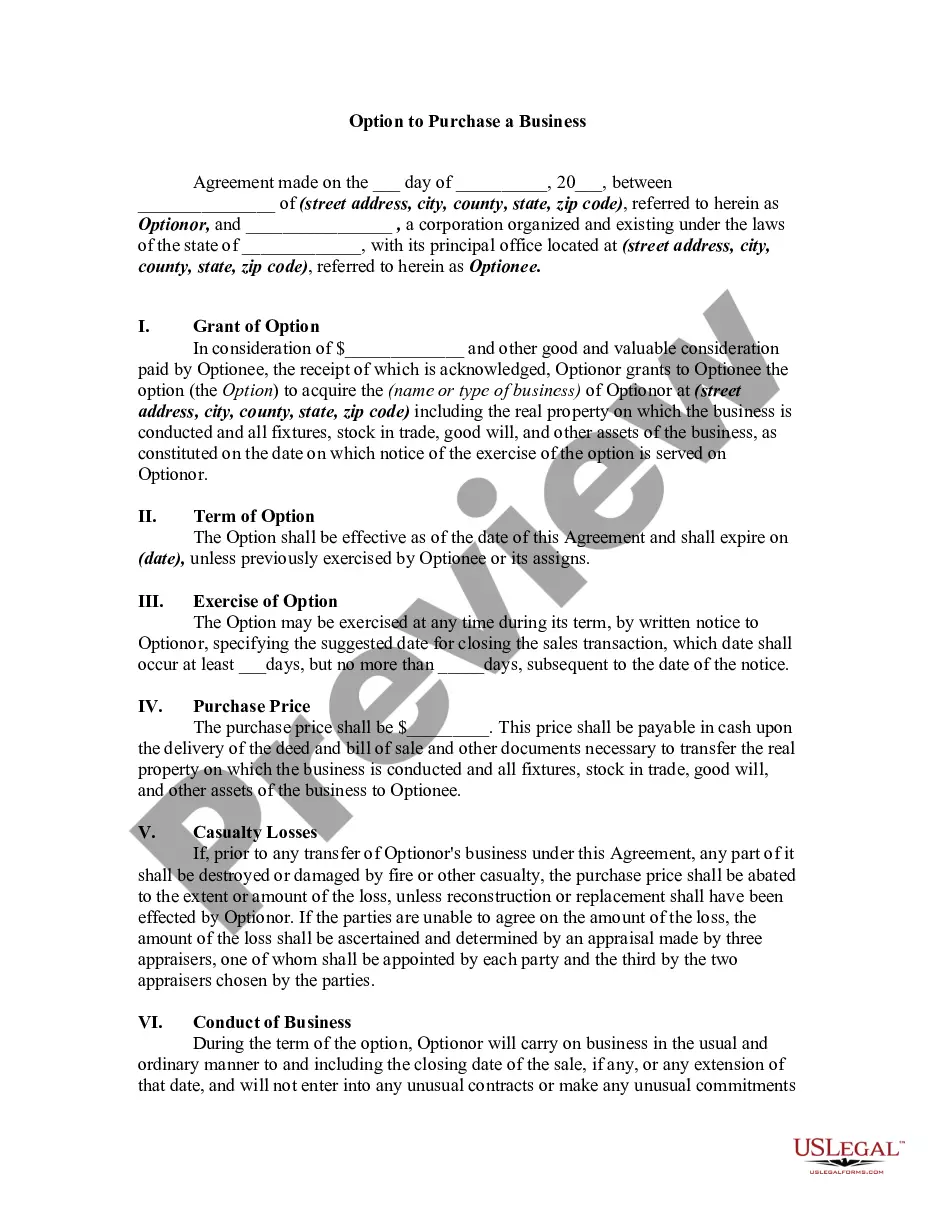

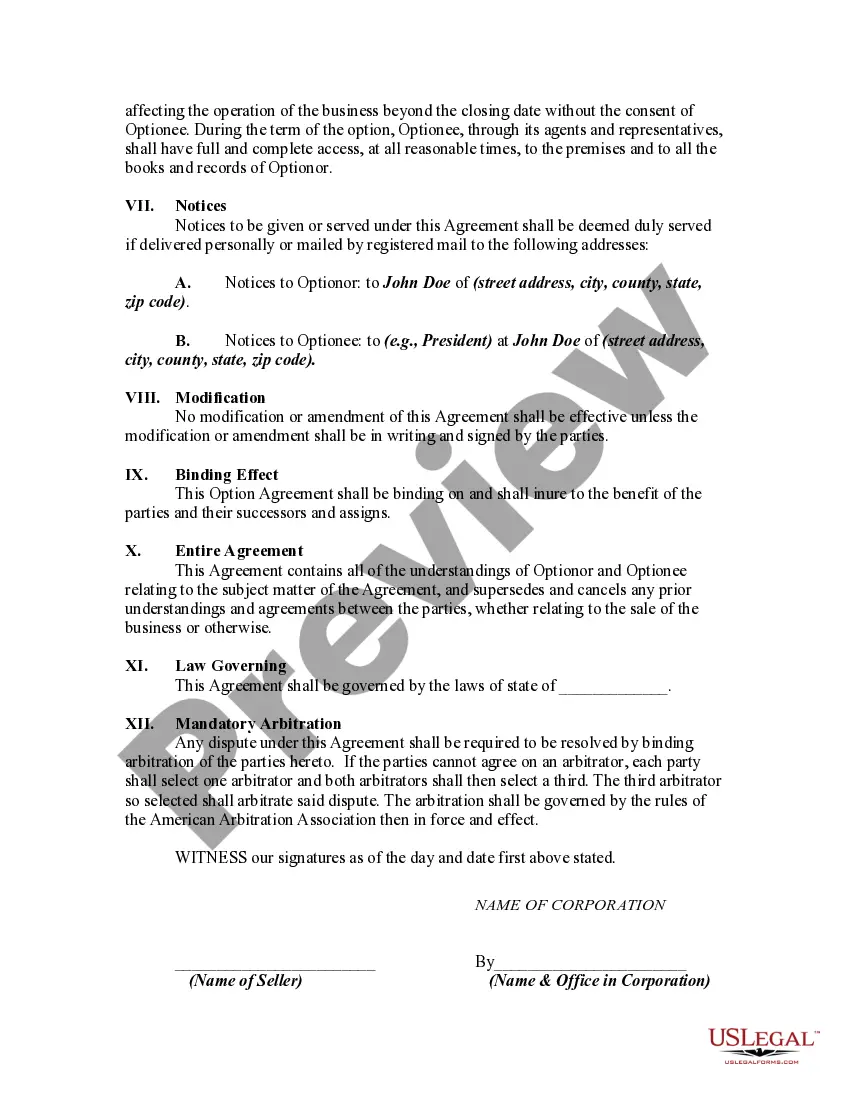

Introduction: Minnesota Option to Purchase a Business refers to a legal agreement that allows a potential buyer to secure the right to purchase a business at a predetermined price and terms within a specified period. This option provides flexibility for both parties involved, giving the buyer time to conduct due diligence on the business before committing to a purchase. Key Terms: 1. Option Agreement: The legally binding contract outlining the terms and conditions of the option, including the purchase price, expiration date, and any contingencies. 2. Purchase Price: The predetermined price at which the buyer can exercise the option and buy the business. 3. Expiration Date: The deadline by which the option must be exercised, after which it becomes invalid. 4. Due Diligence: The process of investigating and assessing the business's financial, legal, and operational aspects before making a final decision to purchase. Types of Minnesota Option to Purchase a Business: 1. Standard Option Agreement: This is the most common type of option to purchase a business, typically utilized in straightforward transactions. It allows the buyer to secure the right to buy the business at a predetermined price and within a specified time frame. 2. Right of First Refusal: This type of option grants the buyer the first opportunity to purchase the business if the owner decides to sell it. The owner must present the terms to the buyer before selling to any other interested party. 3. Lease with Option to Purchase: In this arrangement, the buyer initially leases the business premises with an option to buy it at a later date. This allows the buyer to assess the profitability and viability of the business before committing to the purchase. Benefits of Minnesota Option to Purchase a Business: 1. Flexibility: The buyer can secure the right to purchase the business without fully committing, allowing for further investigation and due diligence. 2. Price Lock: By agreeing on a predetermined purchase price, the buyer can avoid potential price increases during the option period. 3. Risk Mitigation: The option allows the buyer to back out if the due diligence uncovers unforeseen issues, minimizing financial risk. 4. Strategic Decision-Making: The buyer can assess the market, competition, and potential growth opportunities before exercising the option. 5. Tax Advantages: By deferring the purchase until a later date, the buyer may benefit from potential tax advantages or changes in tax laws. Conclusion: Minnesota Option to Purchase a Business provides an excellent opportunity for potential buyers to secure the right to purchase a business at a predetermined price and terms within a specified period. With various types of options available, buyers can choose the option that best suits their needs and circumstances. These options offer flexibility, risk mitigation, and strategic decision-making capabilities, making them valuable tools in the business acquisition process.

Minnesota Option to Purchase a Business

Description

How to fill out Minnesota Option To Purchase A Business?

Are you currently in the position the place you need files for possibly organization or personal uses just about every day time? There are plenty of authorized document themes available online, but finding versions you can rely on isn`t easy. US Legal Forms delivers a huge number of form themes, like the Minnesota Option to Purchase a Business, which are published to meet state and federal specifications.

In case you are already informed about US Legal Forms internet site and possess an account, merely log in. After that, you are able to acquire the Minnesota Option to Purchase a Business design.

If you do not offer an bank account and wish to begin using US Legal Forms, follow these steps:

- Obtain the form you want and ensure it is to the appropriate metropolis/county.

- Use the Review key to examine the form.

- See the information to actually have chosen the proper form.

- In the event the form isn`t what you are searching for, make use of the Lookup industry to obtain the form that meets your needs and specifications.

- When you find the appropriate form, just click Get now.

- Choose the rates prepare you would like, fill out the desired information to create your account, and purchase your order utilizing your PayPal or bank card.

- Decide on a convenient data file format and acquire your duplicate.

Get all of the document themes you might have bought in the My Forms menus. You can obtain a further duplicate of Minnesota Option to Purchase a Business whenever, if possible. Just go through the essential form to acquire or print the document design.

Use US Legal Forms, the most substantial variety of authorized types, to save lots of time and avoid blunders. The services delivers professionally created authorized document themes that can be used for a selection of uses. Produce an account on US Legal Forms and initiate producing your life easier.