A Minnesota Letter of Credit (L/C) is a financial instrument used in commercial transactions to provide a guarantee of payment between a buyer and a seller. It is often utilized in international trade or when there is a lack of trust between the parties involved. The Minnesota Letter of Credit serves as a written commitment by a bank or financial institution (known as the issuing bank) on behalf of the buyer/importer to honor the payment obligations defined in the L/C, once the seller/exporter meets the specific terms and conditions outlined within the letter. The L/C acts as a safeguard, protecting the seller from non-payment or other risks associated with the buyer, while assuring the buyer that payment will only be made once the agreed-upon conditions are met. There are various types of Minnesota Letters of Credit, each tailored to meet specific requirements: 1. Commercial Letter of Credit: This type of L/C is predominantly used in international trade, ensuring the timely payment to the exporter once the necessary documents (e.g., bill of lading, commercial invoice, etc.) are presented in compliance with the L/C terms. 2. Standby Letter of Credit: Unlike a commercial L/C, a standby L/C primarily serves as a backup option, which ensures payment in case the buyer fails to fulfill their contractual obligations. It acts as a guarantee of payment in case of default or any other non-performance. 3. Revocable Letter of Credit: A revocable L/C can be altered or canceled by the buyer or the issuing bank without prior notice to the seller. This type of L/C is considered infrequent due to the inherent risk for the seller. 4. Irrevocable Letter of Credit: On the other hand, an irrevocable L/C cannot be amended or canceled without the consent of all parties involved. This type of L/C provides a higher level of security to the seller, as it eliminates the risk of unilateral changes. 5. Confirmed Letter of Credit: A confirmed L/C involves the participation of a second bank, often in the seller's country, known as the confirming bank. The confirming bank adds its guarantee on top of the issuing bank's commitment, providing an additional layer of protection to the seller. 6. Revolving Letter of Credit: In certain cases, where there is an ongoing business relationship, a revolving L/C can be established. It allows for the issuance of multiple drafts or draw downs within a specified time period or up to a predetermined amount. Minnesota Letter of Credit plays a vital role in facilitating secure commercial transactions, particularly in international trade, where trust and reliability are paramount. The different types of L/Cs cater to various scenarios and requirements, offering flexibility and assurance to both buyers and sellers.

Minnesota Letter of Credit

Description

How to fill out Minnesota Letter Of Credit?

If you have to complete, acquire, or produce authorized document templates, use US Legal Forms, the biggest collection of authorized forms, that can be found on the Internet. Use the site`s easy and hassle-free look for to discover the paperwork you want. Numerous templates for company and individual purposes are sorted by categories and claims, or key phrases. Use US Legal Forms to discover the Minnesota Letter of Credit within a couple of clicks.

When you are presently a US Legal Forms buyer, log in in your account and click on the Acquire switch to get the Minnesota Letter of Credit. Also you can entry forms you in the past delivered electronically within the My Forms tab of your respective account.

If you are using US Legal Forms the first time, follow the instructions listed below:

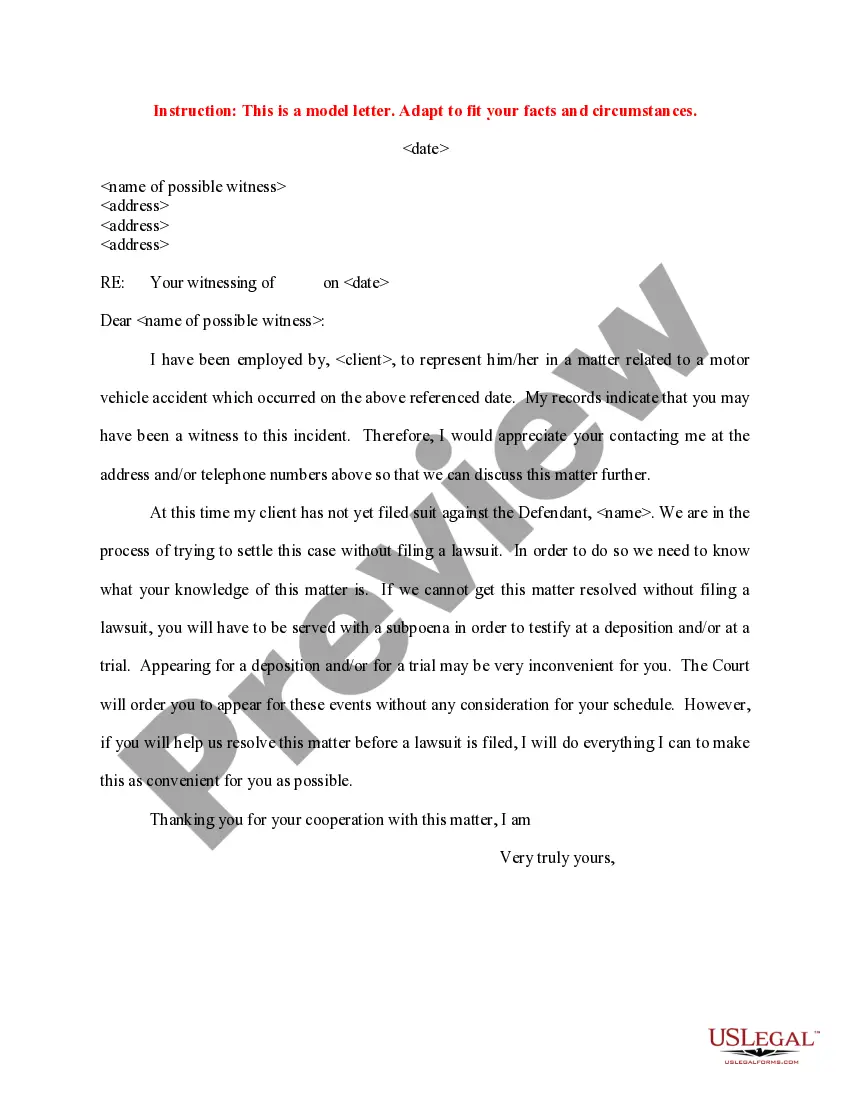

- Step 1. Make sure you have selected the form for that right city/land.

- Step 2. Make use of the Preview choice to look through the form`s content material. Do not forget to read through the outline.

- Step 3. When you are unsatisfied with the develop, utilize the Look for area at the top of the screen to find other variations from the authorized develop format.

- Step 4. Once you have located the form you want, select the Get now switch. Choose the prices strategy you prefer and put your qualifications to register for an account.

- Step 5. Process the purchase. You should use your bank card or PayPal account to finish the purchase.

- Step 6. Choose the formatting from the authorized develop and acquire it on the gadget.

- Step 7. Total, change and produce or sign the Minnesota Letter of Credit.

Each and every authorized document format you purchase is yours for a long time. You have acces to each develop you delivered electronically within your acccount. Click on the My Forms section and decide on a develop to produce or acquire yet again.

Contend and acquire, and produce the Minnesota Letter of Credit with US Legal Forms. There are millions of specialist and express-distinct forms you can use for your personal company or individual demands.

Form popularity

FAQ

Common types of letters of credit A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees.

An irrevocable letter of credit must be obtained through the bank. You should not try to craft a letter or adapt somebody else's letter of credit. Doing so can put you at risk of an expensive legal battle, potentially overseas.

Banks will usually charge a fee for a letter of credit, which can be a percentage of the total credit that they are backing. The cost of a letter of credit will vary by bank and the size of the letter of credit. For example, the bank may charge 0.75% of the amount that it's guaranteeing.

Documents required for a Letter of Credit Shipping Bill of Lading. Airway Bill. Commercial Invoice. Insurance Certificate. Certificate of Origin. Packing List. Certificate of Inspection.

The issuing bank is the importer's bank and issues the confirmed LC on behalf of the importer.