Minnesota Federal Trade Commission Affidavit regarding Identity Theft

Description

How to fill out Federal Trade Commission Affidavit Regarding Identity Theft?

Selecting the appropriate authorized document format can be quite a challenge.

Of course, there are numerous templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Minnesota Federal Trade Commission Affidavit concerning Identity Theft, which can be utilized for both business and personal purposes.

You can preview the form using the Preview feature and read the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the right form. Once you are sure the form is appropriate, click on the Purchase now button to obtain the form. Select the pricing plan you prefer and enter the required information. Create your account and complete your order using your PayPal account or credit card. Choose the file format and download the legal document format to your device. Fill out, modify, print, and sign the acquired Minnesota Federal Trade Commission Affidavit concerning Identity Theft. US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Use the service to download professionally crafted documents that adhere to state requirements.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Minnesota Federal Trade Commission Affidavit concerning Identity Theft.

- Use your account to search for the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your locality/region.

Form popularity

FAQ

In most cases, taxpayers do not need to complete this form. Only victims of tax-related identity theft should submit the Form 14039, and only if they haven't received certain letters from the IRS.

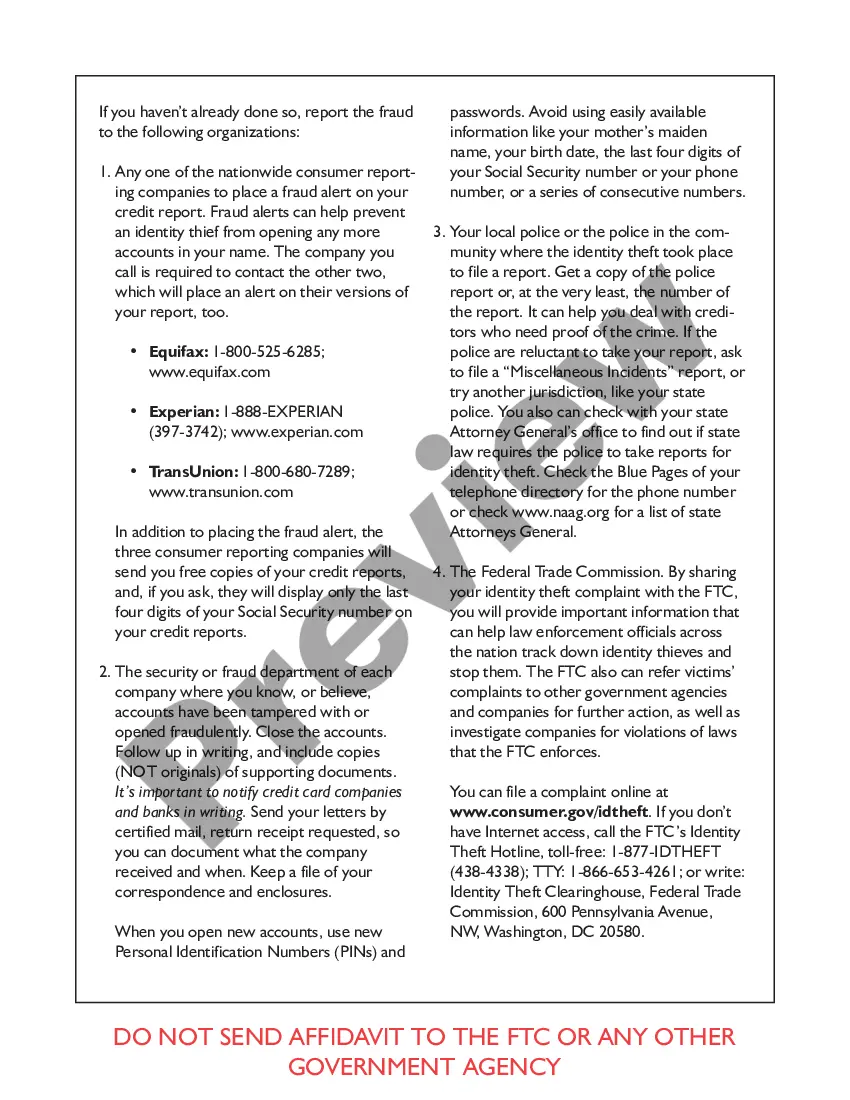

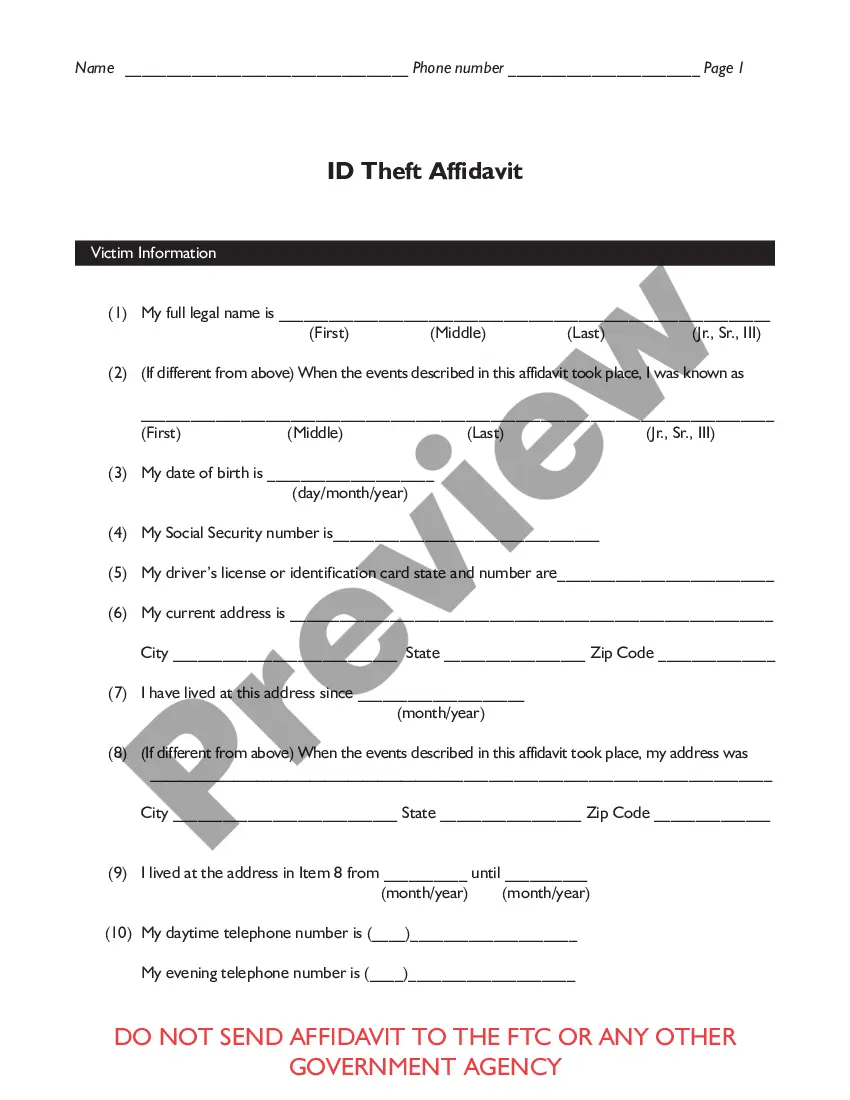

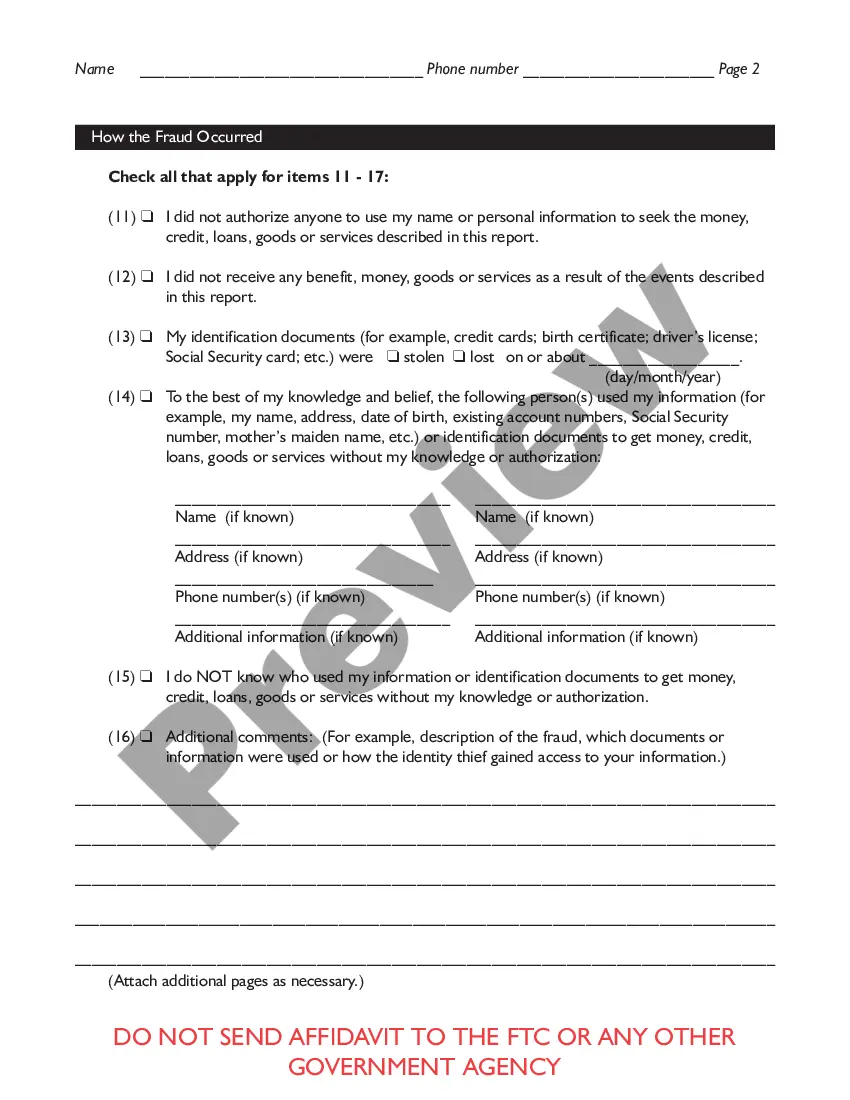

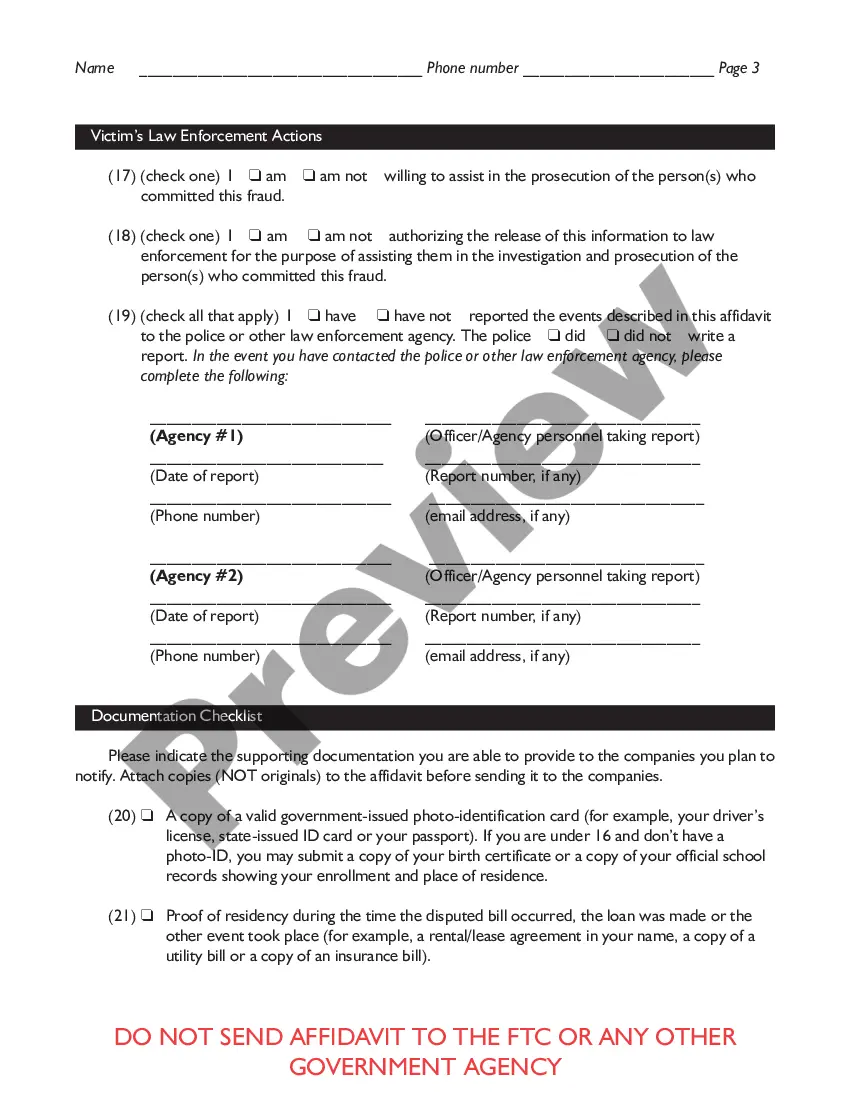

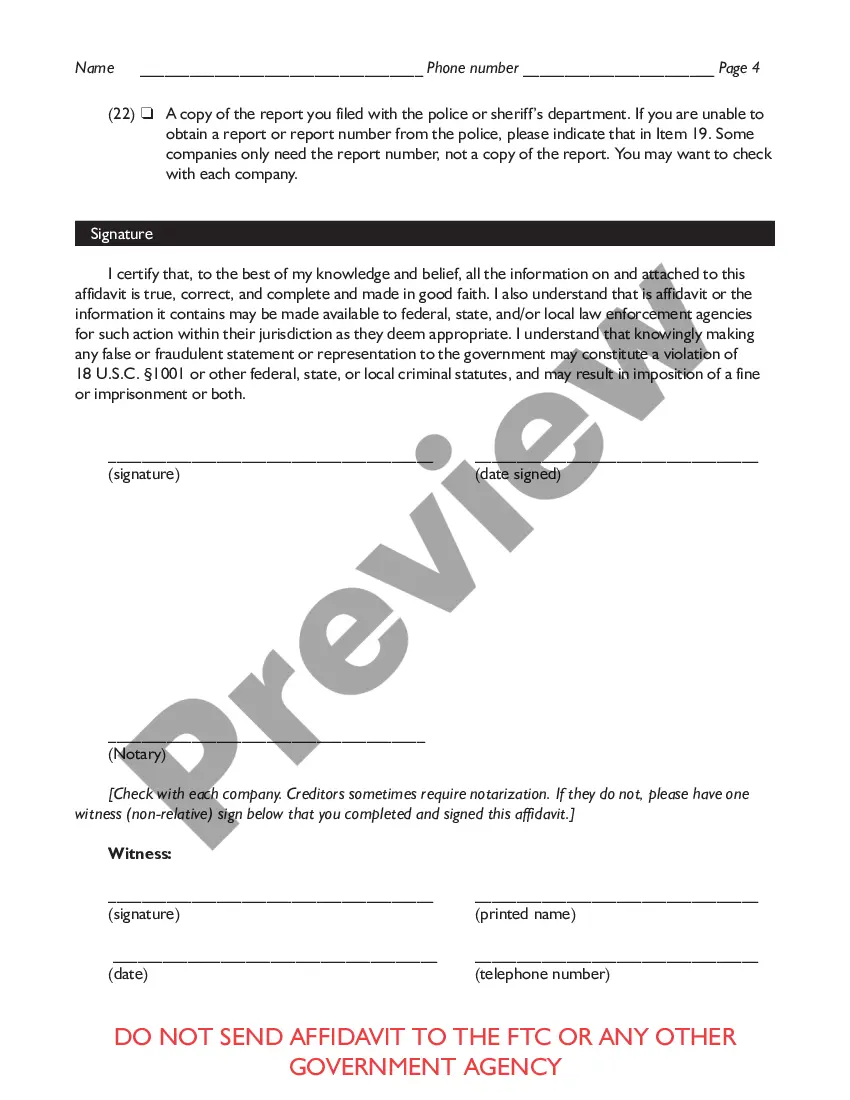

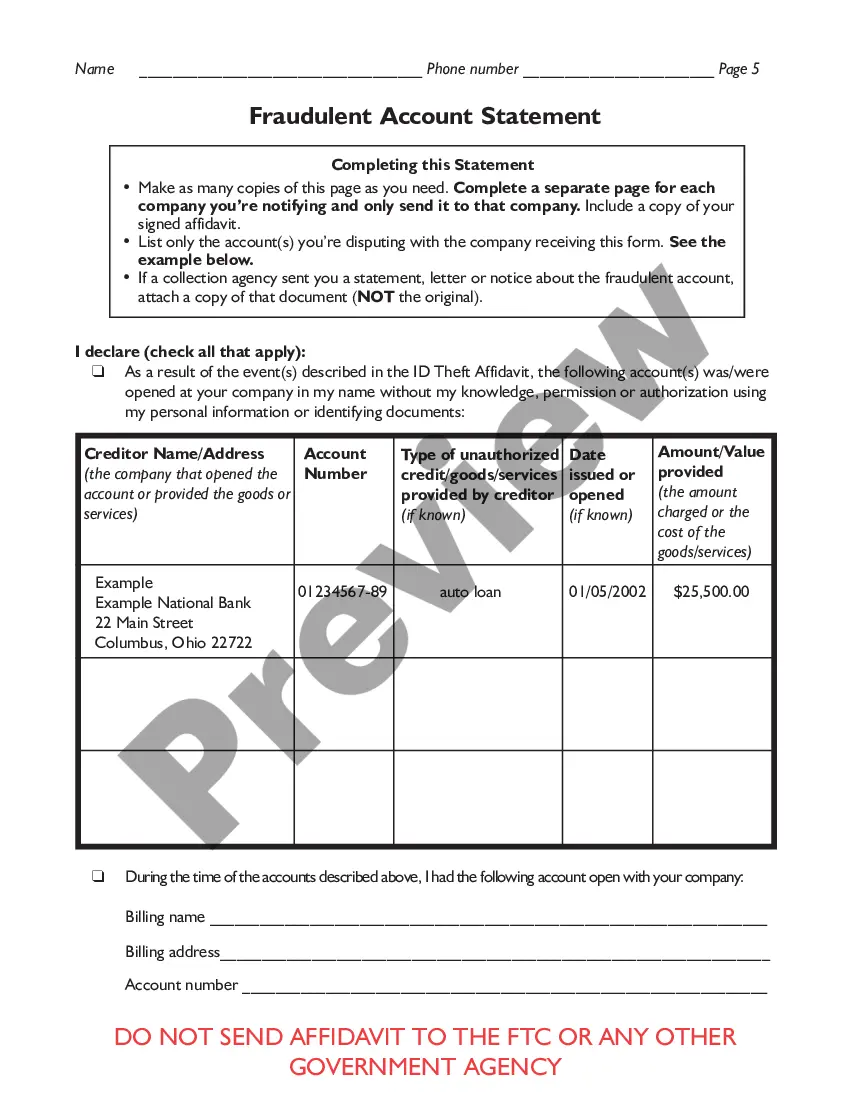

FTC ID Theft Affidavit The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report.

How to Complete and Submit Form 14039. Explain your issue and how you discovered that your identity had been stolen in Section B. Attach any supporting documentation, such as a notice you received from the IRS, and submit it along with the form. You can't electronically file the IRS Identity Theft Affidavit.

In 1998, Congress enacted the Identity Theft and Assumption Deterrence Act (?the Identity Theft Act? or ?the Act?),1 directing the Federal Trade Commission to establish the federal government's central repository for identity theft complaints and to provide victim assistance and consumer education.

The IRS wants you to submit Form 14039 when you believe someone has unauthorized access to your personal information. Use the "potential victim" box when unfamiliar entries on a credit report, unusual credit card charges, a lost purse or a stolen wallet suggest identity theft.

Visit ftc.gov/idtheft to use a secure online version that you can print for your records. Before completing this form: 1. Place a fraud alert on your credit reports, and review the reports for signs of fraud.

FTC ID Theft Affidavit The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report. Some creditors will accept this affidavit instead of a police report.

The FTC's IdentityTheft.gov can assist attorneys who counsel identity theft victims. The site provides victims with a personal recovery plan, walking through each step to take. It also provides pre-filed letters and forms to send to credit bureaus, businesses, and debt collectors.