Minnesota Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Increase Dividend - Resolution Form - Corporate Resolutions?

Finding the appropriate legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how can you acquire the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Minnesota Increase Dividend - Resolution Form - Corporate Resolutions, which you can use for business and personal purposes.

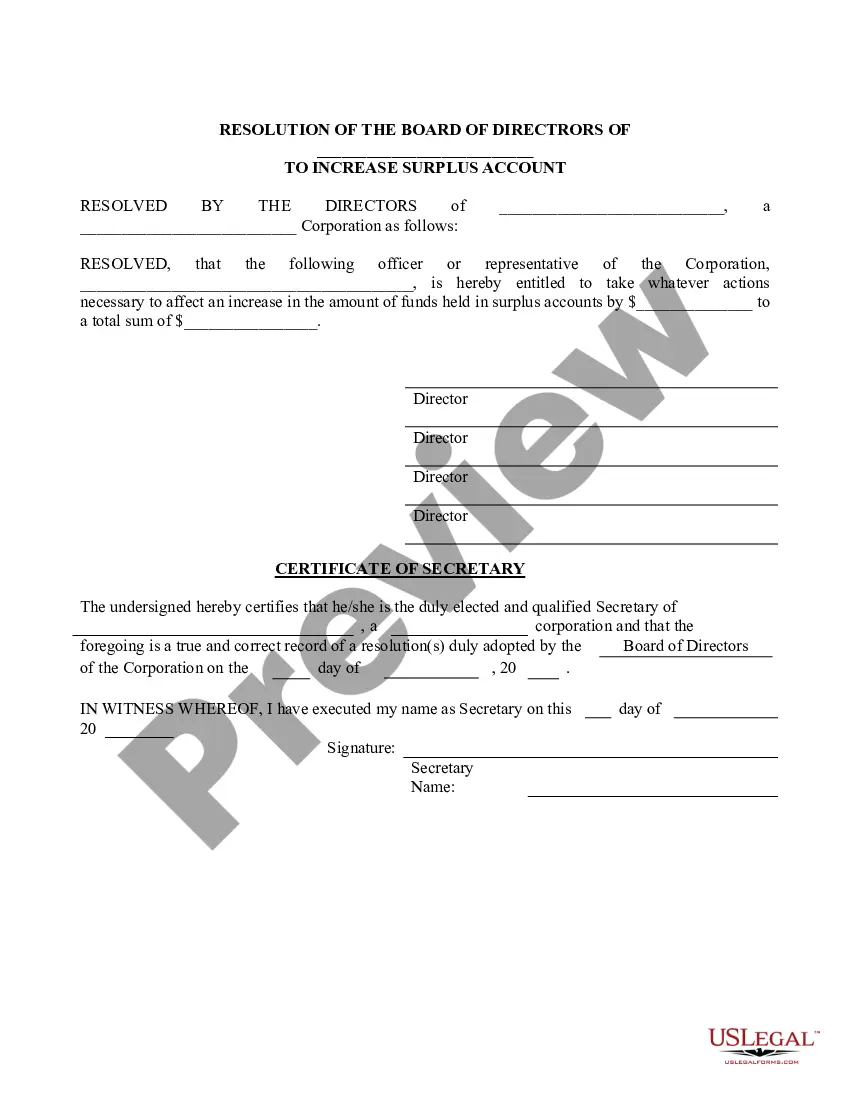

You can review the form using the Preview button and read the form description to confirm it is the right one for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click on the Download button to get the Minnesota Increase Dividend - Resolution Form - Corporate Resolutions.

- Use your account to access the legal forms you have previously purchased.

- Navigate to the My documents tab of your account and obtain an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your region/county.

Form popularity

FAQ

A transferred resolution refers to a corporate decision that is moved from one entity to another, often involving responsibilities or assets. This process ensures the continuity of authority and clarity regarding the new parties involved. For streamlined handling of such transfers, utilize the Minnesota Increase Dividend - Resolution Form - Corporate Resolutions to formalize and document the transition effectively.

Yes, Minnesota taxes dividend income as part of your overall state income tax. The dividend income you receive is subject to taxation based on your tax bracket. If you plan to increase dividends, using the Minnesota Increase Dividend - Resolution Form - Corporate Resolutions can help keep your financial records organized while ensuring compliance with state regulations.

A corporate resolution for a bank account is a formal document that authorizes individuals within your company to engage in financial transactions on behalf of the business. This resolution includes details like signatory powers, account types, and any limitations placed on these powers. For easy management, consider using the Minnesota Increase Dividend - Resolution Form - Corporate Resolutions as a straightforward solution for your banking needs.

The point of a corporate resolution is to provide a clear, documented decision regarding specific actions taken by a company. This document acts as a safeguard, ensuring that corporate decisions align with legal and regulatory standards. When you use the Minnesota Increase Dividend - Resolution Form - Corporate Resolutions, you enhance your company's transparency while protecting your interests during critical transactions.

A corporate resolution for transfer is a document stating the approval of a stock or asset transfer within a company. This resolution confirms that the designated shareholders or directors agree to the transfer, ensuring that all steps adhere to legal requirements. By utilizing the Minnesota Increase Dividend - Resolution Form - Corporate Resolutions, you simplify this process and maintain clear records of authority and consensus.

A corporate resolution for a transaction is a formal statement that documents a decision made by a company's board of directors or shareholders. This resolution highlights the approval of specific actions, such as entering into contracts or financial transactions. Using the Minnesota Increase Dividend - Resolution Form - Corporate Resolutions can help ensure that the process follows legal protocols and protects your company’s interests.

In Minnesota, certain serious crimes, such as murder and some sexual offenses, have no statute of limitations. This means that legal action can be pursued at any time, regardless of how much time has passed since the crime occurred. While this topic may seem unrelated to your corporate needs, being aware of such legal nuances can advise how you manage corporate resolutions like the Minnesota Increase Dividend - Resolution Form - Corporate Resolutions.

Documenting a resolution requires recording the essential details of the decision-making process, including the date, purpose, and outcomes. It's vital to have signatures from authorized individuals who agree to the resolution. Adopting a Minnesota Increase Dividend - Resolution Form - Corporate Resolutions simplifies this process by providing a structured template to ensure all necessary information is included.

Statute 302a 251 in Minnesota addresses the requirements for issuing and transferring shares. It lays out guidelines that must be adhered to when a corporation decides to adjust its dividend policies. Understanding this statute is essential for using a Minnesota Increase Dividend - Resolution Form - Corporate Resolutions to effectively manage share transactions.

Minnesota statute 302a 521 covers the provisions for corporate governance, particularly relating to the authority of corporate officers and directors. This statute is important for corporations that aim to increase dividends because it outlines the required procedures for such actions. By following this statute, businesses can ensure their Minnesota Increase Dividend - Resolution Form - Corporate Resolutions are legally sound.