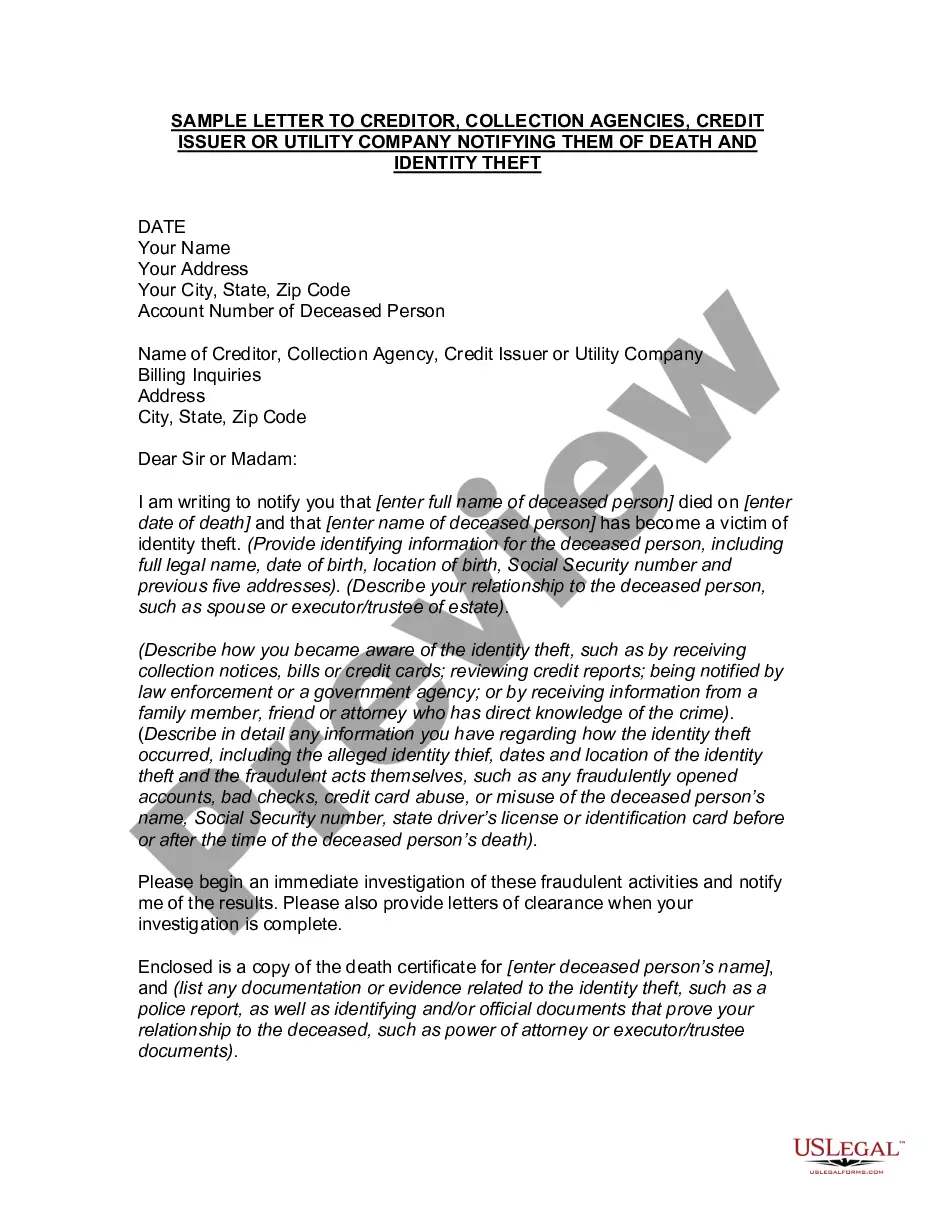

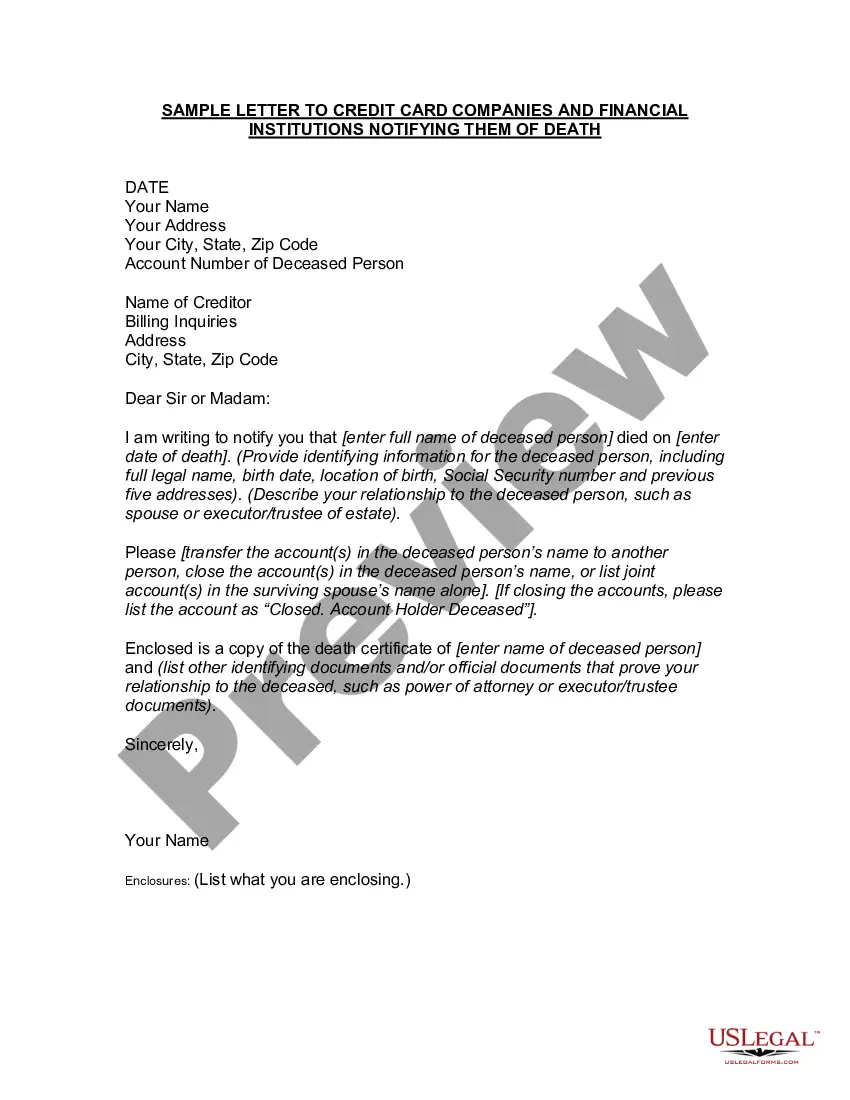

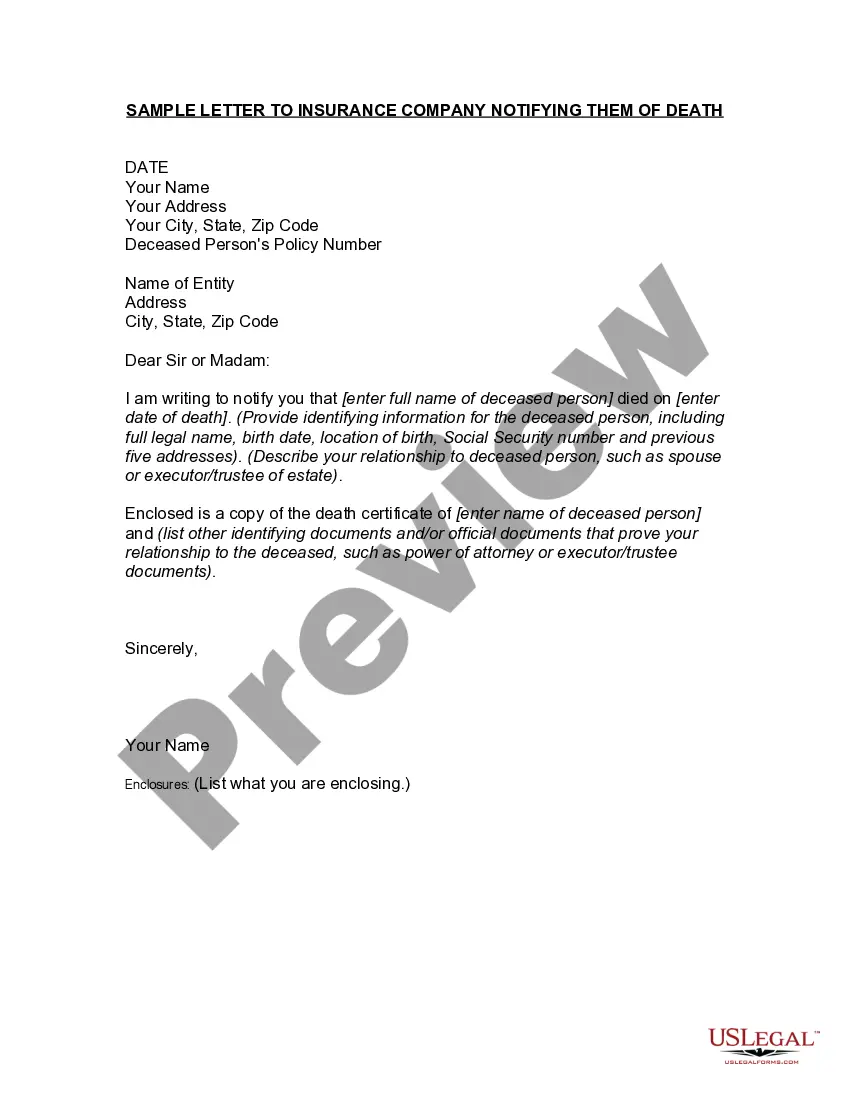

Minnesota Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death

Description

How to fill out Letter To Creditor, Collection Agencies, Credit Issuer Or Utility Company Notifying Them Of Death?

If you desire to be thorough, retrieve, or produce legal document templates, utilize US Legal Forms, the largest assortment of legal forms, which are accessible online.

Take advantage of the site's straightforward and convenient search to find the documents you require. A multitude of templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to locate the Minnesota Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Informing Them of Death within just a few clicks.

Step 5. Process the purchase. You can use your Visa or MasterCard or PayPal account to complete the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit and print or sign the Minnesota Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Informing Them of Death. Every legal document template you purchase is yours indefinitely. You have access to each form you downloaded in your account. Visit the My documents section and select a form to print or download again. Be proactive and download, and print the Minnesota Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Informing Them of Death with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal requirements.

- If you are currently a US Legal Forms customer, Log In to your account and then click the Acquire option to find the Minnesota Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Informing Them of Death.

- You can also access forms you previously retrieved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

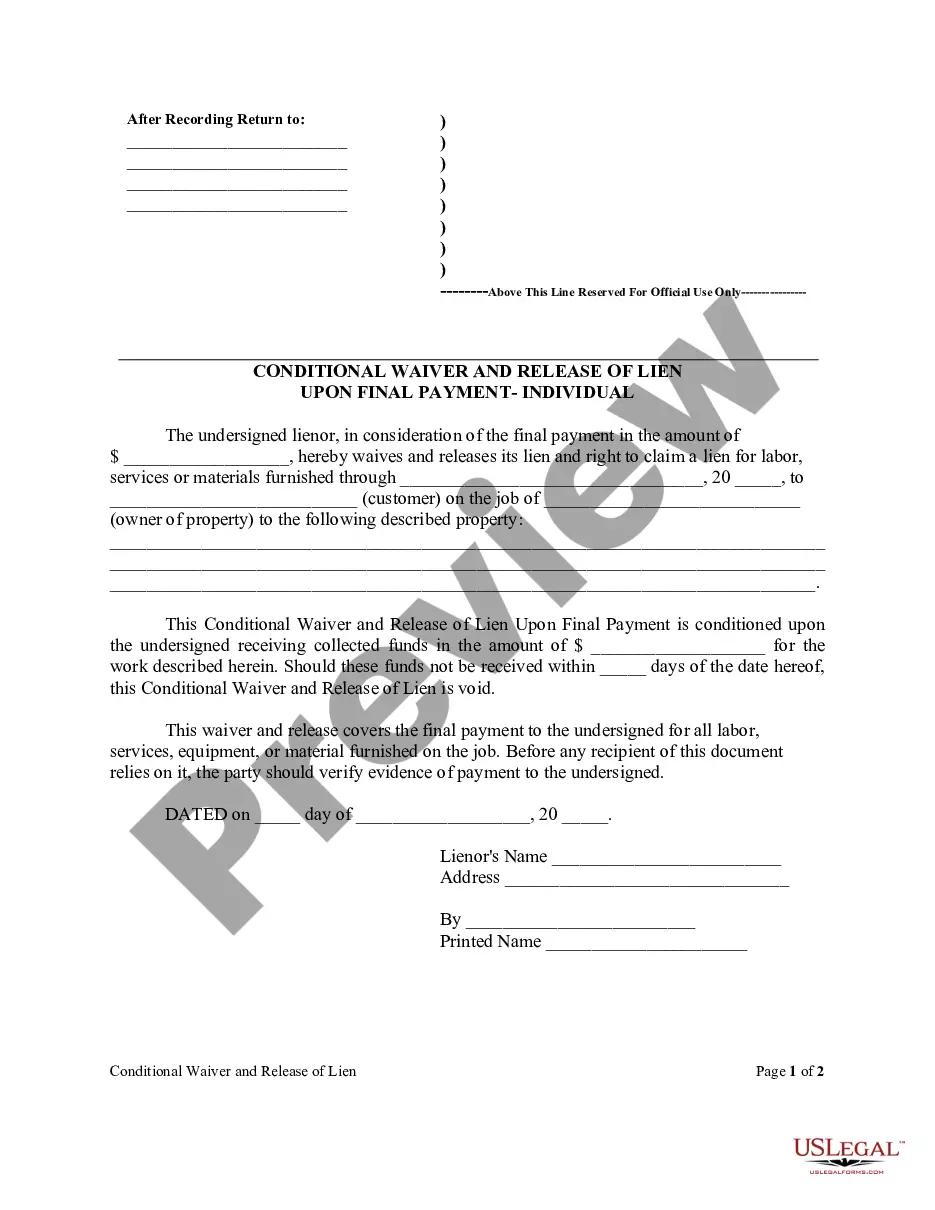

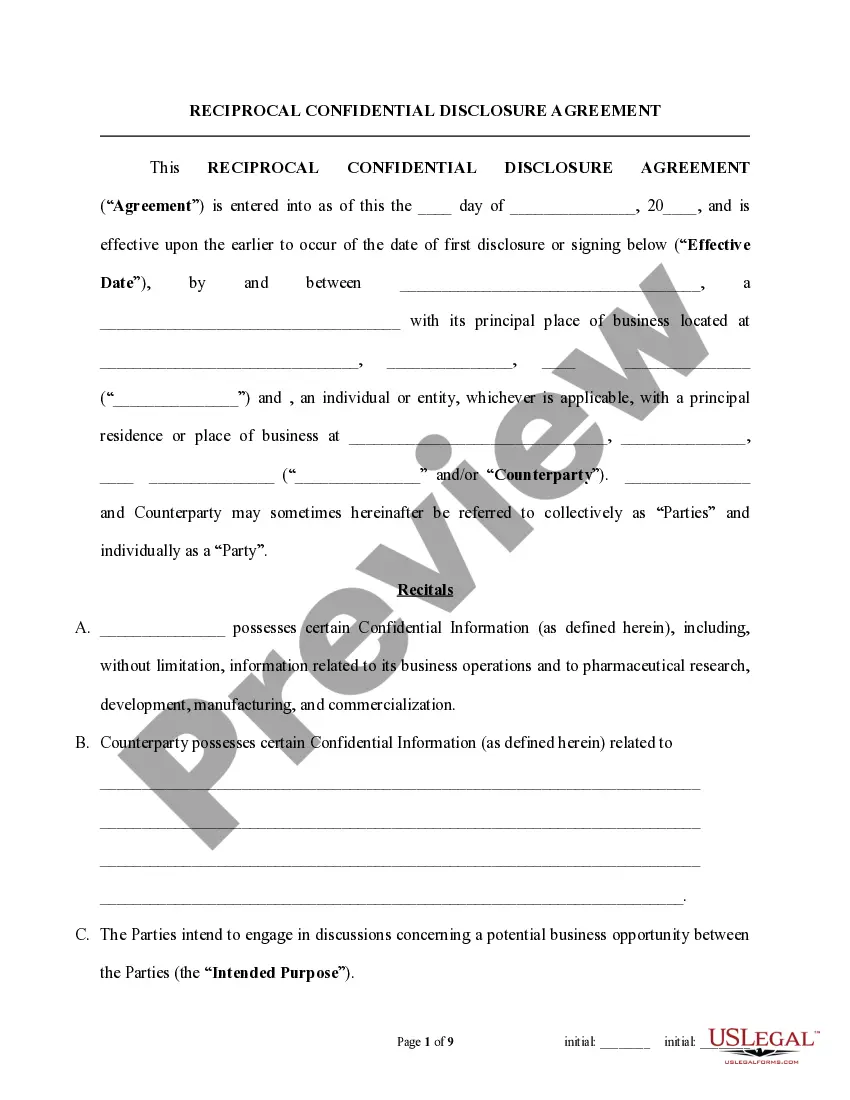

- Step 2. Use the Review method to examine the form's details. Always remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Acquire now option. Choose the payment plan you prefer and provide your information to register for the account.

Form popularity

FAQ

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

Tell the debt collector that you'll call them back as soon as you verify the information. Review your bills and bank statements to confirm if the debt is yours. This may also help you confirm if the amount you owe is correct. You can ask the collection agency to contact you only in writing.

Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. If you feel the amount of the proposed debt is correct and you can afford to pay it, do so. This will be a sufficient form of response and should halt any collection activity.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.

Dear [Client name], We're sending you this letter as a friendly reminder that your account in the amount of [amount due to you] is past due. Your invoice was due on [month, day and year their payment was originally due as stated in their invoice]. This payment is now [number of days since the due date] past due.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

If there's no money in their estate, the debts will usually go unpaid. For survivors of deceased loved ones, including spouses, you're not responsible for their debts unless you shared legal responsibility for repaying as a co-signer, a joint account holder, or if you fall within another exception.