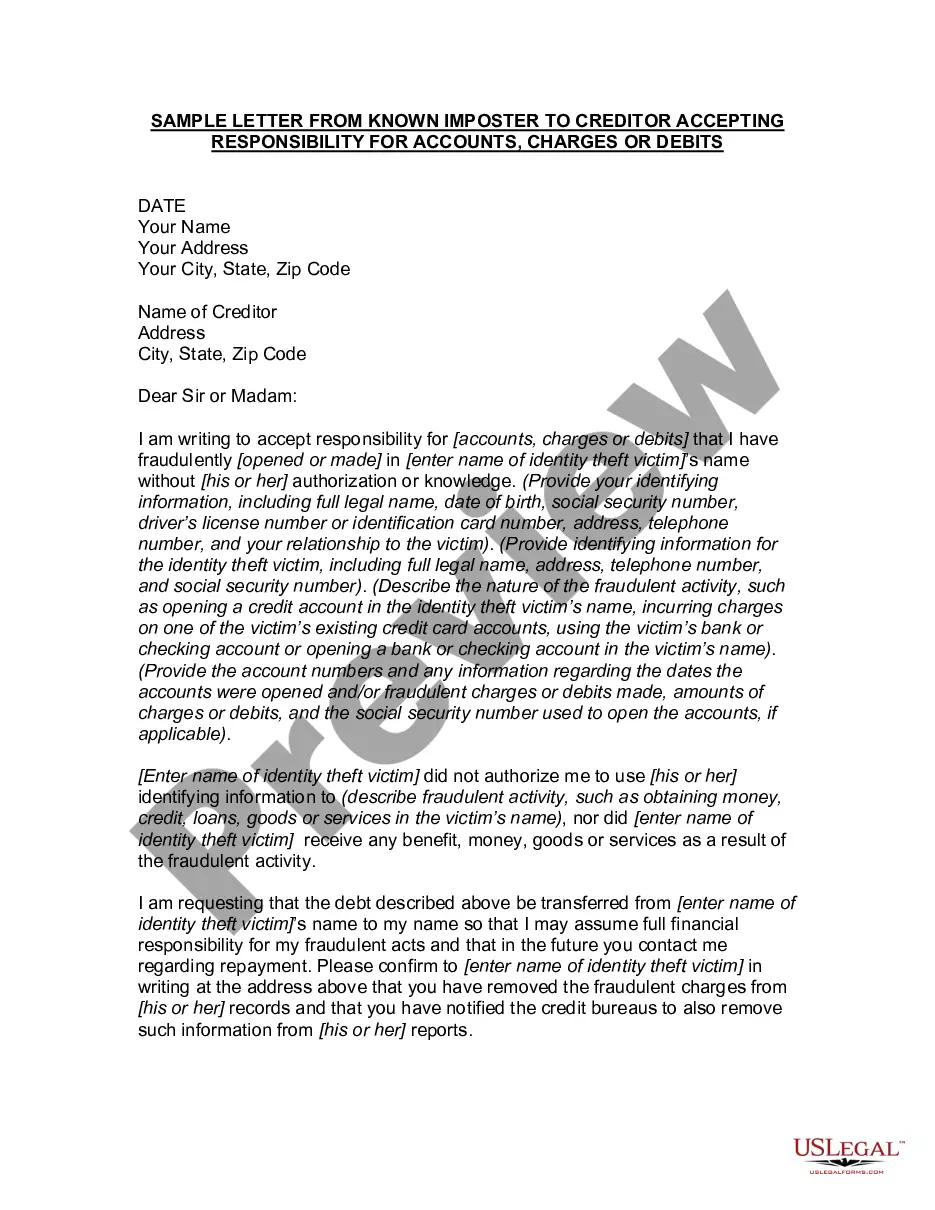

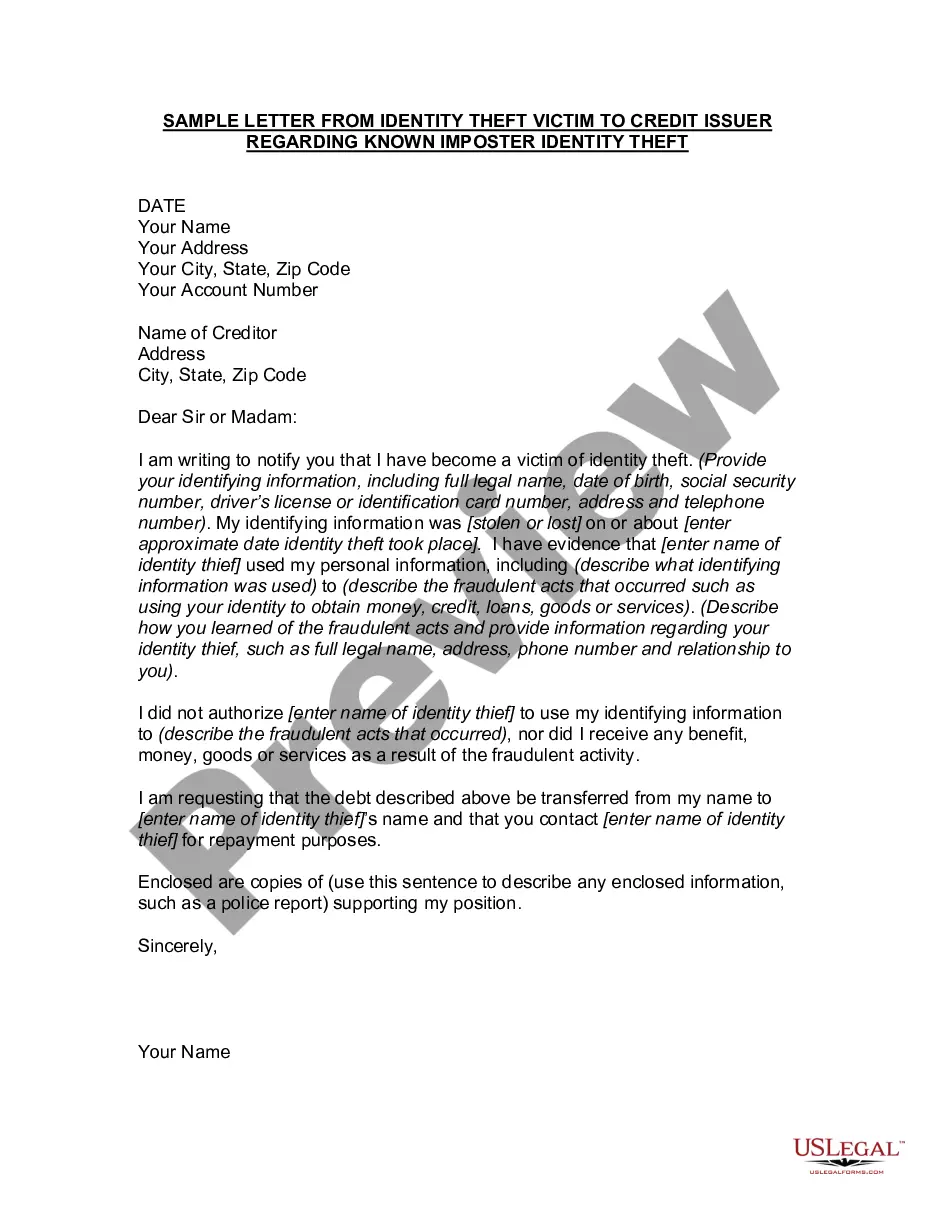

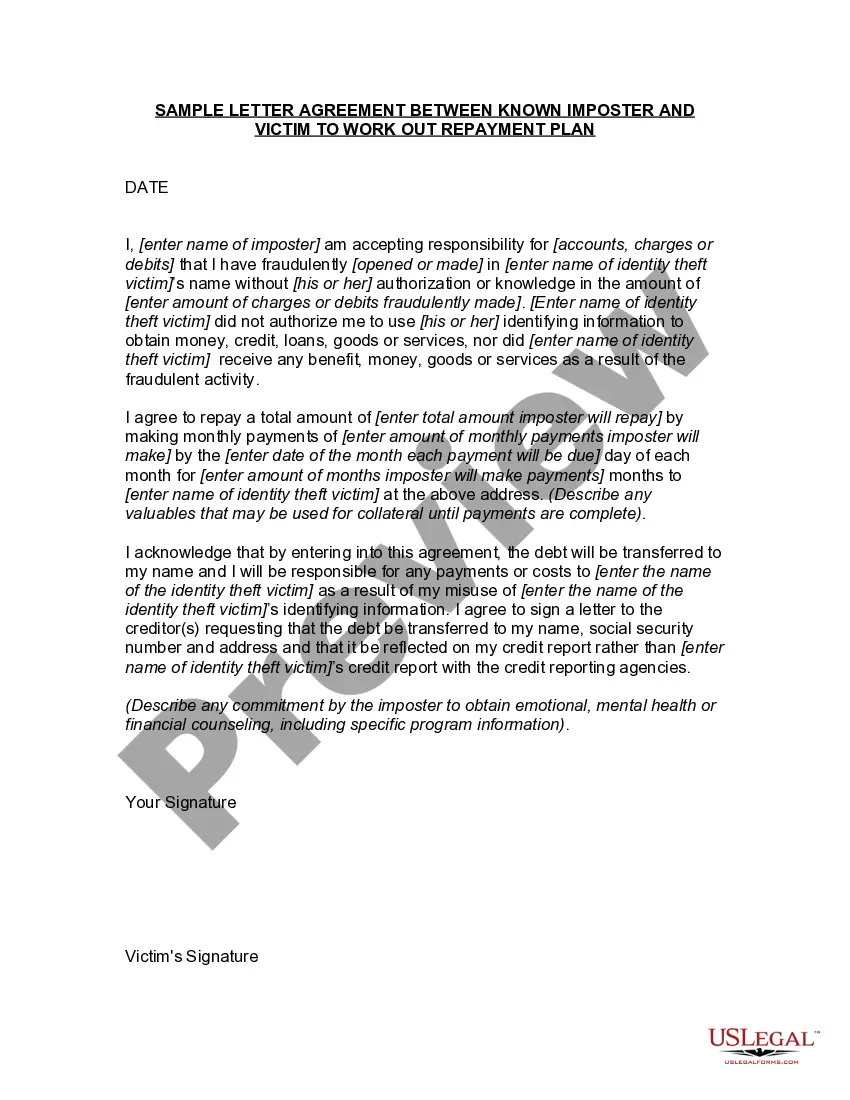

Minnesota Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

How to fill out Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

Are you currently inside a place in which you need papers for possibly company or person reasons almost every day time? There are a variety of authorized file themes available online, but finding ones you can depend on is not simple. US Legal Forms provides 1000s of develop themes, like the Minnesota Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits, that are published to fulfill federal and state specifications.

In case you are presently familiar with US Legal Forms web site and have a merchant account, merely log in. After that, you can down load the Minnesota Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits design.

Should you not provide an account and want to begin using US Legal Forms, adopt these measures:

- Discover the develop you want and ensure it is for your correct metropolis/state.

- Take advantage of the Review button to review the shape.

- Look at the description to ensure that you have selected the correct develop.

- If the develop is not what you are looking for, take advantage of the Look for field to obtain the develop that fits your needs and specifications.

- If you obtain the correct develop, simply click Buy now.

- Opt for the costs program you want, fill in the necessary info to make your account, and buy the order with your PayPal or bank card.

- Decide on a hassle-free data file format and down load your duplicate.

Get every one of the file themes you possess purchased in the My Forms menu. You may get a extra duplicate of Minnesota Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits anytime, if necessary. Just go through the needed develop to down load or produce the file design.

Use US Legal Forms, probably the most substantial collection of authorized kinds, in order to save some time and prevent blunders. The service provides skillfully created authorized file themes which can be used for a variety of reasons. Generate a merchant account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter. If you don't dispute the debt within 30 days, the debt is assumed valid. That means the debt collector can continue to contact you. You can still send a dispute after 30 days.

Send the agency a letter by mail asking them to confirm their debt in writing. Search for the company name on the internet, review their website, call their number, etc. Do your homework. If they refuse to answer all of your questions, there's a good chance you're in the middle of a scam.

If you feel you've been contacted in error, send a letter disputing a debt in writing. Ask the agency to stop contacting you. If the agency can't provide proof, you owe the money, by law, they must stop collection efforts.

The debt validation letter must include at least the following information: The amount of debt owed. The name of the creditor to whom the debt is owed. A statement of notice that the debt will be considered valid by the debt collector unless the consumer disputes it within 30 days of notice.

It's generally easier for first-party creditors to prove you owe a debt. They simply produce the original credit agreement that shows your name and identifying information, like your address and Social Security number.

I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt. This is NOT a request for ?verification? or proof of my mailing address, but a request for VALIDATION made pursuant to 15 USC 1692g Sec.

This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by. Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors.