Minnesota Computer Software License Agreement and Data Base Update Agreement

Description

How to fill out Computer Software License Agreement And Data Base Update Agreement?

You can spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

It is easy to download or print the Minnesota Software License Agreement and Database Update Agreement from our platform.

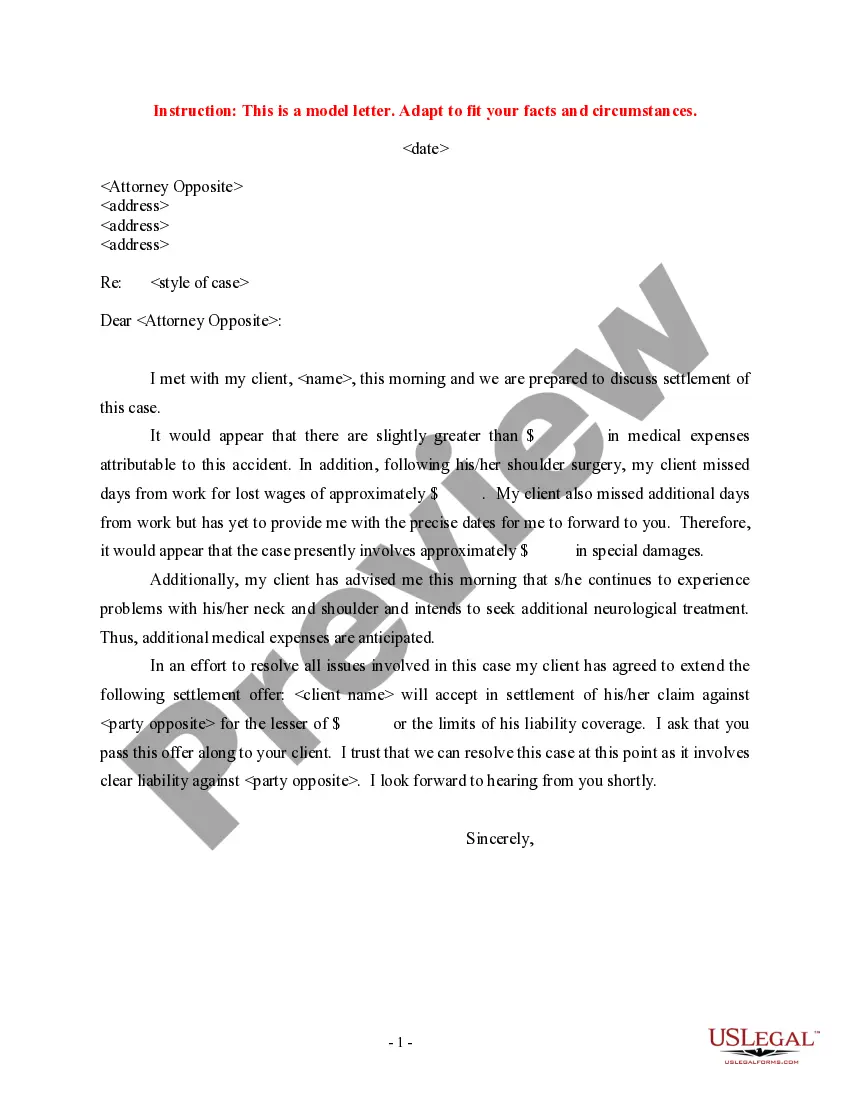

If available, make use of the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Get button.

- After that, you can complete, modify, print, or sign the Minnesota Software License Agreement and Database Update Agreement.

- Every legal document template you obtain is yours permanently.

- To obtain another copy of any purchased form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/town you have chosen.

- Review the form details to confirm you have selected the appropriate form.

Form popularity

FAQ

The current Minnesota sales tax is set at 6.875%. This rate, along with local taxes, can influence the total tax burden of acquiring software licenses and services under a Minnesota Computer Software License Agreement and Data Base Update Agreement. It's wise to budget adequately for this in your financial plans.

Digital services often attract sales tax in Minnesota, aligning with state legislation. If you utilize digital services as part of a Minnesota Computer Software License Agreement and Data Base Update Agreement, make sure to consider the applicable taxes. Staying educated on this topic will aid in fiscal responsibility.

Yes, in Minnesota, Software as a Service (SaaS) is generally subject to sales tax. This classification can impact your overall expenses, especially if you acquire services outlined in a Minnesota Computer Software License Agreement and Data Base Update Agreement. Understanding these tax implications is essential for effective financial planning.

The current state sales tax rate in Minnesota is 6.875%. Depending on your location, local jurisdictions may impose additional taxes. If you are entering into a Minnesota Computer Software License Agreement and Data Base Update Agreement, it is vital to stay informed about these rates to ensure compliance with state tax laws.

The taxability of Software as a Service (SaaS) varies across the United States. In Minnesota, SaaS can be taxable, especially if it falls under the scope of a Minnesota Computer Software License Agreement and Data Base Update Agreement. Businesses should consult local tax guidelines to understand how SaaS services affect their tax obligations.

Not all products and services are subject to sales tax in Minnesota. Items like certain food products, most clothing, and specific services fall into this category. If your agreement involves a Minnesota Computer Software License Agreement and Data Base Update Agreement, it might include provisions that can affect taxability, so review them carefully.

Minnesota offers a variety of non-taxable items, but it’s crucial to understand the specifics. For individuals and businesses operating under a Minnesota Computer Software License Agreement and Data Base Update Agreement, certain software and data services may qualify for exemption. Staying informed about these exclusions can significantly impact your financial strategy.

Web hosting services are generally considered taxable in Minnesota. This means that if your business uses web hosting services as part of a Minnesota Computer Software License Agreement and Data Base Update Agreement, you should factor in sales tax when budgeting for these services. Consulting with tax experts can help clarify your obligations.

In Minnesota, there is indeed sales tax applied to many goods and services. However, specific exemptions exist, especially in the context of a Minnesota Computer Software License Agreement and Data Base Update Agreement. It's essential for businesses to know these exemptions to comply with tax laws and avoid unexpected costs.

In Minnesota, most groceries are exempt from sales tax, which offers a relief to consumers. However, prepared foods and some specific items may still incur tax. If you want to know how this applies to your purchases, it’s best to consult relevant resources or speak with a tax professional. Keep in mind that understanding these details can help you manage costs effectively.