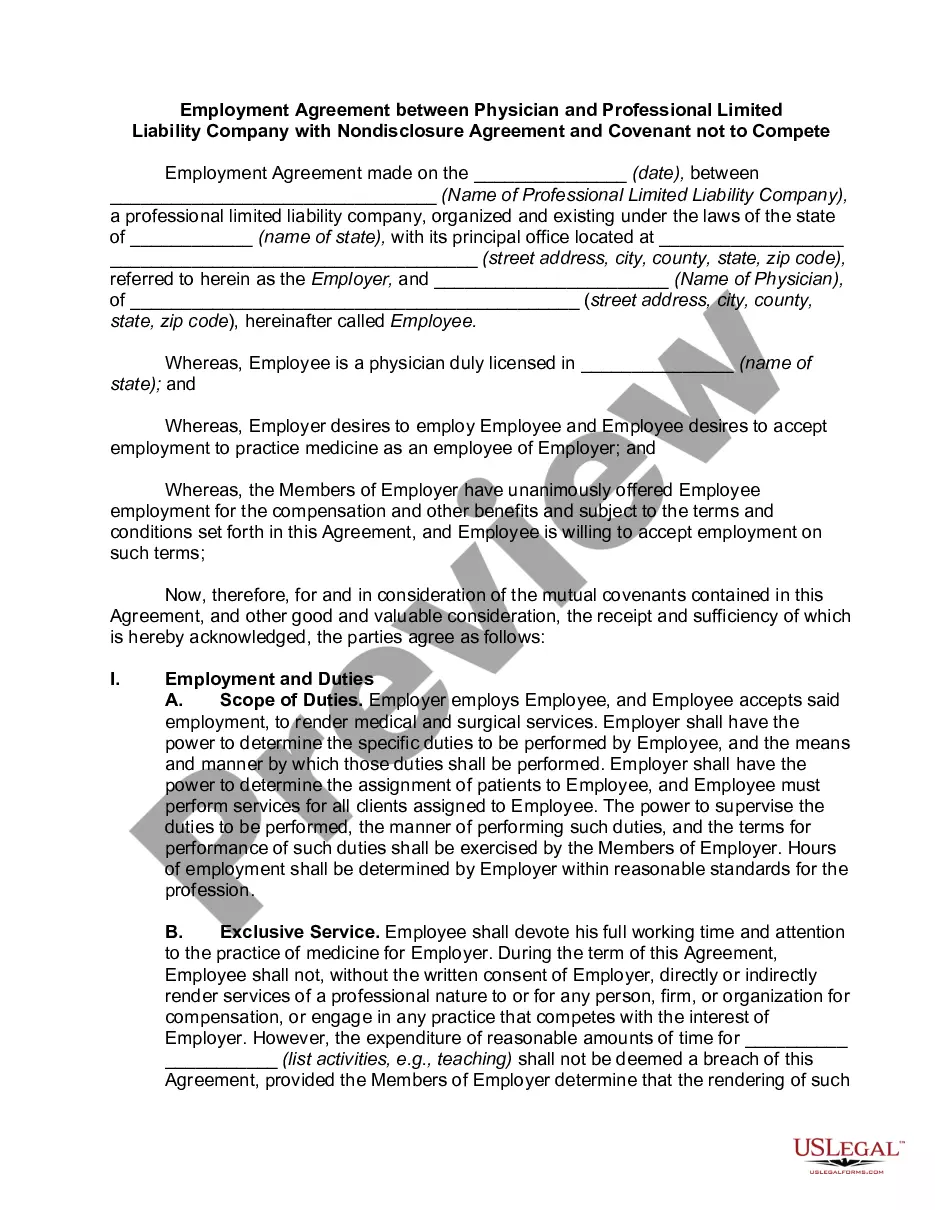

Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation

Description

Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

How to fill out Agreement Between Physician As Self-Employed Independent Contractor And Professional Corporation?

Finding the appropriate legal document template can be challenging. Naturally, numerous templates are accessible online, but how can you locate the legal form you require? Utilize the US Legal Forms website.

The service provides thousands of templates, including the Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, suitable for both business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to access the Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. Use your account to view the legal forms you may have purchased previously. Navigate to the My documents section of your account and obtain another copy of the document you need.

US Legal Forms is the largest repository of legal documents where you can find numerous record templates. Utilize the service to download properly crafted papers that meet state requirements.

- First, ensure you have selected the correct form for your city/county. You can review the form using the Preview button and examine the description to confirm it is suitable for you.

- If the form does not fulfill your requirements, utilize the Search field to find the appropriate form.

- Once you are confident the form is correct, click on the Purchase now button to acquire the form.

- Choose the payment plan you desire and provide the necessary details. Create your account and complete the purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the retrieved Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation.

Form popularity

FAQ

As an independent contractor, you will typically complete forms that include your business information, tax identification number, and details of the services provided. Additionally, you may need to submit invoices for payment, along with any required tax documents. Using proper templates, such as those found in a Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, can help simplify this process.

The independent contractor rule in Minnesota establishes criteria that define whether a worker is considered an independent contractor or an employee. This rule includes assessments of the degree of control the employer has over the worker's performance. Understanding this classification is crucial for compliance and tax responsibilities, especially when creating a Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation.

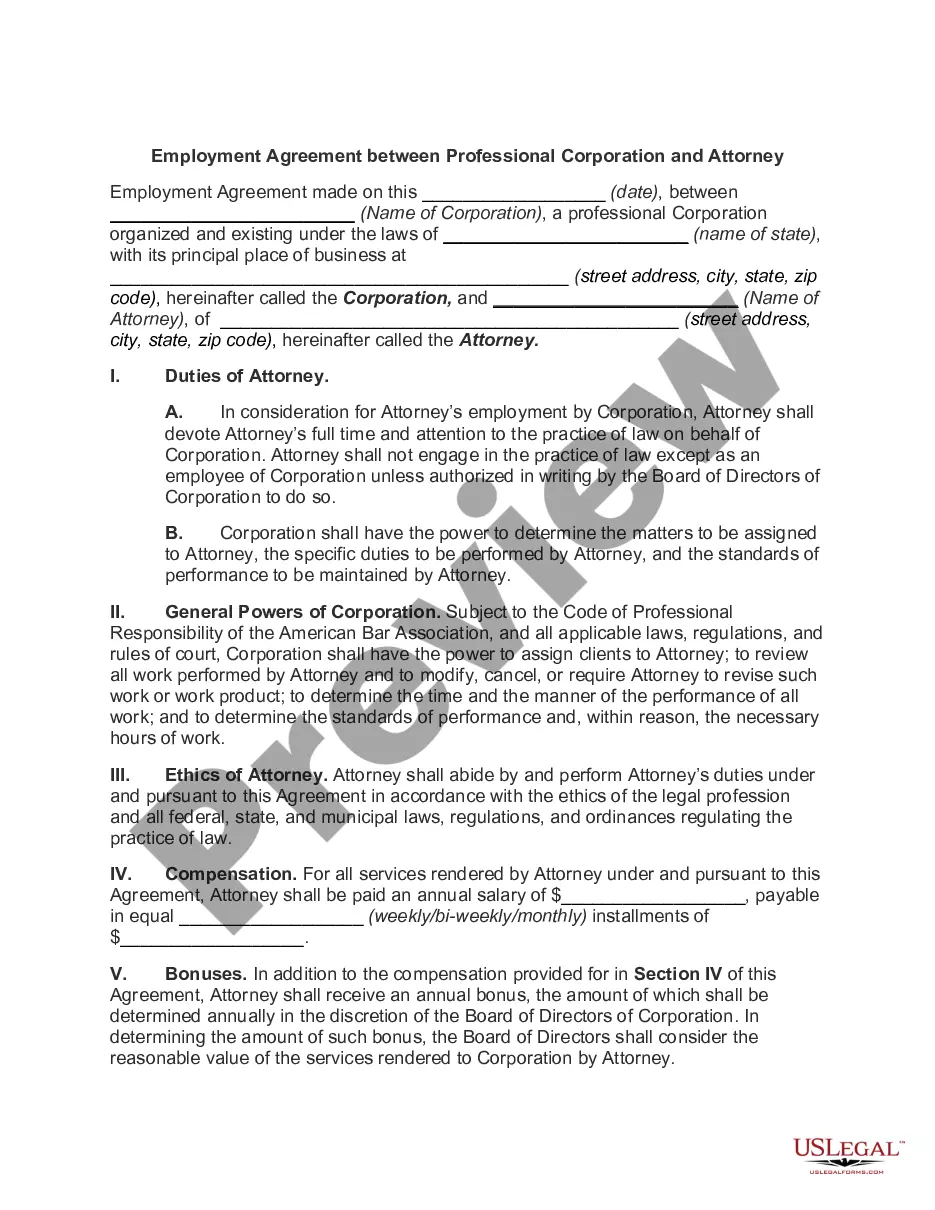

The independent contractor agreement, often referred to as ICA, is a legal document that defines the relationship between a client and a contractor. This agreement clarifies expectations regarding work completion, payment terms, and the responsibilities of each party. By having a clearly defined ICA, you protect yourself from potential disputes, especially when using a Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation.

To create a proper independent contractor agreement, first outline the roles and responsibilities of each party involved. Include key details such as the scope of work, payment terms, and duration of the contract. Additionally, ensure to specify any confidentiality clauses and dispute resolution processes. Utilizing a well-structured template, like the Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, can streamline this process.

A physician employee typically receives a regular salary, enjoys benefits, and works under the direct supervision of an employer. In contrast, an independent contractor operates more autonomously, controlling their schedules and methods of work. The Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation explicitly outlines these differences, ensuring both parties understand their rights and responsibilities. This clarity helps in managing expectations and reduces the risk of disputes.

Yes, you can be both an employee and an independent contractor for the same company, but it is essential to understand the distinctions between the two roles. Each position must have a separate agreement detailing the terms of the work involved. This is important to comply with legal and tax obligations. If you are a physician working under a Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, ensure each role is clearly defined in your agreements.

In Minnesota, independent contractors are generally subject to self-employment tax rates, which include both Social Security and Medicare taxes. The current combined rate is approximately 15.3% on net earnings. Additionally, independent contractors must report their income on their personal tax returns and may be eligible for certain deductions. Understanding these tax responsibilities is crucial for individuals entering into a Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation.

The Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation outlines the terms under which a physician can work as an independent contractor. This agreement includes provisions related to compensation, responsibilities, and duration of the contract. It helps clarify the nature of the working relationship, potentially reducing misunderstandings and legal conflicts. Utilizing a well-drafted agreement ensures compliance with Minnesota laws and protects both parties' interests.

To write a simple contract agreement, begin by stating the names of the parties involved and the purpose of the agreement. Clearly outline the services to be provided, payment amounts, and timelines. Incorporate a section detailing the obligations and rights of each party, as well as provisions for modifications and termination. Using streamlined templates for contracts, such as those found in a Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, can make the process much easier.

The best contract for contractors is one that clearly outlines the delivery of services, payment terms, and the legal obligations of both parties involved. Contracts tailored to specific needs, such as a Minnesota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, provide legal clarity and security. It should also include details like duration, scope, and remedies for breaches. Consulting a legal expert can help ensure your contract meets all necessary legal requirements.