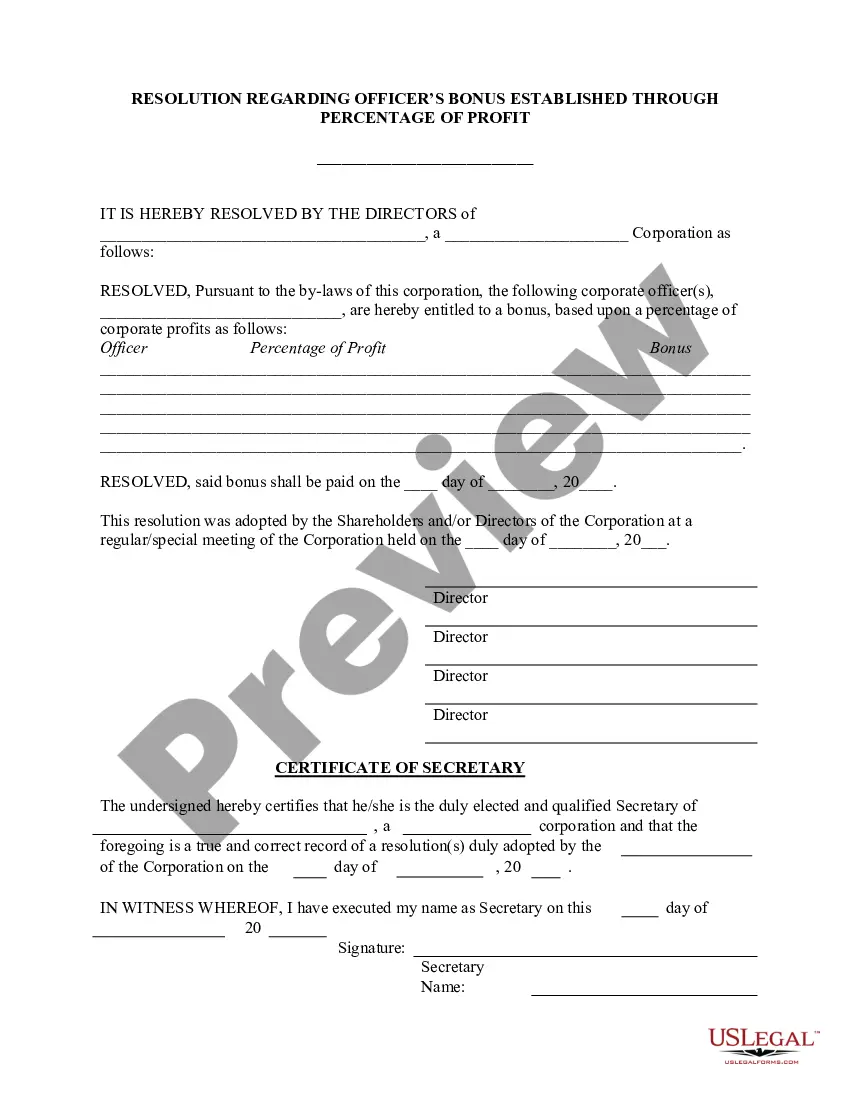

Minnesota Officers Bonus - Percent of Profit - Resolution Form

Description

How to fill out Officers Bonus - Percent Of Profit - Resolution Form?

Selecting the appropriate authentic documents template can be challenging. Undoubtedly, there is an abundance of templates accessible online, but how can you find the authentic document you require.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Minnesota Officers Bonus - Percent of Profit - Resolution Form, which you can employ for business and personal purposes. All forms are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and then click the Download button to obtain the Minnesota Officers Bonus - Percent of Profit - Resolution Form. Use your account to review the authentic forms you have previously purchased. Navigate to the My documents tab of your account to get another copy of the document you desire.

Select the document format and download the authentic document template to your device. Complete, modify, print, and sign the acquired Minnesota Officers Bonus - Percent of Profit - Resolution Form. US Legal Forms is the largest repository of authentic documents where you can find various paper templates. Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- First, ensure you have selected the correct document for your area/region.

- You can preview the form using the Preview button and read the form description to confirm it is the right one for you.

- If the form does not satisfy your requirements, use the Search field to find the appropriate document.

- Once you are confident the form is suitable, click the Get now button to acquire the document.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and process your order using your PayPal account or credit card.

Form popularity

FAQ

No, Minnesota does not recognize bonus depreciation for state tax purposes, which can impact how businesses report their finances. While the federal government allows it, Minnesota’s tax structure requires careful planning regarding asset depreciation. Using the Minnesota Officers Bonus - Percent of Profit - Resolution Form, business owners must account for this difference in treatment. Seeking professional guidance can help navigate this complex landscape.

The due process clause in the Minnesota Constitution ensures that individuals receive fair treatment through the judicial system. This clause protects citizens from arbitrary action by the state, safeguarding their rights. Understanding this can be particularly relevant for business owners dealing with financial resolutions and forms. When completing the Minnesota Officers Bonus - Percent of Profit - Resolution Form, it’s important to ensure compliance with all legal protocols.

In Minnesota, bonuses are treated as supplemental income and taxed accordingly. The state applies a flat withholding rate to bonus payments, which can lead to a different tax obligation than regular income. When filing your taxes, it is essential to take bonuses into account fully, especially when completing the Minnesota Officers Bonus - Percent of Profit - Resolution Form. Being aware of the tax implications can help you better manage your financial planning.

In Minnesota, bonus depreciation is generally not recognized for state tax purposes. Unlike federal guidelines, which allow businesses to take advantage of bonus depreciation, Minnesota has its own rules. For this reason, business owners need to carefully consider their tax planning strategies, especially when completing the Minnesota Officers Bonus - Percent of Profit - Resolution Form. Consulting with a tax professional can provide clarity on how bonus depreciation impacts your specific situation.

The taxation on bonuses in Minnesota varies based on your overall income and the applicable tax brackets. Typically, bonuses are included in your total earnings, so the tax withheld will reflect your cumulative income level. To ensure accurate reporting, using the Minnesota Officers Bonus - Percent of Profit - Resolution Form may simplify the process and help you calculate the exact tax due on your bonuses.

In Minnesota, bonuses are subject to the same income tax rates as regular wages. The tax rate for bonuses can vary, but typically, they get taxed at a flat rate or as part of your cumulative annual income. Understanding the implications of the Minnesota Officers Bonus - Percent of Profit - Resolution Form can help you navigate these tax rates effectively.

Minnesota has a progressive income tax system, which means that tax rates increase as income rises. For 2024, the brackets range from 5.35% to 9.85%, depending on your taxable income. It’s essential to understand these brackets to accurately calculate your taxes on bonuses, especially when dealing with the Minnesota Officers Bonus - Percent of Profit - Resolution Form.

A 35 percent tax rate on your bonus may reflect your higher income bracket, resulting from a progressive tax system. Bonuses are often treated as supplemental income, which can lead to higher withholding. Using the Minnesota Officers Bonus - Percent of Profit - Resolution Form can provide insights into how your bonus impacts your overall tax rate and what strategies you can employ to optimize your tax situation.

To calculate your bonus tax, first determine your marginal tax rate, which varies based on your overall income. Next, multiply your bonus amount by this rate to estimate your tax liability. Tools and forms like the Minnesota Officers Bonus - Percent of Profit - Resolution Form from Us Legal Forms can assist in simplifying this calculation and ensuring accuracy to avoid surprises at tax time.

The marginal tax rate refers to the tax rate applied to your last dollar of income and affects your bonuses as well. In Minnesota, the marginal rates vary based on income levels, making it crucial to understand how your bonuses fit into this structure. Utilizing the Minnesota Officers Bonus - Percent of Profit - Resolution Form can help you analyze how these rates apply to your specific situation and assist you in overwhelming tax areas.