Minnesota Triple Net Commercial Lease Agreement is a legally binding contract designed for real estate rental purposes in the state of Minnesota. This agreement establishes the terms and conditions under which a tenant can lease a commercial property from a landlord, specifically outlining the responsibilities and obligations of both parties. The "Triple Net" aspect refers to the tenant's obligation to pay for three main expenses in addition to their base rent: property taxes, insurance, and maintenance costs. The Minnesota Triple Net Commercial Lease Agreement typically covers various important aspects, including property details, lease term duration, rent amount and payment schedule, as well as the roles and responsibilities of both the landlord and the tenant. It also addresses the procedures for rental adjustments, security deposits, maintenance obligations, improvements, and any potential penalties or remedies for breaching the agreement. Different types of Minnesota Triple Net Commercial Lease Agreements may exist, depending on specific variations determined by landlords or tenants. Some common types can include long-term leases, short-term leases, gross leases, percentage leases, ground leases, and subleases. A long-term lease is a Minnesota Triple Net Commercial Lease Agreement that usually spans several years, providing stability and security for both the landlord and tenant. The lease is often renewable at the end of each term, allowing for continued occupancy. In contrast, a short-term lease has a relatively brief duration, typically ranging from a few months to a year. These leases offer flexibility to both parties, allowing them to evaluate the rental arrangement before making a long-term commitment. Gross leases are another type in which the tenant pays a fixed rent, and the landlord assumes the responsibility of covering property expenses like taxes, insurance, and maintenance. Percentage leases are often used in retail settings, where the tenant pays a base rent as well as a percentage of their sales to the landlord. This type of lease provides an opportunity for the landlord to benefit from the success of the tenant's business. Ground leases involve leasing only the land to a tenant who then constructs a building or makes improvements on it. The landowner retains ownership of the land while receiving rent from the tenant for its use. Subleases occur when a tenant leases a property from a landlord and then rents out a portion or all of the leased space to another tenant, known as the sublessee. The original tenant acts as the landlord to the sublessee, collecting rent and managing the subleased space within the guidelines of the Minnesota Triple Net Commercial Lease Agreement. In conclusion, a Minnesota Triple Net Commercial Lease Agreement is a comprehensive legal document used in real estate rental transactions within the state. It outlines the obligations and rights of both landlords and tenants regarding the lease of commercial properties, including the payment of property taxes, insurance, and maintenance costs.

Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental

Description

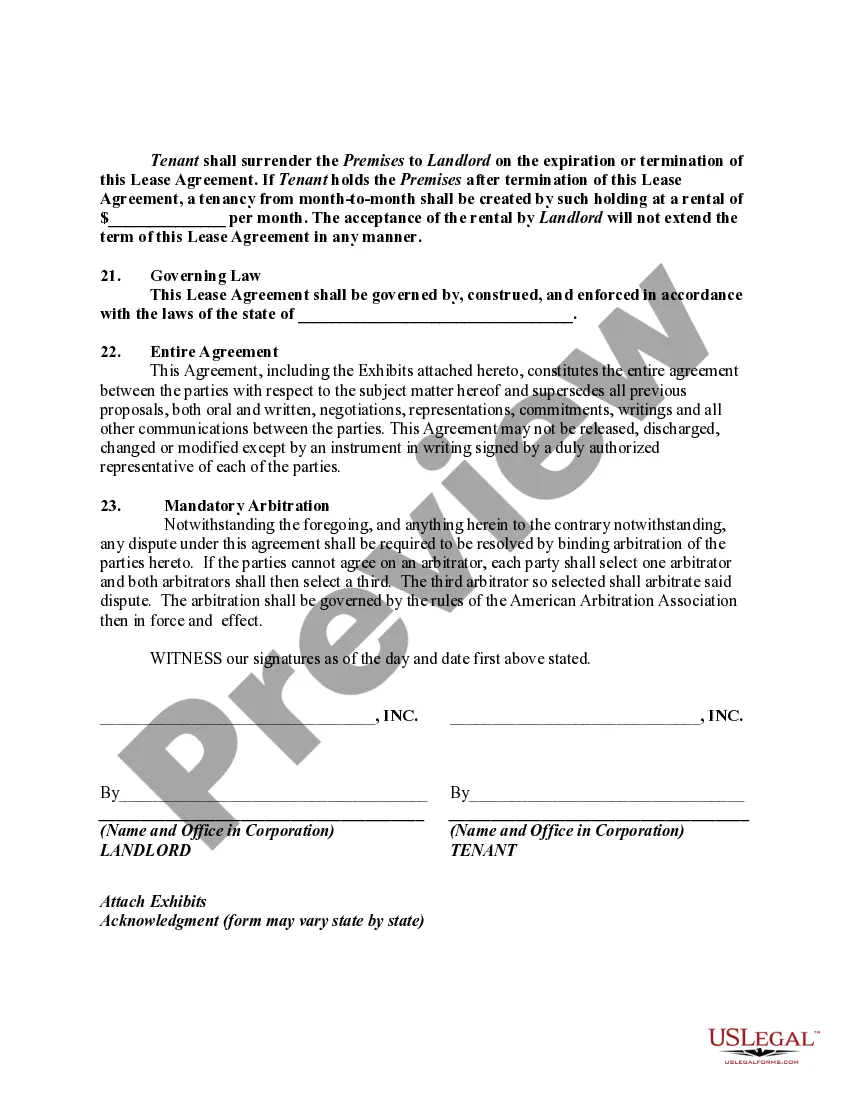

How to fill out Triple Net Commercial Lease Agreement - Real Estate Rental?

You can invest time online searching for the valid document template that meets the local and national requirements you need.

US Legal Forms provides thousands of valid forms that are reviewed by experts.

You can easily download or print the Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental from your services.

If available, utilize the Review button to browse the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental.

- Every valid document template you acquire is yours for a long time.

- To get an additional copy of a purchased form, go to the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the area/city of your preference.

- Read the form description to make sure you have chosen the appropriate form.

Form popularity

FAQ

A Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental typically outlines specific conditions for both parties. These usually cover the obligations of tenants regarding property taxes, insurance, and maintenance. Additionally, the lease may stipulate the length of the agreement, renewal options, and guidelines for subletting. Being clear about these conditions helps foster a successful rental relationship and protects your interests.

The pros of a Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental include predictable income and reduced management burden. You gain peace of mind knowing that tenants handle most expenses, which can enhance profitability. However, the cons may include concerns about tenant reliability and the potential for property neglect. Your role as a landlord shifts, requiring thorough tenant vetting to ensure a successful leasing experience.

While there are benefits, a Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental can present some challenges for landlords. One potential side effect is that tenants may become less proactive about property upkeep, assuming everything is the landlord's responsibility. If tenants neglect their duties, property conditions can decline, which may affect your investment's overall value. Therefore, it is essential to screen tenants carefully to ensure they will maintain the property.

Yes, a Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental provides a significant advantage for landlords. With a triple net lease, tenants are responsible for property taxes, insurance, and maintenance costs. This arrangement typically results in lower management responsibilities for you, allowing for a more streamlined rental experience. Moreover, it can lead to a stable revenue stream, as expenses are passed onto the tenant.

The most common commercial lease agreement is the net lease, with variations including single, double, and the Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental being the most widely used. In a net lease, the tenant pays base rent plus certain operating expenses. This structure benefits landlords as it reduces their financial risk. By understanding the common lease types, you can make more informed choices for your real estate investments.

A triple net lease is characterized by the tenant assuming responsibility for three main costs: property taxes, insurance, and maintenance, in addition to base rent. This arrangement allows landlords to receive stable rental income while transferring certain risks and expenses to the tenant. By clarifying these responsibilities, a Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental can foster more transparent and manageable relationships between landlords and tenants.

States like Minnesota, Texas, and Florida are often recognized as prime locations for triple net leases. These states offer favorable business climates, population growth, and strong consumer spending patterns that attract robust tenants. As you consider a Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental, exploring various local markets can yield promising investment opportunities. Consulting with a real estate expert can also provide valuable insights into specific regions.

The best triple net leases in a Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental often involve well-known brands or located in high-traffic areas. High-quality tenants, such as pharmacies, grocery stores, and convenience retailers, represent strong options. Locations with minimal competition can also enhance lease performance. Conducting thorough market research before committing to a specific lease can significantly impact the success of your investment.

Ideal tenants for a Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental are typically established businesses with a proven track record. Tenants such as national retailers, fast-food chains, and service providers often fit this profile. These businesses generally have the financial stability to meet their obligations while creating a reliable income stream for landlords. A solid tenant mix can enhance the attractiveness of investment properties.

An absolute NNN lease represents the highest level of commitment for tenants in a Minnesota Triple Net Commercial Lease Agreement - Real Estate Rental. In this arrangement, tenants assume all property-related expenses, including taxes, insurance, and maintenance, with no landlord obligations. This lease type is often appealing to investors who seek a stable, passive income. However, prospective tenants should ensure they are prepared for the significant responsibilities this lease entails.

Interesting Questions

More info

A joint tenancy is when all properties owned jointly.