Minnesota General Form of Receipt

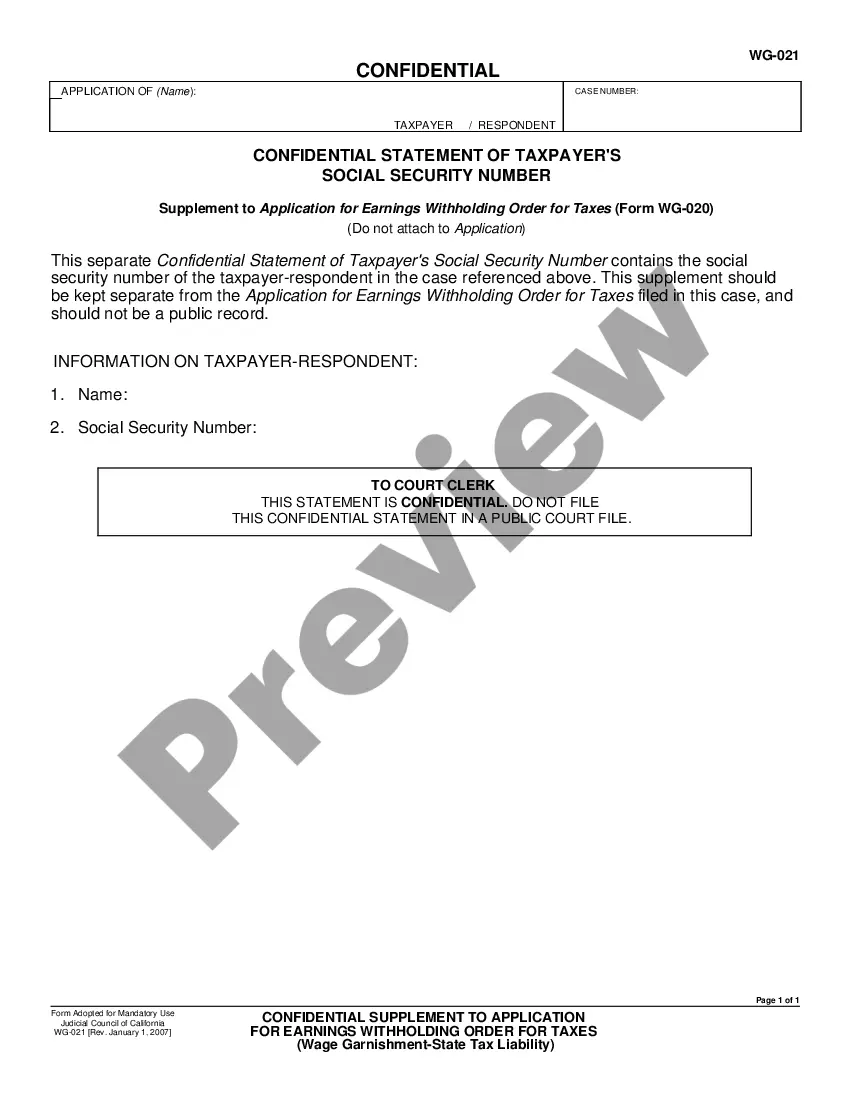

Description

How to fill out General Form Of Receipt?

If you are in need of detailed, downloading, or producing legal document templates, utilize US Legal Forms, the largest assortment of legal forms, accessible online.

Take advantage of the site’s straightforward and user-friendly search to find the documents required.

Various templates for commercial and specific purposes are organized by categories and recommendations, or search phrases.

Every legal document template you acquire is yours to keep indefinitely.

You have access to each form you saved in your account. Visit the My documents section and select a form to print or download again. Stay competitive and download, and print the Minnesota General Form of Receipt with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to obtain the Minnesota General Form of Receipt in just a few clicks.

- If you are currently a US Legal Forms member, Log In to your account and click on the Download button to access the Minnesota General Form of Receipt.

- You can also retrieve forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/region.

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to review the overview.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Select your preferred pricing plan and input your details to register for an account.

- Step 5. Complete the transaction process. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Minnesota General Form of Receipt.

Form popularity

FAQ

Minnesota tax forms are available for printing on the Minnesota Department of Revenue website. You can access these forms in PDF format, making it easy to print. After printing, ensure the information is accurate and up-to-date. Using the Minnesota General Form of Receipt can assist you in verifying you have all the required documentation.

You can pick up Minnesota tax forms at any local Department of Revenue office, as well as public libraries and some post offices. Additionally, many municipalities also provide access to these forms. To streamline your preparation, consider downloading the necessary forms online, and don’t forget to reference the Minnesota General Form of Receipt for completeness.

Form M1 is the Minnesota Individual Income Tax Return form. This form is used by residents to report their income and calculate their state taxes. You can easily find and download this form online. When you complete your Form M1, remember to keep a copy of your Minnesota General Form of Receipt for your records.

The address for sending your state income tax returns to Minnesota is the Department of Revenue, P.O. Box 64620, St. Paul, MN 55164-0620. Make sure to use the correct address based on how you file your taxes. If you are providing a Minnesota General Form of Receipt, ensure it is included with your mailed documents.

Minnesota does not implement a gross receipts tax on income, unlike some other states. Instead, the state collects income tax based on your earnings and various deductions. If you’re unsure about the tax structure, you can consult the Minnesota General Form of Receipt for more insights into reporting requirements and obligations.

The deadline for filing your Minnesota state taxes typically falls on April 15 each year. If April 15 is a weekend or holiday, you can file on the next business day. It’s essential to meet this deadline to avoid penalties. Keeping your Minnesota General Form of Receipt handy can help you track your filing timeline.

After you successfully e-file your taxes, an option will appear to download the e-filing receipt. This receipt serves as proof that you filed your Minnesota state taxes. If you need to access it later, you can log back into the e-filing platform used and download the Minnesota General Form of Receipt to keep your records organized.

To obtain a copy of your Minnesota state tax return, you need to submit a request to the Minnesota Department of Revenue. You can do this online or by mail. It’s important to have your Social Security number and any relevant details at hand. Utilizing the Minnesota General Form of Receipt can help ensure you provide all necessary information when making your request.

Yes, in Minnesota, service by mail is an acceptable method under specific rules, particularly for certain types of documents. It is outlined in the Minnesota Rules of Civil Procedure, ensuring that parties receive necessary documentation. When using mail for service, it's advisable to utilize the Minnesota General Form of Receipt to ensure proper acknowledgment and documentation.

In Minnesota, a declaration is a written statement made under penalty of perjury, whereas an affidavit must be sworn before a notary public or other authorized official. Both serve as legal documents but differ in their methods of verification. Utilizing the Minnesota General Form of Receipt clarifies the process for both declarations and affidavits.