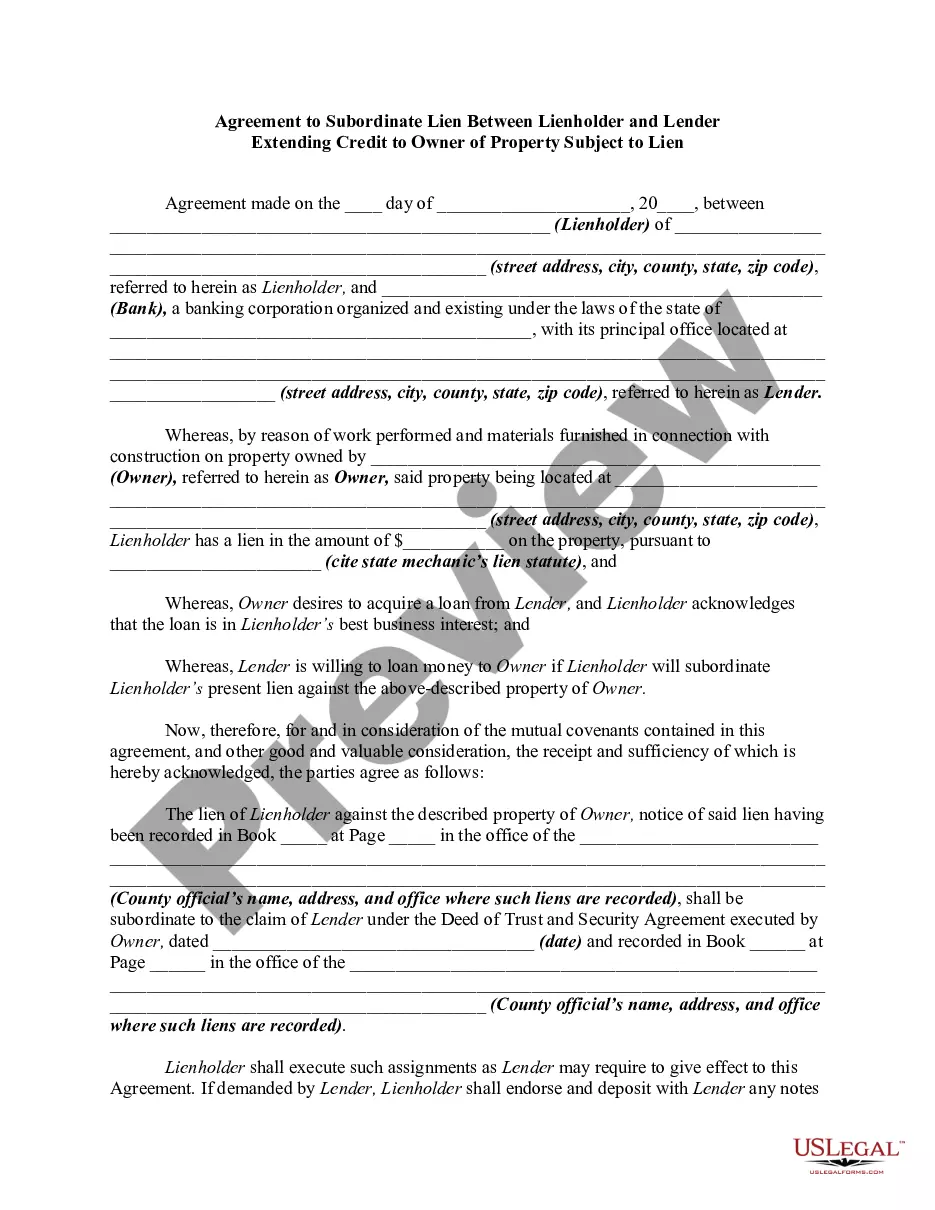

Different liens on the same property usually have priorities according to the time of their creation. To achieve the subordination of a prior lien, there must be an actual agreement to that effect.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Minnesota Agreement to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien is a legal document that establishes the terms and conditions under which a lien holder and a lender agree to subordinate their respective liens on a property. This agreement enables the lender extending credit to have a higher priority lien on the property, while the lien holder agrees to a subordinate position. Here is a detailed description of this agreement: 1. Purpose: The purpose of the Minnesota Agreement to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien is to establish the priorities and obligations between two parties involved in a property transaction where the property owner has an existing lien and seeks to obtain additional credit. 2. Parties involved: This agreement involves three primary parties — the lienholder, the lender extending credit, and the owner of the property subject to the lien. The lien holder is the party holding an existing lien on the property, while the lender extending credit is the party providing additional credit to the property owner. The property owner is the individual or entity who owns the property on which the liens are placed. 3. Liens: Liens are legal claims or encumbrances on a property that give the lien holder a financial interest in the property until the debt or obligation is fully paid. In this agreement, there are two liens involved — the existing lien held by the lienholder and the new lien being granted to the lender extending credit. 4. Subordination: The agreement outlines the subordination of the existing lien to the new lien. This means that the lien holder agrees to allow the lender extending credit to have a higher priority lien on the property. By subordinating their lien, the lien holder accepts a lower priority position and acknowledges that the lender extending credit will have a superior claim in case of default or foreclosure. 5. Priority of payments: The agreement establishes the order in which the liens will be paid off in the event of default or foreclosure. It clarifies that the lender extending credit will have priority over the lien holder in receiving payments from the proceeds of the property sale. Different types of Minnesota Agreement to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien may exist depending on the specific circumstances of the property transaction. These variations can include agreements between different types of lien holders and lenders, such as mortgage lenders, financial institutions, or private individuals. Additionally, the agreement may vary depending on the types of liens involved, such as mortgage liens, judgment liens, tax liens, or mechanic's liens. In conclusion, the Minnesota Agreement to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien is a legally binding document that establishes the terms and conditions under which a lien holder agrees to subordinate their lien to a lender extending credit on a property. It clarifies the priorities of payments and ensures clear understanding between all parties involved in the property transaction, protecting the rights of each party in case of default or foreclosure.The Minnesota Agreement to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien is a legal document that establishes the terms and conditions under which a lien holder and a lender agree to subordinate their respective liens on a property. This agreement enables the lender extending credit to have a higher priority lien on the property, while the lien holder agrees to a subordinate position. Here is a detailed description of this agreement: 1. Purpose: The purpose of the Minnesota Agreement to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien is to establish the priorities and obligations between two parties involved in a property transaction where the property owner has an existing lien and seeks to obtain additional credit. 2. Parties involved: This agreement involves three primary parties — the lienholder, the lender extending credit, and the owner of the property subject to the lien. The lien holder is the party holding an existing lien on the property, while the lender extending credit is the party providing additional credit to the property owner. The property owner is the individual or entity who owns the property on which the liens are placed. 3. Liens: Liens are legal claims or encumbrances on a property that give the lien holder a financial interest in the property until the debt or obligation is fully paid. In this agreement, there are two liens involved — the existing lien held by the lienholder and the new lien being granted to the lender extending credit. 4. Subordination: The agreement outlines the subordination of the existing lien to the new lien. This means that the lien holder agrees to allow the lender extending credit to have a higher priority lien on the property. By subordinating their lien, the lien holder accepts a lower priority position and acknowledges that the lender extending credit will have a superior claim in case of default or foreclosure. 5. Priority of payments: The agreement establishes the order in which the liens will be paid off in the event of default or foreclosure. It clarifies that the lender extending credit will have priority over the lien holder in receiving payments from the proceeds of the property sale. Different types of Minnesota Agreement to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien may exist depending on the specific circumstances of the property transaction. These variations can include agreements between different types of lien holders and lenders, such as mortgage lenders, financial institutions, or private individuals. Additionally, the agreement may vary depending on the types of liens involved, such as mortgage liens, judgment liens, tax liens, or mechanic's liens. In conclusion, the Minnesota Agreement to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien is a legally binding document that establishes the terms and conditions under which a lien holder agrees to subordinate their lien to a lender extending credit on a property. It clarifies the priorities of payments and ensures clear understanding between all parties involved in the property transaction, protecting the rights of each party in case of default or foreclosure.