At one time all ?ˆ?clergy?ˆ were considered self-employed; however, in the mid 1980?ˆ™s the IRS decided to declare such ministers ?ˆ?employees?ˆ of the church . Most pastors should be considered employees. They typically have a governing council they work with or for to determine to work to be performed (which is one of the criteria the IRS uses to determine the status of a person). Exceptions to this would be supply pastors or missionaries who travel from church to church filling in or working for short periods Misclassification of workers is a big issue with churches and the IRS, so be very certain you have properly classified your clergy and other workers such as musicians, nursery workers, and, custodians. A member of the clergy is considered an employee for federal income tax purposes and self-employed for Social Security and Medicare purposes. See Topic 417 - Earnings for Clergy at https://www.irs.gov/taxtopics/tc417.html

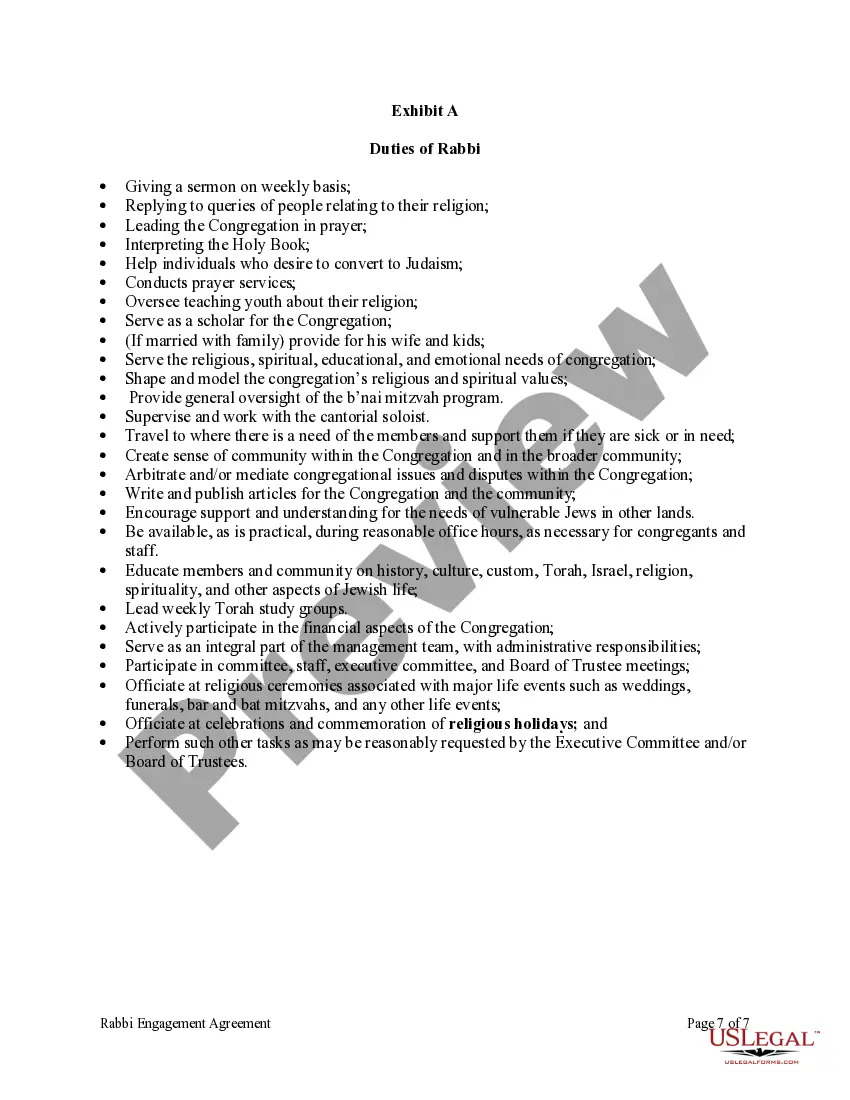

Minnesota Rabbi Engagement Agreement refers to a legally binding contract between a rabbi and a synagogue or religious organization in the state of Minnesota. This agreement outlines the terms and conditions of the rabbi's employment or engagement, ensuring clarity and understanding between both parties. The agreement typically covers various aspects such as the rabbi's role and responsibilities, compensation and benefits, working hours and schedule, length of the engagement, termination provisions, and other relevant details. It serves as a roadmap for the relationship between the rabbi and the synagogue, setting expectations and promoting harmony within the religious community. Different types of Minnesota Rabbi Engagement Agreements may exist, depending on the nature of the engagement and the specific needs of the synagogue. Here are a few examples: 1. Full-Time Rabbi Engagement Agreement: This type of agreement is relevant when a rabbi is hired for full-time employment at a synagogue. It outlines the rabbi's regular duties, expected time commitments, and compensation package. 2. Part-Time Rabbi Engagement Agreement: In cases when a rabbi is employed on a part-time basis, this agreement specifies the agreed-upon weekly or monthly hours of work, areas of responsibility, and compensation that align with the reduced workload. 3. Sabbatical Rabbi Engagement Agreement: Sabbatical agreements are applicable when a rabbi is granted an extended leave of absence for personal growth, study, or travel purposes. This agreement outlines the terms of the sabbatical, including the duration, compensation, and expected deliverables upon return. 4. Interim Rabbi Engagement Agreement: When a synagogue requires temporary rabbinical services due to various reasons such as a search for a permanent rabbi or covering a vacancy, an interim rabbi engagement agreement is established. It outlines the duration, responsibilities, and compensation for the interim rabbi. 5. Guest Rabbi Engagement Agreement: Synagogues sometimes invite guest rabbis to lead services, deliver sermons, or provide specialized teachings. A guest rabbi engagement agreement covers the specific dates and duties of the guest's involvement, any honorarium or reimbursement, and the scope of their engagement. Regardless of the specific type of Minnesota Rabbi Engagement Agreement, it is crucial to ensure that the contract adheres to state laws and aligns with the customs and practices of the Jewish faith. Consulting with legal counsel familiar with religious employment agreements can help both parties create a comprehensive and mutually beneficial agreement.Minnesota Rabbi Engagement Agreement refers to a legally binding contract between a rabbi and a synagogue or religious organization in the state of Minnesota. This agreement outlines the terms and conditions of the rabbi's employment or engagement, ensuring clarity and understanding between both parties. The agreement typically covers various aspects such as the rabbi's role and responsibilities, compensation and benefits, working hours and schedule, length of the engagement, termination provisions, and other relevant details. It serves as a roadmap for the relationship between the rabbi and the synagogue, setting expectations and promoting harmony within the religious community. Different types of Minnesota Rabbi Engagement Agreements may exist, depending on the nature of the engagement and the specific needs of the synagogue. Here are a few examples: 1. Full-Time Rabbi Engagement Agreement: This type of agreement is relevant when a rabbi is hired for full-time employment at a synagogue. It outlines the rabbi's regular duties, expected time commitments, and compensation package. 2. Part-Time Rabbi Engagement Agreement: In cases when a rabbi is employed on a part-time basis, this agreement specifies the agreed-upon weekly or monthly hours of work, areas of responsibility, and compensation that align with the reduced workload. 3. Sabbatical Rabbi Engagement Agreement: Sabbatical agreements are applicable when a rabbi is granted an extended leave of absence for personal growth, study, or travel purposes. This agreement outlines the terms of the sabbatical, including the duration, compensation, and expected deliverables upon return. 4. Interim Rabbi Engagement Agreement: When a synagogue requires temporary rabbinical services due to various reasons such as a search for a permanent rabbi or covering a vacancy, an interim rabbi engagement agreement is established. It outlines the duration, responsibilities, and compensation for the interim rabbi. 5. Guest Rabbi Engagement Agreement: Synagogues sometimes invite guest rabbis to lead services, deliver sermons, or provide specialized teachings. A guest rabbi engagement agreement covers the specific dates and duties of the guest's involvement, any honorarium or reimbursement, and the scope of their engagement. Regardless of the specific type of Minnesota Rabbi Engagement Agreement, it is crucial to ensure that the contract adheres to state laws and aligns with the customs and practices of the Jewish faith. Consulting with legal counsel familiar with religious employment agreements can help both parties create a comprehensive and mutually beneficial agreement.