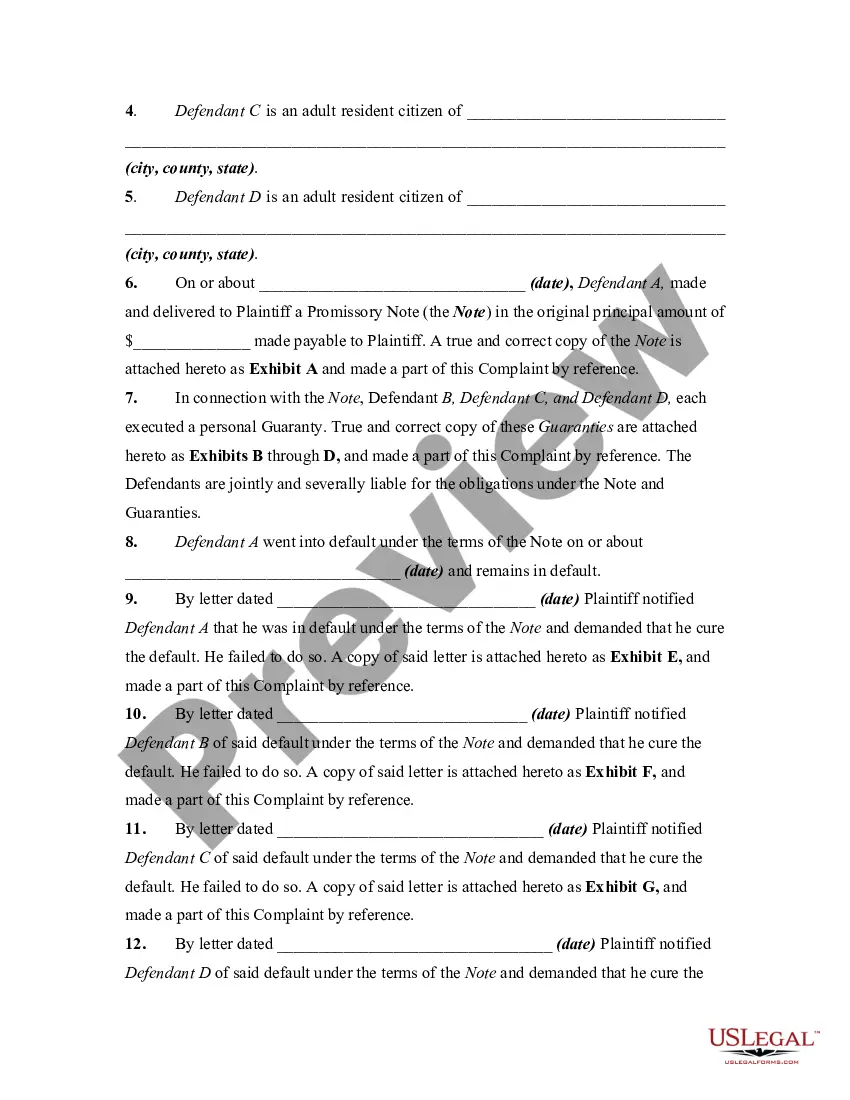

A promissory note is a promise in writing made by one or more persons to another, signed by the maker, promising to pay at a definite time a sum of money to a specific person or to "bearer." The maker is the person who writes out and creates the note. A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so.

Joint and several liability refers to a shared responsibility for a debt or a judgment for negligence, in which each debtor or each judgment defendant is responsible for the entire amount of the debt or judgment. The person owed money can collect the entire amount from any of the debtors or defendants and not be limited to a share from each debtor.

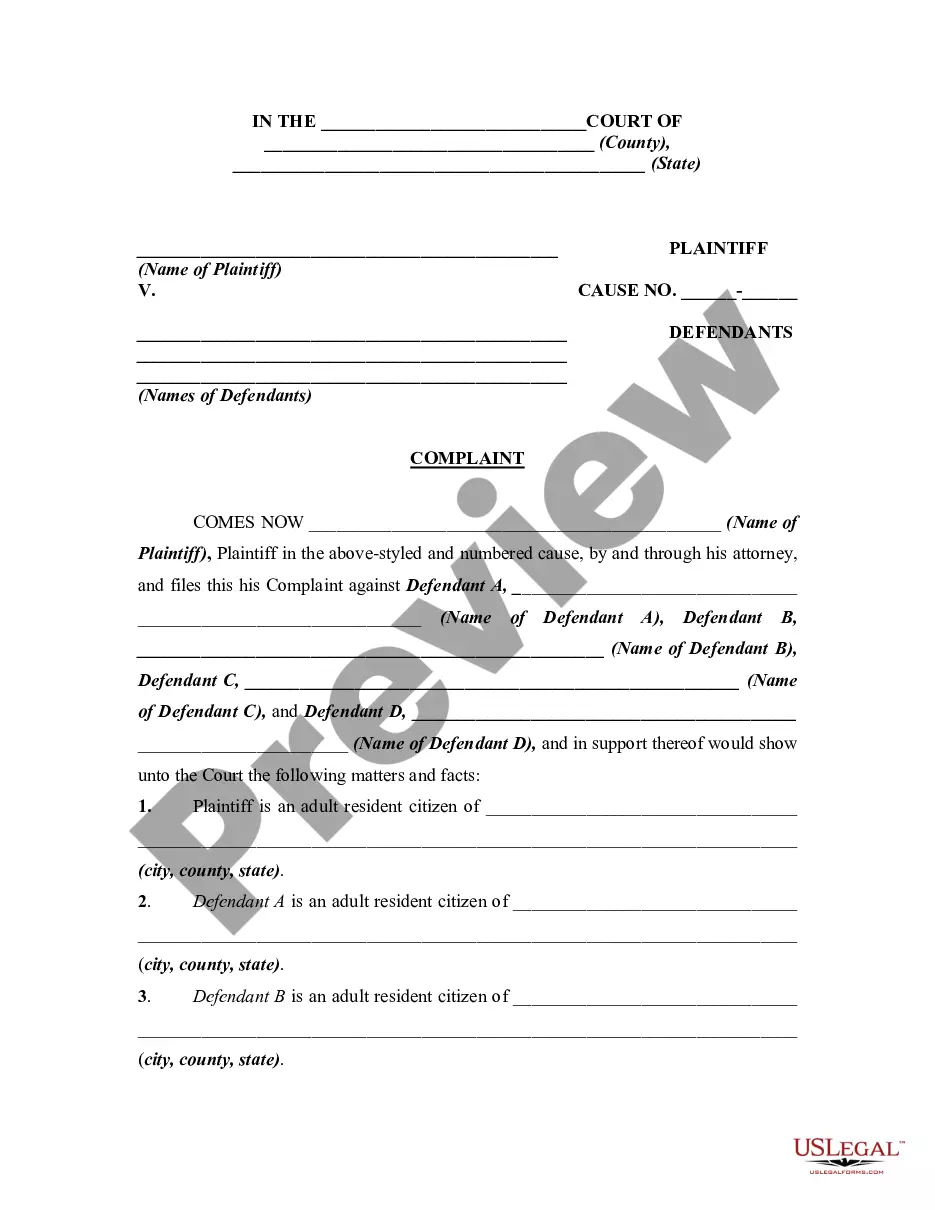

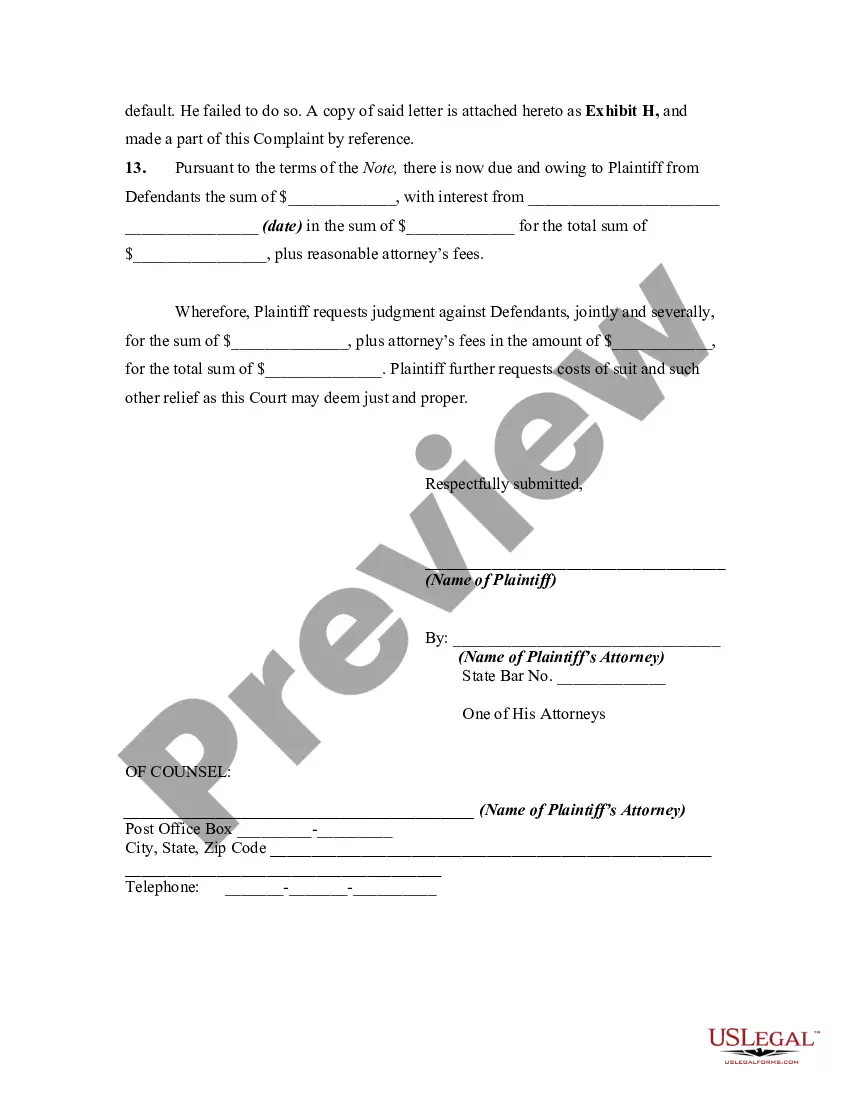

Minnesota Complaint Against Makers of Promissory Note and Personal Guarantors for Joint and Several Liability

Description

How to fill out Complaint Against Makers Of Promissory Note And Personal Guarantors For Joint And Several Liability?

If you wish to total, acquire, or print out authorized papers templates, use US Legal Forms, the greatest assortment of authorized forms, which can be found on-line. Utilize the site`s easy and convenient look for to get the papers you want. Various templates for enterprise and person functions are categorized by types and says, or search phrases. Use US Legal Forms to get the Minnesota Complaint Against Makers of Promissory Note and Personal Guarantors for Joint and Several Liability in just a couple of mouse clicks.

Should you be presently a US Legal Forms consumer, log in in your profile and click the Acquire switch to get the Minnesota Complaint Against Makers of Promissory Note and Personal Guarantors for Joint and Several Liability. Also you can access forms you previously saved within the My Forms tab of the profile.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for your right area/land.

- Step 2. Use the Preview choice to look through the form`s content material. Don`t neglect to read through the information.

- Step 3. Should you be not happy together with the form, use the Research discipline towards the top of the display to find other variations in the authorized form design.

- Step 4. Upon having located the shape you want, click the Get now switch. Select the rates prepare you favor and add your accreditations to sign up for an profile.

- Step 5. Procedure the transaction. You may use your bank card or PayPal profile to complete the transaction.

- Step 6. Pick the format in the authorized form and acquire it on your product.

- Step 7. Comprehensive, modify and print out or sign the Minnesota Complaint Against Makers of Promissory Note and Personal Guarantors for Joint and Several Liability.

Every single authorized papers design you acquire is the one you have for a long time. You possess acces to every form you saved within your acccount. Click on the My Forms segment and select a form to print out or acquire again.

Contend and acquire, and print out the Minnesota Complaint Against Makers of Promissory Note and Personal Guarantors for Joint and Several Liability with US Legal Forms. There are many professional and express-certain forms you can utilize for the enterprise or person requires.

Form popularity

FAQ

The Lender or anyone who takes this Note by transfer and who is entitled to receive payments under this Note is called the ?Note Holder.?

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Minnesota's Consumer Protection Act (?CPA?) contains many consumer protection laws addressing specific industries including automobiles, farm equipment, repairs, and senior citizens. Minn. Stat. §§ 325F et seq.

Your lender will keep the original promissory note until your loan is paid off.

Any two parties who wish to enter into a loan agreement can draft a promissory note, which states the intention of the lender to loan the borrower a specific amount of money, as well as the terms and conditions for repayment of that loan, to which both parties have agreed.

The lender will keep the original promissory note until the loan is paid off. There may be some circumstances, such as during a refinance, where the loan terms (and therefore, the promissory note terms) change and you will likely be issued a new document to sign.

The lender keeps the original promissory note until you have fulfilled all obligations, i.e., paid off, your mortgage. A promissory note will generally contain the following information: The total amount of money borrowed; Your interest rate (either fixed or adjustable);

Obligor ? An obligor is a person who binds oneself to another by contract or legal agreement. In the context of a promisory note, this is another word for ?promisor?. Obligee ? An obligee is a person to whom another is bound by contract or legal agreement.