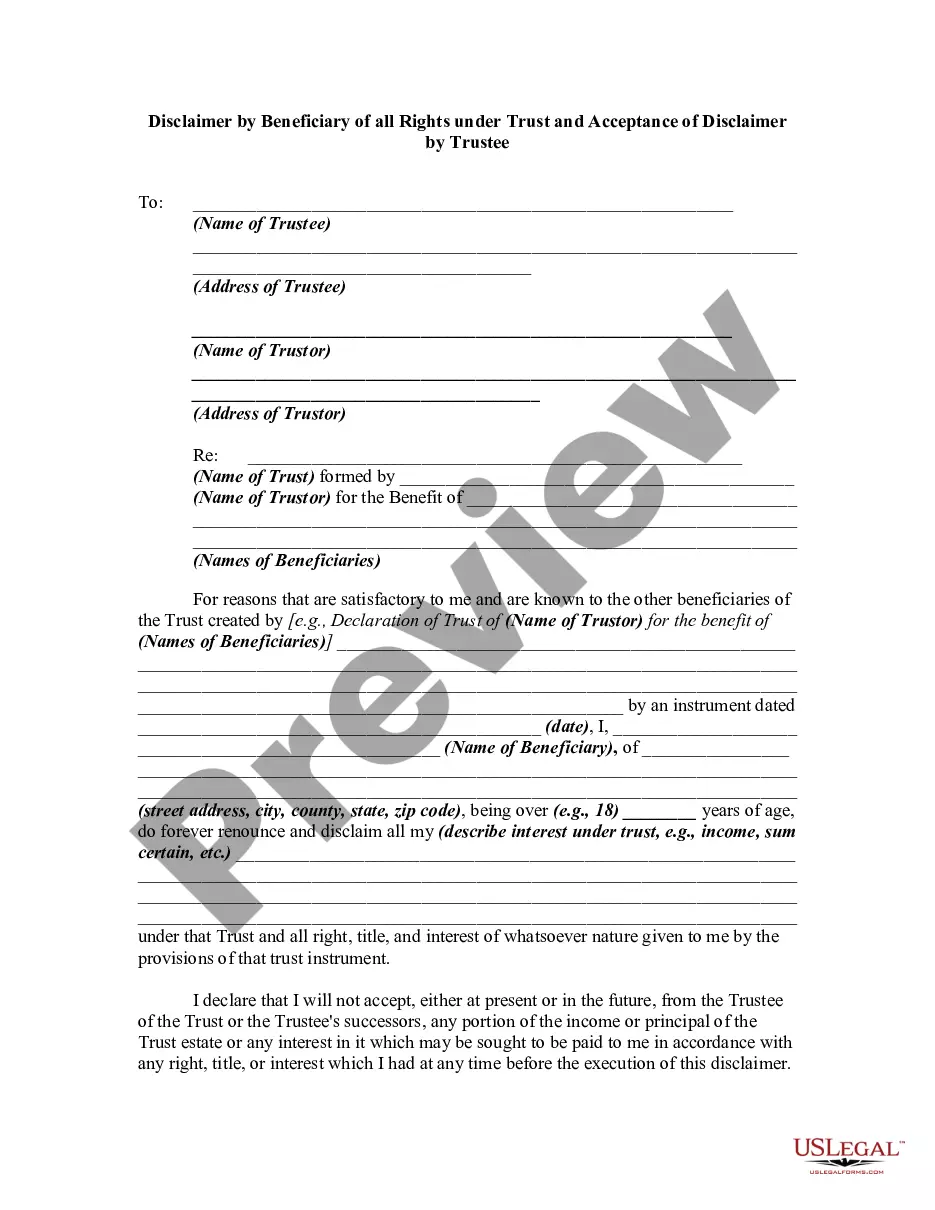

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

How to fill out Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print. By using the website, you will find a vast number of forms for business and personal purposes, categorized by types, states, or keywords.

You can access the latest versions of forms such as the Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee in just minutes.

If you hold a membership, Log In and download the Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee from the US Legal Forms library. The Download button will be available on every form you view. You have access to all previously obtained forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the acquired Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. All templates added to your account have no expiration date and belong to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a large variety of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your state/region.

- Click on the Preview button to review the form’s contents.

- Check the form description to confirm that you have chosen the appropriate form.

- If the form does not meet your needs, utilize the Search feature at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

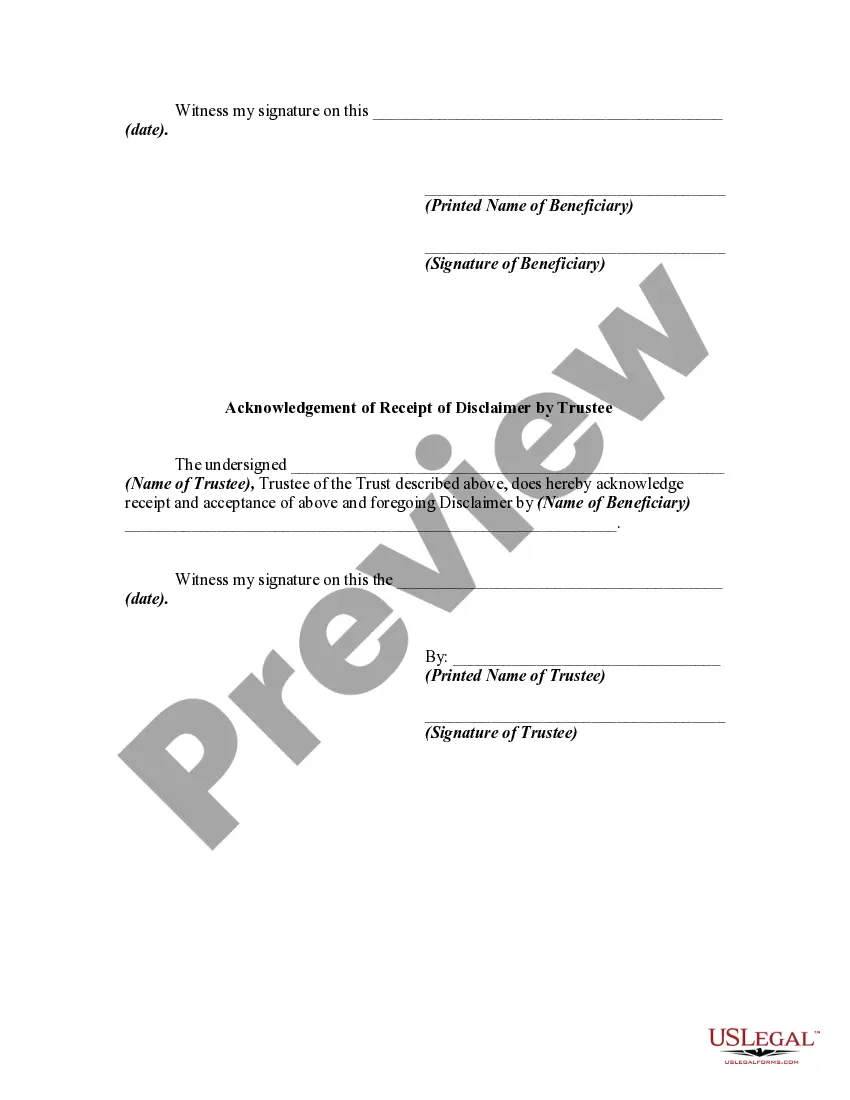

Filing a disclaimer involves a straightforward process that notifies relevant parties of your decision regarding the Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. First, you should prepare a written disclaimer document that clearly states your intention to decline the rights or interests. Then, ensure you file this document with the appropriate trustee and any other beneficiaries involved. Remember, it's advisable to seek legal guidance to ensure that your disclaimer complies with Minnesota laws and is properly executed.

A disclaimer clause typically states that a beneficiary can decline their rights to benefits from a trust. For instance, a trust document may include a provision allowing heirs to opt out, thereby triggering a Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Such clauses help clarify intentions and protect the interest of all beneficiaries involved.

An example of a disclaimer of inheritance rights might occur when a person learns they are a beneficiary of a trust but believes the assets are better suited for others. By executing a Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, they can relinquish their right to the inheritance while still supporting the needs of family members. This choice enhances equitable asset allocation.

A disclaimer trust example could involve a grandparent setting up a trust that benefits their grandchildren. If one grandchild feels that accepting the assets may lead to responsibilities they do not want, they can use a Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee to pass their share to their siblings. This action promotes family harmony and fair distribution without extra burdens.

Individuals might choose to disclaim a trust for various reasons, including to avoid tax liabilities or to ensure that assets go to a more suitable heir. A Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can also prevent unwanted complications associated with managing a large inheritance. This decision allows for clearer asset distribution, making it easier for all parties involved.

An example of a disclaimer trust would be a situation where a beneficiary decides to reject their right to inherited property from a trust. If a parent leaves assets to their child but the child is financially secure, the child might choose a Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee to allow the assets to pass to subsequent beneficiaries. This action can help optimize tax benefits and asset distribution.

A Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can limit your options once you choose to disclaim. When you disclaim, you forfeit any claim to the trust's assets, which could impact your financial planning. Additionally, not all states recognize disclaimers in the same way, so it is essential to understand the legal implications.

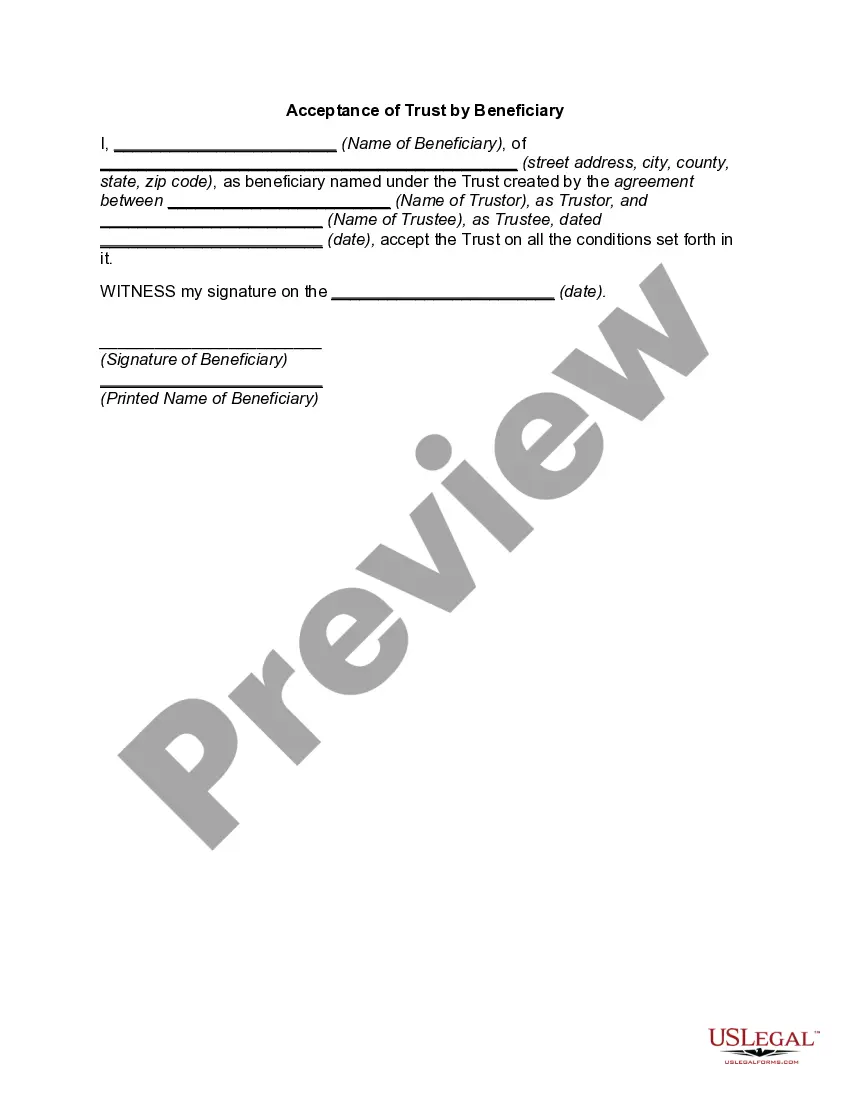

Yes, you can decline to be a beneficiary of a trust through a legal process known as a disclaimer. This allows you to formally express your decision, and similarly, to facilitate the transfer of assets to alternate beneficiaries. The Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee governs this process to ensure it adheres to state law. If you consider this option, consulting with an attorney can provide the assistance you need.

The disclaimer clause in a trust specifies the conditions under which a beneficiary can refuse their interest in the trust. This clause is an important aspect of the Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, clearly outlining the rights and responsibilities of all parties involved. By including a disclaimer clause, the trust creator can provide clarity on how disclaimed assets are to be handled. Understanding this clause can help beneficiaries make informed decisions.

Indeed, a trust beneficiary can disclaim their interest. This process entails formally rejecting their rights to the assets, which results in the property passing to other designated beneficiaries. It is important to follow the Minnesota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee to ensure proper execution. If you are considering this option, seeking legal guidance can simplify the process.