An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Minnesota Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage

Description

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

Are you currently in a situation where you need papers for either enterprise or personal reasons virtually every day time? There are a variety of legal file themes available on the Internet, but discovering types you can rely on isn`t simple. US Legal Forms provides a large number of kind themes, just like the Minnesota Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage, which are created to satisfy federal and state requirements.

If you are previously informed about US Legal Forms site and also have a free account, merely log in. Afterward, you can obtain the Minnesota Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage web template.

If you do not offer an profile and need to begin to use US Legal Forms, follow these steps:

- Discover the kind you will need and make sure it is for the proper metropolis/region.

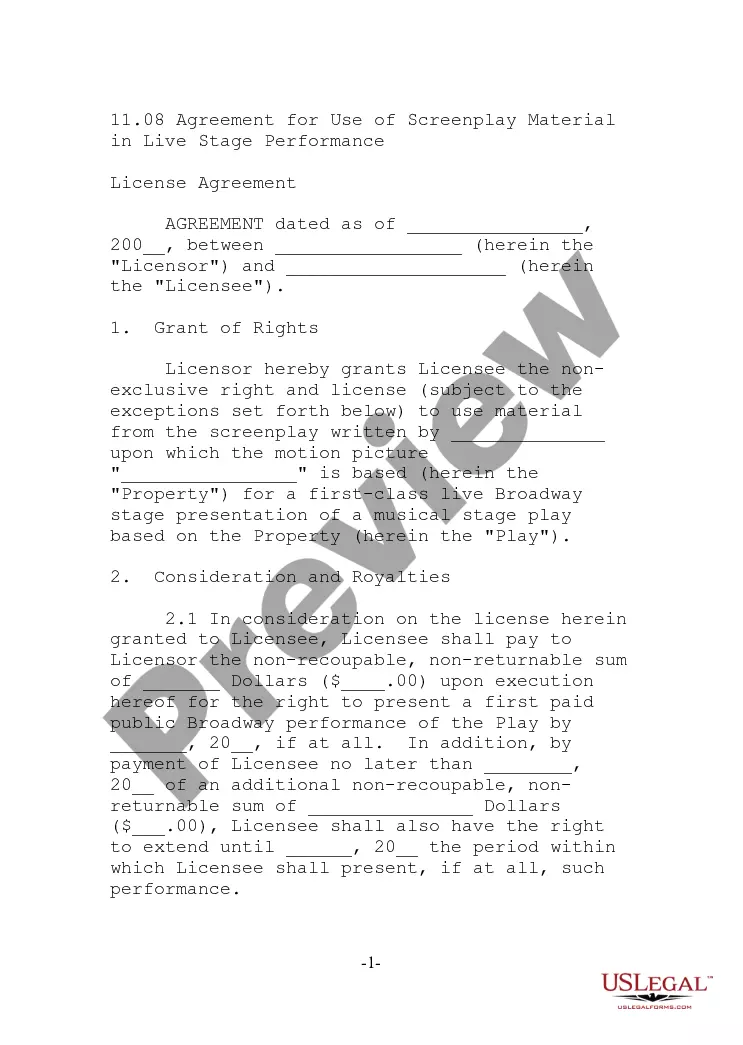

- Utilize the Review switch to analyze the form.

- See the explanation to ensure that you have chosen the right kind.

- In the event the kind isn`t what you are searching for, take advantage of the Look for field to discover the kind that fits your needs and requirements.

- Whenever you find the proper kind, simply click Acquire now.

- Choose the pricing strategy you desire, fill out the required information to produce your money, and pay for the order making use of your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper structure and obtain your duplicate.

Find each of the file themes you may have bought in the My Forms food selection. You can get a extra duplicate of Minnesota Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage at any time, if necessary. Just click the needed kind to obtain or print the file web template.

Use US Legal Forms, probably the most extensive collection of legal types, to save time as well as avoid errors. The support provides expertly made legal file themes which can be used for a variety of reasons. Produce a free account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

Secured promissory notes By assuring that the property attached to the note is of sufficient value to cover the amount of the loan, the payee thus has a guarantee of being repaid. The property that secures a note is called collateral, which can be either real estate or personal property.

By signing a promissory note, a borrower promises to pay back a set amount of money, including interest and fees, to a bank, a person or another lender.

An amended promissory note is a legal document that changes the terms of the original promissory note. These amendments should be made with consent from the lender and, once in place, will be considered binding by all parties involved.

A Promissory Note must always be written by hand. It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements.

A promissory note is a written and signed promise to repay a sum of money in exchange for a loan or other financing. A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.

A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline for repayment. Once the document is signed by both parties, it becomes a legally binding contract.

The promissory note form should include: The names and addresses of the lender and borrower. The amount of money being borrowed and what, if any, collateral is being used. How often payments will be made in and in what amount. Signatures of both parties, in order for the note to be enforceable.

Loan maturity date refers to the date on which a borrower's final loan payment is due. Once that payment is made and all repayment terms have been met, the promissory note that is a record of the original debt is retired. In the case of a secured loan, the lender no longer has a claim to any of the borrower's assets.