This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Minnesota Bill of Sale of Customer Accounts

Description

How to fill out Bill Of Sale Of Customer Accounts?

You have the ability to spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast selection of legal documents that are vetted by experts.

You can conveniently download or print the Minnesota Bill of Sale for Customer Accounts from our service.

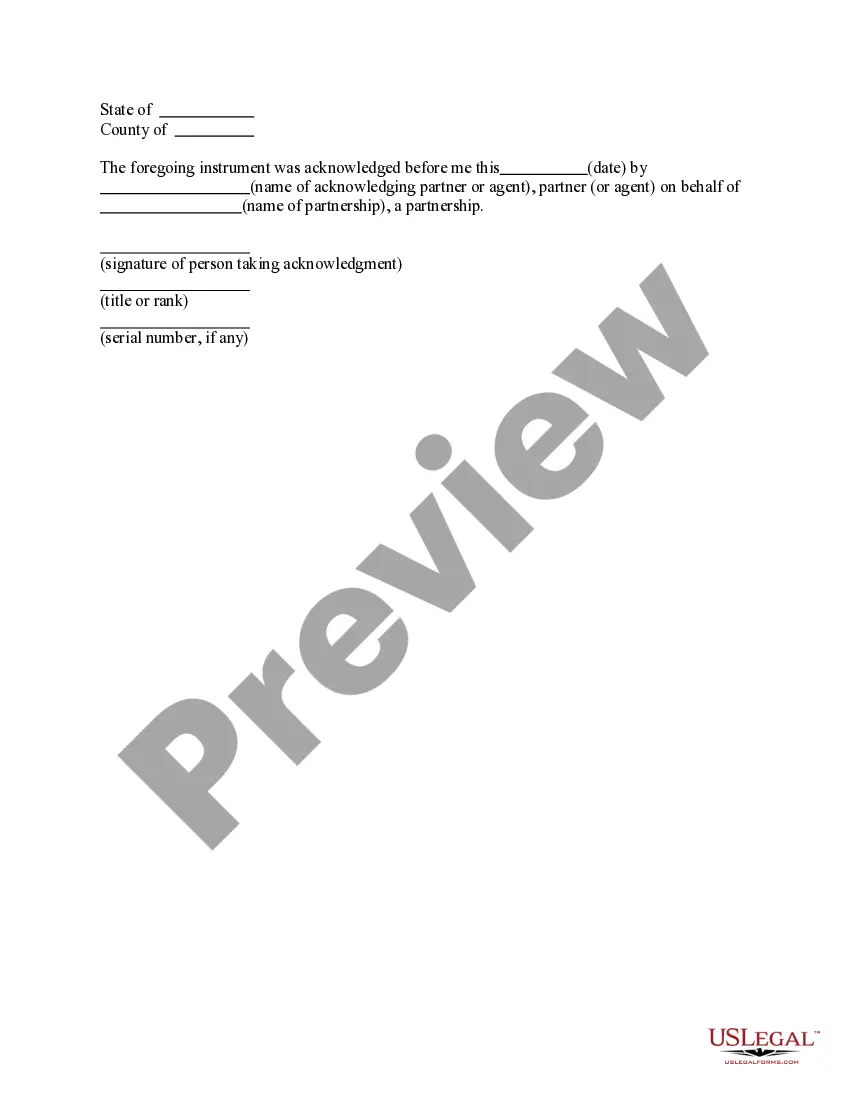

If available, utilize the Review button to examine the template as well.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, alter, print, or sign the Minnesota Bill of Sale for Customer Accounts.

- Every legal document template you acquire is yours indefinitely.

- To retrieve another copy of any purchased form, navigate to the My documents tab and click the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct template for the state/area of your choice.

- Review the template details to confirm that you have selected the right form.

Form popularity

FAQ

To recover a bill of sale, start by checking your records for any existing copies, whether digital or physical. If you still cannot locate it, contact the seller to see if they can provide a duplicate. For future transactions, consider using a Minnesota Bill of Sale of Customer Accounts template from USLegalForms to ensure you have a proper record.

The Utah DMV requires a bill of sale for certain vehicle transactions, providing proof of ownership transfer. While not required for all sales, it is beneficial for buyers and sellers. If you're considering purchases involving customer accounts in Minnesota, utilizing a Minnesota Bill of Sale of Customer Accounts can offer similar benefits for clarity and security.

If you lose your bill of sale, you should first check for any digital copies or backups that you may have. If you cannot find it, you can request a replacement from the seller if they still have their records. For customized solutions, consider using a Minnesota Bill of Sale of Customer Accounts template from USLegalForms to recreate the document.

Typically, the seller retains the original bill of sale. The buyer should have a copy as proof of the transaction. For purchases involving customer accounts, having a Minnesota Bill of Sale of Customer Accounts can help both parties clearly understand the terms and maintain proper records.

Yes, Minnesota provides a bill of sale form that you can fill out for various transactions, including the sale of vehicles, boats, and personal property. When dealing with customer accounts, utilizing a Minnesota Bill of Sale of Customer Accounts ensures that you have the necessary documentation to legitimize the transfer. You can find templates on platforms like USLegalForms to help you create an appropriate form.

A bill of sale can be voided for several reasons, such as if one party committed fraud or if the item sold was stolen. Additionally, if both parties didn't agree to the terms listed, the agreement may become void. To avoid complications, ensure clear communication and understanding at the time of sale, especially when dealing with a Minnesota Bill of Sale of Customer Accounts.

Creating your own bill of sale can be straightforward. Start with a clear title, followed by the necessary details such as the parties' information, item description, sale terms, and date. Using templates from US Legal Forms can simplify this process, as they offer customizable options for different transactions, including Minnesota Bill of Sale of Customer Accounts.

Yes, a handwritten bill of sale is entirely legitimate as long as it includes all necessary information. This document serves as proof of the transaction and can be used if disputes arise in the future. Always ensure that both the buyer and seller sign the bill to affirm its validity. Using the Minnesota Bill of Sale of Customer Accounts enhances this process by providing a structured format.

In Minnesota, a bill of sale is not legally required for every transaction, but it is highly recommended. This document serves as proof of the exchange and protects both the buyer and the seller. In specific situations, such as vehicle sales, a bill of sale may be necessary for registration purposes. Therefore, using a Minnesota Bill of Sale of Customer Accounts can be beneficial.

A bill of trade for a car serves as a document recording the exchange of vehicles between parties. It typically includes the vehicle's details such as the make, model, year, VIN, and the condition of the car. The parties should also include any financial adjustments agreed upon during the trade. Using a platform like US Legal Forms can guide you in creating a valid Minnesota Bill of Sale of Customer Accounts specifically tailored for vehicle exchanges.