A Minnesota Private Annuity Agreement is a financial arrangement entered into between two parties, typically family members, where one party transfers assets or property to the other in exchange for a regular stream of income over a specified period. This agreement allows individuals to transfer wealth to their beneficiaries while providing a reliable income source for themselves. In a Minnesota Private Annuity Agreement, the party who transfers the assets or property is known as the annuitant, while the party receiving the income is called the annuity holder. The annuitant relinquishes ownership of the assets but continues to receive periodic payments based on the agreed terms. This type of agreement essentially acts as a retirement income plan, enabling individuals to convert their assets into a steady income stream. It allows for significant tax benefits, as the annuity holder can defer capital gains tax on the assets transferred until they start receiving payments. At the same time, the annuitant benefits from income tax deferral until they start receiving payments. There are different types of Minnesota Private Annuity Agreements tailored to specific needs: 1. Lifetime Annuity: The annuity holder receives regular payments for their entire lifetime, ensuring a stable income source in retirement. 2. Fixed-term Annuity: Payments are made to the annuity holder for a specified period, often for a set number of years. This option may be suitable for individuals who want a guaranteed income for a predetermined timeframe. 3. Joint and Survivor Annuity: This agreement considers two individuals, typically a couple. Payments are made to the annuity holders as long as either one is alive. It provides financial security for both individuals and ensures income continuation for the surviving spouse. 4. Increasing Annuity: This type of annuity agreement incorporates periodic increases in payment amount, often to account for inflation or changing financial needs. Minnesota Private Annuity Agreements offer flexibility and can be customized to meet specific financial goals and circumstances. It is essential to seek legal and financial advice when considering such agreements to ensure compliance with relevant laws and to make informed decisions regarding asset transfer, income generation, and tax implications.

Minnesota Private Annuity Agreement

Description

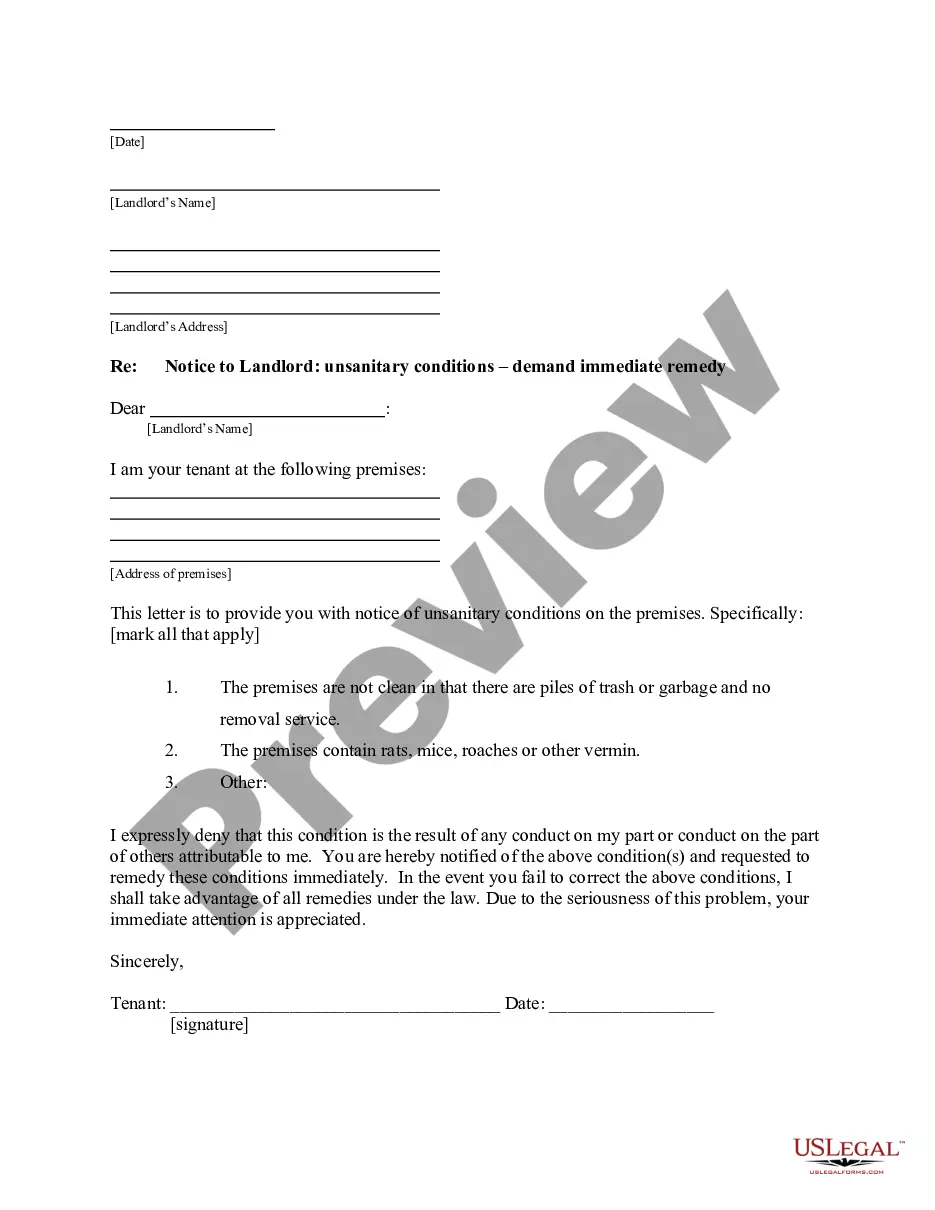

How to fill out Minnesota Private Annuity Agreement?

Are you presently in a circumstance where you require files for both professional or personal reasons almost every day.

There are numerous authentic document templates accessible online, but locating versions you can rely on isn’t simple.

US Legal Forms provides a vast selection of form templates, including the Minnesota Private Annuity Agreement, that are designed to comply with state and federal regulations.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Minnesota Private Annuity Agreement at any time if needed. Just click on the desired form to download or print the format.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Minnesota Private Annuity Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for your specific city/state.

- Use the Preview button to review the form.

- Examine the summary to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to find a form that meets your needs and requirements.

- Once you find the correct form, click on Buy now.

- Select the pricing plan you prefer, enter the necessary information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Yes, annuities, including those established through a Minnesota Private Annuity Agreement, must be reported to the IRS. The issuer of the annuity is typically responsible for providing relevant tax documents, including Form 1099. Understanding how these reports affect your tax situation is important for your financial planning. Utilizing resources like uslegalforms can provide additional clarity on this matter.

Some individuals may qualify for exemptions from state income tax in Minnesota. For instance, certain types of income received by veterans and low-income seniors can be exempt. If you receive payments from a Minnesota Private Annuity Agreement, you should review any exemptions that may apply to your situation. Consulting with a tax professional can help clarify these nuances.

In Minnesota, various forms of retirement income can be taxable. This includes distributions from traditional IRAs, pensions, and certain annuities. If you have a Minnesota Private Annuity Agreement, the payments you receive may be subject to state tax depending on specific conditions. It is crucial to understand how these taxes apply to ensure your retirement plan is effective.

Filing an annuity involves reporting the income you receive from your Minnesota Private Annuity Agreement on your tax return. You will need to complete Schedule B and Form 1040 to accurately report your income. Make sure to include any Forms 1099-R you receive from the issuer of the annuity. If you feel overwhelmed or unsure, using a platform like USLegalForms can guide you through the filing process with ease.

The default tax withholding on annuities can vary based on several factors, including marital status and the amount of your annuity withdrawal. For a Minnesota Private Annuity Agreement, the general default rate is 10% unless you specify otherwise. You have the option to adjust withholding rates on IRS Form W-4P to better suit your financial situation. Consulting a tax advisor can help you determine the best withholding strategy.

Annuities, including those from a Minnesota Private Annuity Agreement, are reported to the IRS using Form 1099-R. This form details the withdrawals you made during the year and indicates the taxable portions. The investment company or financial institution typically issues this form, helping you accurately report your income on your tax return. Always verify the information on the form to ensure everything is correct.

Filling out the NC 4P involves providing your personal information and selecting the appropriate exemptions. This form helps you claim the proper allowances related to your Minnesota Private Annuity Agreement. You should complete each section accurately to ensure the correct amount of tax is withheld from your annuity payments. If needed, a tax professional can provide further assistance with this process.

Yes, annuities are subject to taxation in Minnesota. Generally, income from a Minnesota Private Annuity Agreement is taxed as ordinary income when you withdraw it. It is crucial to understand how these tax rules apply to your specific situation to avoid unexpected tax liabilities. Consulting a tax professional or financial advisor can help clarify your obligations.

For a 70-year-old, purchasing an annuity can be beneficial, especially if you're looking for stability in retirement income. A Minnesota Private Annuity Agreement can provide a reliable payment stream, which can ease financial stresses. However, it’s important to consider personal health, financial needs, and plans for the future. Consulting with a professional can help you evaluate whether an annuity aligns with your retirement strategy.

The best option for an annuity payout typically depends on your financial goals and situation. You might consider a Minnesota Private Annuity Agreement, which can offer flexibility in payment structures. Common payout options include lifetime income or a fixed term, allowing you to choose what aligns best with your retirement plans. It's essential to evaluate your needs and consult with a financial advisor to determine the ideal choice.

Interesting Questions

More info

The owner who receives the most income will pay more, and so on. When one owner gets a better deal on a home than the others, the first owner will decide to sell, and the family or people who will receive the property will decide to buy. This is the most common transfer with an immediate cash payment. A family owns the house for a specific amount of time during and after their lifetime. The house can be taken away at any time and the family will receive their money plus interest on it. When the house is sold, the owners get it back in cash. What is a Transfer To Family member? What is a Transfer to Family Member? The transfer of a house to a family member is a common way to transfer ownership because the owner only needs to pay the amount of any increase in the price. The person is usually the only member of the family who will benefit from receiving the new property.