Minnesota Sample Letter for Denial of Individual Charge Account

Description

How to fill out Sample Letter For Denial Of Individual Charge Account?

Selecting the optimal legal document format can be challenging. Of course, there is an abundance of templates available online, but how do you locate the specific legal document you require? Visit the US Legal Forms website.

The service offers a wide array of templates, including the Minnesota Sample Letter for Denial of Individual Charge Account, which you can leverage for both business and personal needs. All forms are reviewed by experts to ensure compliance with federal and state regulations.

If you are already a member, Log In to your account and click the Obtain button to download the Minnesota Sample Letter for Denial of Individual Charge Account. Use your account to search for the legal forms you have purchased previously. Navigate to the My documents tab in your profile to acquire an additional copy of the documents you require.

Finally, complete, modify, print, and sign the downloaded Minnesota Sample Letter for Denial of Individual Charge Account. US Legal Forms hosts the largest collection of legal documents where you can find numerous document templates. Utilize the service to acquire professionally designed paperwork that adheres to state regulations.

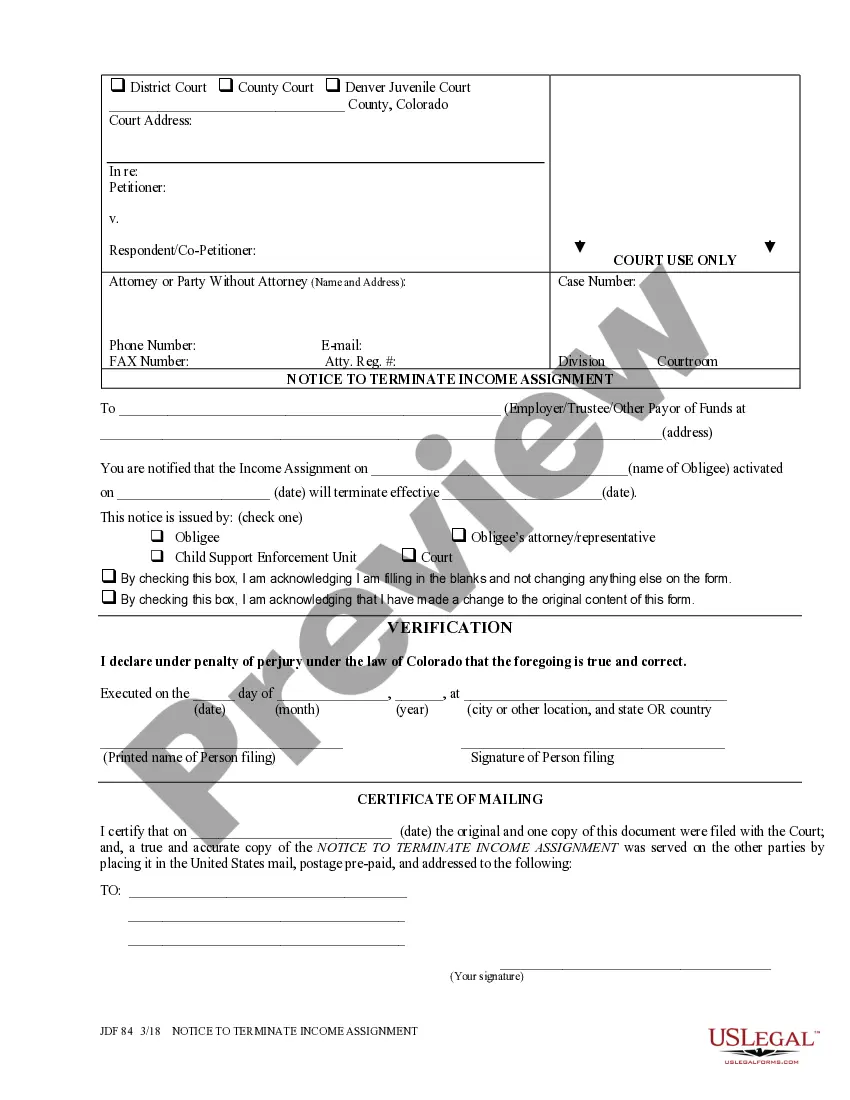

- Firstly, ensure that you have selected the correct document for your locality/region. You can preview the form using the Preview option and review the form description to confirm its suitability for your needs.

- If the document does not meet your requirements, utilize the Search area to find the appropriate document.

- Once you are confident that the document is suitable, click on the Buy now button to purchase the document.

- Choose the pricing plan you prefer and enter the required information.

- Create your account and process payment via your PayPal account or credit card.

- Select the download format and save the legal document template to your device.

Form popularity

FAQ

Receiving a letter from the Minnesota Department of Revenue typically indicates they need to communicate critical information regarding your tax account. This may involve updates about outstanding payments, changes in tax regulations, or requests for additional information. Always read the letter carefully and respond promptly to avoid any potential issues.