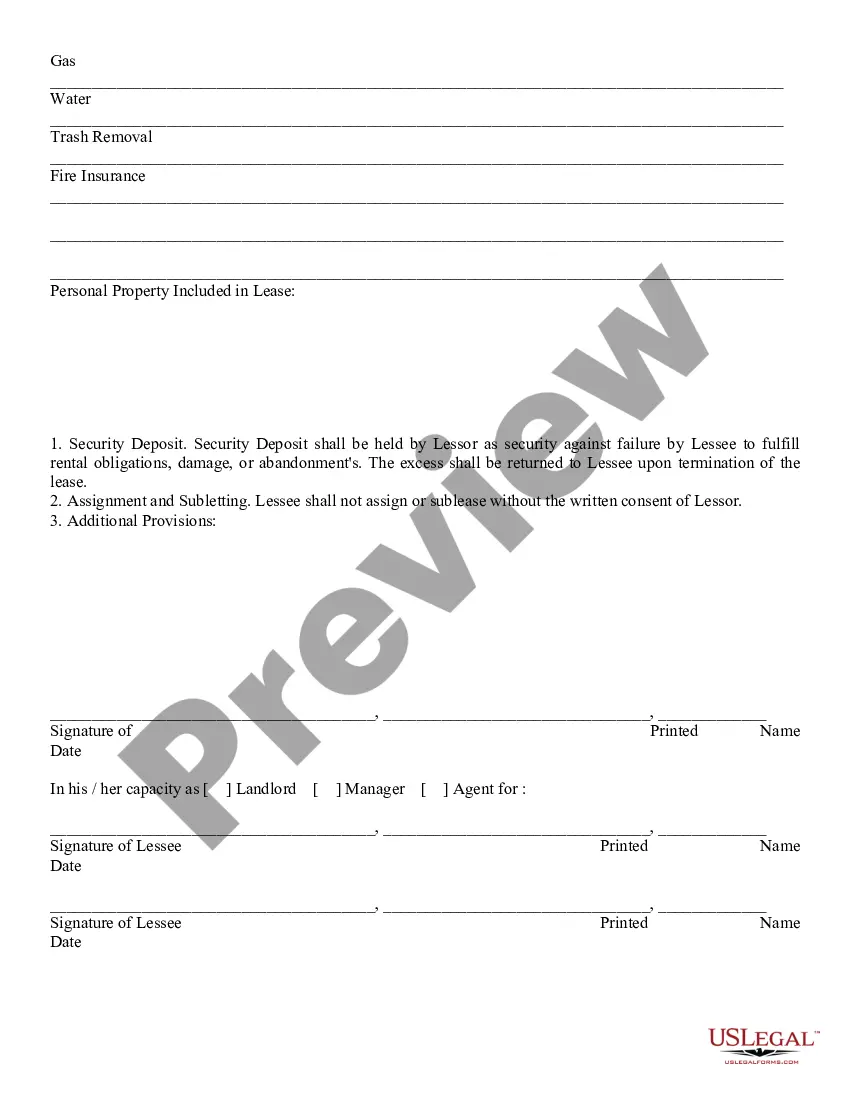

Minnesota Nonresidential Simple Lease is a legal document that outlines the terms and conditions for leasing nonresidential properties in the state of Minnesota. It provides clear guidelines and obligations for both the property owner (lessor) and the tenant (lessee) in a straightforward and easily understandable manner. This type of lease agreement is commonly used for commercial properties such as office buildings, retail spaces, warehouses, and industrial facilities. It is designed to simplify the leasing process while ensuring that the rights and responsibilities of all parties involved are properly addressed. The Minnesota Nonresidential Simple Lease typically includes crucial details such as the names and addresses of the lessor and lessee, the description and location of the leased property, the lease term (start and end date), rental payment information, security deposit requirements, and any additional charges or fees. Furthermore, the lease outlines the permitted uses of the nonresidential property, including any restrictions or limitations imposed by the lessor. It may also cover maintenance and repair responsibilities, insurance requirements, and provisions for alterations or improvements to the property. Other types of nonresidential lease agreements in Minnesota may include variations such as the Net Lease, Gross Lease, Percentage Lease, or Triple Net Lease. These lease types differ in terms of the financial responsibilities of the parties involved and the allocation of expenses related to the property (e.g., taxes, insurance, utilities, and maintenance). Overall, the Minnesota Nonresidential Simple Lease provides a comprehensive framework for leasing nonresidential properties, ensuring that both the lessor and lessee are protected and aware of their respective rights and obligations throughout the lease term.

Minnesota Nonresidential Simple Lease

Description

How to fill out Minnesota Nonresidential Simple Lease?

If you need to total, down load, or print out lawful papers themes, use US Legal Forms, the greatest variety of lawful kinds, which can be found online. Use the site`s easy and practical lookup to obtain the files you want. Numerous themes for business and specific functions are categorized by classes and suggests, or key phrases. Use US Legal Forms to obtain the Minnesota Nonresidential Simple Lease within a couple of click throughs.

Should you be currently a US Legal Forms consumer, log in for your profile and click on the Obtain button to find the Minnesota Nonresidential Simple Lease. You may also access kinds you in the past downloaded within the My Forms tab of your own profile.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape to the appropriate city/nation.

- Step 2. Utilize the Preview option to check out the form`s information. Don`t neglect to read through the information.

- Step 3. Should you be unsatisfied with all the develop, make use of the Lookup field on top of the monitor to find other versions of your lawful develop design.

- Step 4. Once you have identified the shape you want, click on the Acquire now button. Opt for the pricing strategy you favor and add your accreditations to sign up on an profile.

- Step 5. Process the financial transaction. You may use your credit card or PayPal profile to finish the financial transaction.

- Step 6. Choose the file format of your lawful develop and down load it on your own product.

- Step 7. Complete, revise and print out or signal the Minnesota Nonresidential Simple Lease.

Every lawful papers design you acquire is the one you have eternally. You possess acces to every single develop you downloaded in your acccount. Click the My Forms portion and pick a develop to print out or down load yet again.

Remain competitive and down load, and print out the Minnesota Nonresidential Simple Lease with US Legal Forms. There are thousands of specialist and condition-distinct kinds you can use to your business or specific demands.