Minnesota Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

Are you in a position where you need documents for either professional or personal objectives nearly every day.

There are numerous legal form templates accessible online, but finding ones you can trust is not simple.

US Legal Forms offers thousands of document templates, such as the Minnesota Security Agreement related to Sale of Collateral by Debtor, which are crafted to fulfill federal and state requirements.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased under the My documents menu. You can download another copy of the Minnesota Security Agreement related to Sale of Collateral by Debtor whenever necessary by selecting the required form to obtain or print the document template.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Minnesota Security Agreement related to Sale of Collateral by Debtor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

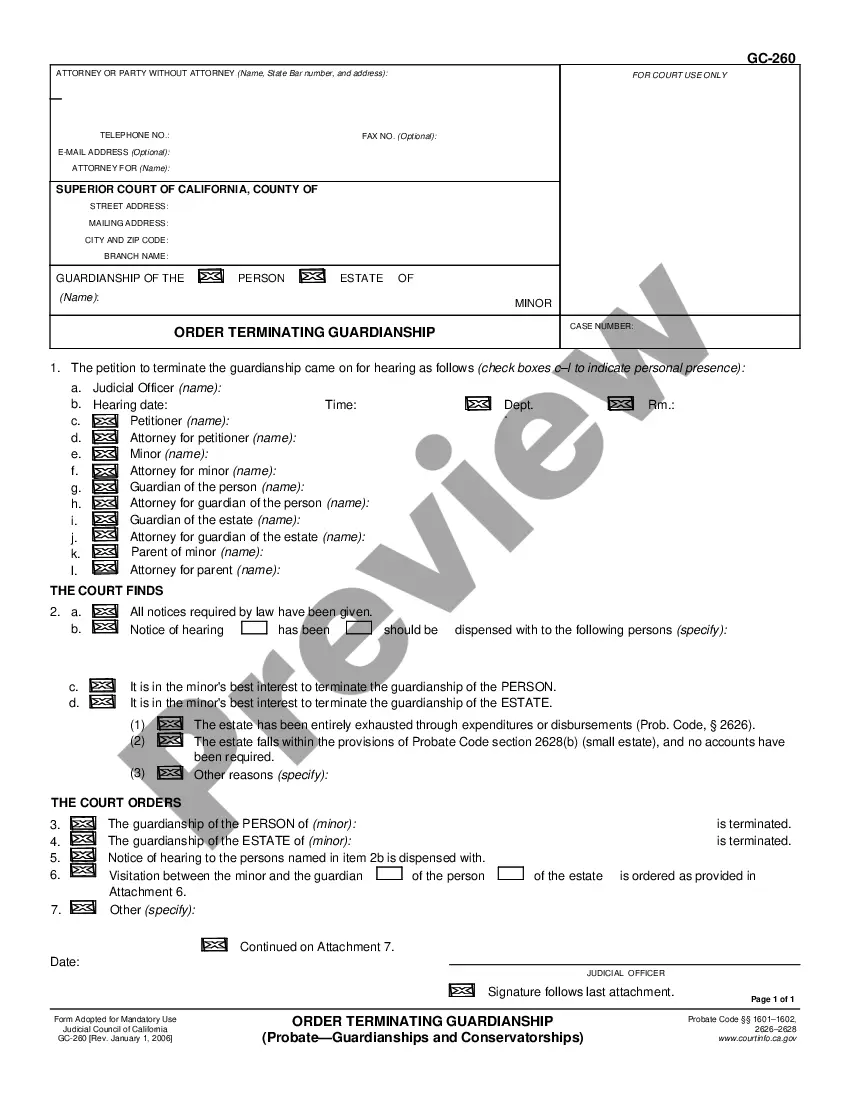

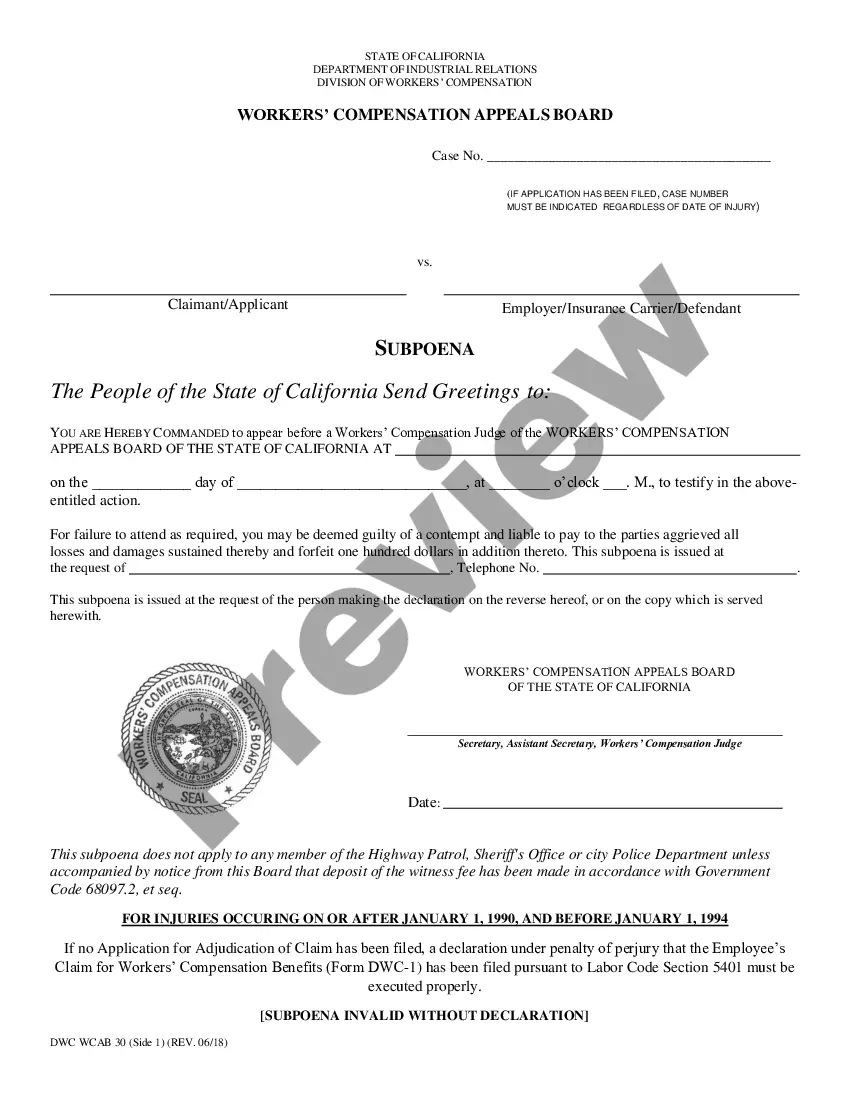

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search section to discover the form that fulfills your needs.

- Once you find the suitable form, click Acquire now.

- Select the payment plan you prefer, input the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

A collateral security interest remains protected for a limited time when the collateral is perfected in one state and then moved to another. Generally, the security interest continues for a period, typically four months, in the new state before requiring re-perfection under the regulations that govern the Minnesota Security Agreement involving Sale of Collateral by Debtor. It’s vital to act promptly to ensure the security interest remains enforceable.

When collateral is sold, several implications arise for both the debtor and the secured party. The Minnesota Security Agreement involving Sale of Collateral by Debtor typically requires notification to the secured party about the sale. This ensures the secured party can protect their rights and interests. Furthermore, the original obligations of the debtor remain, and the proceeds from the sale may be applied toward the outstanding debt.

When a secured party claims a security interest in collateral that has been sold by the debtor, the security interest may shift focus. The secured party retains the right to pursue the value obtained from the sale, depending on the terms of the Minnesota Security Agreement involving Sale of Collateral by Debtor. Additionally, the debtor's obligations under the agreement remain intact, which means they must satisfy their debt despite selling the collateral.

Yes, a security agreement must contain a description of the collateral that reasonably identifies it. This requirement is crucial for the enforceability of the security interest. When creating a Minnesota Security Agreement involving Sale of Collateral by Debtor, focus on providing a thorough and clear description. This approach will benefit both parties in the long run.

A security agreement must contain essential elements such as the identity of the parties involved, a clear description of the collateral, and the terms of the security interest. It should also outline what happens in case of default. When drafting your Minnesota Security Agreement involving Sale of Collateral by Debtor, make sure you cover all these aspects thoroughly.

A security agreement is a contract between the debtor and the secured party that outlines the terms of the security interest. In contrast, a UCC filing is a public notice that establishes the secured party’s claim on the collateral. While the security agreement details the terms and conditions, the UCC filing serves to inform third parties about the security interest. Understanding these distinctions is essential when preparing a Minnesota Security Agreement involving Sale of Collateral by Debtor.

An example of collateral description in a security agreement could be 'all inventory, equipment, and accounts receivable related to the business operations of XYZ Corp.' This description clearly identifies the specific assets tied to the agreement. When creating a Minnesota Security Agreement involving Sale of Collateral by Debtor, it is important to be precise about the collateral to avoid any misunderstandings.

Yes, a written security agreement should include a summary of the collateral. This information provides clarity and helps both parties understand what is at stake in the agreement. A clear summary can also prevent disputes in the future. If you are drafting a Minnesota Security Agreement involving Sale of Collateral by Debtor, ensure the collateral is well-defined.

To place a lien on someone's property in Minnesota, you must have a valid debt and file the appropriate lien documents with the county recorder or registrar of titles. This process usually involves providing evidence of the debt and the agreement made. A Minnesota Security Agreement involving Sale of Collateral by Debtor can enhance your case by documenting the transaction clearly and authorizing your claim.

Minnesota has specific rules governing liens that protect lenders and borrowers alike. Generally, liens must be filed promptly and contain accurate information about the debtor and the collateral involved. A Minnesota Security Agreement involving Sale of Collateral by Debtor can help you comply with these rules effectively, providing a safeguard for both parties.