A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships.

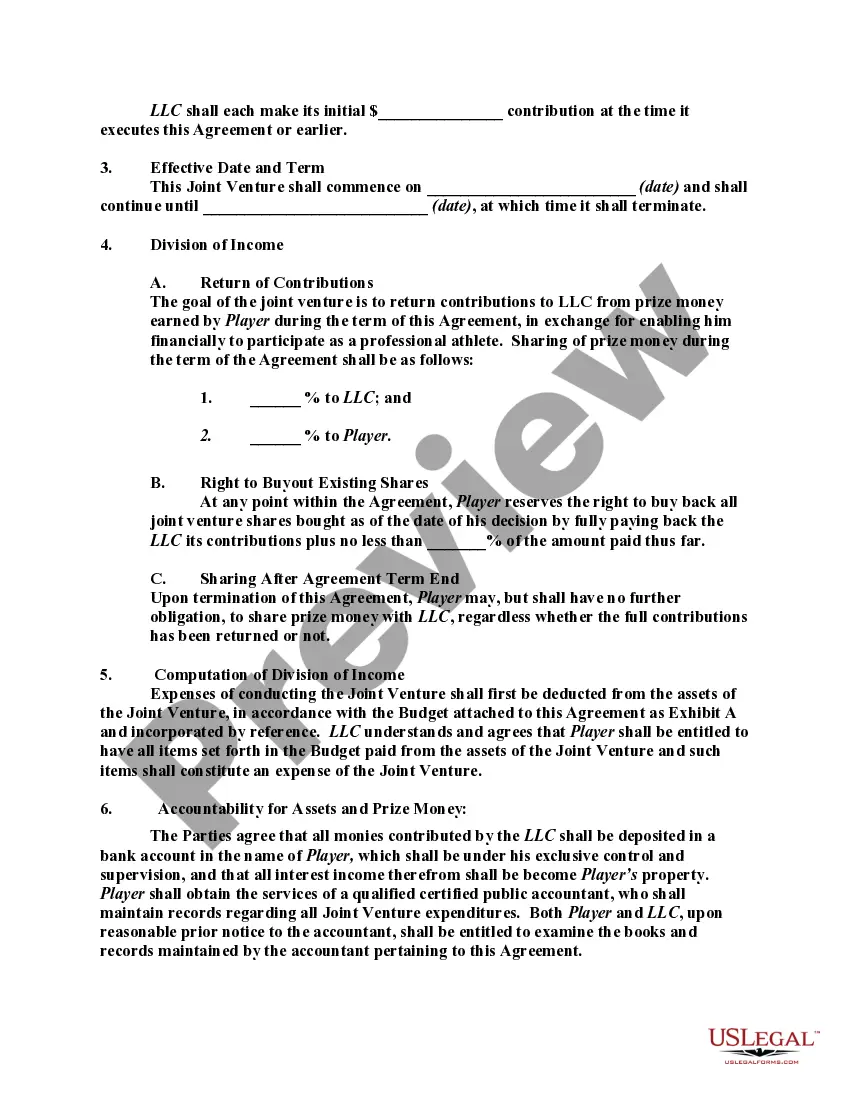

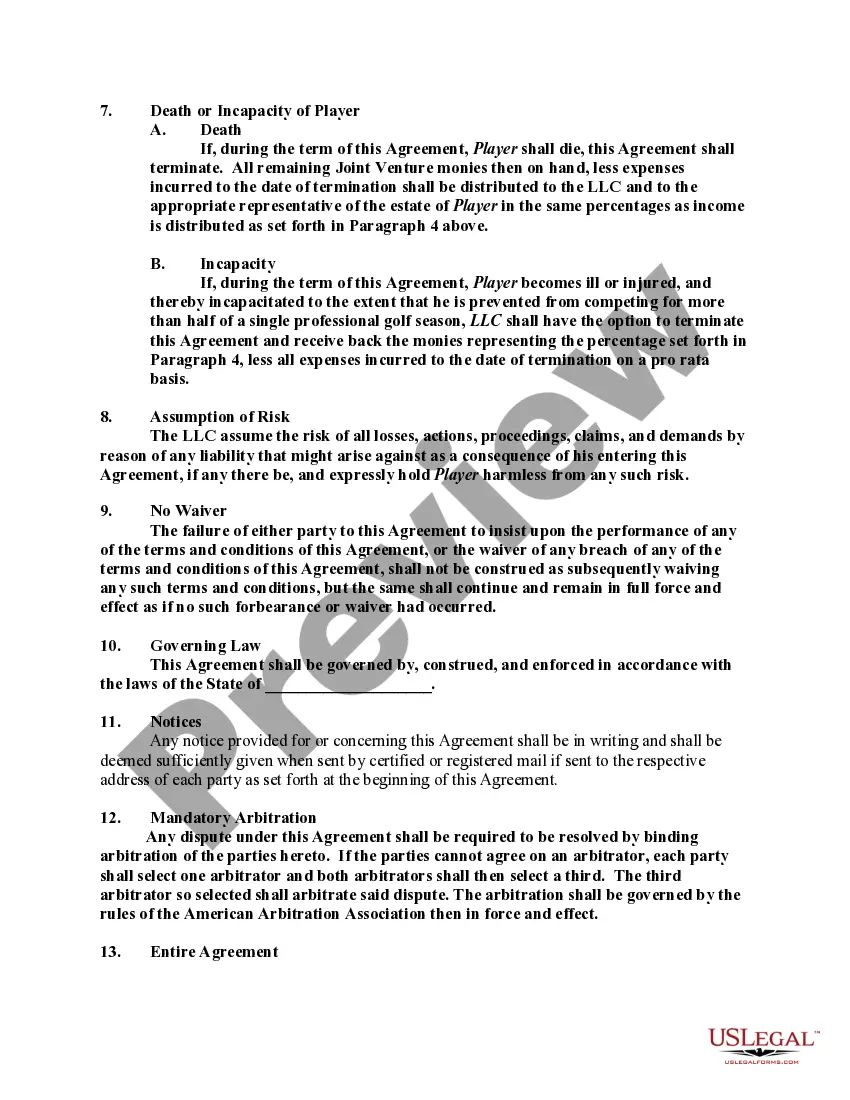

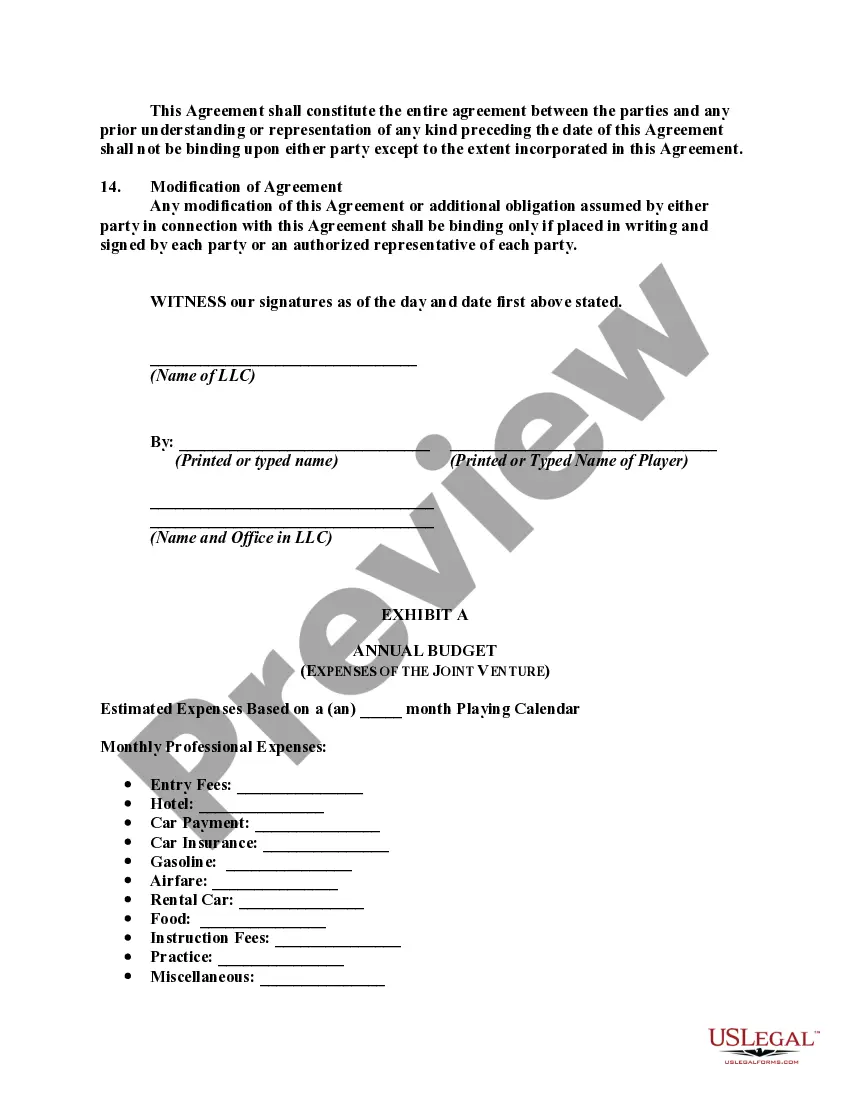

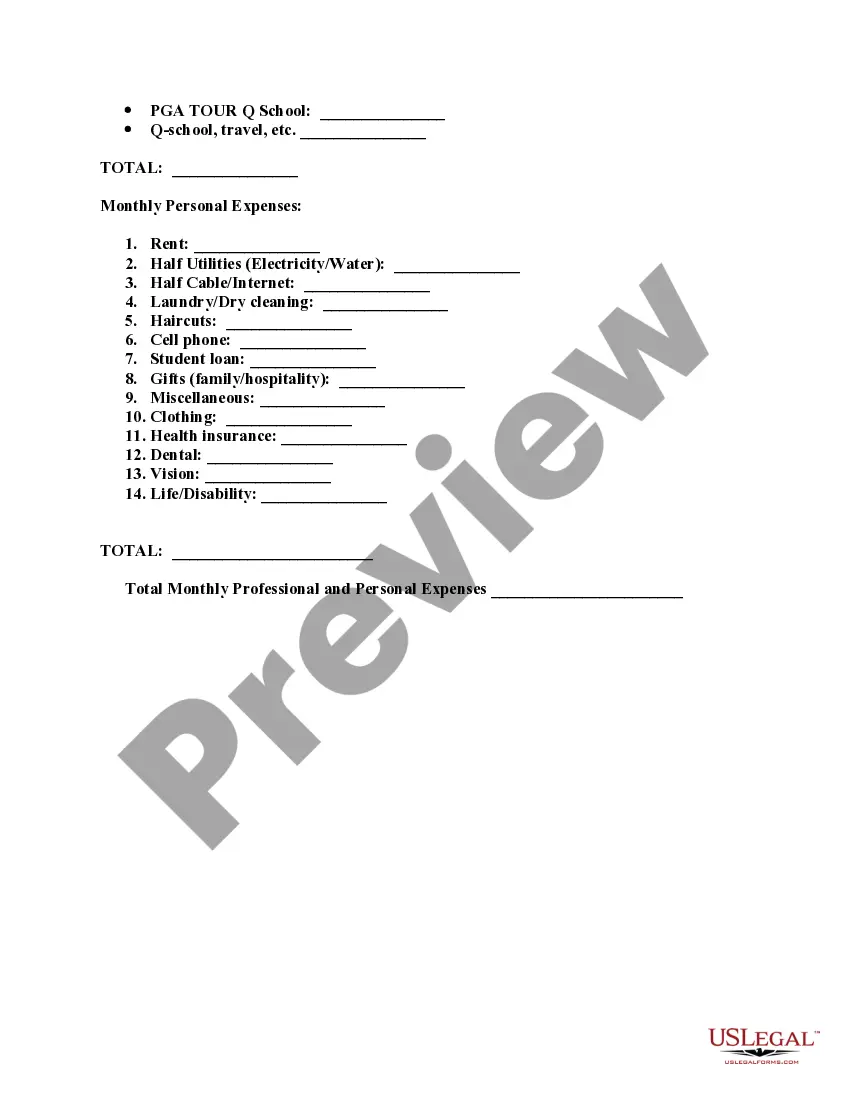

Title: Exploring the Minnesota Joint Venture Agreement Between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds Introduction: In the realm of sports sponsorship, joint ventures often play a crucial role in promoting talents and creating mutually beneficial partnerships. This article aims to provide a detailed description of a specific type of joint venture agreement in Minnesota, forged between a Limited Liability Company (LLC) and a professional golfer. The focus revolves around sponsorship and financial support, enabling both parties to achieve their goals. Read on to understand the intricacies and potential variations of this arrangement. 1. Understanding the Minnesota Joint Venture Agreement: The Minnesota Joint Venture Agreement is a legally binding contract that outlines the terms and conditions between an LLC and a professional golfer seeking sponsorship and financial assistance. This collaborative partnership aims to support the golfer's career aspirations and ensure the LLC receives valuable exposure and promotional benefits in return. 2. Objectives of the Joint Venture Agreement: The primary goal of this joint venture is two-fold: a. Sponsorship Support: The agreement facilitates financial assistance by the LLC to cover the golfer's training expenses, entry fees for golf tournaments, equipment costs, travel expenses, and more. b. Promotional Exposure: In return for funding, the professional golfer agrees to represent the LLC's brand, wear sponsored apparel, display logos, participate in marketing campaigns, and attend brand-associated events. 3. Key Elements of the Joint Venture Agreement: a. Financial Contributions: This section specifies the amount and frequency of funds that the LLC will provide as sponsorship. It also outlines how the golfer should allocate and spend the funds, ensuring transparency and accountability. b. Scope of Promotion: Here, the agreement outlines the extent to which the golfer will represent the LLC. It includes obligations such as logo placement, advertisement appearances, social media endorsements, and participation in events or media engagements. c. Duration and Termination: The agreement defines the specific time period for which the partnership will remain valid, along with details on how either party can terminate the joint venture prematurely upon violation of terms or unsatisfactory performance. d. Profit-Sharing and Ownership: In cases where the joint venture generates profits, this section outlines how they will be shared between the golfer and the LLC. It may also address the ownership of intellectual property rights related to promoting the golfer's brand. 4. Potential Variations of the Minnesota Joint Venture Agreement: While the core principles of the agreement remain consistent, specific variations may arise based on individual circumstances and preferences. Some possible types of Minnesota Joint Venture Agreements include: a. Performance-Based Agreement: The LLC may choose to structure funding based on the golfer's achievement of specific milestones, such as tournament wins or ranking improvements. b. Exclusive Sponsorship Agreement: The LLC becomes the sole sponsor of the professional golfer, preventing them from forming competing partnerships with other companies. c. Endorsement Deal Agreement: This type of joint venture agreement focuses on the golfer exclusively endorsing and promoting the LLC's products or services outside the golfing realm. Conclusion: The Minnesota Joint Venture Agreement between a Limited Liability Company and a Professional Golfer to Sponsor and Provide Funds is a strategic partnership enabling financial support and promotional exposure for the golfer's career. Though the fundamental aspects of the agreement remain intact, potential variations exist based on performance, exclusivity, or endorsement preferences. By forging successful joint ventures, both parties can thrive and achieve their respective goals within the golfing industry.Title: Exploring the Minnesota Joint Venture Agreement Between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds Introduction: In the realm of sports sponsorship, joint ventures often play a crucial role in promoting talents and creating mutually beneficial partnerships. This article aims to provide a detailed description of a specific type of joint venture agreement in Minnesota, forged between a Limited Liability Company (LLC) and a professional golfer. The focus revolves around sponsorship and financial support, enabling both parties to achieve their goals. Read on to understand the intricacies and potential variations of this arrangement. 1. Understanding the Minnesota Joint Venture Agreement: The Minnesota Joint Venture Agreement is a legally binding contract that outlines the terms and conditions between an LLC and a professional golfer seeking sponsorship and financial assistance. This collaborative partnership aims to support the golfer's career aspirations and ensure the LLC receives valuable exposure and promotional benefits in return. 2. Objectives of the Joint Venture Agreement: The primary goal of this joint venture is two-fold: a. Sponsorship Support: The agreement facilitates financial assistance by the LLC to cover the golfer's training expenses, entry fees for golf tournaments, equipment costs, travel expenses, and more. b. Promotional Exposure: In return for funding, the professional golfer agrees to represent the LLC's brand, wear sponsored apparel, display logos, participate in marketing campaigns, and attend brand-associated events. 3. Key Elements of the Joint Venture Agreement: a. Financial Contributions: This section specifies the amount and frequency of funds that the LLC will provide as sponsorship. It also outlines how the golfer should allocate and spend the funds, ensuring transparency and accountability. b. Scope of Promotion: Here, the agreement outlines the extent to which the golfer will represent the LLC. It includes obligations such as logo placement, advertisement appearances, social media endorsements, and participation in events or media engagements. c. Duration and Termination: The agreement defines the specific time period for which the partnership will remain valid, along with details on how either party can terminate the joint venture prematurely upon violation of terms or unsatisfactory performance. d. Profit-Sharing and Ownership: In cases where the joint venture generates profits, this section outlines how they will be shared between the golfer and the LLC. It may also address the ownership of intellectual property rights related to promoting the golfer's brand. 4. Potential Variations of the Minnesota Joint Venture Agreement: While the core principles of the agreement remain consistent, specific variations may arise based on individual circumstances and preferences. Some possible types of Minnesota Joint Venture Agreements include: a. Performance-Based Agreement: The LLC may choose to structure funding based on the golfer's achievement of specific milestones, such as tournament wins or ranking improvements. b. Exclusive Sponsorship Agreement: The LLC becomes the sole sponsor of the professional golfer, preventing them from forming competing partnerships with other companies. c. Endorsement Deal Agreement: This type of joint venture agreement focuses on the golfer exclusively endorsing and promoting the LLC's products or services outside the golfing realm. Conclusion: The Minnesota Joint Venture Agreement between a Limited Liability Company and a Professional Golfer to Sponsor and Provide Funds is a strategic partnership enabling financial support and promotional exposure for the golfer's career. Though the fundamental aspects of the agreement remain intact, potential variations exist based on performance, exclusivity, or endorsement preferences. By forging successful joint ventures, both parties can thrive and achieve their respective goals within the golfing industry.