Minnesota Sale of Partnership to Corporation refers to the legal process in which a partnership entity transfers its ownership and operations to a corporation entity in the state of Minnesota. This transition can occur due to various reasons, such as changes in business structure, tax benefits, liability concerns, or strategic business decisions. The Minnesota Sale of Partnership to Corporation typically involves a comprehensive agreement between the partners of the existing partnership and the acquiring corporation. This agreement outlines the terms and conditions of the sale, including the transfer of assets, liabilities, contracts, intellectual property, and other relevant properties of the partnership. There are several types of Minnesota Sale of Partnership to Corporation, including: 1. Complete Acquisition: In this type, the corporation acquires the entire partnership, including all assets, liabilities, and ongoing business operations. The partnership entity is dissolved, and the corporation becomes the new legal entity responsible for all business activities. 2. Partial Acquisition: In a partial acquisition, the corporation acquires only a portion of the partnership assets or specific business divisions. The remaining partnership continues to exist, either with reduced operations or with a new focus. 3. Merger: A merger involves the combining of both the partnership and the corporation to form a new entity. The partnership and corporation assets, liabilities, and operations are merged into the newly created entity, often resulting in a stronger and more diversified business structure. 4. Conversion: Conversion refers to the process where the partnership is legally transformed into a corporation. This can be accomplished by amending the partnership agreement and filing the necessary documents with the Minnesota Secretary of State. The converted partnership becomes a wholly-owned subsidiary of the newly created corporation. During the Minnesota Sale of Partnership to Corporation, it is crucial to consult legal and financial professionals to ensure compliance with state laws, tax regulations, and other legal requirements. Additionally, partners may need to consider potential implications such as capital gains tax, dissolution procedures, employee rights, and the impact on business contracts and relationships. In conclusion, Minnesota Sale of Partnership to Corporation involves the transfer of a partnership's ownership and operations to a corporation in the state of Minnesota. The process may vary based on the type of sale chosen, including complete acquisition, partial acquisition, merger, or conversion. Partners interested in pursuing this transition should seek professional guidance to navigate the legal and financial complexities involved.

Minnesota Sale of Partnership to Corporation

Description

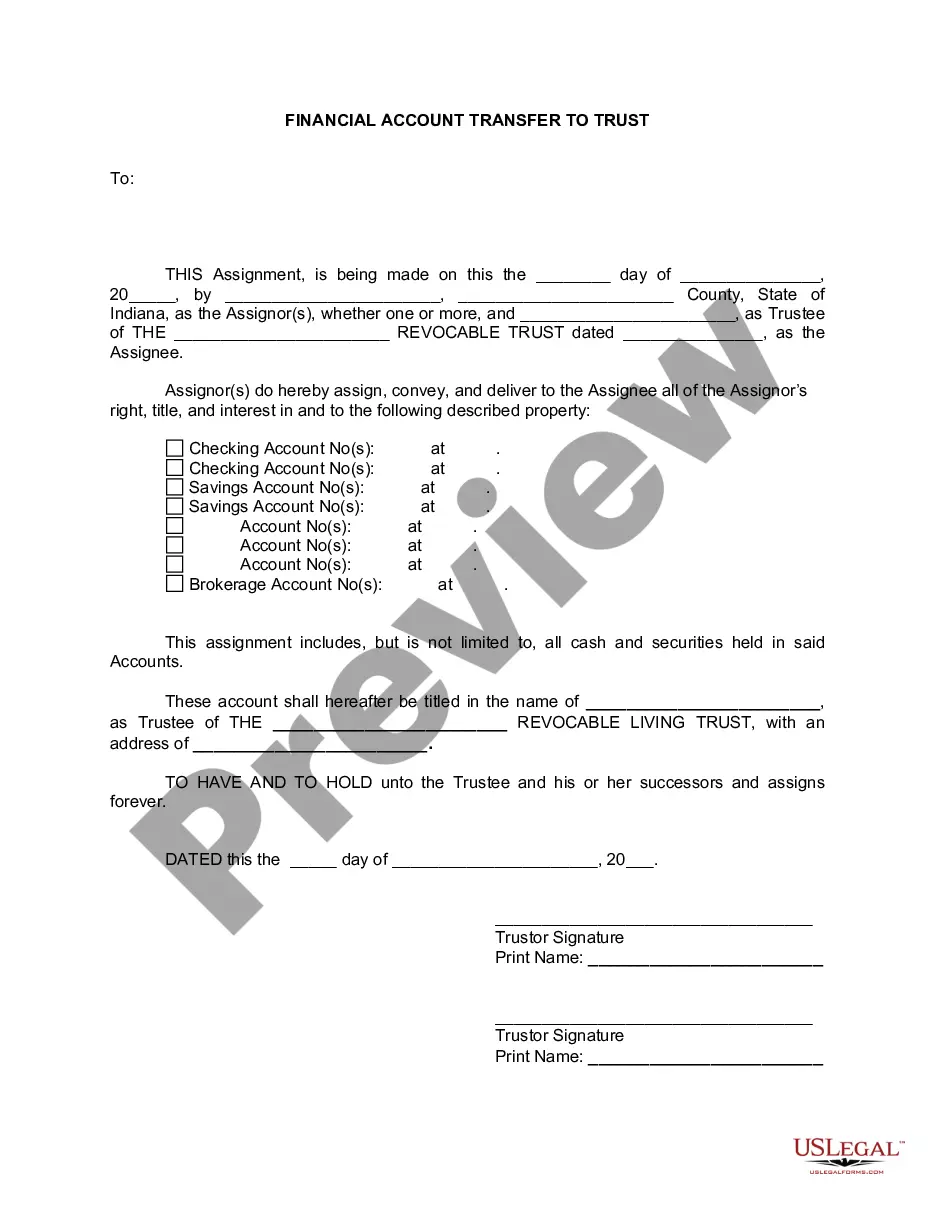

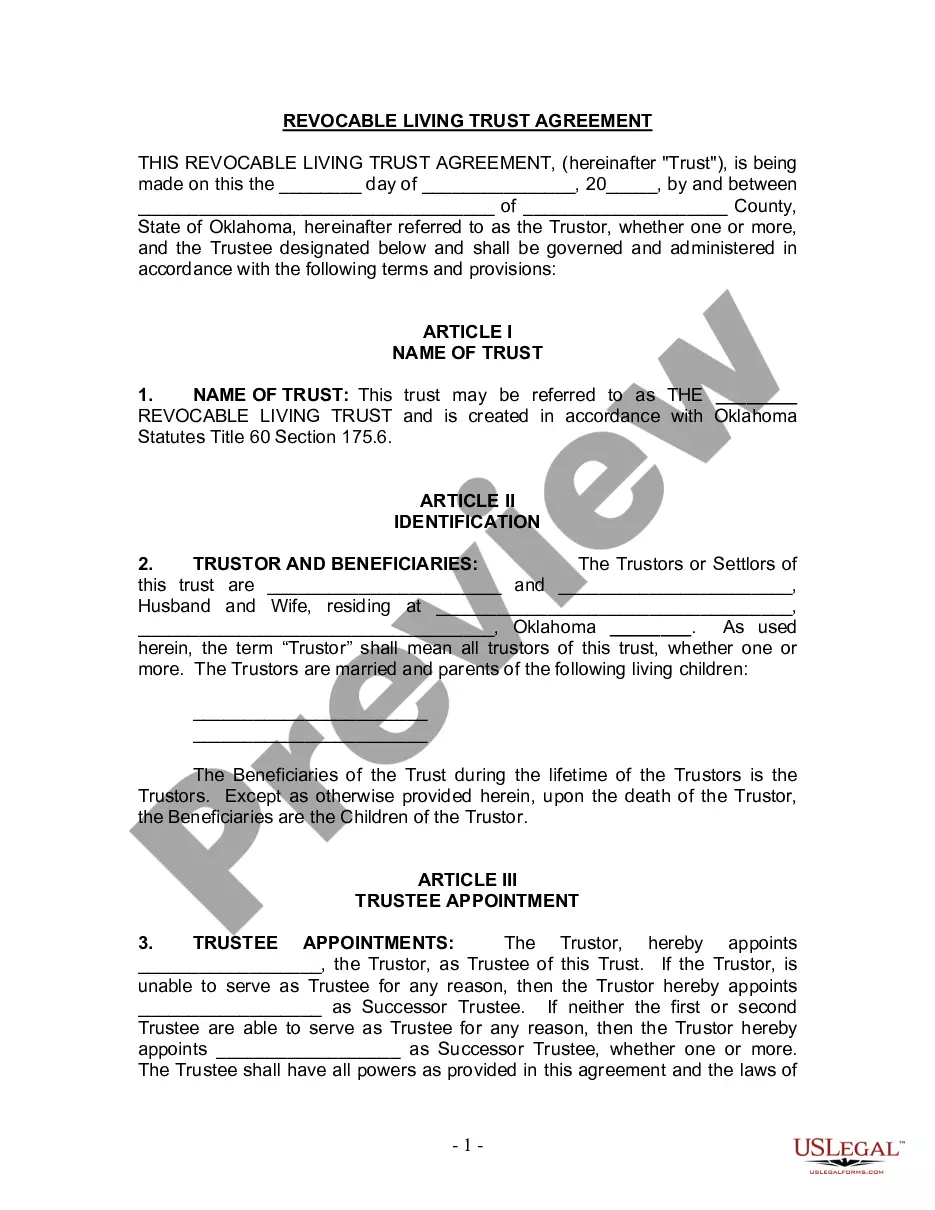

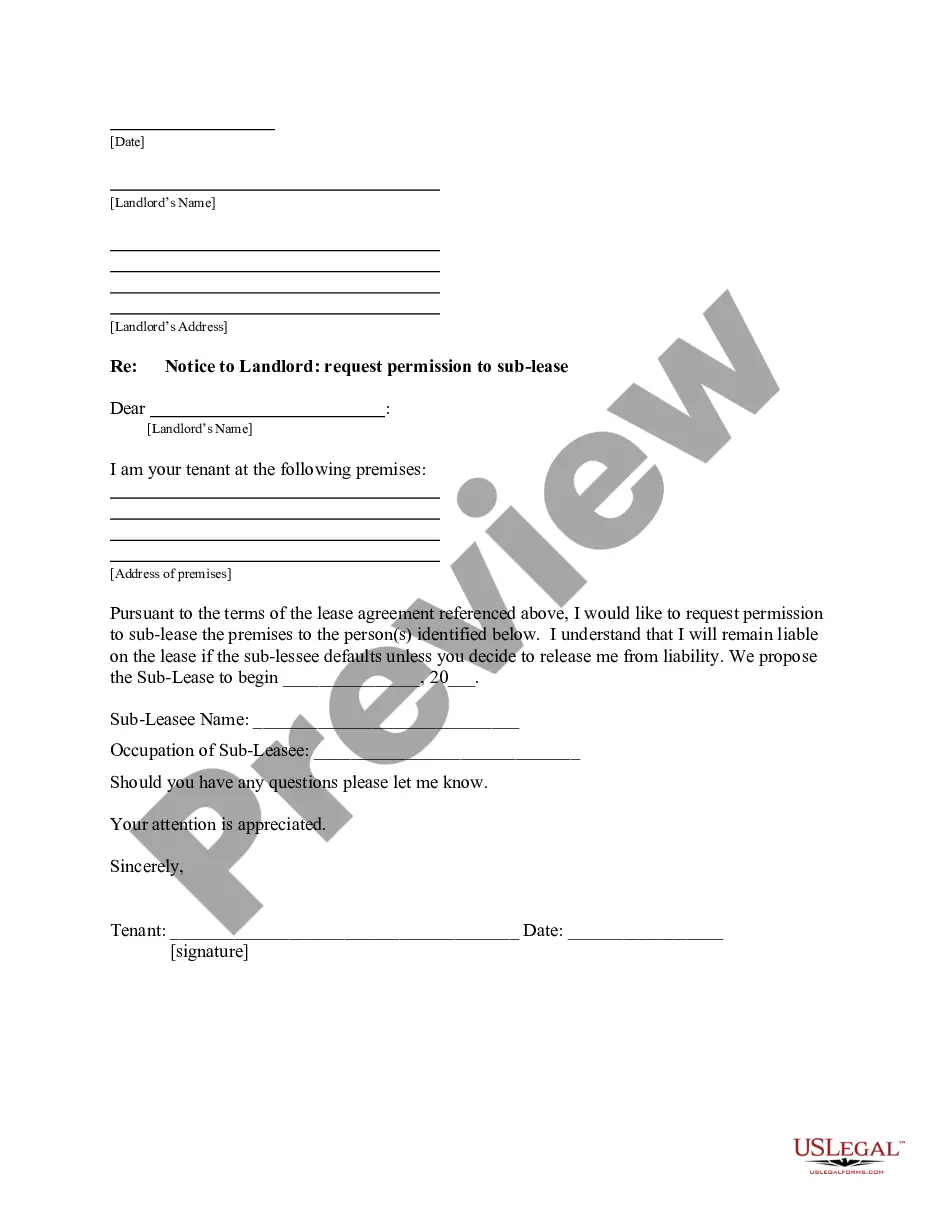

How to fill out Minnesota Sale Of Partnership To Corporation?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by genres, states, or keywords. You can obtain the latest versions of forms such as the Minnesota Sale of Partnership to Corporation in moments.

If you already have an account, Log In and retrieve the Minnesota Sale of Partnership to Corporation from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously saved forms under the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device.Edit. Fill out, modify, print, and sign the saved Minnesota Sale of Partnership to Corporation.Every template added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you need.Access the Minnesota Sale of Partnership to Corporation using US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- Make sure to select the correct form for your area/region.

- Click the Preview button to examine the form's details.

- Review the form description to confirm you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, verify your choice by clicking on the Download now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Yes, converting a partnership to a corporation can have tax implications in Minnesota. This conversion can trigger a taxable event, meaning the partnership may owe taxes on appreciated assets. If you are planning a Minnesota Sale of Partnership to Corporation, consider the tax consequences carefully. Engaging with uslegalforms can assist in managing the legal aspects of this transition while keeping tax considerations in focus.

The apportionment rule in Minnesota determines how a business allocates its income between multiple states for tax purposes. This is particularly important when dealing with a Minnesota Sale of Partnership to Corporation, as it can affect where you owe taxes. Generally, the apportionment relies on sales, property, and payroll factors. Understanding this rule helps ensure accurate reporting and compliance.

Failing to file a partnership tax return can lead to penalties, interest on unpaid taxes, and potential legal issues with the state of Minnesota. The state might impose fines that accumulate over time, making it increasingly expensive to resolve the issue. If you are undergoing a Minnesota Sale of Partnership to Corporation, it is wise to file timely and correctly to prevent complications later. Resources like uslegalforms can help you navigate your obligations effectively.

If you are part of a partnership doing business in Minnesota, the partnership itself is required to file a partnership tax return. Each partner also receives a schedule K-1 detailing their share of the income. This is important for reporting, especially during a Minnesota Sale of Partnership to Corporation, as it affects the overall tax obligations. Make sure your records are clear and consult with uslegalforms to simplify the process.

Certain individuals may be exempt from paying Minnesota income tax including low-income earners and some non-residents. If you fall under specific income thresholds or if your income comes from tax-exempt sources, such as municipal bonds, you might qualify for exemptions. However, if you are in the process of a Minnesota Sale of Partnership to Corporation, clarify your tax liability with an expert to avoid surprises.

In Minnesota, anyone who earns income or has a business presence in the state is required to file a tax return. This includes residents, part-year residents, and non-residents with Minnesota-source income. If you're involved in a Minnesota Sale of Partnership to Corporation, understanding your filing obligations becomes crucial. Make sure to consult a tax professional to ensure you meet all requirements.

The taxation of a limited partnership sale primarily depends on the profit made from the sale of its assets or from the partners' interests. In most cases, the transaction may result in capital gains tax, which is important to understand during a Minnesota Sale of Partnership to Corporation. Factors like individual partner's tax position and the partnership's structure also play a critical role in determining the overall tax implications. Engaging with tax professionals can help clarify these details.

Yes, you can convert an existing LLC to an S Corporation. This process requires filing an election with the IRS using Form 2553 and fulfilling state registration requirements. It's important to review your existing LLC Agreement to ensure it can accommodate this change. Utilizing the right resources, such as the US Legal Forms platform, can guide you through the complexities of converting your LLC, particularly in terms of a Minnesota Sale of Partnership to Corporation.

Changing your LLC to an S Corporation in Minnesota involves a few key steps. You will need to file Form 2553 with the IRS for S Corp election and then submit any necessary state-level paperwork. Additionally, make sure your operating agreement is updated to align with the new corporate structure. This proactive approach could enhance your business's tax structure, particularly in light of any future Minnesota Sale of Partnership to Corporation.

To convert an LLC to an S Corporation in Minnesota, you must first file Form 2553 with the IRS to elect S Corporation status. Next, you can file the appropriate state forms with the Minnesota Secretary of State to ensure compliance. Be mindful that the process involves changing your tax structure and potentially altering your operating agreement to reflect this new status. This transition can be advantageous, especially in relation to a Minnesota Sale of Partnership to Corporation.

Interesting Questions

More info

Search Related Documents Related Search.