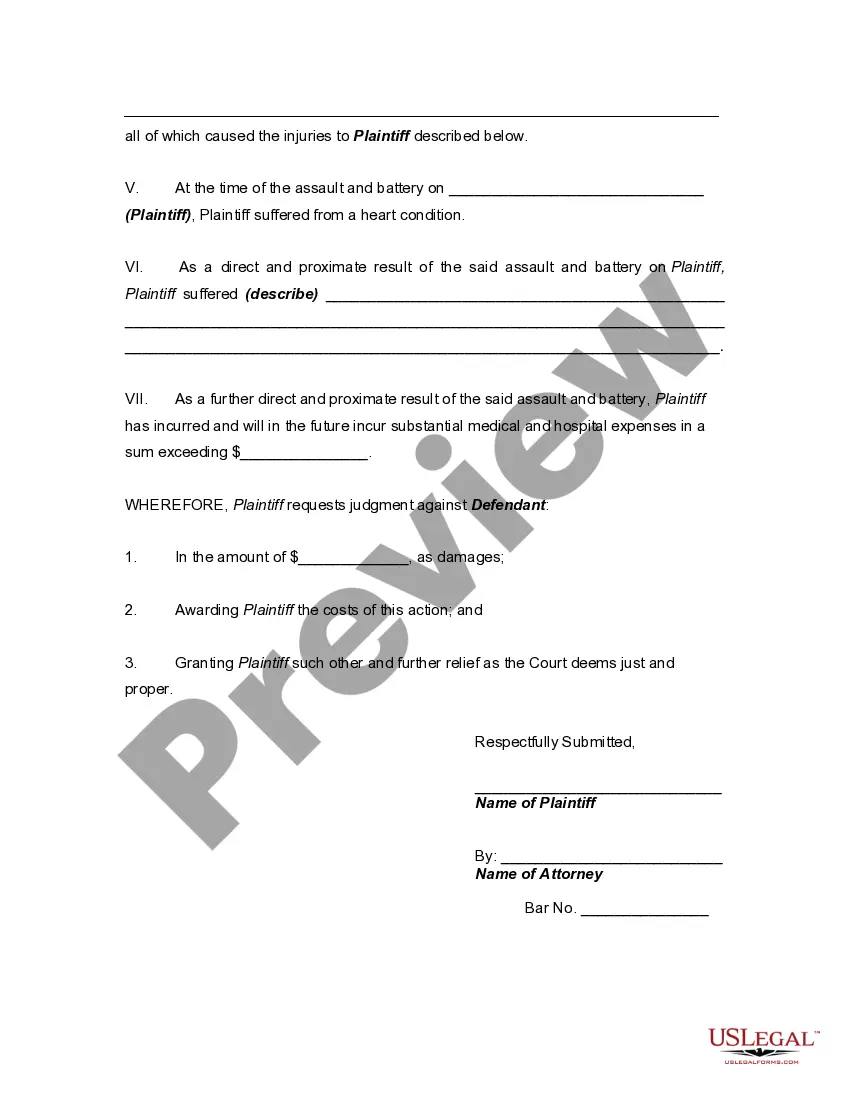

If you wish to comprehensive, obtain, or printing legal papers web templates, use US Legal Forms, the biggest variety of legal forms, which can be found on the Internet. Make use of the site`s simple and easy convenient research to discover the documents you will need. A variety of web templates for business and specific purposes are categorized by groups and suggests, or keywords. Use US Legal Forms to discover the Minnesota Complaint against Bank Branch Manager for Assault and Battery for Attacking Customer in a number of mouse clicks.

If you are already a US Legal Forms buyer, log in for your bank account and click on the Obtain switch to have the Minnesota Complaint against Bank Branch Manager for Assault and Battery for Attacking Customer. Also you can gain access to forms you in the past acquired in the My Forms tab of your bank account.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have chosen the shape to the right town/land.

- Step 2. Utilize the Review choice to check out the form`s content. Do not overlook to learn the explanation.

- Step 3. If you are unhappy with the kind, take advantage of the Lookup field towards the top of the screen to find other types of your legal kind design.

- Step 4. After you have located the shape you will need, go through the Get now switch. Pick the costs prepare you like and put your credentials to sign up on an bank account.

- Step 5. Procedure the purchase. You can use your bank card or PayPal bank account to accomplish the purchase.

- Step 6. Select the formatting of your legal kind and obtain it on your own device.

- Step 7. Total, edit and printing or sign the Minnesota Complaint against Bank Branch Manager for Assault and Battery for Attacking Customer.

Every legal papers design you get is the one you have eternally. You might have acces to every kind you acquired within your acccount. Select the My Forms area and choose a kind to printing or obtain yet again.

Contend and obtain, and printing the Minnesota Complaint against Bank Branch Manager for Assault and Battery for Attacking Customer with US Legal Forms. There are millions of skilled and status-particular forms you may use to your business or specific demands.