Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books.

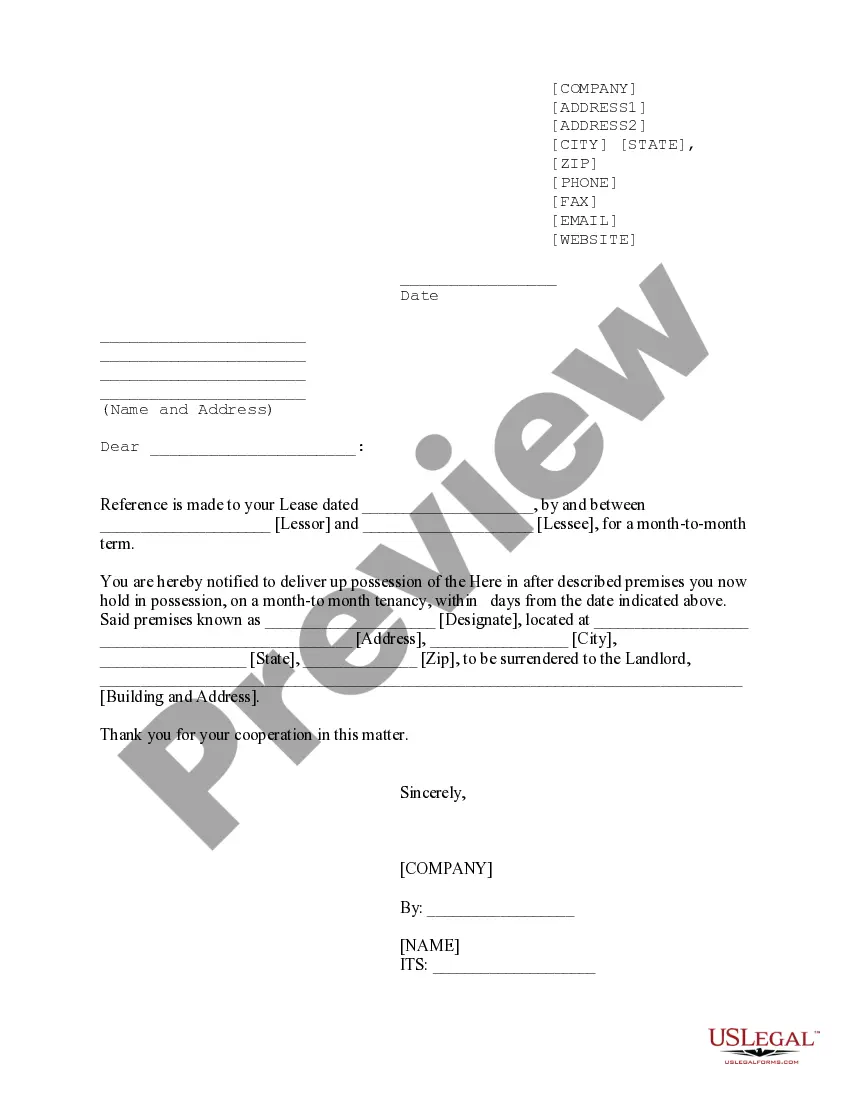

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Minnesota Engagement Letter Between Accounting Firm and Client For Audit Services An engagement letter is a crucial document that serves as a contract and outlines the terms and expectations between an accounting firm and its client for audit services. In Minnesota, specific engagement letters are tailored to comply with state laws and regulations. These letters ensure transparency, establish clear boundaries, and promote a productive working relationship between the accounting firm and the client. Key elements typically included in a Minnesota Engagement Letter for Audit Services: 1. Identity of the Parties: The engagement letter should clearly state the name and address of both the accounting firm and the client, ensuring accurate identification. 2. Scope of Services: It is essential to outline the specific audit services that the accounting firm will provide. This may include financial statement audits, internal control assessments, regulatory compliance audits, or any other audit-specific requirements. 3. Audit Standards: The engagement letter should specify the applicable audit standards adhered to in Minnesota. This could include Generally Accepted Auditing Standards (GAS), Generally Accepted Government Auditing Standards (GAGS), or International Standards on Auditing (ISA). 4. Audit Period: The letter should establish the time frame or periods for which the audit service will be conducted. This ensures both parties have a clear understanding of the scope and duration of the engagement. 5. Fee Structure: Clear details regarding the fee structure should be included. This may encompass fixed fees, hourly rates, or a combination of both. It should also outline any additional charges, such as travel expenses or administrative costs. 6. Reporting and Deliverables: The engagement letter should state the expected deliverables, such as audited financial statements, management letters, or recommendations. It should also clarify the format and timeline for delivering these documents. 7. Confidentiality and Data Security: Ensure compliance with relevant data protection laws by including clauses to safeguard client information and restrict disclosure to third parties without explicit consent. 8. Limitation of Liability: Define the extent of liability on the part of the accounting firm, considering state laws and regulations. This protects both parties from potential legal disputes. Types of Minnesota Engagement Letters Between Accounting Firm and Client for Audit Services: 1. Financial Statement Audit Engagement Letter: Specifically designed for auditing the client's financial statements, ensuring compliance with applicable accounting principles. 2. Compliance Audit Engagement Letter: For audits focused on assessing compliance with specific regulations, such as Internal Revenue Service (IRS) regulations or state regulations mandated by Minnesota authorities. 3. Internal Control Audit Engagement Letter: When the primary purpose of the audit is to evaluate and provide recommendations on the client's internal control systems. In conclusion, a Minnesota Engagement Letter Between Accounting Firm and Client for Audit Services is a comprehensive agreement that establishes the expectations, scope, and terms for auditing services provided by an accounting firm to its client. These letters are tailored to comply with Minnesota state laws and regulations, ensuring a professional and productive working relationship.