A corporation may be organized for the business of conducting a profession. These are known as professional corporations. Doctors, attorneys, engineers, and CPAs are the types of profes¬sionals who may form a professional corporation. Usually there is a designation P.A. or P.C. after the corporate name in order to show that this is a professional association or professional corporation.

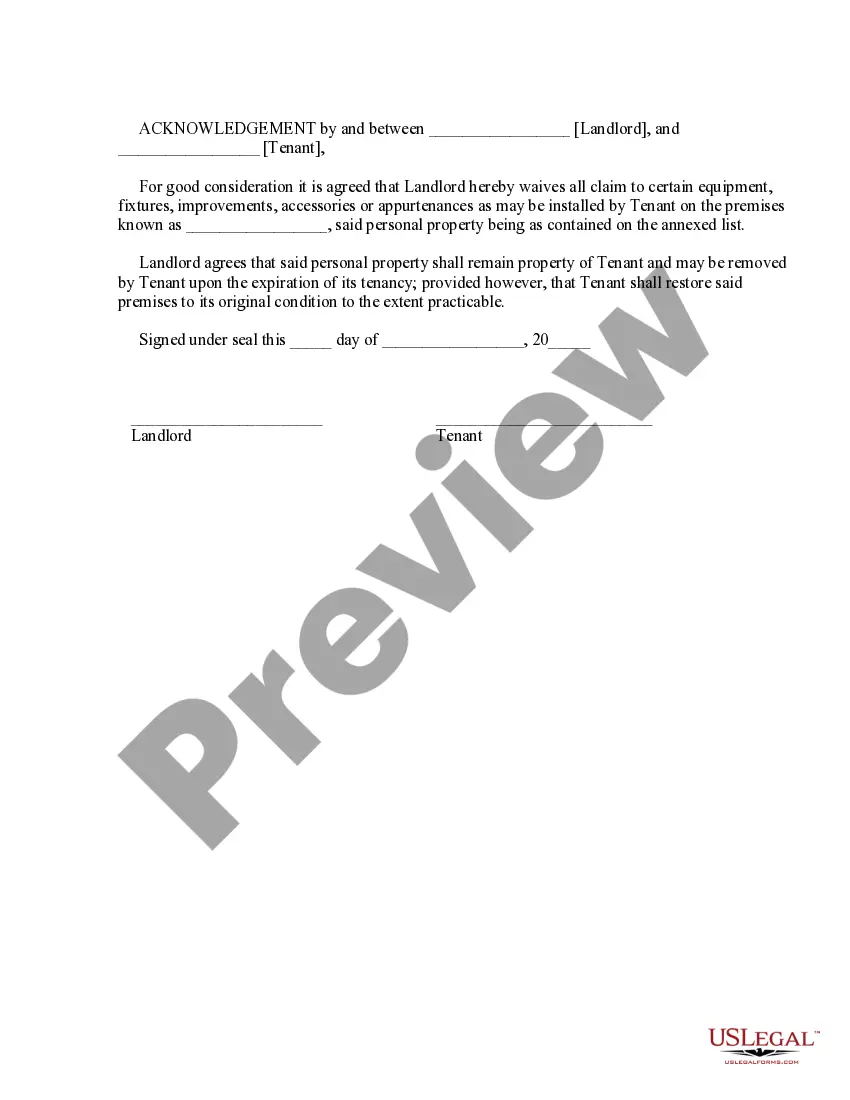

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Keywords: Minnesota, Pre-incorporation Agreement, Professional Corporation of Attorneys, types The Minnesota Pre-incorporation Agreement of Professional Corporation of Attorneys is a legal document that outlines important details and agreements between attorneys who are planning to establish a professional corporation in the state of Minnesota. This agreement is crucial in ensuring a smooth and legally compliant formation of the corporation. The agreement typically covers various essential aspects such as the corporation's name, purpose, principal place of business, and registered agent. It outlines the roles, responsibilities, and rights of the attorneys involved, as well as the initial capital contributions and ownership interests of each attorney shareholder. Furthermore, the agreement provides guidelines for decision-making processes within the corporation, including voting rights, meeting requirements, and procedures for adding or removing shareholders. It also establishes protocols for the allocation and distribution of profits, losses, and liabilities among the attorneys. There are a few different types of Minnesota Pre-incorporation Agreements of Professional Corporation of Attorneys, each tailored to specific needs and circumstances: 1. Standard agreement: This is the most common type of agreement, encompassing essential provisions necessary for the formation and operation of a professional corporation. 2. Customized agreement: In some cases, attorneys may choose to customize the pre-incorporation agreement according to their specific requirements. This allows for greater flexibility in incorporating unique provisions, such as non-compete clauses, confidentiality agreements, or restrictions on transferring ownership shares. 3. Partnership-to-corporation agreement: If a group of attorneys is currently operating as a partnership and wishes to transition to a professional corporation structure, a specific agreement known as the partnership-to-corporation agreement may be drafted. This agreement ensures a smooth conversion process while maintaining the continuity of the partnership. It is important to consult with a legal professional experienced in corporate law to ensure that the Minnesota Pre-incorporation Agreement of Professional Corporation of Attorneys adheres to all relevant laws and regulations, as well as meets the specific needs and goals of the attorneys involved. Proper drafting and execution of this agreement contribute to a well-structured and legally compliant professional corporation of attorneys in Minnesota.