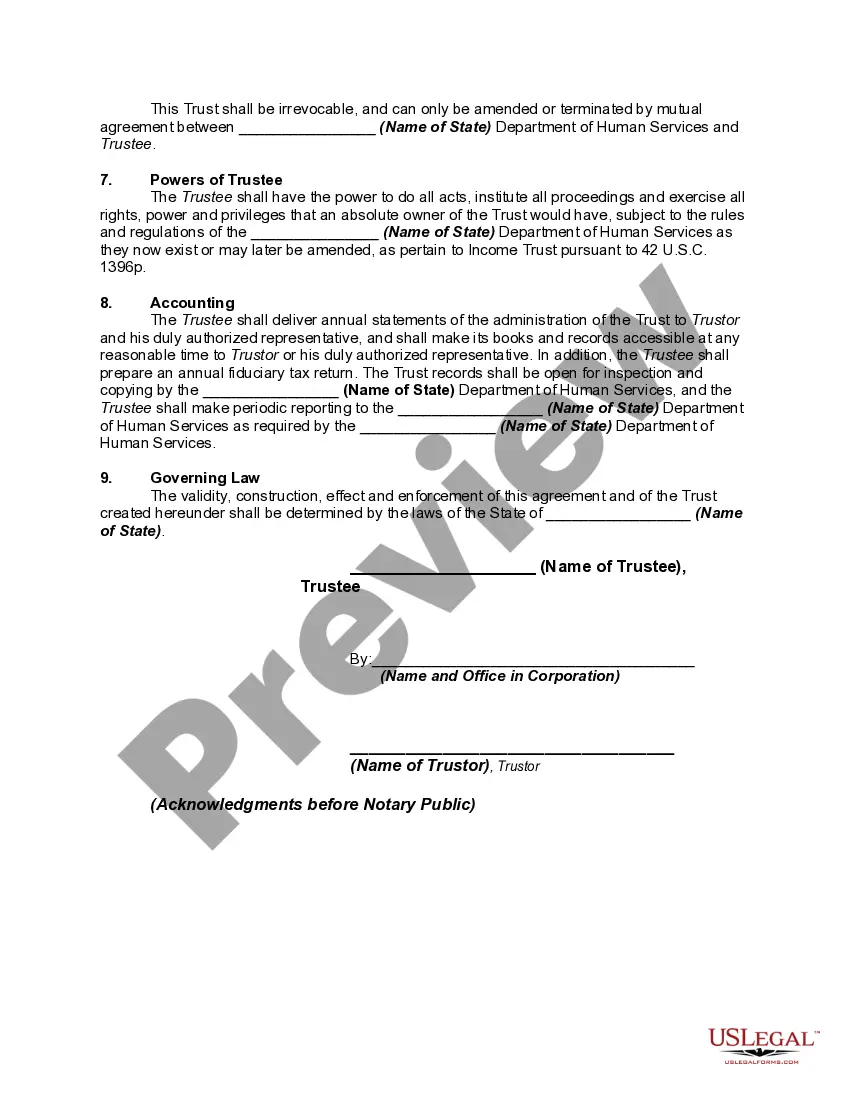

Minnesota Miller Trust Forms for Assisted Living: A Comprehensive Guide Minnesota Miller Trust Forms for Assisted Living play a crucial role for eligible individuals hoping to cover their long-term care costs while still qualifying for the Medical Assistance program in the state of Minnesota. This detailed description aims to shed light on the significance, purpose, and different types of Miller Trust Forms available for assisted living residents. Miller Trust Forms, also known as Qualified Income Trusts, are a specific type of trust established to ensure that individuals with excess income can receive Medicaid benefits. In Minnesota, a Miller Trust is designed for applicants who need to meet the income limit set by the Medical Assistance program but have a monthly income that surpasses this threshold. The key purpose of a Minnesota Miller Trust Form for Assisted Living is to legally redirect the excess income into the trust, which then gets allocated as necessary for various assisted living expenses. By doing so, individuals can maintain their Medicaid eligibility while utilizing their income to cover the costs associated with assisted living services. There are several types of Minnesota Miller Trust Forms available to cater to different situations and conditions. These include: 1. Income-Only Miller Trust: This form is commonly used when the individual's income exceeds the Medical Assistance income limit, but their assets fall within the permissible range. The excess income is diverted into the trust and used solely for assisted living expenses. 2. Exempt Asset Miller Trust: Individuals who possess assets that exceed the allowable limit can utilize this form. It helps in protecting certain assets, such as a primary residence, from being counted when determining eligibility for Medical Assistance. 3. Pooled Miller Trust: This type of trust is suitable for individuals with no family members or loved ones to appoint as trustees. It allows them to pool their assets with other trust participants, ensuring professional management and distribution of funds for assisted living costs. To initiate a Minnesota Miller Trust Form for Assisted Living, certain essential information is required. These include the individual's financial statements, identification documents, and a detailed list of assisted living expenses they anticipate. It is essential to consult with an experienced elder law attorney or a trust specialist who can guide individuals through the process and help in drafting the appropriate trust form based on their unique circumstances. In conclusion, Minnesota Miller Trust Forms for Assisted Living serve as a critical tool for individuals seeking Medical Assistance while exceeding the income limit. Various types of Miller Trust Forms cater to different situations, ensuring individuals can direct their excess income towards essential assisted living expenses. By availing the benefits of a Miller Trust, individuals can effectively combine their finances and assisted living needs, promoting a comfortable and financially sustainable lifestyle in their chosen assisted living facility.

Minnesota Miller Trust Forms for Assisted Living

Description

How to fill out Minnesota Miller Trust Forms For Assisted Living?

If you have to complete, acquire, or print out lawful record themes, use US Legal Forms, the most important collection of lawful varieties, which can be found online. Take advantage of the site`s simple and convenient lookup to get the files you want. Different themes for business and specific reasons are sorted by groups and states, or search phrases. Use US Legal Forms to get the Minnesota Miller Trust Forms for Assisted Living within a couple of clicks.

Should you be already a US Legal Forms customer, log in for your account and then click the Down load switch to find the Minnesota Miller Trust Forms for Assisted Living. You can even gain access to varieties you formerly saved inside the My Forms tab of your account.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for the right metropolis/nation.

- Step 2. Make use of the Review method to look over the form`s content. Do not overlook to read the outline.

- Step 3. Should you be unsatisfied with the kind, make use of the Research industry towards the top of the monitor to discover other models from the lawful kind design.

- Step 4. Once you have found the form you want, go through the Purchase now switch. Opt for the costs strategy you prefer and add your credentials to register for the account.

- Step 5. Method the financial transaction. You can use your Мisa or Ьastercard or PayPal account to finish the financial transaction.

- Step 6. Pick the formatting from the lawful kind and acquire it on the device.

- Step 7. Full, revise and print out or indication the Minnesota Miller Trust Forms for Assisted Living.

Every lawful record design you buy is your own permanently. You might have acces to each and every kind you saved with your acccount. Click the My Forms portion and decide on a kind to print out or acquire once more.

Be competitive and acquire, and print out the Minnesota Miller Trust Forms for Assisted Living with US Legal Forms. There are many expert and status-specific varieties you can utilize for your personal business or specific requires.