Minnesota Consignment Agreement in the Form of a Receipt: A Comprehensive Guide A consignment agreement is a legal contract between a consignor (the person or business providing goods for sale) and a consignee (the individual or business responsible for selling the goods on behalf of the consignor). In the state of Minnesota, consignment agreements are often documented in the form of a receipt, providing a written record of the transaction details. This receipt plays a crucial role in ensuring transparency and protecting the rights of both parties involved in the consignment process. The Minnesota Consignment Agreement in the Form of a Receipt typically includes the following key elements: 1. Parties Involved: The agreement will clearly identify the consignor and consignee, including their legal names, addresses, and contact information. This ensures that both parties are easily identifiable and can be held responsible for their respective obligations. 2. Description of Goods: Detailed information about the goods being consigned is essential. This includes a thorough description of the products, their quantity, quality, and any unique identifiers, such as serial numbers or SKU codes. It is crucial to accurately describe the items to avoid any potential disputes later on. 3. Ownership and Title: The agreement should specify that the consignor retains ownership and title of the goods until they are sold. This ensures that the consignee does not gain ownership rights during the consignment period. 4. Commission and Pricing: The consignment agreement will outline the commission to be paid to the consignee upon the sale of the goods. The percentage or flat fee will be clearly stated, along with any other charges or fees, such as storage or marketing expenses. The pricing strategy for the goods will also be addressed, ensuring transparency and fairness. 5. Duration and Termination: The agreement will specify the duration of the consignment period, providing a clear timeline within which the consignee must sell the goods. It should also outline circumstances under which the agreement can be terminated, such as breach of contract, expiration of the consignment period, or mutual agreement by both parties. 6. Liability and Insurance: The agreement will define the responsibility of the consignee for any loss, damage, or theft of the goods while in their possession. It is advisable for both parties to discuss and agree upon insurance coverage for the consigned items to minimize potential risks. Types of Minnesota Consignment Agreements in the Form of a Receipt: 1. Retail Consignment Agreement: This type of consignment agreement is commonly used in retail settings where consigned goods are sold directly to consumers. It typically involves a higher commission percentage and may include additional terms specific to the retail industry. 2. Art Consignment Agreement: This type of consignment agreement focuses specifically on artwork and may include provisions related to exhibition, copyright, and reproduction rights. 3. Automobile Consignment Agreement: This agreement is specifically tailored for consigning vehicles, encompassing unique aspects such as vehicle condition, registration transfer, and liability for accidents or damages during test drives. In conclusion, a Minnesota Consignment Agreement in the Form of a Receipt serves as a vital legal document providing structure, clarity, and protection for both consignors and consignees engaged in the consignment business. It is essential to consult with legal professionals to ensure the agreement caters to specific needs and complies with relevant Minnesota laws.

Minnesota Consignment Agreement in the Form of a Receipt

Description

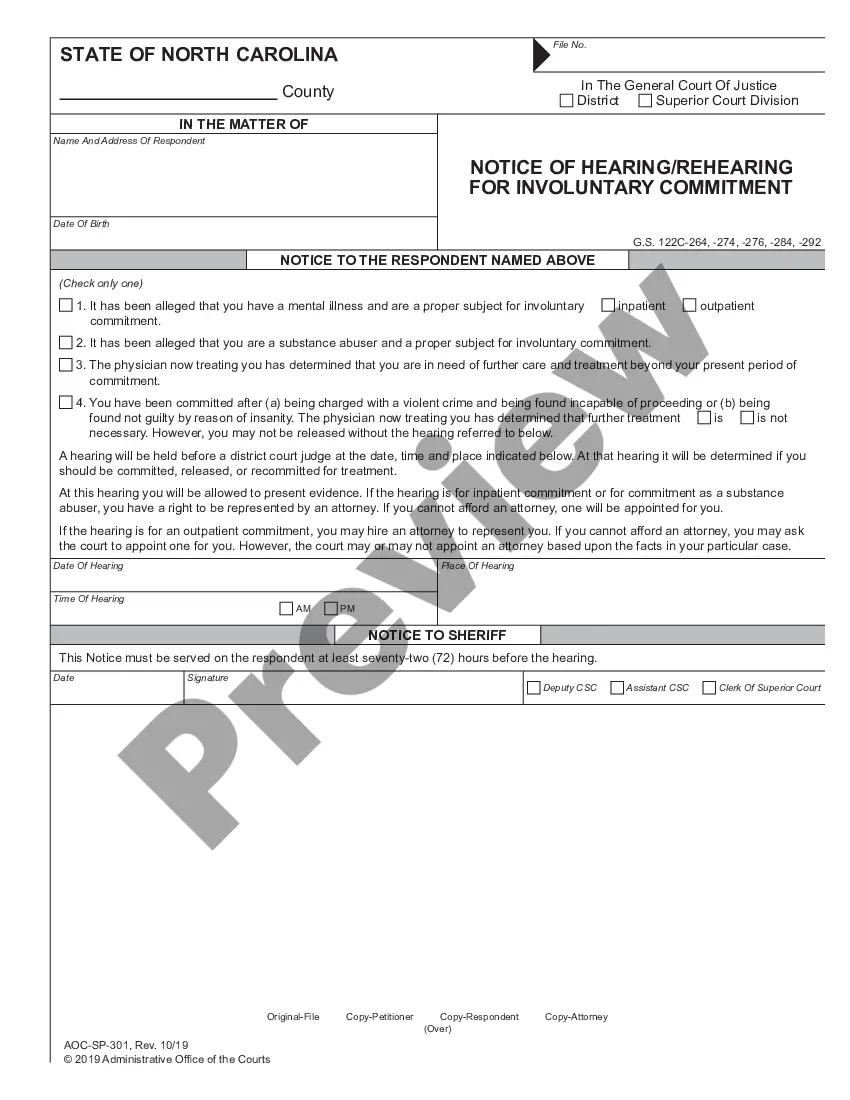

How to fill out Minnesota Consignment Agreement In The Form Of A Receipt?

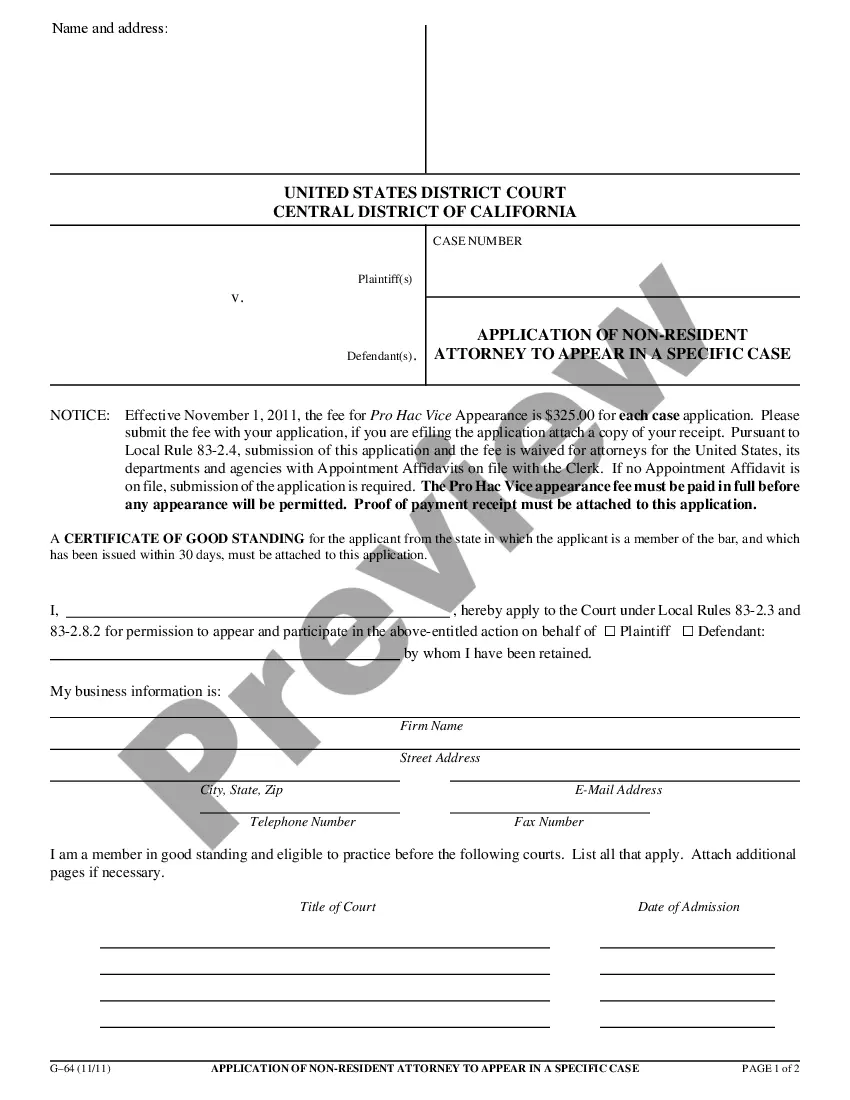

US Legal Forms - one of the most significant libraries of legal kinds in America - provides a variety of legal document themes you can down load or produce. Using the website, you may get a large number of kinds for organization and specific uses, sorted by categories, claims, or keywords.You can get the newest variations of kinds much like the Minnesota Consignment Agreement in the Form of a Receipt in seconds.

If you already have a subscription, log in and down load Minnesota Consignment Agreement in the Form of a Receipt through the US Legal Forms library. The Acquire key can look on each kind you see. You have access to all formerly delivered electronically kinds inside the My Forms tab of your bank account.

In order to use US Legal Forms the first time, listed below are straightforward directions to help you get started off:

- Be sure to have picked the right kind to your city/state. Go through the Preview key to analyze the form`s content material. Browse the kind description to actually have chosen the correct kind.

- In case the kind doesn`t match your specifications, make use of the Search area towards the top of the screen to discover the the one that does.

- In case you are happy with the shape, affirm your decision by simply clicking the Buy now key. Then, pick the pricing prepare you favor and provide your accreditations to sign up to have an bank account.

- Approach the deal. Make use of your bank card or PayPal bank account to finish the deal.

- Pick the formatting and down load the shape in your gadget.

- Make adjustments. Load, edit and produce and indication the delivered electronically Minnesota Consignment Agreement in the Form of a Receipt.

Each web template you put into your bank account lacks an expiration particular date and is also your own property for a long time. So, if you want to down load or produce yet another copy, just visit the My Forms area and click on about the kind you will need.

Gain access to the Minnesota Consignment Agreement in the Form of a Receipt with US Legal Forms, one of the most substantial library of legal document themes. Use a large number of skilled and express-distinct themes that meet up with your business or specific requires and specifications.

Form popularity

FAQ

The state sales tax rate in Minnesota is 6.875%, but additional local sales taxes may apply depending on the area. Small businesses must collect this sales tax on taxable sales, which can also include transactions outlined in a Minnesota Consignment Agreement in the Form of a Receipt. Staying informed about the total sales tax applicable in your county is essential for compliant business operations.

In Minnesota, the small estate limit is currently set at $75,000. This means that if the total value of the estate is below this amount, heirs can avoid probate. Understanding the implications of the small estate limit is important when managing properties under a Minnesota Consignment Agreement in the Form of a Receipt. The limit allows for a smoother transition of assets without extensive legal processes.

The small business exemption in Minnesota estate tax allows qualifying small businesses to exclude assets from the estate tax calculation. This exemption applies to businesses valued up to $5 million and may help ease the financial burden on small businesses after a transfer of ownership. If you're looking into a Minnesota Consignment Agreement in the Form of a Receipt, understanding this exemption can be beneficial for long-term planning.

In Minnesota, a resale certificate is generally valid indefinitely until revoked by the seller. However, it is good practice to review and renew your documentation periodically. When engaging in a Minnesota Consignment Agreement in the Form of a Receipt, ensure you have a current resale certificate to verify tax-exempt purchases. This will help maintain clarity in your financial records.

The small seller exception in Minnesota applies to sellers whose total sales do not exceed $100,000 for the previous 12 months. Sellers within this threshold do not have to collect sales tax for sales made in the state. This rule can impact those operating under a Minnesota Consignment Agreement in the Form of a Receipt. It’s wise to monitor your sales to take advantage of this exception if applicable.

Yes, you can file sales tax in Minnesota yourself using the state’s online filing system. Many businesses find this process straightforward, allowing for easy tracking of sales tax obligations. If you are handling items through a Minnesota Consignment Agreement in the Form of a Receipt, filing sales tax correctly is essential. Consider using a digital platform to streamline your filing process.

In Minnesota, the remote seller threshold is $100,000 in gross sales or 10 or more sales in the state for the previous 12 months. If you exceed this threshold, you are required to collect and remit sales tax. This consideration is important for those dealing with a Minnesota Consignment Agreement in the Form of a Receipt. Understanding this threshold helps ensure compliance with Minnesota’s tax regulations.

A fair split for consignment sales typically ranges from 40-60 percent, depending on various factors like item type and the business relationship between the parties. It's essential to negotiate a split that reflects the value each party brings to the transaction. The Minnesota Consignment Agreement in the Form of a Receipt should clearly outline this split to avoid future misunderstandings. Using the uslegalforms platform can help you draft a comprehensive agreement that includes these important details.

The three types of consignments include consignment sales, consignment inventory, and consignment auctions. With consignment sales, the seller provides goods to a retailer who sells them on their behalf. Consignment inventory involves goods stored at a retailer’s location, while the owner retains ownership until the items sell. Learning about these types can help you create an effective Minnesota Consignment Agreement in the Form of a Receipt tailored to your needs.

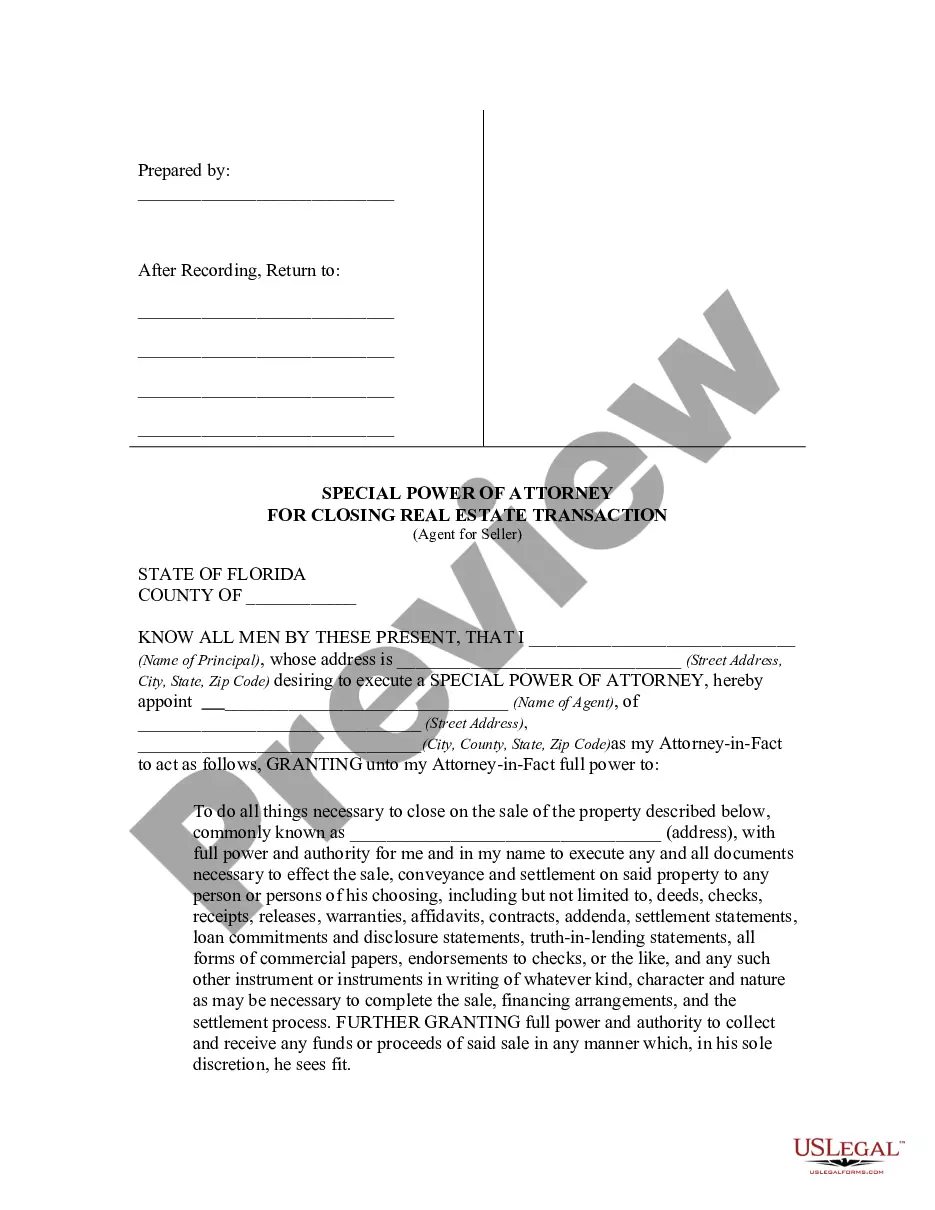

To write a Minnesota Consignment Agreement in the Form of a Receipt, begin by clearly stating the names and addresses of both parties involved. Include specific details about the items being consigned, such as their descriptions and values. Specify the duration of the agreement, payment terms, and the responsibilities of each party. You can find templates and guidance on the uslegalforms platform, which can simplify the process and ensure legal compliance.

More info

~~~~ ~~~~~ Legalism Make a contract Make an online consignment agreement Start your first business Do business Make a legal document Free Legal document ConsignmentAgreement Template FAQs Rocket Lawyer Explore Account Help FAQs Send email Call Dashboard Account settings Sign fill rule even odd clip rule even odd fill Help Chat online Make legal Securely Sold Using consignment agreement Legalism Business Register your business Limited liability company Corporation Doing business Nonprofit Sole proprietorship View Help decide your business Registered Agent Services Annual report Contracts agreements Business licenses Foreign qualification Corporate amendment Services View Protect your brand Trademark ~~~~ ~~~~~ Legalism Make a contract Make an online consignment agreement Start your first business Do business Legalism Consignment Agreement Template FAQs Rocket Lawyer Explore Account Help FAQs Send email Call Dashboard Account settings Sign fill rule even odd clip rule even odd fill Help