A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

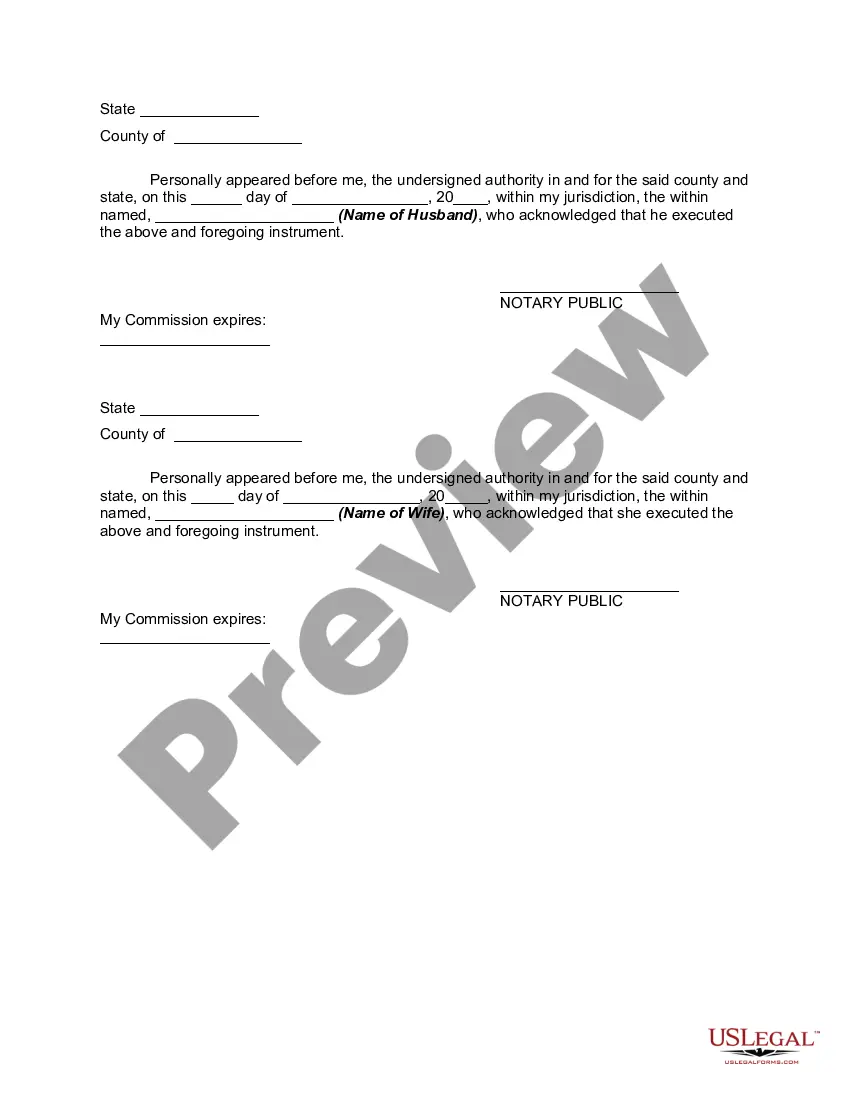

A Minnesota Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property is a legal document used to change the classification of joint or marital property into separate property. In the state of Minnesota, this agreement allows spouses to convert their shared assets into individual assets, providing clarity and protection in the event of a divorce or separation. These agreements are particularly relevant for couples in Minnesota who are seeking to delineate ownership rights over specific assets within their marriage. Whether due to personal or financial reasons, transmutation agreements allow couples to make strategic decisions about their property and financial matters during their marriage. There are several types of Minnesota Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, each catering to different needs and circumstances: 1. Non-marital Property Conversion: This type of agreement is often used when one spouse wishes to convert non-marital property, such as assets acquired prior to the marriage or through gifts or inheritances, into separate property. By transmuting these assets, the couple agrees that they will no longer be considered marital property subject to division upon divorce. 2. Division of Marital Assets: In some cases, spouses may decide to convert jointly-owned marital assets into separate property to ensure individual ownership and control. This type of agreement is particularly relevant when there is a significant disparity in contributions to the property or when one spouse wishes to protect specific assets. 3. Conversion of Retirement Accounts: Minnesota Transmutation or Postnuptial Agreements can also be used to convert retirement accounts, such as individual retirement accounts (IRAs) or 401(k) plans, into separate property. This allows spouses to maintain control and ownership over their retirement assets rather than subjecting them to potential division during divorce proceedings. 4. Real Estate Transmutation: Couples may also utilize this agreement to convert jointly-owned real estate or other property into separate property. By doing so, they can establish individual ownership and protect their respective interests in the property. It is important to note that these agreements must meet specific legal requirements to be enforceable in Minnesota. They must be in writing, signed by both spouses, and notarized. Both parties should have ample time to review the terms and conditions, seek legal advice if necessary, and enter into the agreement voluntarily. In conclusion, a Minnesota Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property allows couples to modify the classification of joint assets, providing clarity and protection in the event of divorce or separation. By converting community property into separate property, couples can establish individual ownership, protect specific assets, and make strategic decisions about their financial matters during their marriage.A Minnesota Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property is a legal document used to change the classification of joint or marital property into separate property. In the state of Minnesota, this agreement allows spouses to convert their shared assets into individual assets, providing clarity and protection in the event of a divorce or separation. These agreements are particularly relevant for couples in Minnesota who are seeking to delineate ownership rights over specific assets within their marriage. Whether due to personal or financial reasons, transmutation agreements allow couples to make strategic decisions about their property and financial matters during their marriage. There are several types of Minnesota Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, each catering to different needs and circumstances: 1. Non-marital Property Conversion: This type of agreement is often used when one spouse wishes to convert non-marital property, such as assets acquired prior to the marriage or through gifts or inheritances, into separate property. By transmuting these assets, the couple agrees that they will no longer be considered marital property subject to division upon divorce. 2. Division of Marital Assets: In some cases, spouses may decide to convert jointly-owned marital assets into separate property to ensure individual ownership and control. This type of agreement is particularly relevant when there is a significant disparity in contributions to the property or when one spouse wishes to protect specific assets. 3. Conversion of Retirement Accounts: Minnesota Transmutation or Postnuptial Agreements can also be used to convert retirement accounts, such as individual retirement accounts (IRAs) or 401(k) plans, into separate property. This allows spouses to maintain control and ownership over their retirement assets rather than subjecting them to potential division during divorce proceedings. 4. Real Estate Transmutation: Couples may also utilize this agreement to convert jointly-owned real estate or other property into separate property. By doing so, they can establish individual ownership and protect their respective interests in the property. It is important to note that these agreements must meet specific legal requirements to be enforceable in Minnesota. They must be in writing, signed by both spouses, and notarized. Both parties should have ample time to review the terms and conditions, seek legal advice if necessary, and enter into the agreement voluntarily. In conclusion, a Minnesota Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property allows couples to modify the classification of joint assets, providing clarity and protection in the event of divorce or separation. By converting community property into separate property, couples can establish individual ownership, protect specific assets, and make strategic decisions about their financial matters during their marriage.