Minnesota Stock Purchase Agreement is a legally binding document that outlines the terms and conditions of the sale and purchase of company stocks between two sellers and one investor. This agreement ensures that the transfer of stocks and the transfer of title occur simultaneously upon the execution of the agreement. It serves as a crucial instrument in facilitating smooth stock transactions in Minnesota, protecting the rights and interests of all parties involved. The Minnesota Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement can be categorized into three different types, based on the nature and purpose of the stock transaction: 1. Straight Stock Purchase Agreement: This type of agreement entails the sale and purchase of company stocks without any additional provisions or conditions. The agreement establishes the terms of the sale, including the purchase price, the number of shares being sold, and any warranties or representations made by the sellers. It also outlines the obligations and responsibilities of both sides. 2. Stock Purchase Agreement with Due Diligence: In this type of agreement, the buyer, or investor, has the opportunity to conduct due diligence on the company whose stocks are being sold. Due diligence allows the buyer to assess the company's financial condition, assets, liabilities, and other vital information to make an informed decision. The agreement specifies the timeline and scope of due diligence and defines the consequences if any material issues are discovered. 3. Stock Purchase Agreement with Earn out Provision: An Darn out provision is a mechanism used when the purchase price of stocks is contingent upon future performance or milestones achieved by the company being acquired. This type of agreement is often used when the seller plays an ongoing role in the company's operations or when certain performance targets need to be met. The agreement defines to earn out structure, the criteria for measuring performance, and the consequences if the targets are not met. In all types of Minnesota Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement, the agreement commonly includes provisions related to representations and warranties, indemnification, dispute resolution, confidentiality, and any other specific arrangements agreed upon by the parties involved. It is important for all parties to seek legal counsel to ensure that the Minnesota Stock Purchase Agreement reflects their intentions accurately and protects their respective rights and interests.

Minnesota Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement

Description

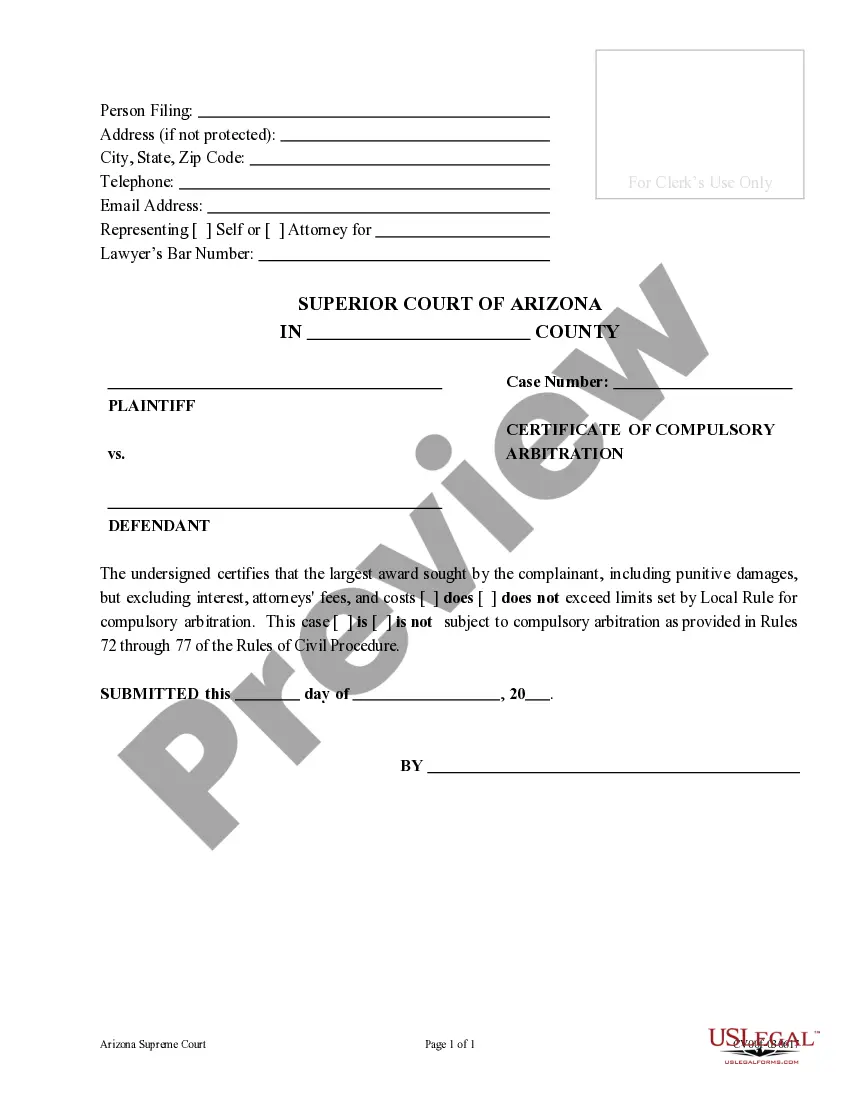

How to fill out Stock Purchase Agreement Between Two Sellers And One Investor With Transfer Of Title Concurrent With Execution Of Agreement?

Have you encountered a scenario where you frequently require documents for either organizational or personal purposes on a daily basis.

There is a multitude of legal document templates accessible online, but finding reliable ones isn't straightforward.

US Legal Forms offers thousands of template options, similar to the Minnesota Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement, which are crafted to comply with state and federal regulations.

Once you have the correct form, click Buy now.

Select the pricing option you prefer, enter the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the Minnesota Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/county.

- Utilize the Review button to examine the form.

- Review the details to ensure you selected the right form.

- If the form isn't what you are seeking, use the Search field to find the template that fits your needs.

Form popularity

FAQ

In a share purchase, the purchaser buys the shares of the company that operates the business and that owns the assets of the business. Therefore, the purchaser would not own the business or the business assets directly but rather, through the company.

A company executes a Share subscription agreement (SSA) in case of a fresh issue of shares. A shareholders' agreement (SHA) is a contract that contains the rights and obligations of the shareholders in a company.

Stock Purchase AgreementName of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.

As share purchase agreements just lay down a lawful agreement between the parties about the transfer of shares, Shareholders agreement lays down the rights and other obligations of the parties. It defines the actual relationship of the parties in terms of rights generated by purchasing shares of the company.

A Share Purchase Agreement is a document that transfers company shares (also called stocks) from one party to another. It contains the shares for sale, price, date of the transaction, and other terms and conditions.

The number and type of stock sold (i.e. common, preferred) the purchase price. when the transaction will take place. price per share.

In real estate, a purchase agreement is a binding contract between a buyer and seller that outlines the details of a home sale transaction. The buyer will propose the conditions of the contract, including their offer price, which the seller will then either agree to, reject or negotiate.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

A Share Purchase Agreement is a sales agreement used to transfer and assign ownership (shares of stock) in a corporation. The Seller is the current Shareholder of the Shares for sale.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

More info

Free Consultations Get Free Advice From Real Lawyers Find The Best Legal Document Review Your Contract Quickly Investment Contract Innovation of new products and services Pharmacists are recognized leaders in cancer therapy. Pharmacy has pioneered several innovative cancer treatment protocols, including the successful Phase 2 study of a new oral cavity cancer screening device, the Chemo sensory Intravenous Catheter. Pharmaceutical companies have successfully tested this diagnostic device at national research and clinical sites. Pharmacists are also recognized for their innovative treatment practices by the U.S. Food and Drug Administration (FDA) and other public health and public safety organizations. The U.S. Health Resources and Services Administration (RSA) is particularly interested in the ability of pharmacists to provide more effective and rapid cancer diagnosis and treatment.