Minnesota Sample Letter for Fraudulent Charges against Client's Account

Description

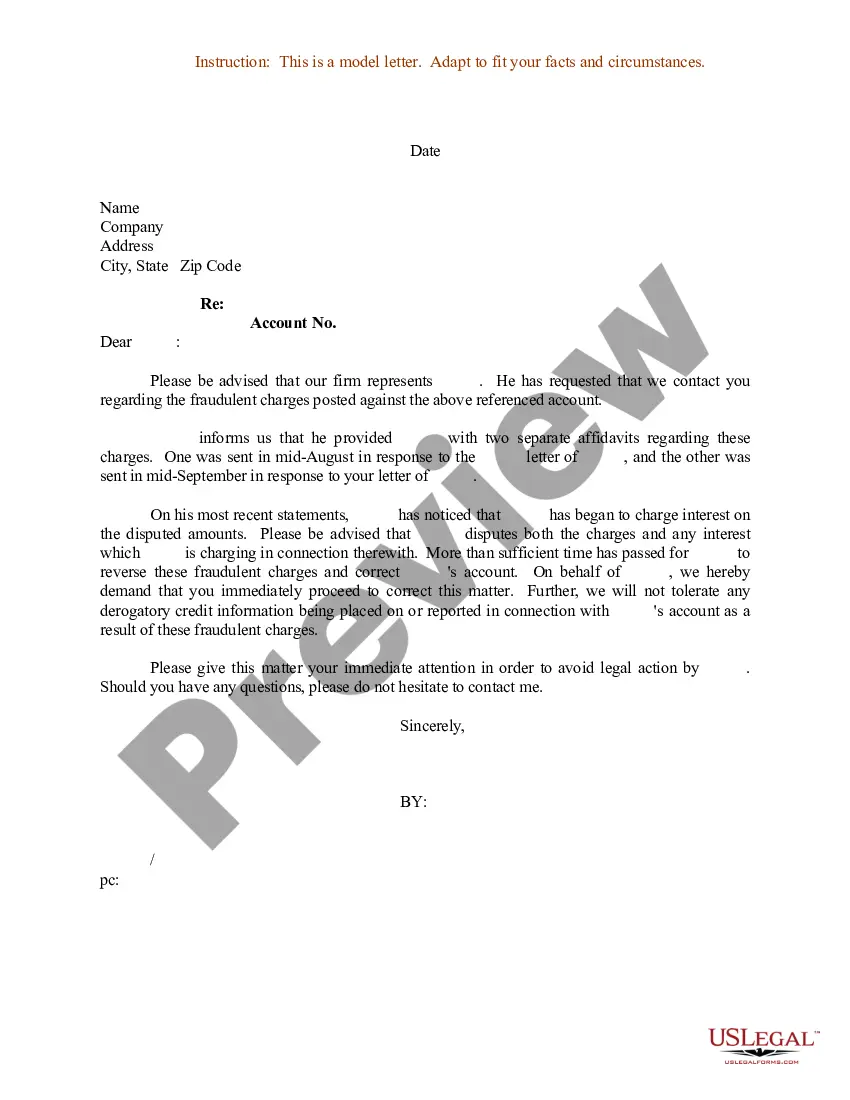

How to fill out Sample Letter For Fraudulent Charges Against Client's Account?

Are you in a place in which you need to have files for possibly organization or individual reasons almost every time? There are plenty of authorized file layouts available on the Internet, but discovering versions you can rely on is not effortless. US Legal Forms delivers thousands of develop layouts, like the Minnesota Sample Letter for Fraudulent Charges against Client's Account, which can be composed to fulfill federal and state needs.

If you are previously acquainted with US Legal Forms website and also have a free account, basically log in. After that, you can acquire the Minnesota Sample Letter for Fraudulent Charges against Client's Account web template.

If you do not come with an account and wish to begin using US Legal Forms, abide by these steps:

- Find the develop you need and ensure it is for your proper city/area.

- Make use of the Review key to analyze the form.

- Browse the description to ensure that you have chosen the correct develop.

- If the develop is not what you`re looking for, take advantage of the Look for discipline to discover the develop that meets your needs and needs.

- Whenever you obtain the proper develop, click on Get now.

- Choose the rates plan you want, fill out the specified info to generate your account, and pay money for the order utilizing your PayPal or charge card.

- Choose a practical paper structure and acquire your copy.

Discover each of the file layouts you possess bought in the My Forms menu. You can get a more copy of Minnesota Sample Letter for Fraudulent Charges against Client's Account anytime, if needed. Just click on the essential develop to acquire or print out the file web template.

Use US Legal Forms, one of the most substantial selection of authorized kinds, to conserve time as well as avoid faults. The assistance delivers skillfully manufactured authorized file layouts which can be used for an array of reasons. Make a free account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Under Section 611, a credit reporting agency is not required to provide consumers with the verification method or send them any written result of the dispute if it is sent electronically. A 611 credit disputing letter is sent after a credit agency confirms that the information mentioned in the letter has been verified.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Dispute in writing, and include any evidence that supports your claims (such as copies of cancelled checks showing you paid the debt or a police report in the case of identity theft). If the debt collector knows that you don't owe the money, it should not try to collect the debt.

A dispute is appropriate if you have hard evidence that clearly shows the debt doesn't belong to you, was already paid, or if the amount due is incorrect. The more information you can provide to the debt collection agency concerning the dispute, the better.

Under the rules of the FDCPA, you must receive a written notification of a debt. After that, you have 30 days to contact the debt collector ? also by letter ? and give your reasons why you don't owe the debt or why the amount is incorrect.

Contact the Credit Card Company Log into your credit card account or call the number on the back of your credit card to inform the card issuer. Submitting a dispute online can often be done in under a minute. You just need to submit information identifying the charge, such as the date and amount of the transaction.

What should I do if there are unauthorized charges on my credit card account? Contact your bank right away. To limit your liability, it is important to notify the bank promptly upon discovering any unauthorized charge(s). You may notify the bank in person, by telephone, or in writing.