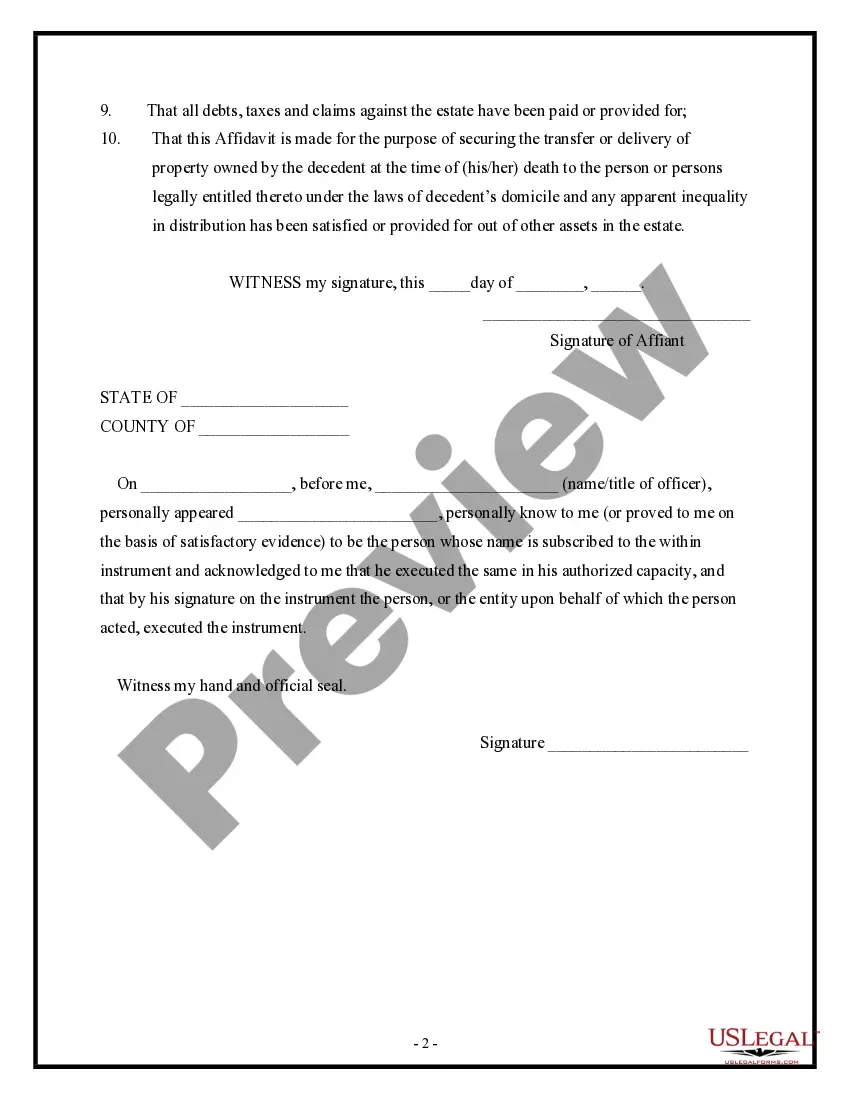

Title: Understanding the Minnesota Affidavit of Domicile: Types, Uses, and Key Information Introduction: The Minnesota Affidavit of Domicile is an official legal document used to establish an individual's residency or domicile within the state of Minnesota. It serves multiple purposes such as determining inheritance tax liability, eligibility for property tax exemptions, and voting rights. This article aims to provide a comprehensive overview of the Minnesota Affidavit of Domicile, highlighting its types, uses, and essential details. 1. Minnesota Affidavit of Domicile — General Definition: The Minnesota Affidavit of Domicile is a sworn statement provided by an individual to declare their permanent residency within the state. It helps validate their intention to reside in Minnesota for an extended period, making them eligible for various state benefits and fulfilling certain legal requirements. 2. Types of Minnesota Affidavit of Domicile: While there are no specific subtypes of Minnesota Affidavit of Domicile, it is important to understand that the affidavit may vary slightly based on its intended purpose. However, in essence, it serves as a document to assert legal residency status within Minnesota. 3. Key Uses and Purposes: — Inheritance Tax Liability: Minnesota imposes an inheritance tax on certain estates. The Affidavit of Domicile facilitates the determination of whether the deceased person was a domiciled resident of Minnesota, impacting their tax liabilities. — Voter Registration: This affidavit helps verify an individual's residence for voting purposes, ensuring that only eligible residents are allowed to cast their votes in Minnesota. — Property Tax Exemptions: The Affidavit of Domicile can be used to establish eligibility for property tax exemptions available to primary residences within the state. — Establishing Residency: Individuals may require this affidavit to prove their residency status when applying for in-state tuition fees, obtaining driver's licenses, or fulfilling other legal obligations. 4. Essential Information and Process: To complete the Minnesota Affidavit of Domicile, individuals must carefully provide accurate information, including but not limited to: — Full legal name, address, and contact details of the affine (the individual completing the affidavit). — Statement of residence: A declaration affirming that the affine is a legal resident of Minnesota. — Supporting evidence: Depending on the purpose, individuals may need to submit additional documentation, such as utility bills, lease agreements, or voter registration information, to validate their residency claim. — Notarization: The Minnesota Affidavit of Domicile must be acknowledged before a notary public to be considered legally valid. Conclusion: The Minnesota Affidavit of Domicile holds significant importance in establishing an individual's domicile within the state for various legal and financial purposes. Whether it be determining inheritance tax liability or claiming property tax exemptions, understanding and completing this affidavit accurately is crucial. Remember to consult with legal experts or relevant authorities in case of any specific requirements or doubts in completing the document.

Affidavit Of Domicile

Description

How to fill out Minnesota Affidavit Of Domicile?

If you want to full, obtain, or print legitimate document web templates, use US Legal Forms, the biggest collection of legitimate varieties, which can be found on-line. Utilize the site`s basic and handy lookup to discover the files you need. Numerous web templates for organization and individual purposes are sorted by types and claims, or keywords and phrases. Use US Legal Forms to discover the Minnesota Affidavit of Domicile within a handful of mouse clicks.

Should you be currently a US Legal Forms consumer, log in for your accounts and click on the Down load button to obtain the Minnesota Affidavit of Domicile. You can also access varieties you formerly downloaded in the My Forms tab of your respective accounts.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form for your right town/land.

- Step 2. Use the Preview solution to check out the form`s content material. Never forget to learn the description.

- Step 3. Should you be not satisfied together with the kind, make use of the Search field on top of the monitor to locate other models of the legitimate kind template.

- Step 4. Once you have discovered the form you need, click the Buy now button. Choose the rates program you choose and include your accreditations to register for the accounts.

- Step 5. Approach the deal. You can utilize your bank card or PayPal accounts to finish the deal.

- Step 6. Choose the file format of the legitimate kind and obtain it on the system.

- Step 7. Total, change and print or indication the Minnesota Affidavit of Domicile.

Each and every legitimate document template you acquire is your own for a long time. You may have acces to each and every kind you downloaded with your acccount. Click the My Forms area and decide on a kind to print or obtain again.

Compete and obtain, and print the Minnesota Affidavit of Domicile with US Legal Forms. There are millions of specialist and condition-certain varieties you may use for your personal organization or individual demands.

Form popularity

FAQ

What's the Difference between Residency and Domicile? Residency is where one chooses to live. Domicile is more permanent and is essentially somebody's home base. Once you move into a home and take steps to establish your domicile in one state, that state becomes your tax home.

Any resident may terminate the residency agreement at any time after assuming residency. A residency agreement may not require more than 120 days' written notice by any resident desiring to terminate; nor require any additional fees for termination of residency.

Your physical presence in a state plays an important role in determining your residency status. Usually, spending over half a year, or more than 183 days, in a particular state will render you a statutory resident and could make you liable for taxes in that state.

"Resident" means a person who has maintained his or her place of permanent abode in this state for a period of 30 days immediately preceding his or her application for an approval. Domiciliary intent is required to establish that a person is maintaining his or her place of permanent abode in this state.

You are considered a Minnesota resident for tax purposes if both apply: You spend at least 183 days in Minnesota during the year. Any part of a day counts as a full day. You or your spouse rent, own, maintain, or occupy an abode.

Your physical presence in a state plays an important role in determining your residency status. Usually, spending over half a year, or more than 183 days, in a particular state will render you a statutory resident and could make you liable for taxes in that state.

Once you establish your domicile in Minnesota, it continues until you take actions to change it. If you move out of Minnesota but do not intend to permanently remain in another state or country, you continue to be a Minnesota resident.

You can be a resident of two states at the same time, usually by maintaining a domicile in one state and spending 183 days or more in another. It is not advisable, as you will be liable to file income taxes in both states, rather than in only one.