Minnesota Judgment Foreclosing Mortgage and Ordering Sale

Description

How to fill out Judgment Foreclosing Mortgage And Ordering Sale?

Are you presently inside a situation the place you require papers for either company or individual functions almost every working day? There are plenty of lawful papers layouts available on the Internet, but locating ones you can depend on is not straightforward. US Legal Forms offers a huge number of kind layouts, much like the Minnesota Judgment Foreclosing Mortgage and Ordering Sale , which are composed to fulfill federal and state specifications.

In case you are presently acquainted with US Legal Forms website and also have your account, merely log in. Afterward, you may down load the Minnesota Judgment Foreclosing Mortgage and Ordering Sale template.

Should you not have an account and want to begin using US Legal Forms, abide by these steps:

- Discover the kind you will need and ensure it is for the correct town/county.

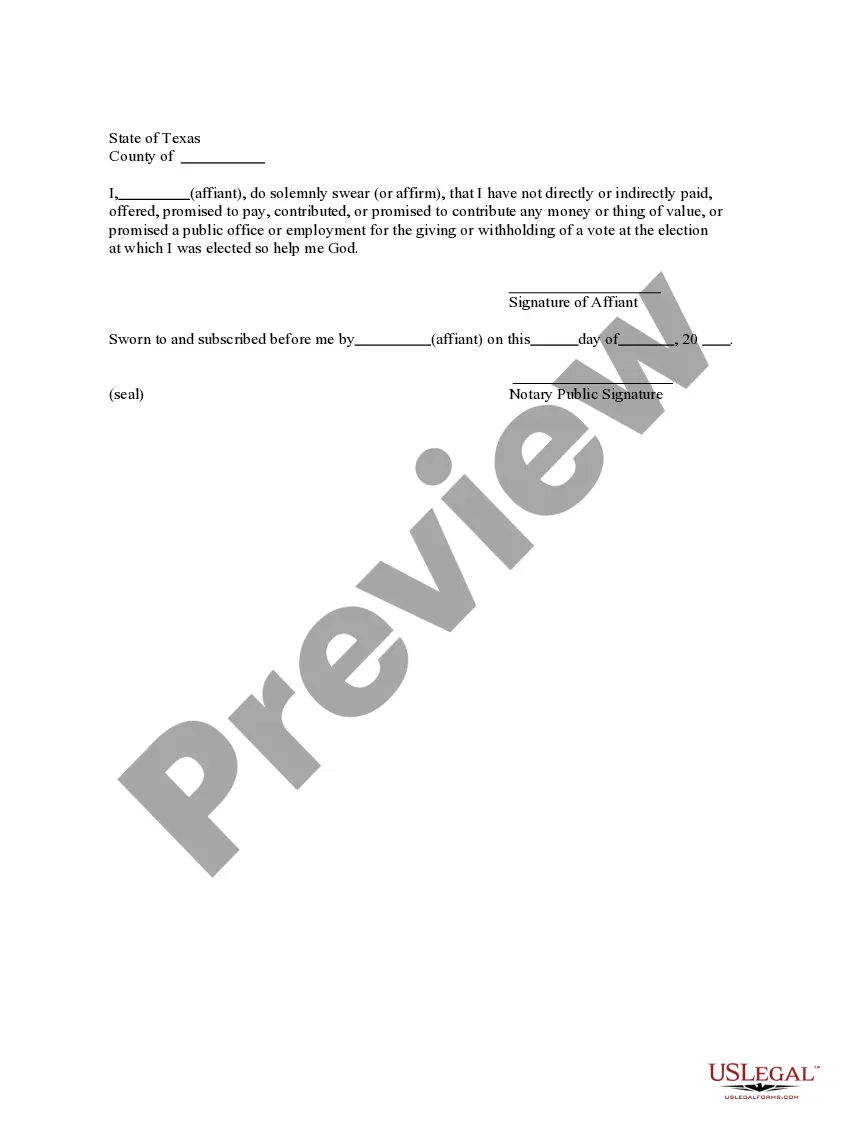

- Utilize the Preview option to examine the shape.

- See the explanation to actually have selected the proper kind.

- When the kind is not what you`re looking for, take advantage of the Research field to find the kind that meets your needs and specifications.

- Once you discover the correct kind, click on Buy now.

- Pick the rates strategy you would like, fill out the necessary information and facts to create your account, and pay money for the order utilizing your PayPal or charge card.

- Choose a handy document structure and down load your backup.

Get every one of the papers layouts you might have purchased in the My Forms menu. You can get a further backup of Minnesota Judgment Foreclosing Mortgage and Ordering Sale any time, if required. Just click on the required kind to down load or print the papers template.

Use US Legal Forms, probably the most substantial assortment of lawful varieties, to save lots of some time and avoid blunders. The support offers skillfully manufactured lawful papers layouts which can be used for a selection of functions. Create your account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

(a) A mortgagor has a cause of action, based on a violation of this section, to enjoin or set aside a sale. A mortgagor who prevails in an action to set aside or enjoin a sale, or who successfully defends a foreclosure by action based on a violation of this section, is entitled to reasonable attorney fees and costs.

Statutory Language ? The Minnesota dual tracking statute primarily addresses three different points in a foreclosure: (1) prior to the time that a mortgage servicer refers a loan to an attorney for foreclosure; (2) after a loan has been referred to an attorney for foreclosure but prior to the time that a foreclosure ...

Alternately, the borrower may attempt to sell the home in order to take advantage of any equity built up in the home. If the borrower is unable to refinance or sell the home after the six-month redemption period, he or she must vacate the property.

A deed in lieu of foreclosure occurs when the mortgagor (i.e. the borrower) conveys their interest in real property to the mortgagee (i.e. the lender) in order to avoid foreclosure proceedings.

Pursuant to Minnesota Statutes, most properties sold in a Mortgage Foreclosure action can be redeemed by the mortgagor. The published Notice of Mortgage Foreclosure sale usually contains a paragraph indicating the length of the redemption period. In most cases, this is 6 months.

Lender calls and sends a letter stating a payment was missed. Homeowner receives Default and Intent to Foreclose Notice. Homeowner receives Preforeclosure Notice. The account is given to a foreclosure attorney and legal fees can begin accruing.

The county sheriff or sheriff's deputy conducts the foreclosure sale between a.m. and sundown at a public place, usually the sheriff's office. Anyone may bid at the sale, and the property is sold to the winning bidder. The lender usually has a high bidder representative and usually the only bidder.

A deficiency judgment or personal judgment obtained to enforce a mortgage debt on property used in agricultural production may be enforced by execution, but the judgment may not be executed after three years from the date judgment was entered.