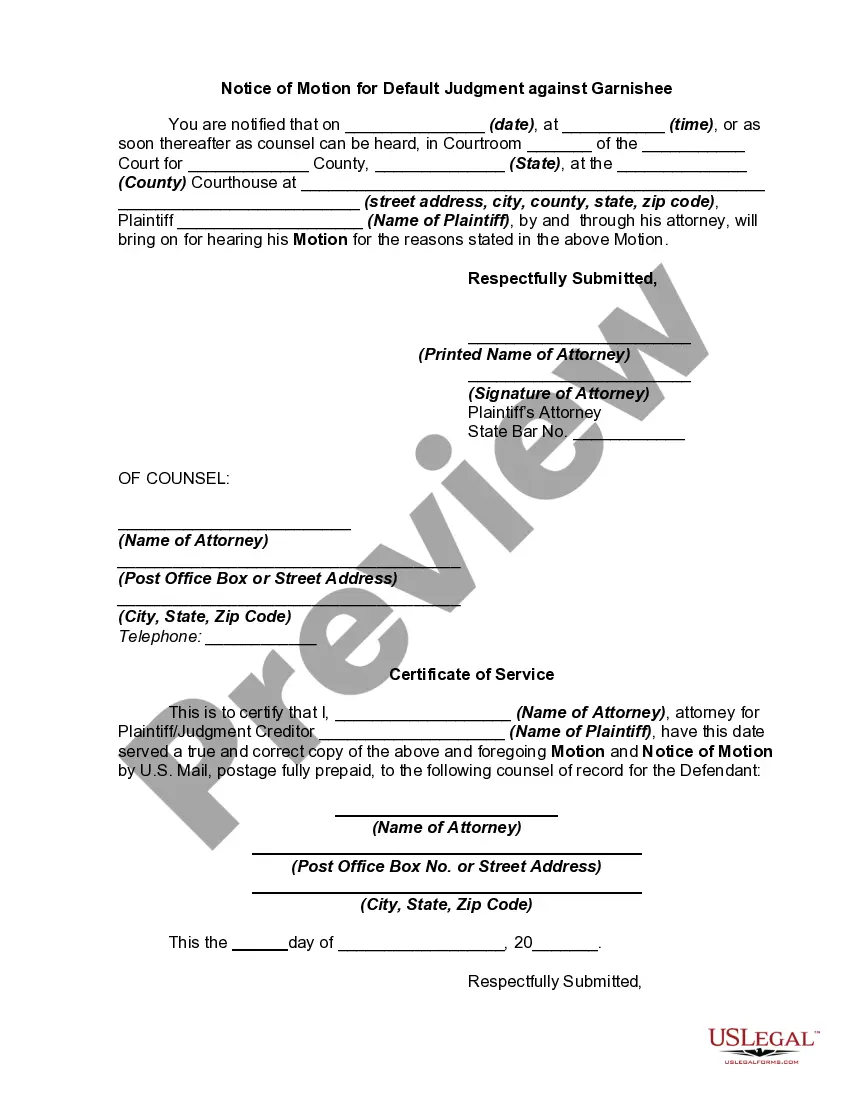

Most states have laws that provided that if a garnishee, personally summoned, shall fail to answer as required by law, the court shall enter a judgment against him for the amount of plaintiff's demand.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Minnesota Motion for Default Judgment against Garnishee is a legal procedure initiated by a judgment creditor seeking to enforce a judgment against a garnishee, who may be holding assets or funds belonging to the judgment debtor. When the garnishee fails to respond or comply with the garnishment order, the judgment creditor can request a default judgment against the garnishee. This motion is an important tool for securing payment from third parties who owe money to the judgment debtor. In Minnesota, there are two main types of Motion for Default Judgment against Garnishee: 1. Ordinary Garnishment: This type of garnishment is used when the judgment debtor has a financial obligation to the garnishee. The creditor files a garnishment summons to notify the garnishee and the debtor about the garnishment. If the garnishee fails to respond and disclose the debtor's assets or earnings, the judgment creditor can file a Motion for Default Judgment against the garnishee. 2. Continuing Garnishment: In cases where the garnishee is an employer, this type of garnishment is used to attach a portion of the judgment debtor's earnings. The creditor serves a garnishment summons to the employer, who is responsible for deducting a certain percentage from the debtor's wages and remitting it to the creditor. If the employer fails to comply with the garnishment order or fails to make the required payments, the creditor can file a Motion for Default Judgment against the garnishee. Keywords: Minnesota, Motion for Default Judgment, Garnishee, judgment creditor, judgment debtor, garnishment order, garnishment summons, assets, funds, third parties, payment, financial obligation, ordinary garnishment, continuing garnishment, employer, earnings, wages, remitting, comply. Note: It is important to consult with an attorney or legal professional for accurate and up-to-date information regarding specific laws and procedures in Minnesota.Minnesota Motion for Default Judgment against Garnishee is a legal procedure initiated by a judgment creditor seeking to enforce a judgment against a garnishee, who may be holding assets or funds belonging to the judgment debtor. When the garnishee fails to respond or comply with the garnishment order, the judgment creditor can request a default judgment against the garnishee. This motion is an important tool for securing payment from third parties who owe money to the judgment debtor. In Minnesota, there are two main types of Motion for Default Judgment against Garnishee: 1. Ordinary Garnishment: This type of garnishment is used when the judgment debtor has a financial obligation to the garnishee. The creditor files a garnishment summons to notify the garnishee and the debtor about the garnishment. If the garnishee fails to respond and disclose the debtor's assets or earnings, the judgment creditor can file a Motion for Default Judgment against the garnishee. 2. Continuing Garnishment: In cases where the garnishee is an employer, this type of garnishment is used to attach a portion of the judgment debtor's earnings. The creditor serves a garnishment summons to the employer, who is responsible for deducting a certain percentage from the debtor's wages and remitting it to the creditor. If the employer fails to comply with the garnishment order or fails to make the required payments, the creditor can file a Motion for Default Judgment against the garnishee. Keywords: Minnesota, Motion for Default Judgment, Garnishee, judgment creditor, judgment debtor, garnishment order, garnishment summons, assets, funds, third parties, payment, financial obligation, ordinary garnishment, continuing garnishment, employer, earnings, wages, remitting, comply. Note: It is important to consult with an attorney or legal professional for accurate and up-to-date information regarding specific laws and procedures in Minnesota.