Subject: Official Notice of Intent to Administratively Dissolve or Revoke — Minnesota Dear [Recipient's Name], We hope this letter finds you well. The purpose of this correspondence is to provide you with an official notice of intent to administratively dissolve or revoke your business entity's legal status in Minnesota. We want to ensure that you are aware of the potential consequences and take appropriate action within the given timeframe. [Insert relevant background information about the recipient's business entity and their obligations] As per the Minnesota statutes, specifically [cite relevant statute or section], the Secretary of State has the authority to initiate the administrative dissolution or revocation process for non-compliant businesses or organizations. This action is taken when there has been a failure to comply with certain reporting requirements, payment of taxes, or other obligations mandated by law. The non-compliance issues identified in your case are as follows: 1. [Specify the non-compliance issue(s) — e.g., failure to file annual reports for multiple years] 2. [Additional non-compliance issues, if applicable] Given the significance of maintaining a legally compliant status for your business, we urge you to promptly address these issues to prevent further escalation. We recommend taking the following steps: 1. Retrieve your business entity's filings and records from the Minnesota Secretary of State's website or your official business records. 2. Review the requirements for reinstatement or resolution of the specific non-compliance issues mentioned. 3. Ensure all outstanding annual reports, taxes, and fees are filed, paid, or resolved within the prescribed timeframe. 4. Consider seeking legal guidance or consulting with a professional to ensure compliance and the best course of action. Failure to rectify these matters within the specified timeframe, typically [mention the timeframe stipulated by law], may result in the administrative dissolution or revocation of your business entity. This will render your entity void and incapable of carrying on any business activities legally. It is important to note that the administrative dissolution or revocation does not absolve your entity from any outstanding liabilities, taxes, or legal responsibilities. Therefore, settling all outstanding obligations promptly can help mitigate any further repercussions. If you believe this notice has been issued in error or have any questions regarding the administrative dissolution or revocation process, please contact the Minnesota Secretary of State's office immediately. Their contact information can be found on their official website. We strongly recommend taking this matter seriously and addressing it promptly. Please be aware that failure to respond or take action may result in the termination of your business entity's legal existence in Minnesota. Thank you for your attention to this matter, and we remain available to assist you in resolving the non-compliance issues efficiently. Sincerely, [Your Name] [Your Title/Organization] [Contact Information]

Minnesota Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke

Description

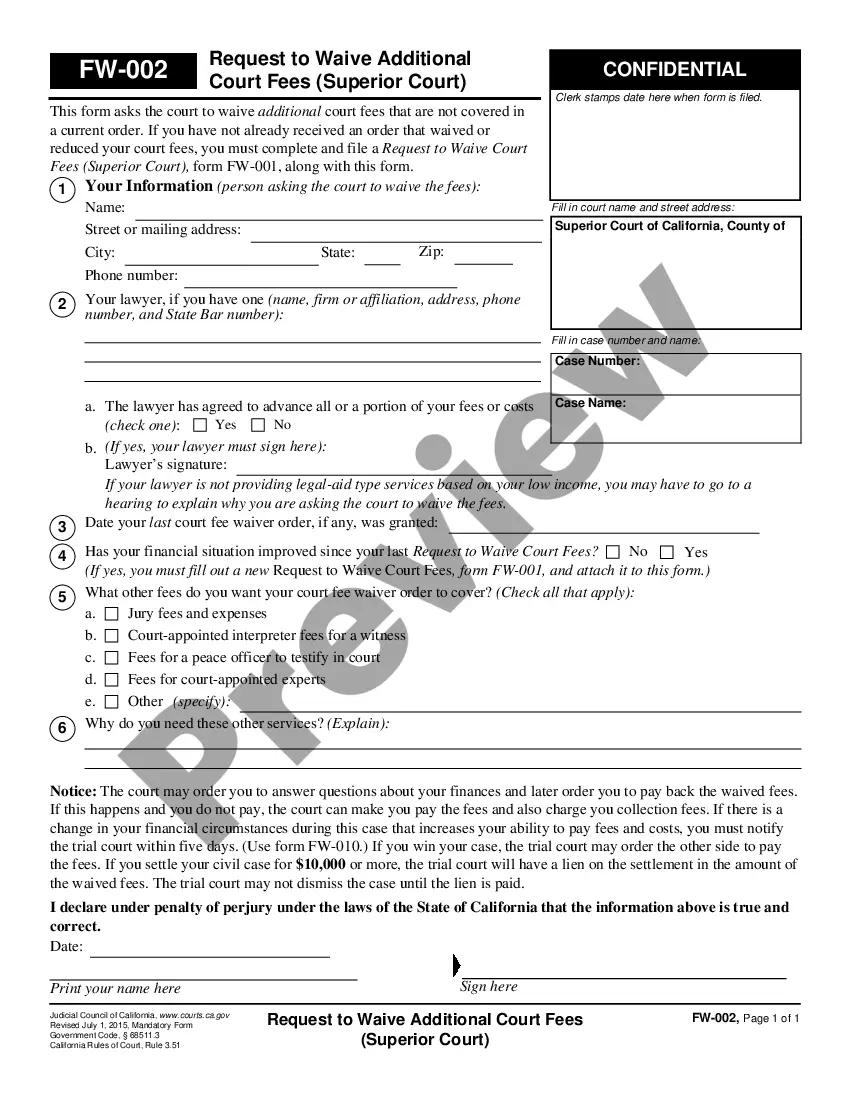

How to fill out Minnesota Sample Letter For Official Notice Of Intent To Administratively Dissolve Or Revoke?

Are you in a situation where you require paperwork for both business or personal uses virtually every time? There are tons of authorized document web templates available online, but getting types you can trust isn`t effortless. US Legal Forms provides a large number of type web templates, much like the Minnesota Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke, that are published to satisfy state and federal specifications.

If you are presently acquainted with US Legal Forms web site and have an account, merely log in. Afterward, it is possible to down load the Minnesota Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke format.

Unless you have an accounts and want to begin using US Legal Forms, adopt these measures:

- Find the type you need and ensure it is for your correct area/region.

- Take advantage of the Review switch to examine the form.

- Look at the description to ensure that you have chosen the right type.

- In the event the type isn`t what you`re looking for, use the Lookup area to obtain the type that meets your requirements and specifications.

- When you find the correct type, click on Purchase now.

- Opt for the rates plan you desire, fill out the necessary information and facts to generate your account, and buy the transaction making use of your PayPal or bank card.

- Pick a handy paper formatting and down load your copy.

Locate every one of the document web templates you have purchased in the My Forms menus. You can get a additional copy of Minnesota Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke any time, if possible. Just select the required type to down load or printing the document format.

Use US Legal Forms, the most extensive collection of authorized types, to conserve time as well as steer clear of blunders. The services provides skillfully manufactured authorized document web templates which can be used for a variety of uses. Generate an account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

File the appropriate dissolution, surrender, or cancellation SOS form(s) within 12 months of filing your final tax return.

Failure to dissolve your business can also leave you open to forms of business fraud, such as business identity theft. Step 1: Get approval of the owners of the corporation or LLC. ... Step 2: File the Certificate of Dissolution with the state. ... Step 3: File federal, state, and local tax forms. ... Step 4: Wind up affairs.

Administrative dissolution is an action that the Minnesota Secretary of State takes when a Minnesota business does not take certain actions required by law. When a business is administratively dissolved, it ceases to exist in Minnesota.

To dissolve your Minnesota corporation after it has issued shares, you must first file the Intent to Dissolve form with the Minnesota Secretary of State (SOS). Then the corporation will file the Articles of Dissolution Chapter 302A. 7291 or 302A. 727.

Corporations that are able to pay off their debts and want to close down need to follow these important steps: Take on no further business. Repay any loans taken by the directors. Pay back all debts. Keep the company bank account open until all the debts clear.