Minnesota Invoice Template for Independent Contractor

Description

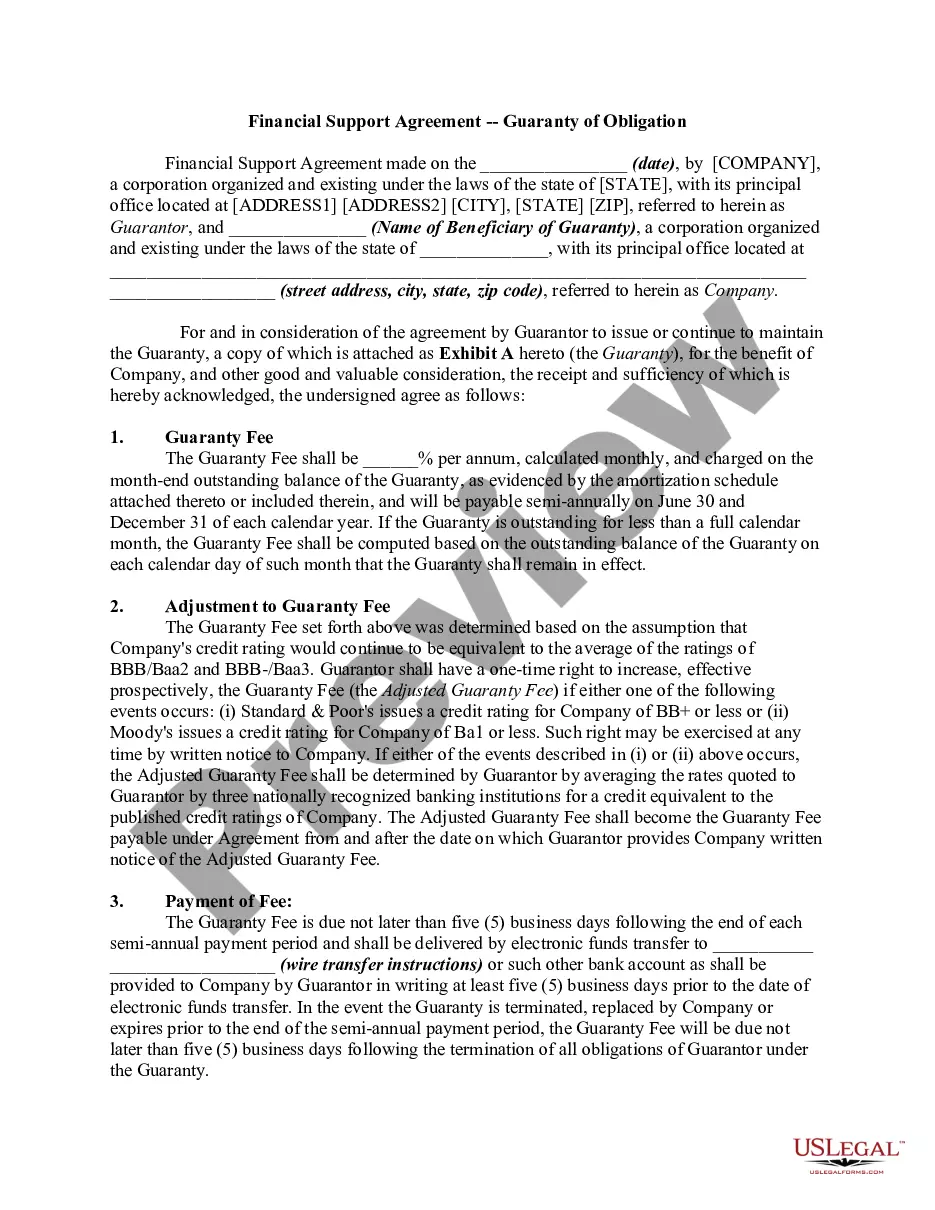

How to fill out Invoice Template For Independent Contractor?

Have you ever been in a situation where you require documents for either business or personal purposes almost all the time.

There is an assortment of authentic document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers a multitude of form templates, such as the Minnesota Invoice Template for Independent Contractor, designed to comply with federal and state requirements.

Once you locate the correct template, click Buy now.

Choose the pricing plan you desire, complete the necessary information to create your account, and make the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Minnesota Invoice Template for Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct city/region.

- Use the Review button to check the form.

- Examine the details to make sure you have selected the appropriate template.

- If the template is not what you’re looking for, use the Lookup section to find the template that meets your needs and requirements.

Form popularity

FAQ

Creating an invoice as an independent contractor begins with selecting a suitable format, such as a Minnesota Invoice Template for Independent Contractor. Include essential information like your name, contact details, the client's information, and a list of services provided. Ensure to include payment terms and the total amount due. For convenience, consider using a platform like US Legal Forms, which offers customizable templates to streamline the invoicing process.

The independent contractor rule in Minnesota defines the conditions under which a worker can be classified as an independent contractor rather than an employee. This classification can affect tax responsibilities and access to benefits. By utilizing a Minnesota Invoice Template for Independent Contractor, you can navigate these rules effectively while maintaining proper documentation.

The new law for independent contractors in Minnesota aims to provide clearer guidelines regarding rights, responsibilities, and classification. Understanding these legal requirements helps protect your interests as a contractor. Furthermore, utilizing a Minnesota Invoice Template for Independent Contractor can assist in aligning your invoicing with these regulations.

An independent contractor in Minnesota is a self-employed individual who offers services to clients without being classified as an employee. Such individuals often have the flexibility to set their schedules and choose their clients. Using a Minnesota Invoice Template for Independent Contractor is essential for managing billing and maintaining clear records.

The new independent contractor rules include adjustments to classification standards and tax implications for freelancers and contractors. Familiarize yourself with these changes to avoid liabilities. Having a solid understanding of these regulations enables you to leverage a Minnesota Invoice Template for Independent Contractor, ensuring compliance with local laws.

Submitting an invoice as an independent contractor involves sending the completed document to your client through email or a designated invoicing platform. Attach your Minnesota Invoice Template for Independent Contractor for convenience. Make sure to follow up politely if you do not receive confirmation of receipt within a few days.

To bill as an independent contractor, start by outlining the services you provided along with the corresponding rates. Utilize a Minnesota Invoice Template for Independent Contractor to ensure all necessary details, like your contact information and payment terms, are included. This ensures clarity for your client, facilitates timely payments, and helps maintain professionalism.

Contractors are not legally obligated to provide invoices in all scenarios, but they should do so to promote transparency. Implementing a Minnesota Invoice Template for Independent Contractor benefits both the contractor and the client by detailing services rendered and due payments. This practice simplifies financial tracking and helps avoid potential disputes.

While it is not always legally required, contractors typically should provide an invoice to maintain clarity and professionalism in their work. Utilizing a Minnesota Invoice Template for Independent Contractor not only formalizes the payment request but also protects both parties' rights in the transaction. Invoices help ensure consistent communication regarding payments.

In many cases, companies do not have a legal obligation to provide an invoice for every transaction. However, they should issue an invoice if requested, especially if you are using a Minnesota Invoice Template for Independent Contractor. An invoice serves as proof of services or products delivered and can be vital for financial records and tax filing.