Minnesota Loan Agreement between Stockholder and Corporation

Description

How to fill out Loan Agreement Between Stockholder And Corporation?

If you want to thoroughly, download, or print proper document samples, utilize US Legal Forms, the largest assortment of valid forms, accessible online.

Leverage the website's simple and user-friendly search to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours permanently.

You have access to every form you saved in your account. Visit the My documents section and select a form to print or download again.

- Use US Legal Forms to obtain the Minnesota Loan Agreement between Stockholder and Corporation with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the Minnesota Loan Agreement between Stockholder and Corporation.

- You can also reach forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your appropriate region/country.

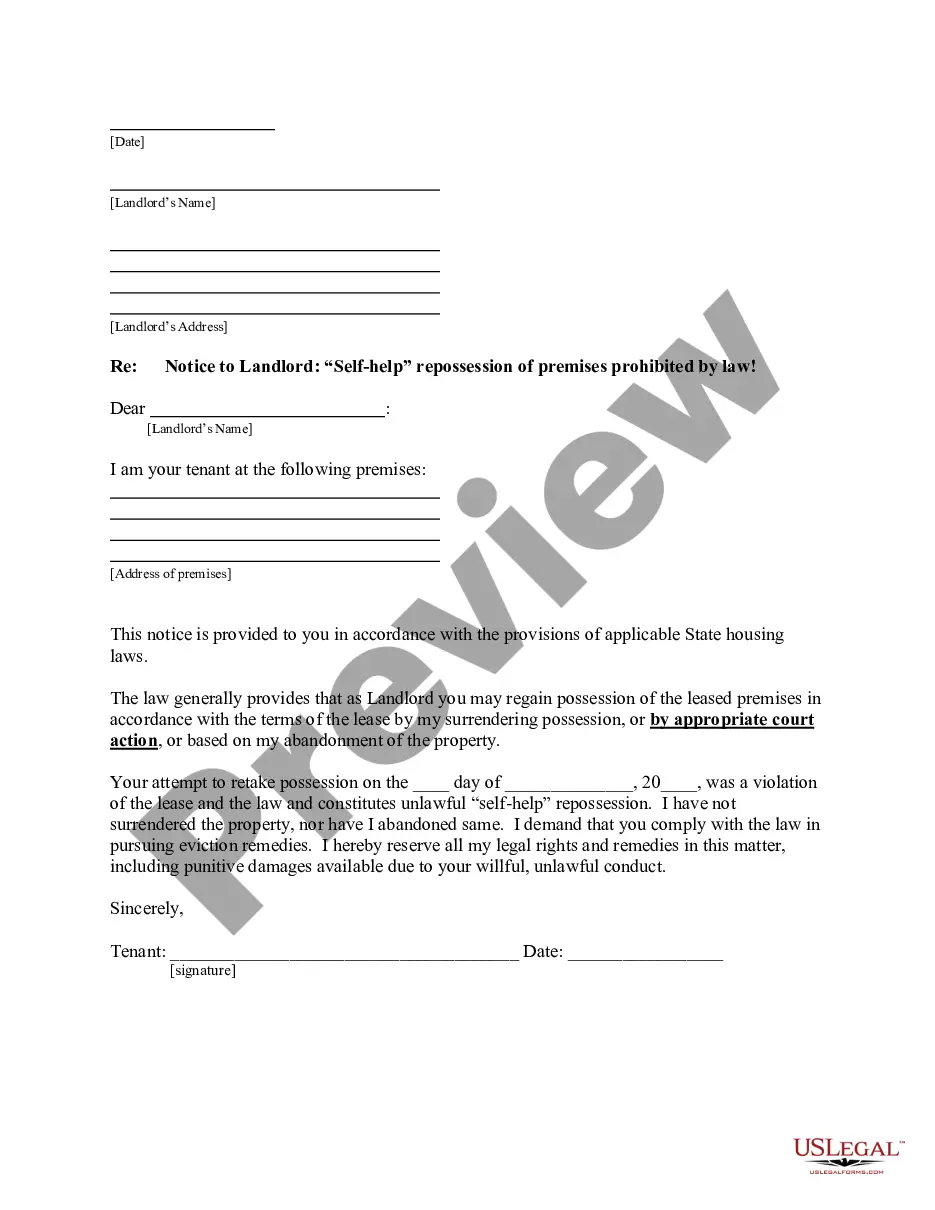

- Step 2. Use the Review option to examine the form's details. Remember to check the summary.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other forms in the legal form template.

- Step 4. Once you have located the form you need, select the Acquire now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, revise, and print or sign the Minnesota Loan Agreement between Stockholder and Corporation.

Form popularity

FAQ

The MOI automatically binds new shareholders without their explicit agreement, while a Shareholders Agreement needs to be agreed to before being binding.

A corporation is not required to have a shareholder agreement, but due to the flexibility of this document and what it can include, it is in the interest of shareholders to legalize such an agreement so as to protect their rights and the success of the corporation.

Are Shareholder's Agreements Legally Binding? Yes. A shareholders' agreement, once signed, is a legally binding contract.

The term MOI is an abbreviation for Memorandum of Incorporation. It is a document that sets out the rights, duties and responsibilities of shareholders, directors and other persons involved in a company.

A shareholders' agreement is a legally binding contract among the shareholders of a company that sets out their rights and obligations, maps out how the company should be managed, establishes share ownership, and share transfer rules all in order to provide clear solutions to contentious scenarios that may arise in

State statutes permit corporations to freely enter into binding contracts. A corporation, like an individual, has a legal duty to fulfill its contractual promises or face a possible lawsuit. A corporation may also file a breach of contract claim if its counter-party to a contract breaks his agreement.

A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.

The president usually has general authority to bind the corporation and the manager usually has general authority to bind the LLC, but you cannot be positive without seeing the bylaws and/or a resolution for the corporation.

Corporation Incorporated under a Special Act and Joint Stock Company. Such a corporation or company will be an artificial person formed by the law. It does not have the capacity to contract outside the powers of the Memorandum of Association or the Special Act.

Not unlike bylaws, shareholder agreements may address who can serve on the board of directors. Although bylaws often contain information regarding how many shares an organization can issue, they typically do not address founder's equity, equity shares or what owners can and cannot do with their equity.