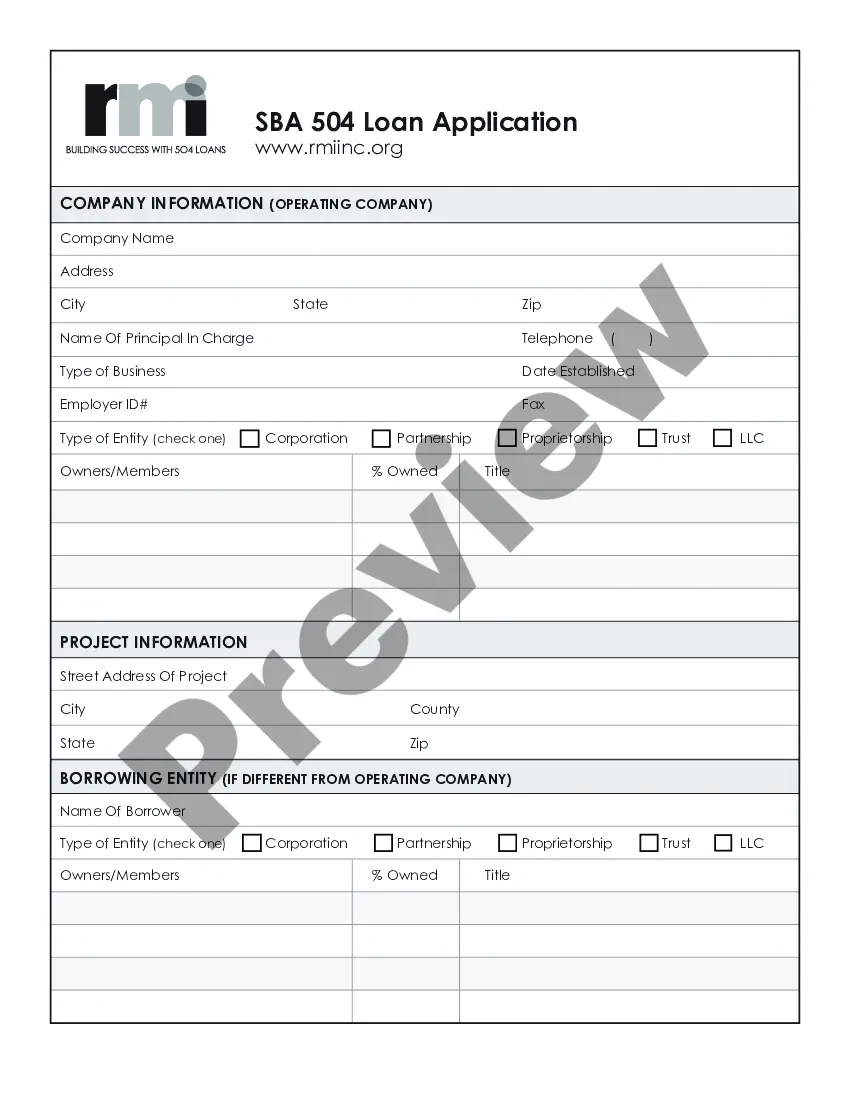

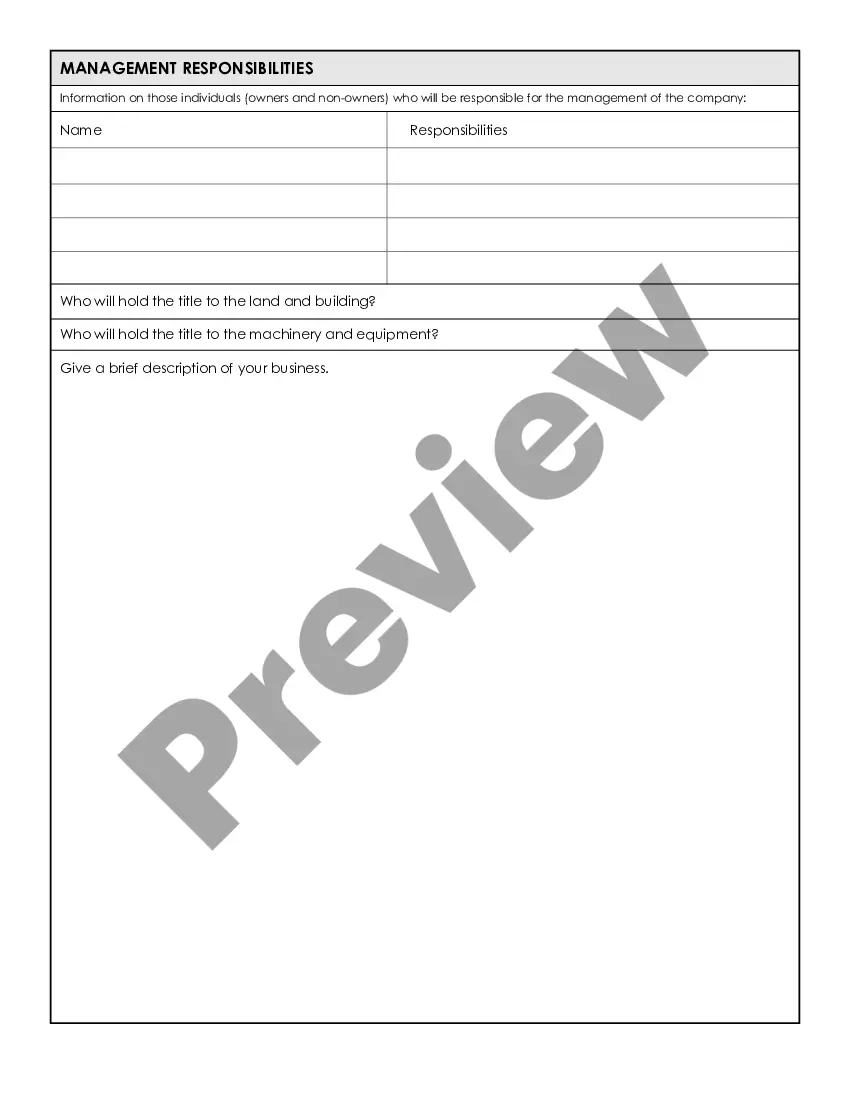

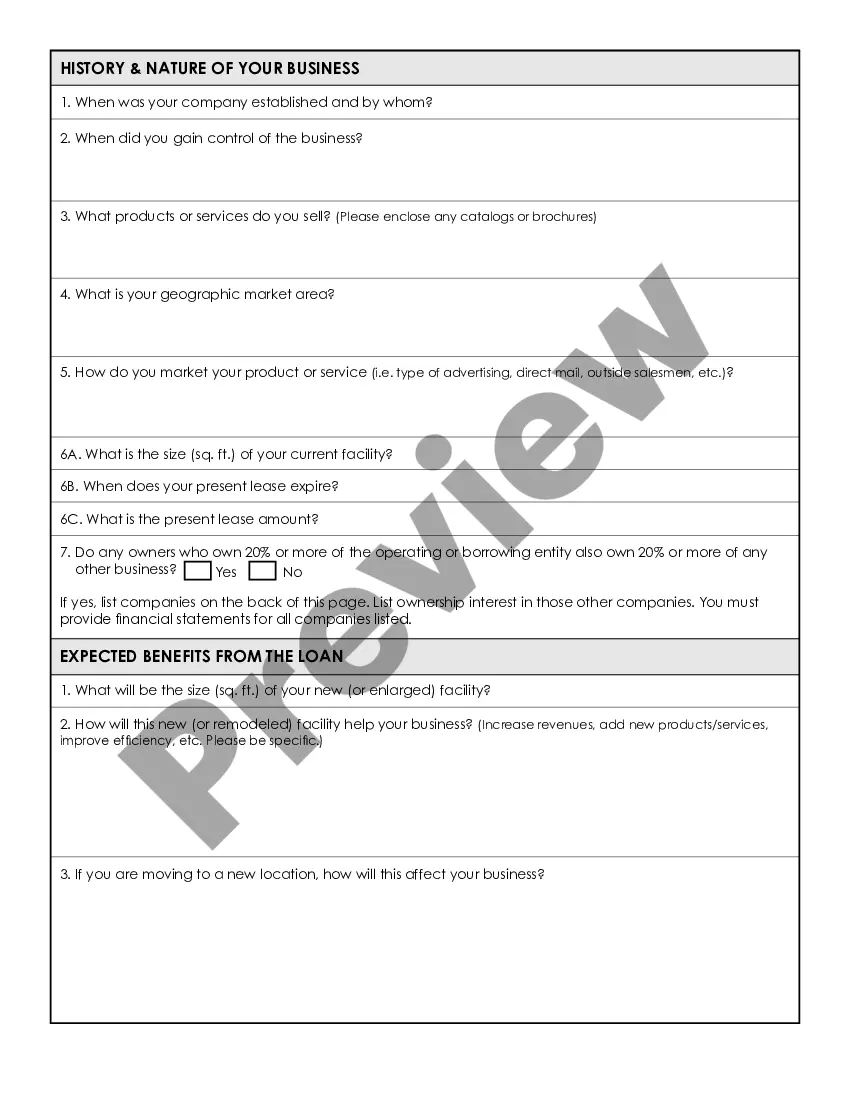

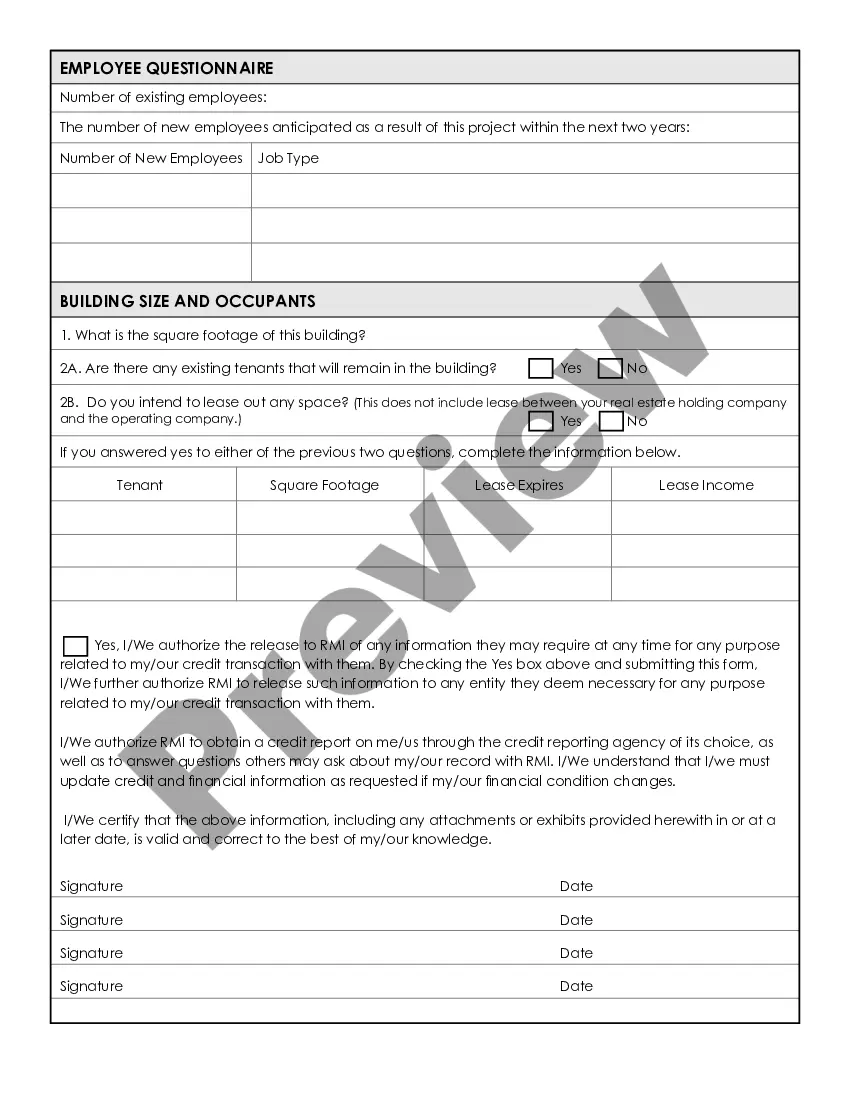

Minnesota Small Business Administration Loan Application Form and Checklist

Description

How to fill out Small Business Administration Loan Application Form And Checklist?

If you have to full, acquire, or print lawful record layouts, use US Legal Forms, the most important collection of lawful types, that can be found on-line. Take advantage of the site`s basic and handy search to discover the files you will need. Numerous layouts for organization and specific functions are categorized by categories and states, or key phrases. Use US Legal Forms to discover the Minnesota Small Business Administration Loan Application Form and Checklist in just a few clicks.

Should you be previously a US Legal Forms buyer, log in to your accounts and click the Obtain switch to obtain the Minnesota Small Business Administration Loan Application Form and Checklist. You can also entry types you formerly acquired from the My Forms tab of your own accounts.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for your appropriate city/nation.

- Step 2. Utilize the Preview option to look through the form`s articles. Never neglect to see the information.

- Step 3. Should you be not happy with the develop, utilize the Search field near the top of the monitor to get other types in the lawful develop format.

- Step 4. Upon having discovered the shape you will need, go through the Purchase now switch. Choose the rates strategy you like and put your references to register to have an accounts.

- Step 5. Approach the transaction. You can utilize your bank card or PayPal accounts to accomplish the transaction.

- Step 6. Choose the structure in the lawful develop and acquire it on the gadget.

- Step 7. Total, edit and print or sign the Minnesota Small Business Administration Loan Application Form and Checklist.

Every lawful record format you get is the one you have for a long time. You might have acces to every single develop you acquired with your acccount. Go through the My Forms section and choose a develop to print or acquire yet again.

Remain competitive and acquire, and print the Minnesota Small Business Administration Loan Application Form and Checklist with US Legal Forms. There are many professional and condition-certain types you can utilize for your organization or specific needs.

Form popularity

FAQ

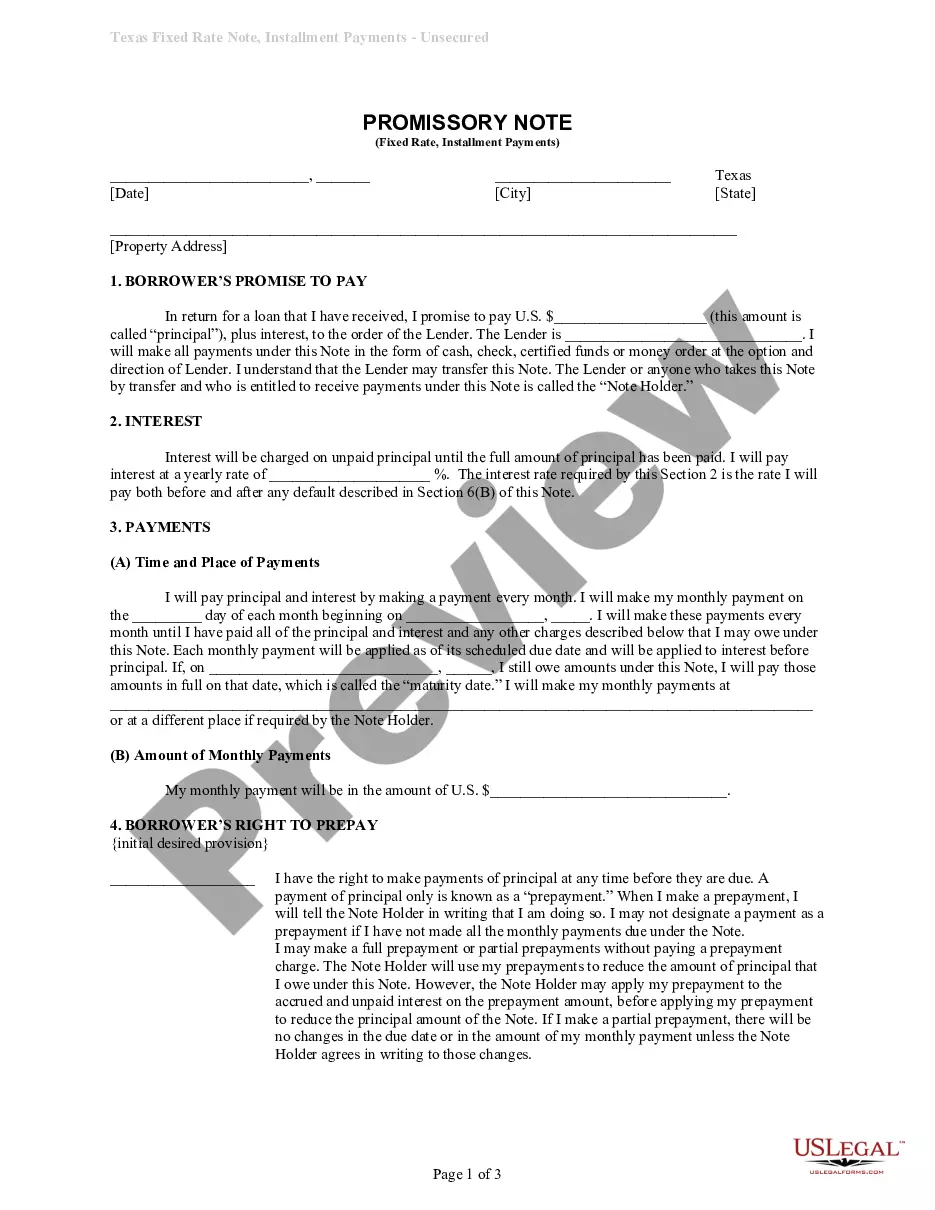

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

SBA only makes direct loans in the case of businesses and homeowners recovering from a declared disaster. SBA partners with lenders to help increase small business access to loans.

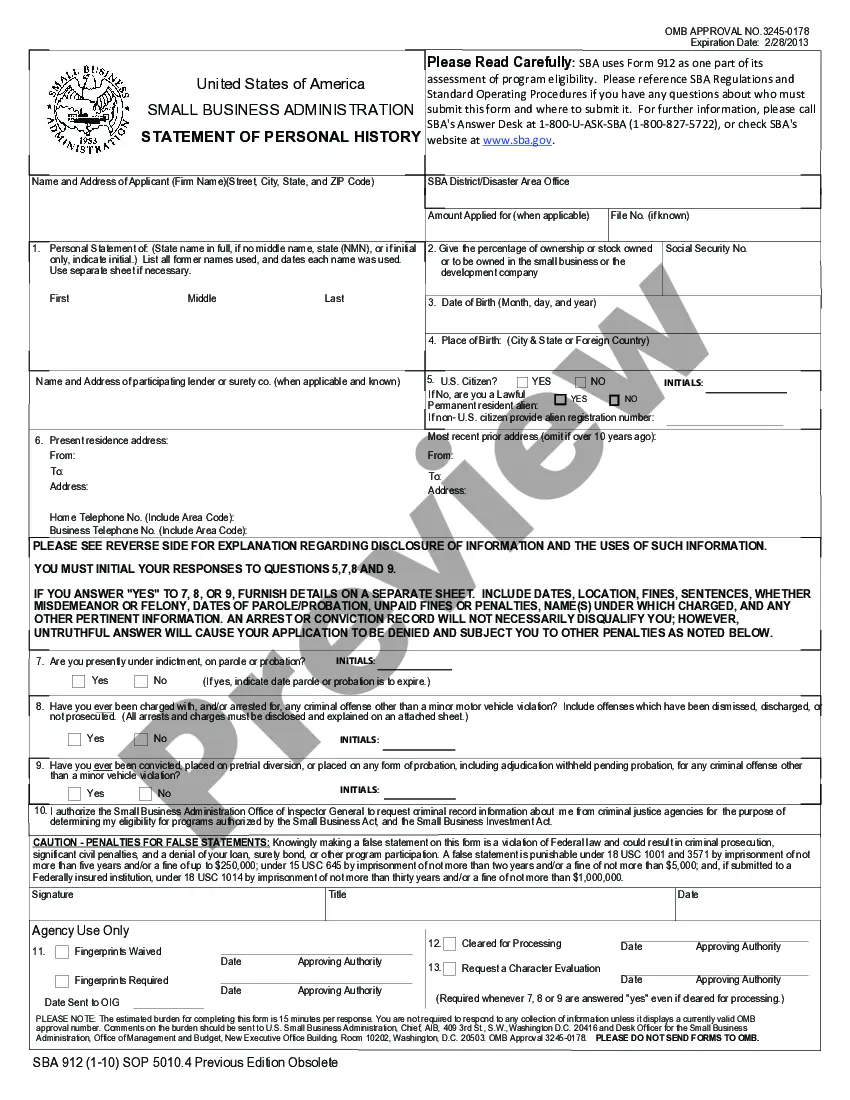

Minimum SBA Loan Requirements Basic Criteria. Your business is currently in operation. ... Financial Criteria. ... Personal Background Statement. ... Borrow Information: SBA Form 1919. ... Personal Financial Statement: SBA Form 413. ... Personal Tax Returns. ... Personal Credit Report & Score. ... Professional Resume.

You may get denied an SBA loan if your business could obtain financing elsewhere or has a wealth of assets above the loan amount requested. You also probably won't get approved if you've had a past default on a government loan. Finally, the SBA disqualifies specific industries, including: Financial institutions.

On average, most SBA loans take 30 to 90 days from applying to funding. 7(a) loan subtypes are backed directly by the SBA. Approval can take 30 to 60 days. Microloans are loans for smaller amounts of $50,000 or less.

In general, SBA loans are not as difficult to get as business bank loans. Because they're backed by the U.S. government, they're less risky for banks than issuing their own loans.

The minimum credit score required for an SBA loan depends on the type of loan. For SBA Microloans, the minimum credit score is typically between 620-640. For SBA 7(a) loans, the minimum credit score is typically 640, but borrowers may find greater success if they can boost their credit score into the 680+ range.

SBA Express It features the easiest SBA application process and accelerated approval times, plus it offers longer terms and lower down payment requirements than conventional loans.