A Minnesota Review of Loan Application refers to the process carried out by lending institutions in the state of Minnesota to evaluate and assess loan applications from prospective borrowers. This meticulous review aims to ensure that borrowers meet the necessary requirements and qualifications set by the lender and relevant authorities. The Minnesota Review of Loan Application plays a crucial role in determining whether an applicant is eligible to receive financing and the terms and conditions that will apply to the loan. Keywords: Minnesota, loan application, review, lending institutions, borrowers, requirements, qualifications, financing, terms and conditions. Different Types of Minnesota Review of Loan Application: 1. Mortgage Loan Application Review: This type of Minnesota Review of Loan Application specifically applies to individuals or borrowers seeking mortgage financing. Lending institutions conduct a thorough examination of the applicant's creditworthiness, employment history, income, assets, and other financial factors to determine their suitability for a mortgage loan. The review considers various aspects such as the loan-to-value ratio, debt-to-income ratio, and credit score to assess the applicant's ability to repay the loan. 2. Personal Loan Application Review: Personal loans are typically unsecured loans that borrowers can utilize for various purposes such as debt consolidation, home improvements, or unexpected expenses. Lenders in Minnesota perform a comprehensive review of personal loan applications, taking into account factors such as the applicant's credit history, income, employment stability, and debt obligations. This evaluation assists lenders in determining whether the borrower has the capacity to repay the loan within the agreed-upon terms. 3. Business Loan Application Review: Minnesota lending institutions also review loan applications related to business financing. Business loan applicants are subjected to a detailed evaluation process that scrutinizes their business plan, financial statements, credit history, industry experience, collateral, and other relevant factors. The Minnesota Review of Business Loan Applications helps lenders assess the borrower's business viability, ability to generate revenue, and the potential risks associated with the loan. 4. Student Loan Application Review: With higher education becoming increasingly expensive, student loan applications are common among individuals pursuing academic degrees or vocational training. Lenders thoroughly analyze student loan applications in Minnesota, considering the applicant's educational institution, program of study, enrollment status, cost of education, and their financial situation. This review assists lenders in determining the amount of loan and the terms that will be offered to the student borrower. In conclusion, the Minnesota Review of Loan Application is a comprehensive assessment conducted by lending institutions to evaluate borrowers' eligibility for financing. Several types of reviews, such as mortgage loan application reviews, personal loan application reviews, business loan application reviews, and student loan application reviews, apply depending on the specific loan purpose. A meticulous examination of various factors helps lenders determine the borrower's suitability and the terms and conditions that will govern the loan.

Minnesota Review of Loan Application

Description

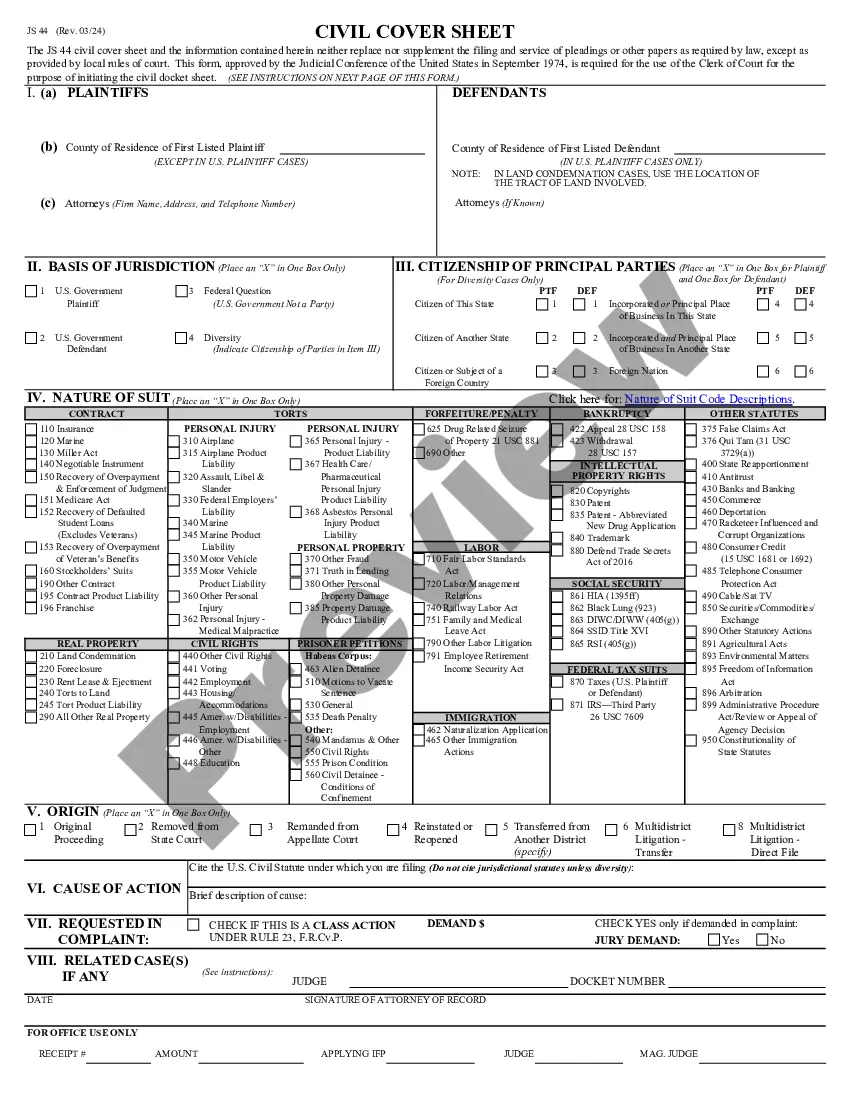

How to fill out Minnesota Review Of Loan Application?

US Legal Forms - one of several greatest libraries of lawful forms in America - gives a variety of lawful document themes it is possible to download or print out. Making use of the site, you will get a large number of forms for business and personal purposes, categorized by types, states, or keywords and phrases.You can find the latest models of forms much like the Minnesota Review of Loan Application within minutes.

If you have a monthly subscription, log in and download Minnesota Review of Loan Application through the US Legal Forms library. The Download option will appear on each kind you perspective. You gain access to all earlier delivered electronically forms inside the My Forms tab of your respective bank account.

If you wish to use US Legal Forms the very first time, listed below are straightforward recommendations to help you began:

- Be sure you have selected the right kind for your metropolis/state. Go through the Preview option to examine the form`s information. See the kind description to ensure that you have chosen the right kind.

- In case the kind doesn`t match your demands, make use of the Look for area towards the top of the monitor to find the one which does.

- When you are content with the form, affirm your option by clicking the Purchase now option. Then, opt for the prices program you favor and give your credentials to sign up for the bank account.

- Process the transaction. Make use of charge card or PayPal bank account to complete the transaction.

- Choose the format and download the form on your gadget.

- Make changes. Fill up, revise and print out and indicator the delivered electronically Minnesota Review of Loan Application.

Each template you added to your money lacks an expiration date and is yours forever. So, if you want to download or print out an additional backup, just check out the My Forms section and then click around the kind you will need.

Get access to the Minnesota Review of Loan Application with US Legal Forms, one of the most substantial library of lawful document themes. Use a large number of specialist and status-particular themes that fulfill your organization or personal demands and demands.

Form popularity

FAQ

A loan review provides an assessment of the overall quality of a loan portfolio. Specifically, a loan review: ? Assesses individual loans, including repayment risks.

When a loan application is under review or pending approval from a lender, it means that the lender is evaluating the borrower's creditworthiness and financial situation to determine whether they are eligible for a loan.

For instance, a buyer might request an inspection, or the seller could request a specific type of loan from the buyer. Deals can fall apart due to certain contingencies. Pending status means the offer has been accepted and is getting processed. At this stage, the deal heads to closing.

Approval for a personal loan through an online lender will generally take 1 ? 3 business days, while disbursal will typically take 1 ? 5 business days. It's possible for a loan to take as long as 30 days to process, but this is generally a rare occurrence.

Loan application volume (how many mortgages a lender is processing at once) The complexity of your loan profile (for example, someone with issues in their credit history might take longer to approve than someone with an ultra-clean credit report)

Once you have applied for the loan, you can visit the lender's website to check your loan status. After loan approval, your loan amount will be disbursed within a few hours to your bank account.

Final verification check During this period, your app dashboard shows ?pending?. This doesn't mean your loan has been rejected but rather your documents and identity are being vetted.

It means that a loan that is available for investment, and if it is fully funded, it is subject to a final assessment prior to funds being released to the borrower.